The Next Big Theme: January 2026

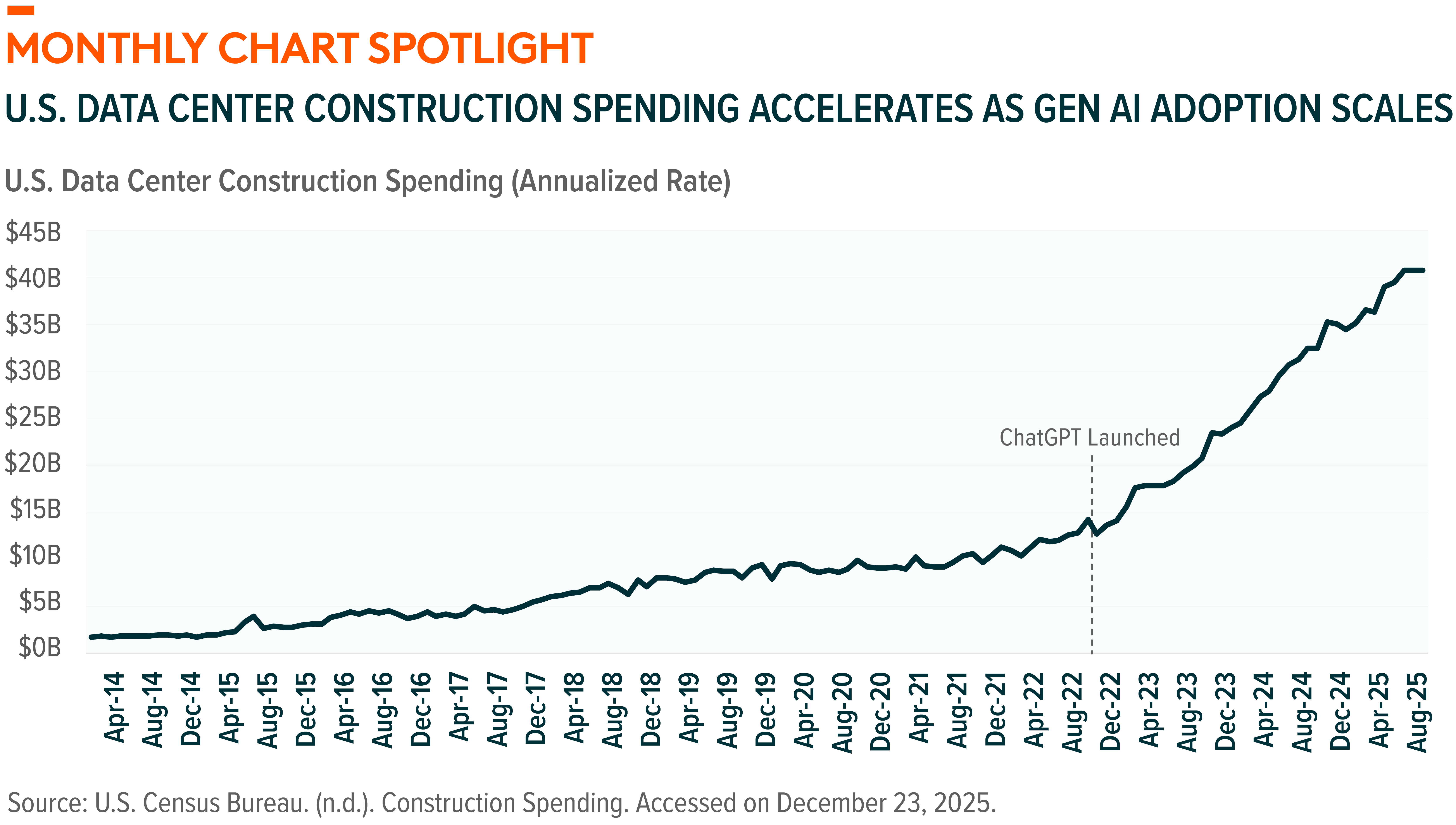

Data Centers

Momentum Builds as AI Reshapes Digital Infrastructure

We believe the global data center market is poised for strong, sustained growth as artificial intelligence drives demand for compute infrastructure. Estimates suggest 14% annual growth through 2030, potentially adding 100 gigawatts of capacity and effectively doubling worldwide data center power load. AI workloads already account for around 25% of all data center computing, and with inference tasks—the real-time delivery of AI results—overtaking training workloads, firms are prioritizing geographically distributed facilities to optimize performance.1 Behind this surge is a broad range of participants, including cloud hyperscalers, major tech companies, semiconductor and memory vendors, energy providers, and real estate developers securing land for future builds. Power availability and energy infrastructure are critical site determinants, pushing data center developers to invest not just in buildings and chips, but also in the energy capacity needed to keep them running. The result is a robust multi-sector expansion underpinned by AI’s insatiable demand for compute, capacity, and connectivity.

Defense Technology

U.S. Army Pushes Next-Gen Autonomous Drone Capabilities

The U.S. Army is advancing a major effort to develop a large short/vertical takeoff and landing (S/VTOL) unmanned aerial system (UAS) aimed at fielding an advanced Group 4-class drone by 2028. Unlike legacy runway-dependent systems, this next-generation platform is designed to operate without runways, incorporate autonomous mission execution, and continue missions even if communications are jammed—lessons drawn from recent conflicts like Russia’s invasion of Ukraine.2 For the Defense Tech theme, this project reflects growing momentum for autonomous, modular, and resilient unmanned systems designed for contested environments. It highlights how the rising demand for—and investment in—advanced sensors, mission software, cybersecurity, and scalable architectures is fostering innovation from traditional primes and startups alike.

Artificial Intelligence

Competition for AI Capital Accelerates

Leading AI company OpenAI is in talks with e-commerce and cloud giant Amazon about a potential investment that could exceed $10 billion, a move that would deepen ties between the two firms. The potential deal would reportedly link the investment to OpenAI’s use of Amazon’s custom AI chips and cloud infrastructure, strengthening Amazon Web Services’ position as a major supplier in the competitive AI compute market. More broadly, an investment of this scale—which could boost OpenAI’s valuation well above $500 billion—underscores that AI leadership depends not only on algorithms, but also on access to massive capital, scalable cloud infrastructure, and reliable computing resources.3

FinTech

Coinbase’s Expansion Signals the Rise of “Everything Exchanges”

Coinbase has expanded its platform to include commission-free U.S listed stock trading in its brokerage accounts and prediction markets for U.S. users, marking a major shift from a crypto-only exchange to a broader multi-asset financial hub. U.S. users can now trade stocks and ETFs directly within the Coinbase app alongside digital assets and participate in Kalshi-powered prediction markets tied to real-world events such as elections and macroeconomic data. This rollout is part of Coinbase’s everything exchange strategy, which also includes futures, perpetuals, and plans for tokenized equities and stablecoin-powered services.4 For the FinTech theme, the strategy blurs traditional lines between crypto exchanges and mainstream financial platforms, intensifying competition with brokerage apps like Robinhood. It also underscores growing investor demand for unified, multi-asset platforms and highlights the growth of stablecoins, tokenization, and on-chain markets in mainstream finance. As digital asset firms expand into traditional finance functions, regulatory clarity and infrastructure adoption are likely to be key determinants of success.

AI Semiconductors

TSMC’s 2nm Breakthrough Points to a New Wave of Chip Innovation

Taiwan Semiconductor Manufacturing Company (TSMC) has begun mass production of its cutting-edge 2-nanometer (nm) semiconductor chips. The company describes these next-gen chips, built by using an advanced nanosheet transistor structure, as the most advanced technology in the industry in terms of density and energy efficiency. Production is underway at TSMC’s major fabrication facilities in Hsinchu and Kaohsiung, Taiwan as global demand for high-performance, energy-efficient computing continues to surge, particularly for AI, data centers, and mobile devices. TSMC counts major technology clients, including Nvidia and Apple, among its users.5 The ramp-up of 2 nm chips highlights the rapid pace of innovation at the leading edge of chip technology, with broad implications for AI computing, consumer electronics, and global tech supply chains.

CleanTech

Corporate Procurement Emerges as a Clean Energy Catalyst

Corporate demand for clean firm energy—carbon-free power sources that can deliver reliable electricity on demand like new nuclear, fusion, geothermal, and hydropower—is rapidly gaining traction across the United States. Corporate buyers have announced over 6 gigawatts of new clean firm energy capacity across 10 states, with more than half of that total unveiled in 2025 alone, signaling rapid adoption beyond pilot projects. More broadly, in the first three quarters of 2025, companies announced 20.4 gigawatts of new clean energy capacity of all types, underscoring the scale of private-sector demand shaping the energy transition.6 These deals highlight how corporations may be moving beyond intermittent renewables to secure dependable, round-the-clock clean power, while helping to de-risk and commercialize next-generation technologies. Together, they point to a maturing clean energy market and long-term opportunities in decarbonization.

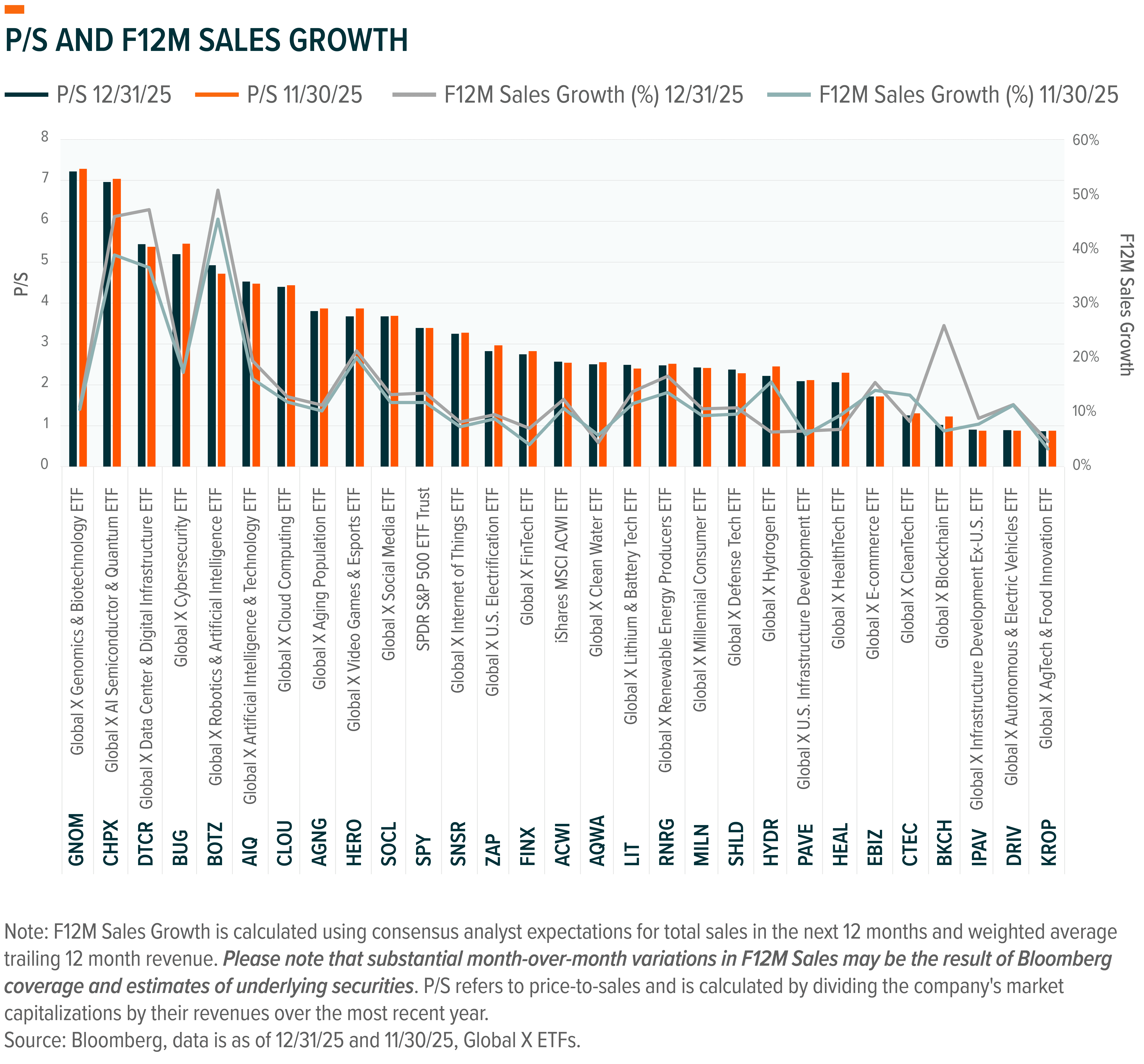

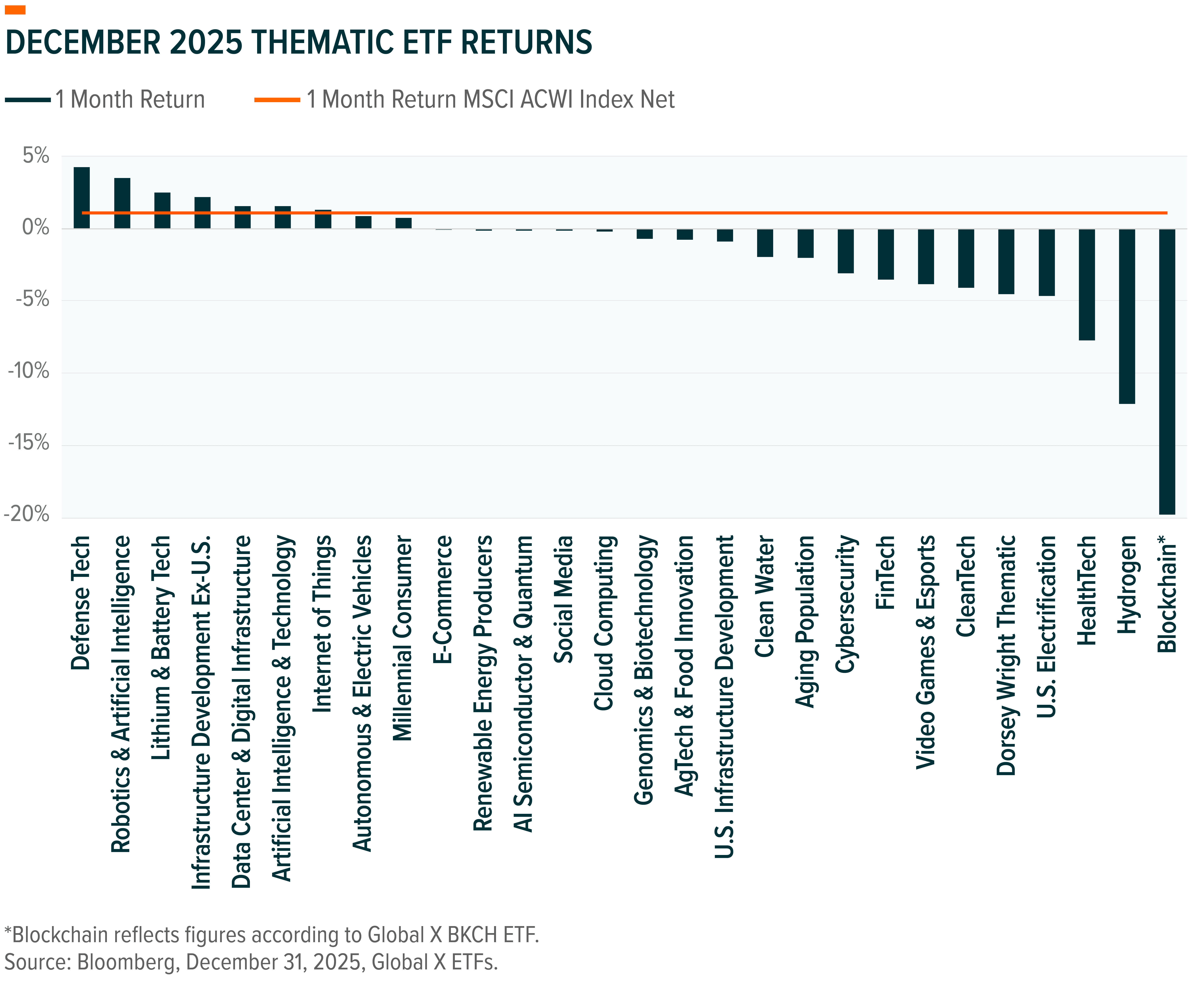

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- A Thematic Playbook to Invest in the AI Ecosystem

- Defense Tech Enters 2026 with Strengthening Fundamentals

- Why U.S. Electrification? Why ZAP?

- 2026 Outlook

- Blockchain Accelerates as Innovation Meets Regulatory Clarity

ETF HOLDINGS AND PERFORMANCE

To see individual ETF holdings and current performance across the Global X Thematic Suite, including information on the indexes shown, click these links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Blockchain ETF (BKCH), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), AI Semiconductor & Quantum ETF (CHPX), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), Data Center & Digital Infrastructure ETF (DTCR), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Defense Tech ETF (SHLD), Internet of Things ETF (SNSR), Social Media ETF (SOCL), U.S. Electrification ETF (ZAP)

- Consumer Economy:Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), HealthTech ETF (HEAL)

- Infrastructure & Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), AgTech & Food Innovation ETF (KROP), Infrastructure Development ex-U.S. ETF (IPAV)

- Digital Assets:Blockchain & Bitcoin Strategy ETF (BITS), Bitcoin Trend Strategy ETF (BTRN)

- Multi-Theme:Dorsey Wright Thematic ETF (GXDW)

Related ETFs

DTCR – Global X Data Center & Digital Infrastructure ETF

SHLD – Global X Defense Tech ETF

466A – Global X Defense Tech ETF

AIQ – Global X Artificial Intelligence & Technology ETF

223A – Global X Artificial Intelligence & Technology ETF

178A – Global X Innovative Bluechip Top 10+ ETF

2243 – Global X Semiconductor ETF

RNRG – Global X Renewable Energy Producers ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.