FinTech Momentum Could Continue into 2025

Sentiment around FinTech has turned positive after a challenging period, and we believe that several converging secular trends point to a favorable outlook for 2025. Strong consumer spending, supported by receding inflation and a robust employment market, has payment volume growth trending higher for digital financial solutions providers. FinTech companies have also used the post-COVID slump to get leaner and more efficient. Product innovation and deeper integration of crypto and artificial intelligence (AI) offerings have boosted average revenue per user for leading platforms. The crypto-friendly stance of the incoming U.S. administration could further accelerate innovation. Additionally, lending activity shows signs of recovery with interest rates coming down. When we add it all up, we believe that the FinTech theme presents an opportunity for investors who may be looking for reasonably priced growth.

Key Takeaways

- FinTech companies are stabilizing revenues and improving profitability through disciplined cost-cutting efforts, product innovation, and international expansion.

- Global adoption of FinTech super apps is surging, helped by new products such as crypto and AI integrations.

- Payment processors and digital lenders are benefiting from strong consumer spending and an improving rate environment, while digital asset momentum grows alongside increased institutional interest and the potential for crypto-friendly policies.

Revenue and Profit Outlooks Improving, Helped by Product Innovation and Cost-Cutting

Global FinTech revenues topped $320 billion in 2023, growing 14% year-over-year (YoY). Excluding crypto and China-exposed companies, FinTech revenue growth was 21% YoY, signaling a much stronger uptake in core categories and major markets, including the United States.1 Projections indicate growth can accelerate in 2025, supported by lower inflation and lower interest rates.2 By 2030, the FinTech market is expected to grow close to five times, with $1.5 trillion in revenues, indicating a sustainable runway for growth.3

Cost-cutting measures implemented in recent years to address investor concerns about profitability and cash flow in a high-interest rate environment are starting to take hold and boost profit outlooks across the board. For instance, in Q3 2024, PayPal delivered better transaction margin dollar (TMD) results and raised its fiscal year (FY) 2024 TMD and adjusted earnings per share (EPS) outlooks.4 Stronger EPS gains are expected for most processors and payment facilitators in 2024.

More nascent FinTech platforms, like Affirm and SoFi, have reached or are progressing towards profitability, with further potential rate cuts as a catalyst. In its FY Q1 2025 Earnings Supplement, Affirm reported transaction growth of 45% YoY, with transactions per active customer reaching a record 5.1.5 Also, the company recently expanded its total addressable market significantly by launching in the United Kingdom, its first major international foray.6 In its Q3 2024 earnings report, SoFi reported $60.7 million in profits, up from nearly $267 million in losses same time last quarter.7

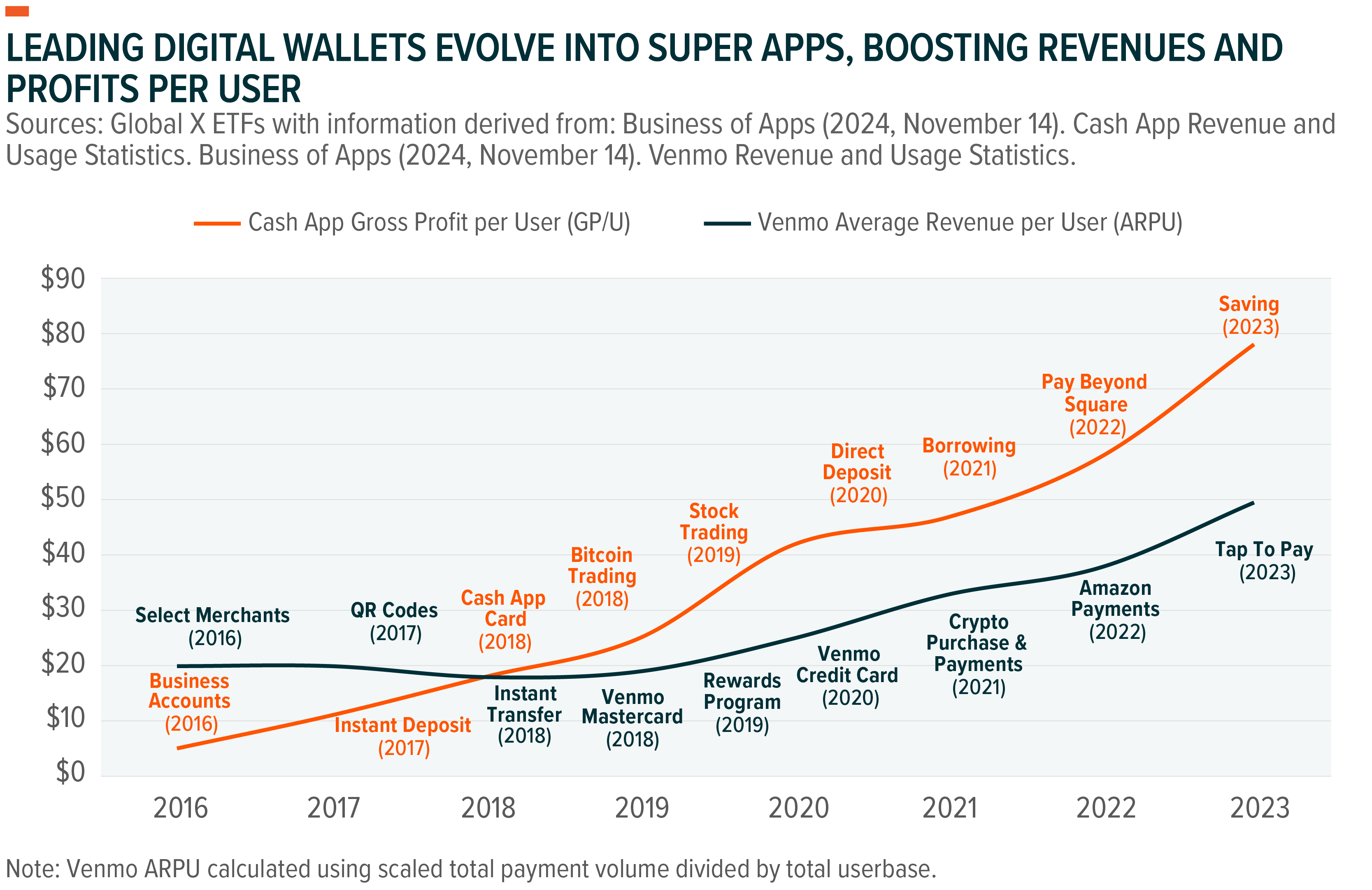

Engagement across FinTech apps continues to grow as well. As of mid-2024, global FinTech app usage surged by over 30% to surpass 2 billion active users.8 Category-leading platforms are increasingly positioning themselves as super apps, consolidating a range of financial products within a single application. These FinTech super apps are designed to enhance monetization by transforming user engagement into cross-selling opportunities for new products. By offering a diverse suite of services, they create a comprehensive ecosystem designed to not only boost user retention but also deter competition, enhancing long-term customer loyalty and platform stickiness.

Additional monetization channels are likely to open for these platforms with the integration of AI and crypto products. Recent positive crypto price action is likely to draw increased retail participation, like in previous cycles, presenting incremental commission dollars for digital wallets. Bitcoin reached a new all-time high of $99,000 in November 2024, which could spur further development activity.9 Additionally, the influx of institutional capital into Bitcoin and Ethereum via newly launched ETFs remains a strong tailwind, which may catalyze institutional businesses of service providers like Coinbase. And the potential for friendlier digital asset regulation from the new U.S. administration could also benefit the broader ecosystem.

Payment Processors Have Benefitted From Resilient Consumer Spending

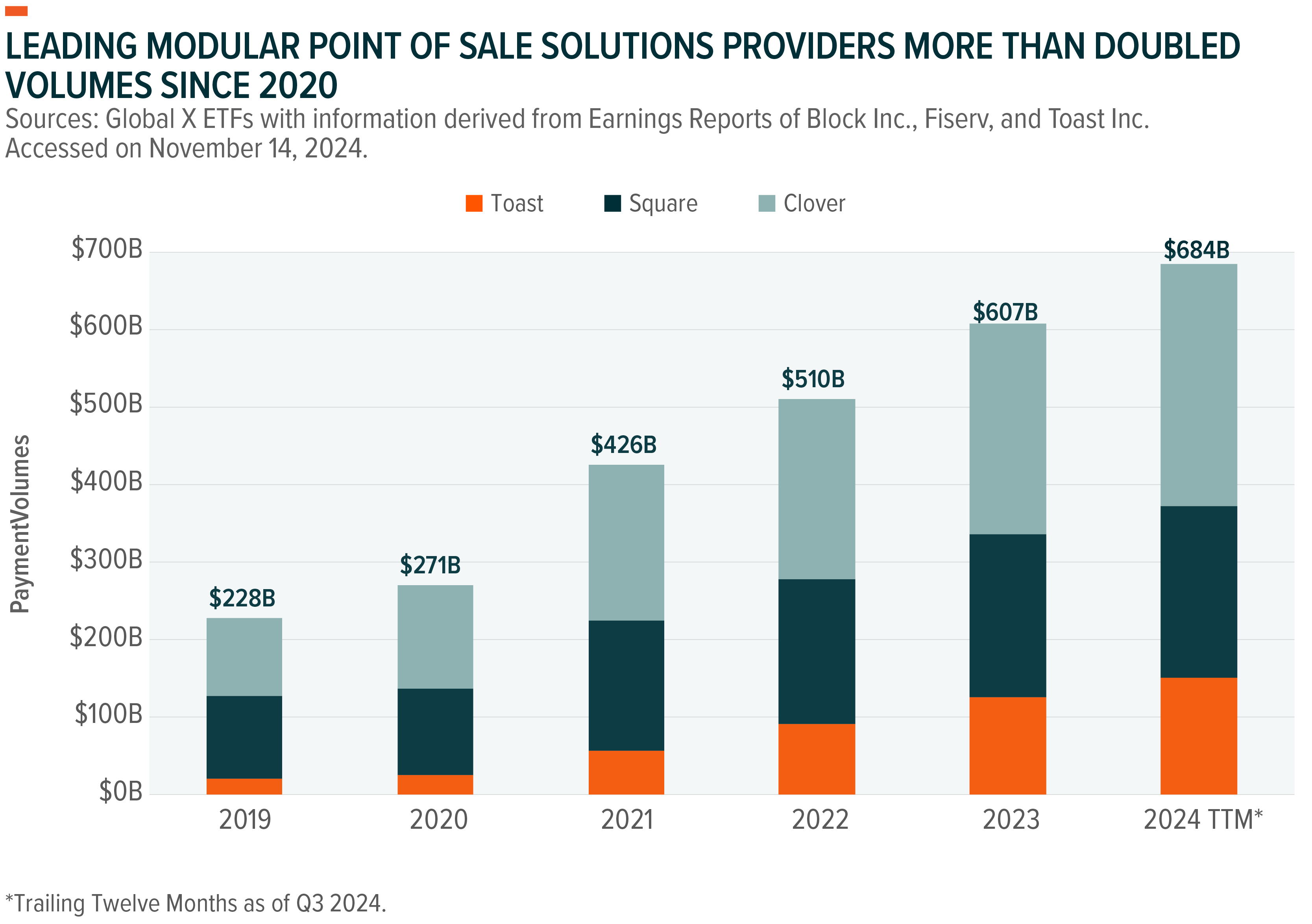

Structural and competitive dynamics remain strong for payment processors, and they appear well-positioned thanks to resilient consumer spending and transaction growth. The monthly Fiserv Small Business IndexÒ, which offers a detailed view of small business and consumer health in the United States, showed that consumer spending was strong in October 2024, with healthy increases to total sales and foot traffic. Small business sales grew 7.1% YoY and 3.7% month-over-month (MoM), with transactions growing 8.8% YoY and 3% MoM.10 Given these tailwinds, Fiserv’s Q3 2024 earnings results showed healthy merchant trends via growth in its core payment services as well as modular Clover point of sale (POS) solution. Total revenues grew 7% YoY, with Clover revenues growing 28% YoY. Revenue projections for FY 2024 were also raised at the midpoint to 7–8% growth.11

Traditional financial institutions are increasingly purchasing software from processors, because it’s more cost-effective than building it in-house. Supplying software infrastructure to banks is a lucrative business for processors, and these companies’ application programming interfaces (APIs) continue to enable banks, and virtually any software company, to offer digital financial products to their customers. The three big processors and infrastructure providers, Fidelity National, Fiserv, and Jack Henry, collectively serve more than 70% of banks and roughly 50% of credit unions in the United States.12

Payment businesses of modular POS solutions providers show similar growth. In Q3, Square, which provides small businesses with Square Terminal, reported 7.5% YoY growth in its payment processing business.13 At Toast, which services restaurants and services businesses, volumes processed on its platforms grew by 24% in Q3.14

Lower Rates Can Potentially Spur Lending

Consumer activity is likely to receive another boost from lower interest rates, to the benefit of FinTech lenders. In Q3 2024, LendingClub reported 6% MoM growth and 27% YoY growth in loan originations with consumers looking for ways to consolidate and pay down debt.15 SoFi’s lending segment total origination volume increased 23% YoY in Q3, driven by growing demand for personal loans and stable growth in student loan and home loan originations.16 The company also raised its full year 2024 adjusted net revenue guidance by $85 million. This guidance assumes lending revenue will be at least 100% of 2023 levels.17

Similar trends are evident in the small business lending and software space. The FDIC’s 2024 Small Business Lending Survey indicated that nearly half of U.S. banks were using or considering using financial technology in their small business lending operations.18 Intuit, which provides online financial products and services such as QuickBooks, reported higher combined platform revenue of 14% to $12.5 billion in its FY 2024. This total includes the company’s Small Business and Self-Employed Group Online Ecosystem, TurboTax Online and Credit Karma.19

Conclusion: FinTech Investment Case Gets a Reset

The FinTech story has improved meaningfully, and valuations remain favorable compared to their 2021 peak, leading us to conclude that the risk-reward dynamic across the ecosystem is attractive going into year-end and 2025. Improving margins, profitability, and earnings growth for already tested business models, combined with continued consumer spending growth, support a positive outlook. Also, we expect spending to accelerate for the remainder of 2024, fueled by the holidays and growing Buy Now Pay Later (BNPL) adoption. Further rate cuts, which may not be fully priced in, could also serve as a catalyst for the theme. Lastly, the new administration’s commitment to reduce regulatory constraints could spur further adoption of digital assets, benefiting the theme.

Related ETFs

BKCH - Global X Blockchain ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.