Uranium Update: When Public Policy and Private-Sector Demands Align

As the number of artificial intelligence (AI) initiatives grow, so have the power demands of hyperscalers and global data centers. By 2026, these global hubs are projected to consume as much energy as the entire country of Japan, underscoring an urgent need for long-term energy solutions.1 Nuclear energy may be poised to play a pivotal role. The uranium market, essential for nuclear fuel, is already facing supply constraints, creating a challenge for suppliers and buyers alike. Global public policy, particularly recent U.S. policies, may lighten the burden further for nuclear reactor construction.

Key Takeaways

- With a track record of power reliability, nuclear energy is increasingly seen as the optimal solution to meet the massive energy demands of expanding artificial intelligence technologies.

- The nuclear industry is already grappling with supply and demand challenges. Geopolitical factors driving renewed demand from utilities may further exacerbate these issues.

- In the U.S., nuclear energy has garnered bipartisan support, with recent laws aimed at expanding the nuclear capacity of the world’s largest reactor fleet.

AI’s Power Needs Present a Significant Challenge

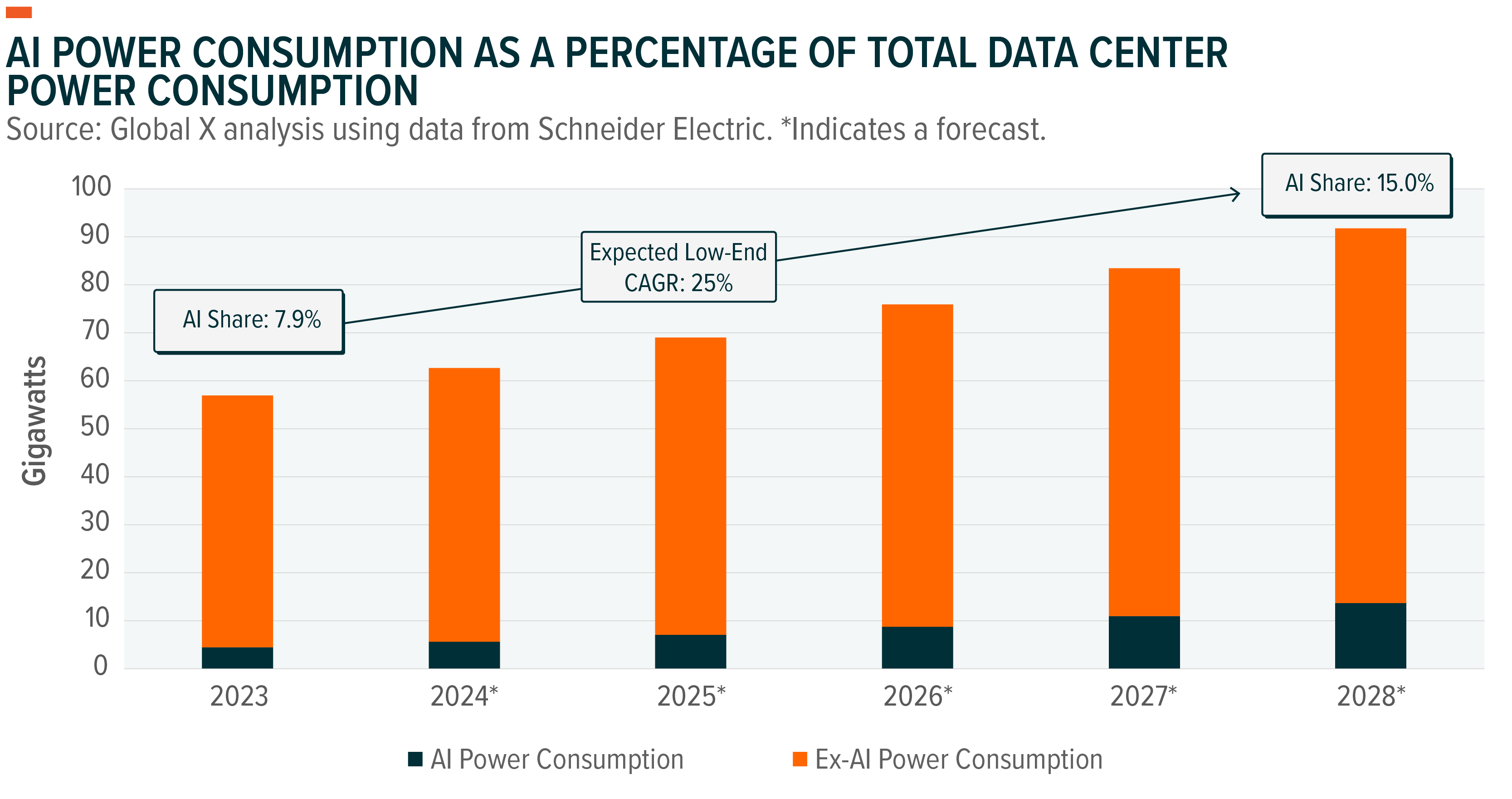

AI’s growing presence in data centers is increasing rack power densities, requiring AI start-ups, enterprises, colocation providers, and internet giants to adapt their data center design and management.2 U.S. power demand is projected to grow at a 2.4% compound annual growth rate (CAGR) through 2030, compared to approximately 0% over the last decade.3 Data centers are expected to account for 0.9 percentage points of this growth.4 The percentage of AI’s power consumption as a percentage of total data center power is expected to grow from 8% to a potential range of 15-20% by 2030, representing a CAGR of 25-33%.5 These expected energy needs are unprecedented, and hyperscalers are expected to spend $200B in capital expenditures in 2024 alone to meet AI and climate goals simultaneously.6

The reliability of nuclear reactors as a clean energy source is already being leveraged. With capacity factors (a measurement of reliability) exceeding 90%, nuclear energy is positioned prominently in the AI infrastructure discussion since data centers operate nearly 24/7.7

Hyperscalers, data center owners, and utilities alike have taken steps to address these mounting issues. Talen Energy sold a 1,200-acre campus to Amazon Web Services (AWS) for $650 million, powered by a 2.5 GW nuclear plant.8 Amazon also recently filed for a data center campus in Louisa County, Virginia, adjacent to the North Anna Nuclear Power Station.9 Constellation Energy agreed to supply up to 35% of the energy for Microsoft’s Boydton, Virginia, data center from nuclear power.10 All the while, Equinix became the first major colocation data center REIT to enter a small modular nuclear reactor (SMR) deal in a move towards integrating nuclear power, signing a pre-agreement with Oklo for up to 500MW of nuclear energy.11

Uranium Needs for AI & Data Center Solutions May Exacerbate an Already Existing Deficit

Uranium miners are a critical component in the nuclear supply chain, given the significance of triuranium octoxide (U3O8) as the key fuel source needed for nuclear reactors. The war in Ukraine led to a major shift in Western nation nuclear policy, as Europe and the U.S. aimed to diversify their energy sources while reducing their dependence on Russian natural resources. As a result, the pace of global reactor shutdowns has slowed, and the construction of new nuclear power plants has increased.12,13 Citing public and private sector shifts, utilities companies expect different sources of renewable energy will be sought after with nuclear as a key solution.14 Uranium miners may be able to take advantage of growing demand that could offer greater pricing power and elevated U3O8 prices.

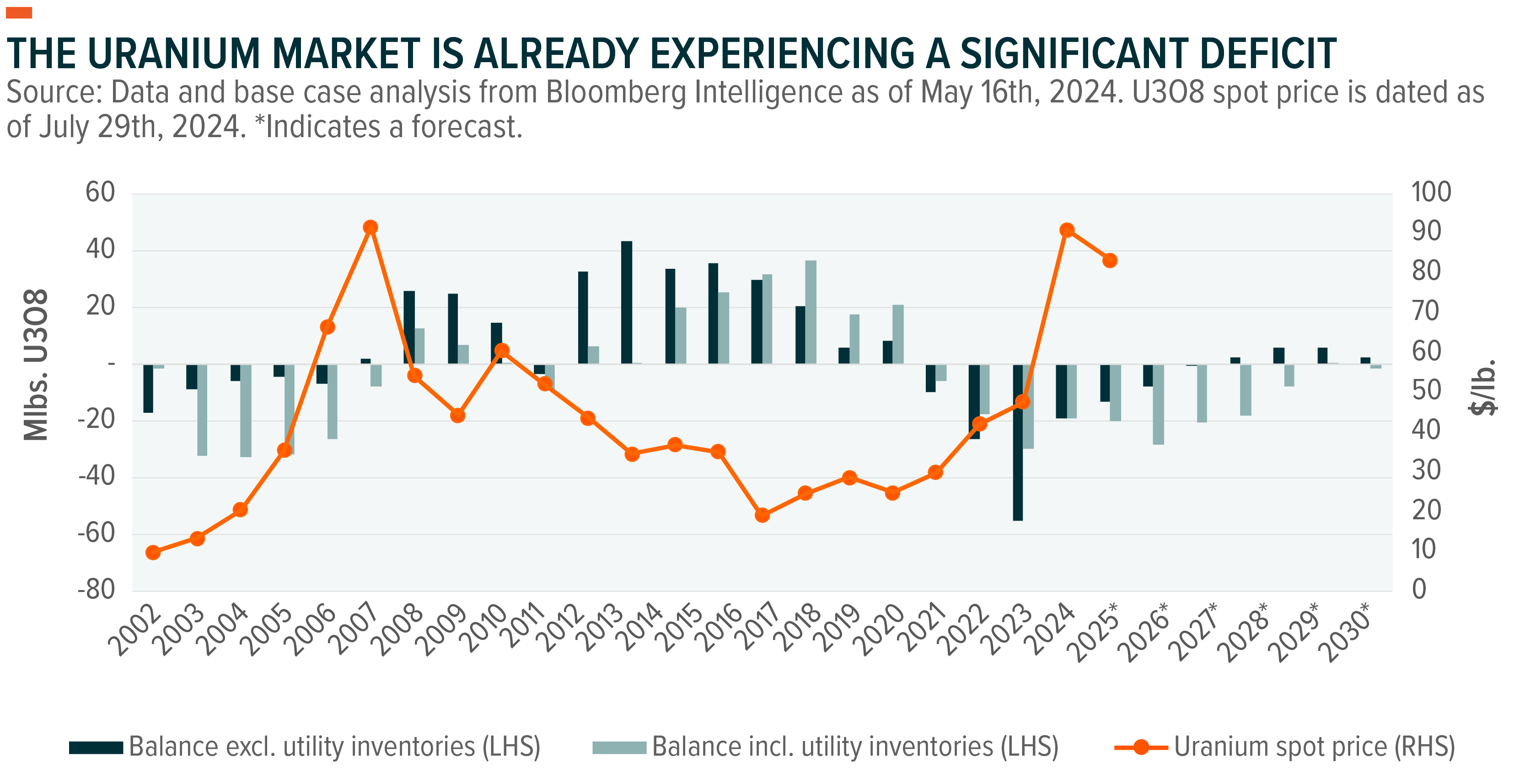

The below graph demonstrates the supply & demand balance of the uranium market with and without utility inventories. Assuming utility restocking ramps up over the next few years, it may take until 2029 for the market to reach equilibrium again.

Production is expected to be primarily driven by Canadian, U.S., and Australian companies.15 Expanding production within existing mines may be a cost- and time-effective solution. During its Q2 2024 earnings report, Cameco reaffirmed its Q1 announcement to extend the Cigar Lake mine’s life to 2036.16 It also continues to anticipate production to expand at McArthur River/Key Lake from 18 million pounds to 25 million pounds.17 Meanwhile, Kazatomprom, the world’s largest uranium producer, recently increased its 2024 production guidance by 6% from Q1 2024 to Q2 2024.18 Junior and senior uranium miner exploratory partnerships paired with continued regulatory overhauls to tap into existing reserves will be key and needed solutions in the long term.19,20

Nuclear’s pent-up demand seems to be a global phenomenon. During the 28th United Nations Conference of Parties (COP), 25 nations announced their ambition to triple nuclear capacity by 2050.21 Achieving this goal will require significant policy reform, financial innovation, and stepped-up construction. Mainland China is expected to lead the way, with nuclear power potentially becoming 10% of the nation’s total electricity generation by 2035.22 France anticipates building six new reactors by 2035, while Japan recently announced a goal for nuclear to encompass 22% of the country’s power mix by 2030, up from 9% in 2023.23,24 The U.S. is getting in on the action as well.

U.S. Nuclear Capacity and Advancement is Largely a Bipartisan Topic

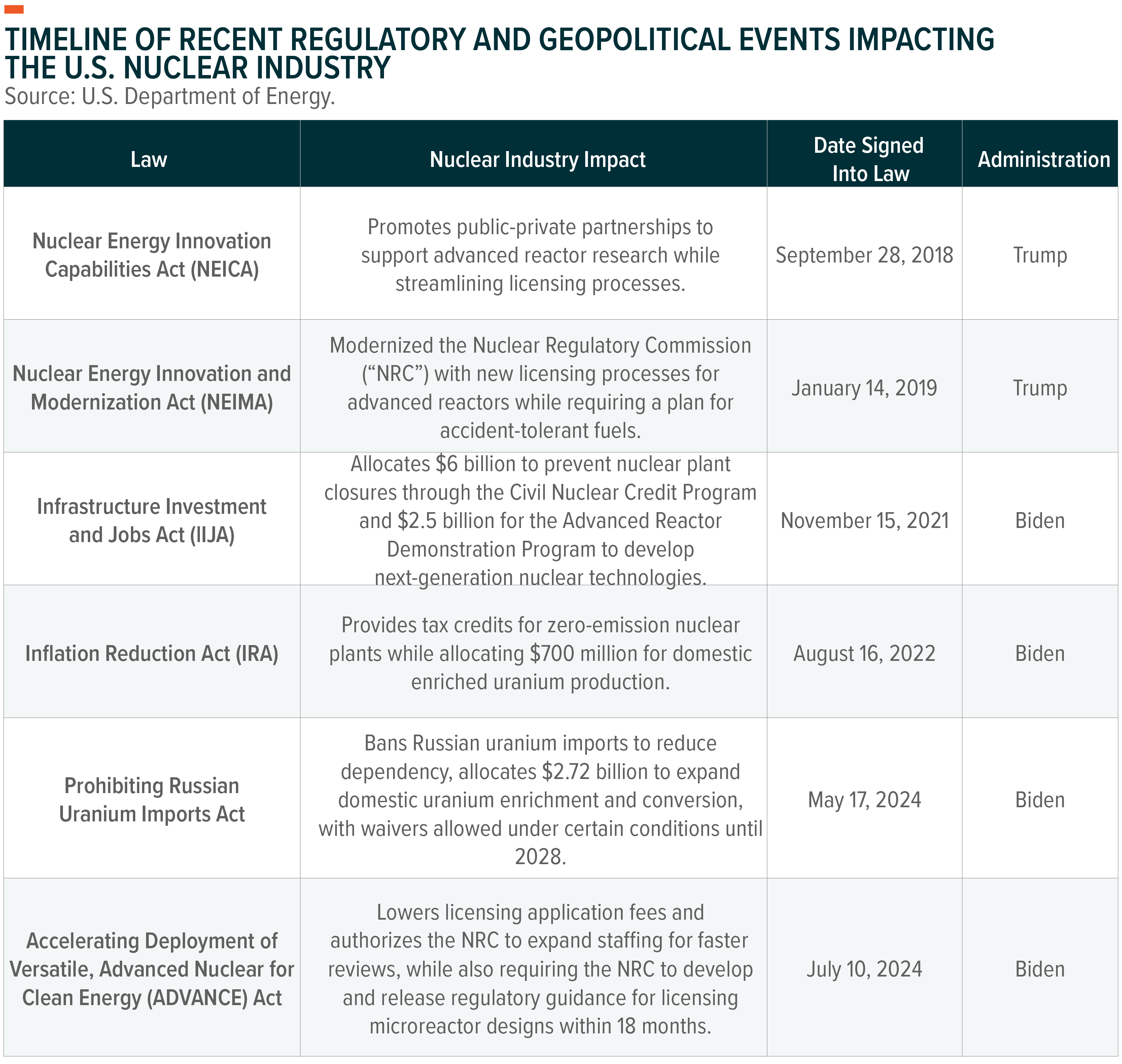

The U.S. currently operates the largest fleet of commercial use nuclear reactors but has no new nuclear reactors under construction.24 Policies passed over the last few years aimed to reverse this by streamlining processes and lowering the barriers to entry for new technologies, such as small modular reactors (SMRs). This has been a bipartisan issue, and most of the recently passed packages that impacted the nuclear energy industry were passed by either a voice vote or close to unanimous consent.25,26,27,28,29,30

The war in Ukraine has promulgated a strategic shift in U.S. nuclear energy policy. The U.S. is effectively cutting out Russia as its main source of unirradiated low-enriched uranium (LEU) by 2028 (35% of the U.S.’s total imports) through the Prohibiting Russian Uranium Imports Act, while unlocking $2.7B in new congressional appropriations.31,32 The recently passed Accelerated Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act, signed into law by President Biden, builds off the previous laws enacted during the Trump Administration. This law is intended to increase competition and reduce certain licensing application fees, while authorizing increased staffing to expediate administrative processes to shorten the reactor deployment timeframe. Uranium producers with conversion capabilities, uranium enrichment companies, and reactor component manufacturers are likely beneficiaries.

Conclusion: Uranium Producer and Component Equities Have an Enticing Set Up

The uranium market is already facing a significant deficit while being presented new tailwinds brought about by advancements in artificial intelligence technology alongside global public policy decisions. The U.S. has recently been aggressive in passing new laws aimed to revitalize its nuclear energy industry while bringing about innovations that could usher in a new phase of nuclear energy production. U3O8 spot markets may be pricing in some of this expected demand, and uranium miners seem to be taking notice. With low-end correlations to both global equities (0.54) and the broader commodities markets (0.42), uranium miners and nuclear component producers offer intriguing, potential portfolio diversification benefits in a market poised for growth.33