The Next Big Theme: September 2023

Internet of Things

Competition for Semiconductors Heats Up

Semiconductors remain crucial to major industries and national economies. U.S. semiconductor giant Qualcomm has partnered with luxury automakers Mercedes and BMW to supply chips for in-car infotainment systems. Qualcomm, known for smartphone chip dominance, is expanding into the automotive sector after a 13% growth in automotive revenue last quarter, despite smartphone challenges.1 The company is servicing BMW with enhanced voice command functionality in vehicles and supplying chips for the upcoming Mercedes E class models in the U.S. by 2024.2 Though Qualcomm is shifting focus from smartphones, Huawei, a Chinese telecommunications leader, just released the Mate 60 Pro powered by Semiconductor Manufacturing International Corp. (SMIC)’s new Kirin 9000s chip, demonstrating China’s semiconductor industry resilience despite U.S. chip sanctions.3 Competition within the semiconductor landscape continues to intensify internationally, as British design firm Arm completed a Nasdaq IPO at $51 a share, valuing the company at nearly $60 billion.4

In the foundry space, Intel Foundry Services (IFS) and Tower Semiconductor announced an agreement for Intel to provide Tower foundry services and manufacturing capacity. Tower plans to invest up to $300 million in equipment for Intel’s New Mexico facility, as Tower needs to boost capacity to meet customer demand for advanced analog processing.5

Video Games & Esports

Gaming’s Resurgence Levels Up

After a turbulent period following the pandemic-induced boost and consumer behaviors normalizing, new hardware has the gaming industry making waves again. Following the reveal of the long-awaited Apple Vision Pro, Meta is reportedly working with LG to improve future versions of Meta’s Quest Pro headset.6 In the past 12 months, hardware accounted for $7 billion of the $57 billion spent in the U.S. video game market, a 19% year-over-year (YoY) increase.7 The release of blockbuster games and new player engagement patterns complemented the positive hardware trend. A key driver of gaming’s resurgence is growth in digital premium full game downloads, which helped counterbalance declines in mobile gaming and a minor decrease in spending on digital add-on content.8 The growth even extends to industry frontrunners like Nvidia, which in Q2 2023 reported double-digit increases quarter-over-quarter (QoQ) (+11%) and YoY (+22%).9

Cloud Computing & Artificial Intelligence

Cloud Computing’s AI Transformation

As artificial intelligence (AI) competition heats up, Big Tech is prominently showcasing its AI prowess through a wave of exciting new product launches. At Google’s annual Cloud Next 2023 conference, the company unveiled the Cloud Tensor Processing Unit (TPU) v5e, featuring a more compact 256-chip configuration per TPU pod. The latest version is tailored for modern neural network architectures based on the transformer architecture.10 Google Cloud is establishing itself as a leading platform for generative AI model training, deployment, and refinement. Diverging from conventional graphics processing units (GPUs), Google’s TPUs are finely tuned for advanced generative AI model execution. Google Cloud offers a range of foundational models, including Google’s proprietary, third-party commercial, and open source models. The cloud platform’s foundational models, including PaLM, Imagen, Codey, and Chirp, underpin core Google products like Search and Translate, enabling swift model adaptation based on usage and feedback. Despite being within the AI space for many years, Google took a backseat to other names when it came to the recent AI wave. This development underscores Google’s current drive to surge ahead in the generative AI competition.

Meanwhile, Zoom and other niche providers are adjusting to generative AI as well. To compete in the videoconferencing market, Zoom is revamping its generative AI assistant, AI Companion, which combines the company’s in-house generative AI with models from Meta, OpenAI, and Anthropic. Notably, Zoom will implement a ChatGPT-like bot in Spring 2024 that allows users to interact directly and inquire about past meetings and chats, among other actions.11

Cybersecurity

Government Entities Prioritize Digital Defense

New Securities and Exchange Commission (SEC) regulations include rigorous cybersecurity disclosure requirements for public companies, potentially boosting the cybersecurity theme in the long run. Cybersecurity incidents must be reported within four business days and include comprehensive details on the nature, scope, timing, and potential impact of incidents.12 Companies must also outline their processes for handling cybersecurity threats and elaborate on the board of directors’ oversight and management’s role in handling these risks. Enforced starting December 2023, these rules extend beyond public companies and U.S. borders.13 Entities not previously required to prioritize cybersecurity due to regulatory gaps in their jurisdictions also must comply.

The Biden Administration continues to prioritize cybersecurity, and it is evident through recent initiatives such as the AI Cyber Challenge. The challenge offers nearly $20 million in prizes to encourage innovation at the intersection of AI and cybersecurity to forge new cybersecurity tools.14 Leading AI companies such as Anthropic, Google, Microsoft, and OpenAI are contributing their technology to assist participants. Also, the White House has a new initiative aimed at safeguarding schools, to which Amazon Web Services will grant $20 million to K-12 schools.15 The funding will provide security training and support to school districts facing cyber threats.

Lithium & Electric Vehicles

The Rush for Lithium Continues as EV Demand Soars

Specialty chemical manufacturer Albemarle is pursuing a $4.3 billion acquisition of Australian lithium miner Liontown Resources to boost its lithium supply for electric vehicles.16 The deal, pending shareholder approval and formalization, also includes Liontown’s existing agreement to supply lithium to Ford and Tesla until 2030, potentially requiring Albemarle to construct processing facilities for Liontown mines.17 Tesla had previously signed an agreement with Albemarle as well.18 With Liontown’s Western Australia mine addition, Albemarle aims to meet its goal of 500,000 to 600,000 metric tons of lithium production by 2030.19

Chinese automaker BYD recently celebrated the production of its five-millionth new energy vehicle, producing the last two million vehicles in just 18 months, compared to 13 years for the first million.20 In the five years to 2022, BYD increased its annual electric passenger vehicle sales from 200,000 to 1.86 million units while phasing out gasoline-powered cars.21 In the first quarter of 2023, BYD became China’s top car brand, surpassing Volkswagen, and in 2023 it may reach 3 million in total vehicle sales, primarily electric.22

Cannabis

Cannabis Market Gets Federal Support

The Department of Health and Human Services (HHS) recommends reclassifying cannabis from its current Schedule I classification, which means no acknowledged medical utility and a high potential for abuse, to a Schedule III substance under the Controlled Substances Act.23 While not tantamount to full federal legalization, this shift would position cannabis as a less hazardous substance that can be legally obtained with a prescription, akin to other Schedule III drugs. Also, this reclassification could lead to reduced taxes for cannabis businesses. The HHS’ assessment follows new measures aimed at alleviating penalties associated with cannabis use that the Biden Administration introduced in October 2022.24 The measures include the pardoning of all prior federal offenses related to simple possession and an appeal to state governors to consider similar actions. As part of that initiative, President Biden tasked the HHS Secretary and the U.S. Attorney General with reevaluating cannabis’ scheduling based on its medical profile.

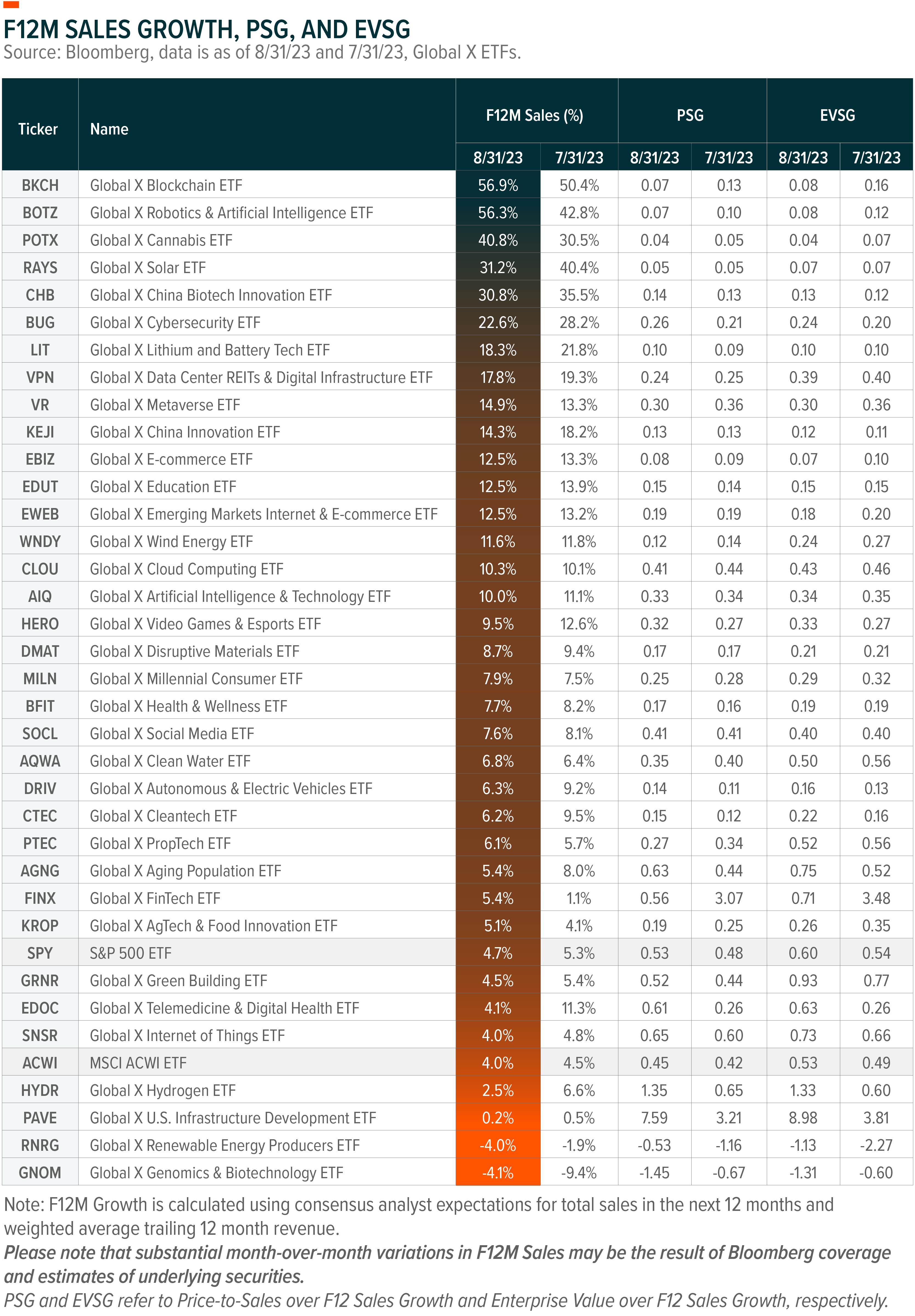

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA®, or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Introducing SHLD: The Case For Defense Tech

- Monthly Thematic ETF Commentary

- One Year In, the Inflation Reduction Act’s Influence on CleanTech Is Just Getting Started

- Investment Strategy Monthly Insights: U.S. Industrial Resurgence, Cloud-Powered AI and Digital Shopping Trends

- Thematic Investing Whitepaper: Healthcare Innovation (Genomics & Telemedicine)

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click these links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR), PropTech ETF (PTEC), Defense Tech ETF

- People and Demographics:Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR), Carbon Credits Strategy ETF (NTRL)

- Multi-Theme:Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)