The Next Big Theme: September 2022

Renewable Energy & Electric Vehicles

Inflation Reduction Act Paves the Way for Clean Energy

The recently passed Inflation Reduction Act (IRA) creates meaningful incentives for clean energy and environmental investments that align with the Biden Administration’s goals to combat climate change. Should the bill help the U.S. to reduce greenhouse gas (GHG) emissions 40% by 2030, the U.S. may be positioned to meet the administration’s of goal reducing emissions by 50% according to their Paris Agreement commitment.1 Curbing methane emissions from oil and gas facilities are a key component of the objective, which allocates $850 million to methane mitigation and monitoring.2 In addition to the tax credits that bill provides for electric vehicles (EVs) themselves, it includes provisions designed to strengthen the U.S. EV supply chain, such as increased credits for EV supply equipment and a 10% bonus for meeting domestic manufacturing requirements.3

Cybersecurity

Earnings Season Showed Growth

Second quarter earnings showed demand for cybersecurity software remained high and that the industry’s positive momentum continued. Shares of Palo Alto Networks soared after reporting Q2 2022 results that exceeded expectations, including year-over-year (YoY) revenue growth of 27% to $1.55 billion.4 The company also announced that it expects fiscal 2023 revenue to increase more than 25%.5 Another industry leader, Crowdstrike, beat estimates with Q2 revenue of $517.2 million, of which $506.2 million was subscription revenue.6 Qualys reported a 20% YoY increase in revenue to $119.9 million.7 The company expects this positive momentum to continue, as its Q3 guidance suggests revenue growth of roughly 19% YoY.8 Upside guidance from majority of these companies suggests strengthening tailwinds.

Artificial Intelligence & Metaverse

AI Leader Bet on the Metaverse

Nvidia continues to expand its metaverse developer toolkit, including new artificial intelligence (AI) capabilities and simulations. Any creator with access to the company’s Omniverse Kit and compatible interfaces can use the new features, which are designed to create as immersive an experience as possible. The new tools target the creation of realistic avatars and accurate digital twins, which are digital representations of a real-world asset or system. Also, with Nvidia PhysX, the company is building reactions within the metaverse that obey the laws of physics. Given the number of resources Nvidia is dedicating to the metaverse, the company mentioned the metaverse as a growth segment in its Q2 2022 earnings release. CEO Jensen Huang mentioned that he anticipates AI and metaverse breakthroughs for the company through Nvidia AI and Nvidia Omniverse.9

Lithium & Electric Vehicles

Lithium Levels Up

Global average lithium prices are up 307% YoY, holding steady from the record high levels achieved earlier this year.10 In China, the world’s largest EV market, technical and battery-grade lithium carbonate prices continued to increase. As the electric vehicle economy booms around the world, automakers are struggling to lock in supply given increased competition in the space. Production capacity will likely take time to ramp up, as measures like the Inflation Reduction Act only accelerate demand for key EV components, namely lithium. The demand for lithium-ion batteries is expected to increase nearly 36% this year to 610 gigawatt-hours (GWh), while lithium supply may increase only 33%.11 Global EV sales increased 34% month-over-month (MoM) in June. Even in China, which continues to contend with COVID lockdowns, EV sales increased 25% MoM in June.12

Internet of Things

Semiconductors a Global Goal

Semiconductor manufacturers were hit hard after the U.S. imposed export restrictions to limit the sale of semiconductors to China. Nvidia announced a potential loss of $400 million in Q3 2022 due to lower A100 and H100 chip sales.13 Likewise, AMD expressed concerns about sales of its MI250 AI chip in China. However, positioning the domestic semiconductor industry for long-term growth remains a top priority for the Biden Administration. From the CHIPs Act, $28 billion will go towards establishing domestic production of edge logic and memory chips, and $10 billion is for increasing production of current-generation chips. The remaining $11 billion is for semiconductor industry research and development.14 The European Union (EU) also has plans to make its semiconductor production more robust. The EU has goals to increase its share of the global semiconductor industry from 9% to 30% by 2030.15

Data Centers & Cloud Computing

Platforms Driven by Engagement

The rapid shift to the cloud has the need for unstructured data management on the rise, creating opportunities for data centers to provide consumers the tools to easily search data and simplify their workflow management. Broadcom’s impending acquisition of VMware is an example of how cloud service providers and data centers can integrate. Broadcom views next-generation server storage connectivity, which is the result of continued deployment of servers and storage to enterprises and the cloud, as a primary growth driver for the company. Industry leader Nvidia noted that its Data Center revenue increased 61% YoY to $3.81 billion in Q2 2022.16 That growth is partially attributed to the expansion of its cloud service Nvidia Fleet Command, as well as the broad growth in consumption of cloud deployed software.

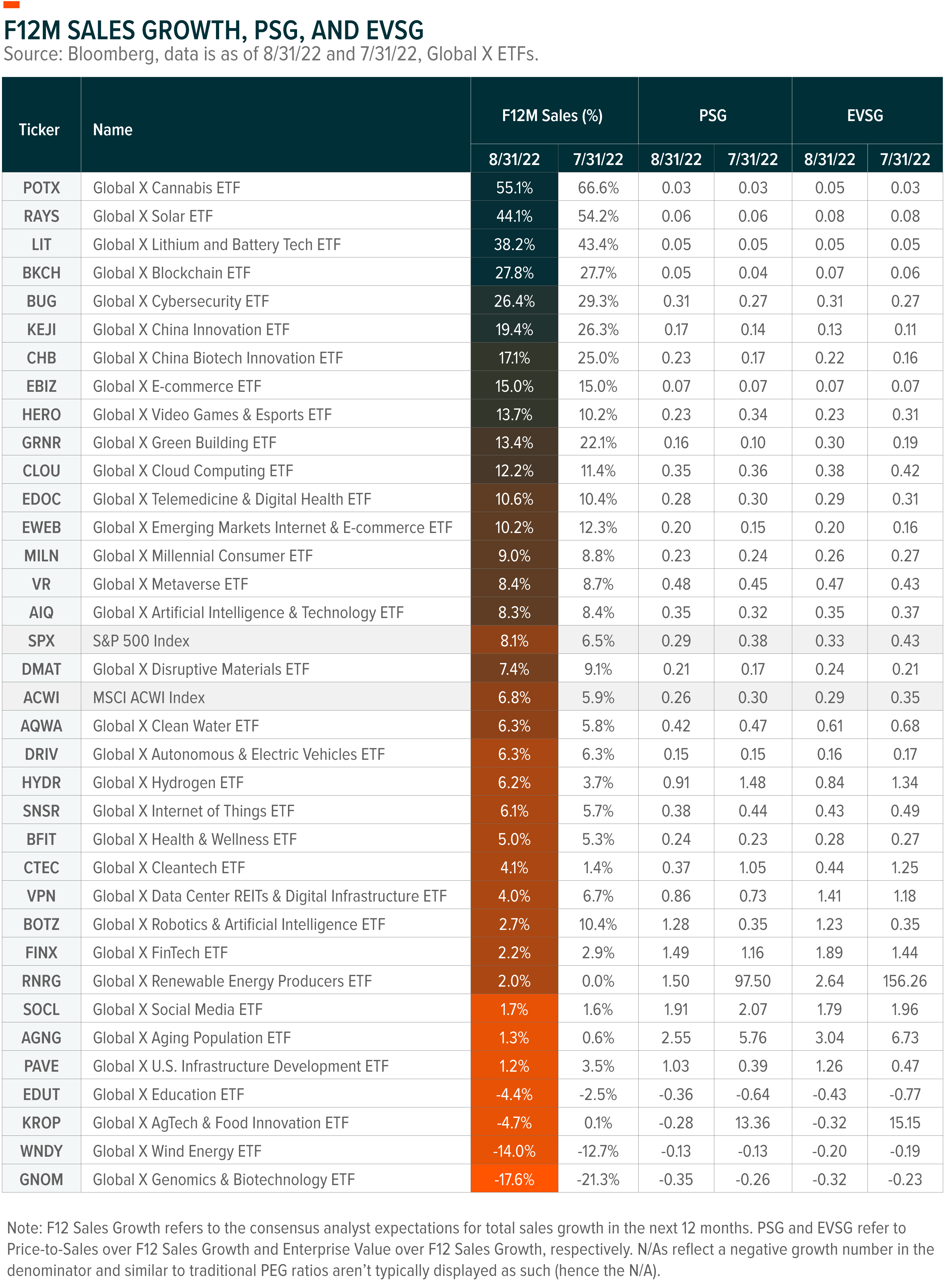

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA® or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- DeFi: The Basics

- Social Media: The Next Chapter of Growth

- Global X ETFs Survey: American Perspective on Digital Assets Exposure

- Four Companies Leading the Rise of Artificial Intelligence & Big Data

- Inflation Reduction Act Could Provide Major Boost for Renewable Energy and CleanTech Industries

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click the below links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR)

- People and Demographics:Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR)

- Multi-Theme:Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)