The Next Big Theme: November 2022

Social Media

User Engagement a Positive as Digital Ad Spending Slowed

Earnings reports from major social media platforms highlighted that no company is immune to the slowdown in digital advertising spend amid recessionary concerns. Alphabet Inc. reported that YouTube ad revenue slid roughly 2% year-over-year (YoY) to $7.07 billion in Q3 2022.1 For Google, verticals such as insurance, loans, and mortgages pulled back significantly.2 However, travel and retail were positives for Google Services revenue.3 Snapchat stated that marketing budgets for their ad partners are lower due to operating headwinds, inflationary pressures, and rising cost of capital. Meta’s ad revenue decreased 4% YoY to $27.2 billion.4

On the positive side, user engagement continued to grow. Snapchat’s daily active users (DAU) beat projections by increasing 19% to 363 million in Q3.5 Facebook’s monthly active users (MAUs) totaled 2.96 billion as of Q3, up 2% YoY.6 Also, 3.71 billion users logged in to at least one of Meta’s apps (Facebook, Instagram, WhatsApp, or Messenger), a 4% YoY increase.7

Cloud Computing

Cloud Growth Persisted at a Moderated Pace

A year ago, each of the top three Hyperscalers reported revenue growth of over 40%, but growth slowed in Q3 2022. Amazon Web Services’ revenue grew 27% YoY and Microsoft Azure’s 35% YoY.8,9 For Azure, consumption revenue growth continued to moderate, and higher energy costs hurt its gross margin. Google Cloud’s revenue increased 38% YoY.10 The $600 million increase since Q2 was the same as Azure’s – indicating that Google Cloud is aggressively adding share against its other two bigger rivals.11 Despite what moderating industry growth in Q3 suggests, we expect businesses to continue to invest in critical long-term projects such as infrastructure tools, monitoring systems, software defined networking, and security software.

E-commerce

Digital Sales Ring in a Hopeful Holiday Outlook

The fate of e-commerce this holiday season remains impacted by inflationary concerns. According to one estimate, U.S. consumers’ digital spending is expected to grow a modest 6.1% YoY in November and December, but still higher than total retail sales at 4% YoY.12 Key online retailers’ Q3 earnings provided hope for the e-commerce outlook. Amazon saw profitability rise after two consecutive quarters of losses. The nation’s largest retailer reported total sales of $127.1 billion in Q3, a 15% YoY jump from $110.8 billion.13 Amazon’s e-commerce sales jumped 13% YoY to $53.4 billion.14 Etsy’s shares soared after a revenue beat and encouraging guidance for Q4. In Q3, Etsy’s revenue grew 11.7% YoY, some of which is attributed to Etsy’s transaction fee hike.15 Also, eBay reported earnings exceeding expectations, helped by gross merchandise volume (GMV) growth in non-new (used and refurbished) in-season goods.

Lithium & Electric Vehicles (EV)

Sustainable Vehicle Market Undeterred by Economic Crises

Lithium producers and EV manufacturers continued to find a sweet spot amid rising demand for electrified transport. On the lithium side, Albemarle reported a revenue surge of 152% YoY to $2.1 billion and reaffirmed guidance suggesting full-year earnings before interest, taxes, depreciation and amortization (EBITDA) growth of 500–550% for its lithium division.16 Albemarle said rising lithium prices could provide upside for Q4, though lower volume growth due to supply chain concerns could weigh on results. Livent reported revenue growth of 124% to $231.6 million.17 Among EV manufacturers, Stellantis reported net revenues of 42.1 billion euros, up 29% YoY.18 The company attributed this growth to higher volumes, strong net pricing, and favorable foreign exchange translation effects. Global battery EV sales for Stellantis increased 41% YoY.19

Genomics

BioMarin Zeros in on Hemophilia Gene Therapy

The U.S. Food and Drug Administration (FDA) plans to review Roctavian, Biomarin’s late-stage gene therapy for hemophilia. The company resubmitted Roctavian for approval in September. The timeline is somewhat uncertain, but BioMarin expects a decision by the end of March 2023. Roctavian is designed to treat hemophilia type A, the disease’s most common form. The treatment involves using a specified virus to deliver a modified copy of the gene, which creates a blood-clotting protein that patients suffering from the disease lack. Despite presenting positive results from late-stage trials, the FDA required further monitoring for at least two years. Biomarin remains hopeful that it will receive approval, given continued positive results from patients. Earlier this year, Roctavian was approved in Europe as the first hemophilia type A gene therapy.

Pacific Bioscience Upgrades DNA Sequencing

Pacific Bioscience is ramping up production of DNA sequences with its first short-read device and upgrading its preexisting long-read hardware. The upgrade, named the Revio system, will be capable of sifting through long strings of genetic code with capacity for more than three human genomes per day at a cost of less than $1,000 per piece.20 Revio will help with cancer and agricultural genomics research and development (R&D). It will be PacBio’s first sequencer using Nvidia GPUs to bring a 20-fold increase to computing power.21

Internet of Things

U.S. Semiconductor Sanctions on China Escalates Trade Tensions

In October, the Biden Administration implemented what is considered to be the most significant sanction on technology exports to China in decades. By imposing a limit on sales of advanced semiconductor chips, the administration wants to cut off critical technology to contain China’s technology and military ambitions. Under the rules, U.S. companies must obtain a license to sell equipment to Chinese chipmakers that intend to produce advanced chips. China is a primary consumer of semiconductors, yet only produces about 15% of the global output.22 Thus far, the restrictions have been manageable for chipmakers such as Nvidia, Intel, and Taiwan Semiconductor Manufacturing Company.

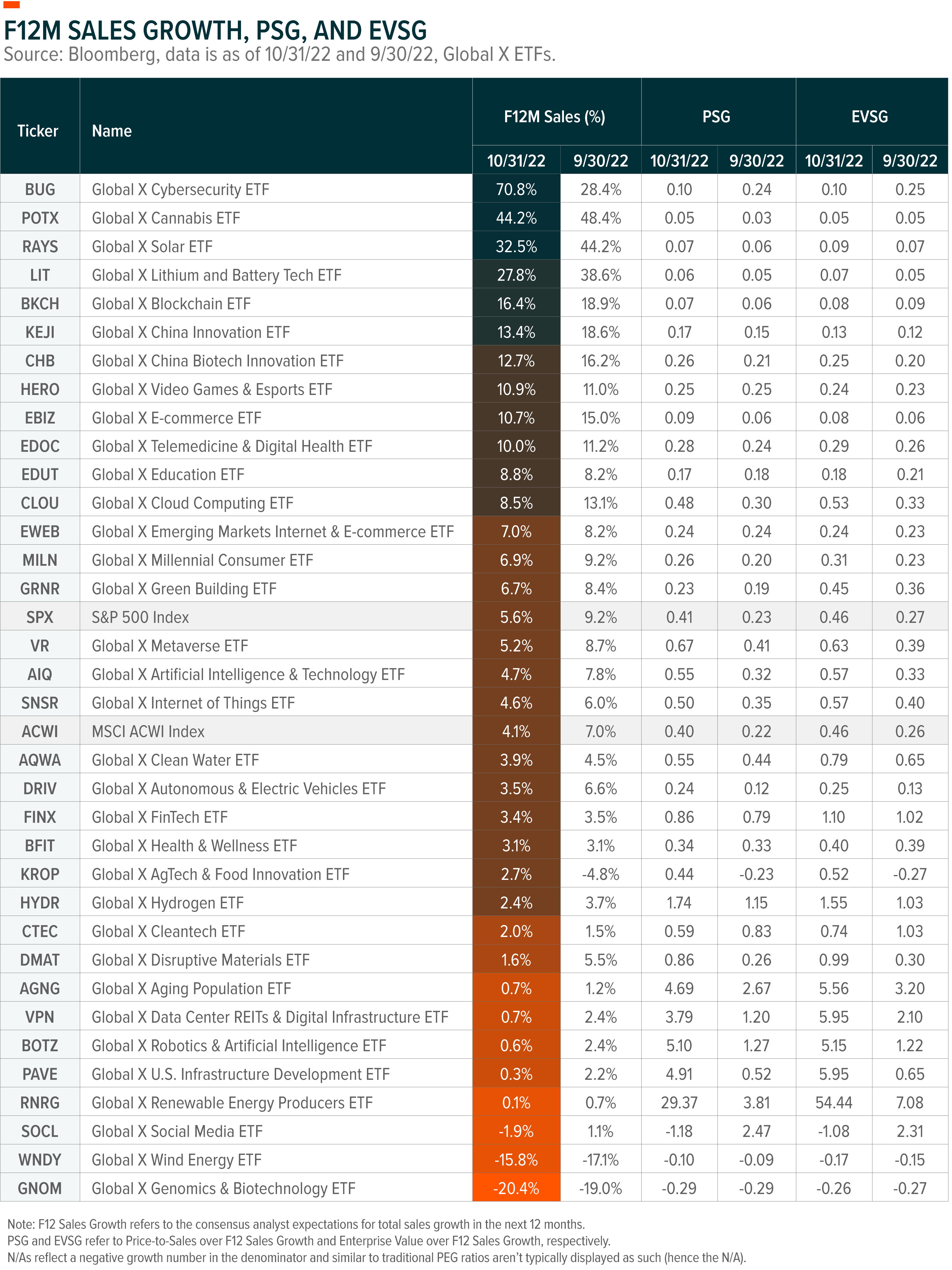

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA® or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent

to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Lithium Market Update: Elevated Prices Are Creating Favorable Dynamics for Miners

- Global X ETFs Survey: Cannabis in Our Current Climate

- Climate Week NYC 2022: “Climate Is the New Beta”

- Global X ETFs Survey: Future of Work

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click the below links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR)

- People and Demographics: Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment: S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR)

- Multi-Theme: Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)