The Next Big Theme (Global): June 2023

Lithium & Battery Technology

U.S.’ Lithium Battery Pipeline Overtakes Europe’s

Propelled by the Inflation Reduction Act (IRA) and a strong commitment to accelerating the clean energy transition, the U.S battery capacity pipeline surpassed Europe’s for the first time. Since the IRA’s implementation, the U.S. pipeline has grown by 57.9%, adding 436 gigawatt hours (GWh) of battery capacity.1 During the same period, Europe’s pipeline has grown by only 3%, equivalent to 35 GWh.2 Projections indicate that the U.S. pipeline reaches 1,190 GWh by 2031.3 In line with this progress, leading lithium producer Albemarle partnered with Ford Motor Company to supply over 100,000 metric tons of battery-grade lithium hydroxide, supporting Ford’s electric vehicle (EV) production scaling efforts.4 The five-year supply agreement, starting in 2026, aims to provide domestically sourced lithium hydroxide within the United States or from countries covered by a U.S. Free Trade Agreement.5 Globally, Chilean lithium producer SQM expects a minimum 20% increase in lithium demand this year, driven by a projected 30% surge in global EV sales.6

Metaverse

Apple Takes Headsets to New Realms

Apple unveiled its augmented reality (AR) headset, the Apple Vision Pro, at its Worldwide Developer Conference, WWDC23. With a separate battery pack and intuitive controls via eyes, hands, and voice, Vision Pro is a significant leap forward in the headset market. Priced at $3,499, it will launch in the United States early next year and other countries thereafter.7 Vision Pro is primarily an AR device but can transition to virtual reality (VR) using a dial. Boasting 12 cameras, five sensors, and a 4K display per eye, it leverages passthrough video to overlay 3D objects in the real world.8 Apple’s entry into the AR/VR market carries weight due to its ecosystem of products and loyal consumer base. AR/VR headset shipments are forecast to increase by 14% in 2023 and grow at a compound annual growth rate (CAGR) of 32.6% from 2023–2027.9 Meta’s Quest 3, featuring higher resolution and improved integration with the real world supports this upward headset demand trajectory. Its release is slated for later this year.10

Artificial Intelligence & Data Centers

Chipmakers Race to Power the AI Revolution

The AI revolution has demand for specialized AI chips soaring, with Nvidia paving the way as the leading graphics processing unit (GPU) manufacturer. The AI push propelled Nvidia to the trillion-dollar market capitalization club.15 To meet demand as companies race to integrate generative AI into many aspects of their products and services, Nvidia significantly increased its chip supply.11 While currently using Taiwan Semiconductor Manufacturing Company’s (TSMC) advanced process nodes, Nvidia remains open to other options should industry supply constraints arise, including Intel.12 At technology trade show Computex 2023, Nvidia unveiled its GPU roadmap, showcasing the upcoming Hopper-Next chips arriving in 2024.13 With unmatched AI computational power, the Hopper series, built for next-gen generative models like ChatGPT, is the world’s fastest 4 nanometer (nm) GPU featuring HBM3 memory.14 Responding to the surging GPU demand, Big Tech companies such as Microsoft, are investing billions in Nvidia-backed startups like CoreWeave to secure the best hardware.

Genomics & Aging Population

Novel Treatments for Melanoma

A promising mid-stage clinical trial involves Moderna and Merck’s experimental cancer vaccine and Merck’s immunotherapy treatment Keytruda. When combined, the two treatments reduce the risk of melanoma spreading to other parts of the body or causing death by a significant 65%, compared with patients who only received Keytruda.16 The trial includes a treatment group of 157 stage 3 and stage 4 patients who had their cancer surgically removed. Patients receive Moderna and Merck’s vaccine every three weeks for a total of nine doses and infusions of Keytruda every three weeks for approximately a year.17 In February, the Food and Drug Administration (FDA) granted Moderna and Merck a breakthrough therapy designation to accelerate the development and review process. Similarly, Regeneron’s phase 1 study on advanced melanoma patients shows promise with its LAG-3 inhibitor and PD-1 inhibitor combination. In this study, the investigational monoclonal antibody Fianlimab targets the LAG-3 immune checkpoint receptor on T cells when used with Libtayo. It achieved an objective response rate (ORR) of 61% across three cohorts, almost double the historical efficacy of anti-PD-1 monotherapy.18

FinTech

FedNow Delivers Funds in Real Time

FedNow, scheduled for release in July, is set to revolutionize the U.S. payments system by enabling instant payments through participating financial institutions, including early adopters Fiserv and Fidelity.19 With the U.S. playing catch-up to countries that already offer real-time payments, such as China and Brazil, FedNow could drive a four-fold increase in real-time payments volume by 2027, from 2.5 billion to 11.5 billiontransactions.20 Fidelity National Information Services is among two dozen companies involved in the final testing stage and expected to participate in the FedNow certification program.21 Fidelity anticipates growth in consumer cases and account-to-account (A2A) payments. Also advancing real-time payments through the FedNow pilot is Fiserv and its NOW Gateway network.

U.S. Infrastructure

Government Doles Out IIJA Funds

Nearly a year and a half after the Infrastructure Investment and Jobs Act’s (IIJA) passage, the White House reported significant progress in deploying the law’s $1.2 trillion for infrastructure projects around the country. Over $220 billion has been allocated for 32,000 projects nationwide.22 To expedite the allocation of funding, the Biden Administration is accelerating design and construction by partnering with organizations and localities through the Permitting Action Plan. Notably, the recent debt ceiling agreement ensured no impact on IIJA funding. However, the bill requires Congress to pass annual budget appropriations by December 31, 2024, with a 1% spending cut for non-compliance.23 Unspent COVID-19 relief funds, including $2 billion for highway infrastructure, will be reclaimed.24

THE NUMBERS

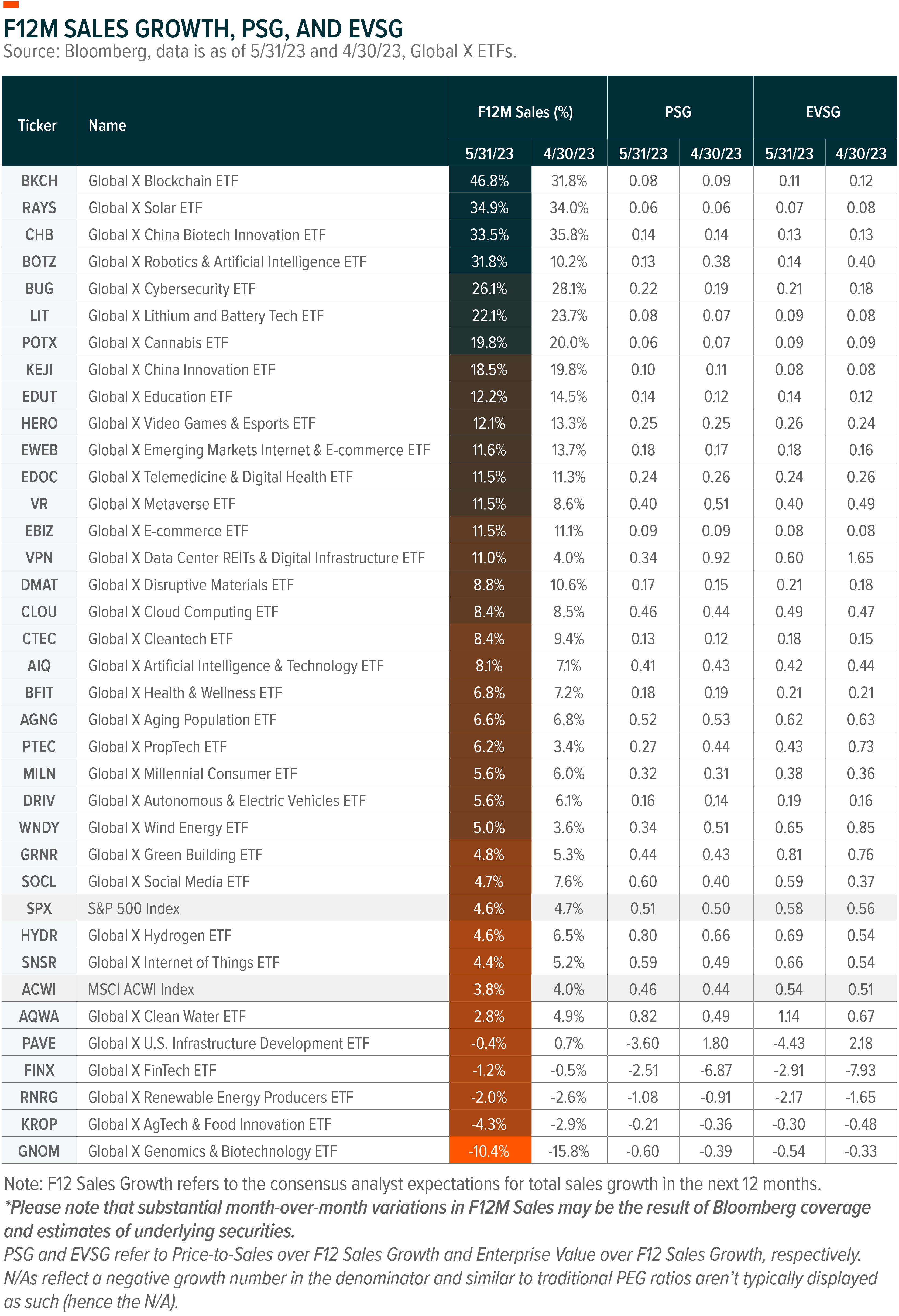

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA®, or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Inflation Reduction Act and CHIPS Act Likely to Build More Momentum for U.S. Infrastructure

- Recent Climate Change & CleanTech Reports Suggest Potential Large Long-Term Investment Opportunities

- The Benefits of Diversification in Crypto

- The Consumer Pulse: Regional Banking Crisis

- From Stagnation to Resurgence: U.S. Industrial Production’s New Path Highlights Infrastructure, Automation, and Commodities Themes

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click these links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR), PropTech ETF (PTEC)

- People and Demographics:Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR), Carbon Credits Strategy ETF (NTRL)

- Multi-Theme:Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)