The Next Big Theme (Japan): July 2023

Semiconductors

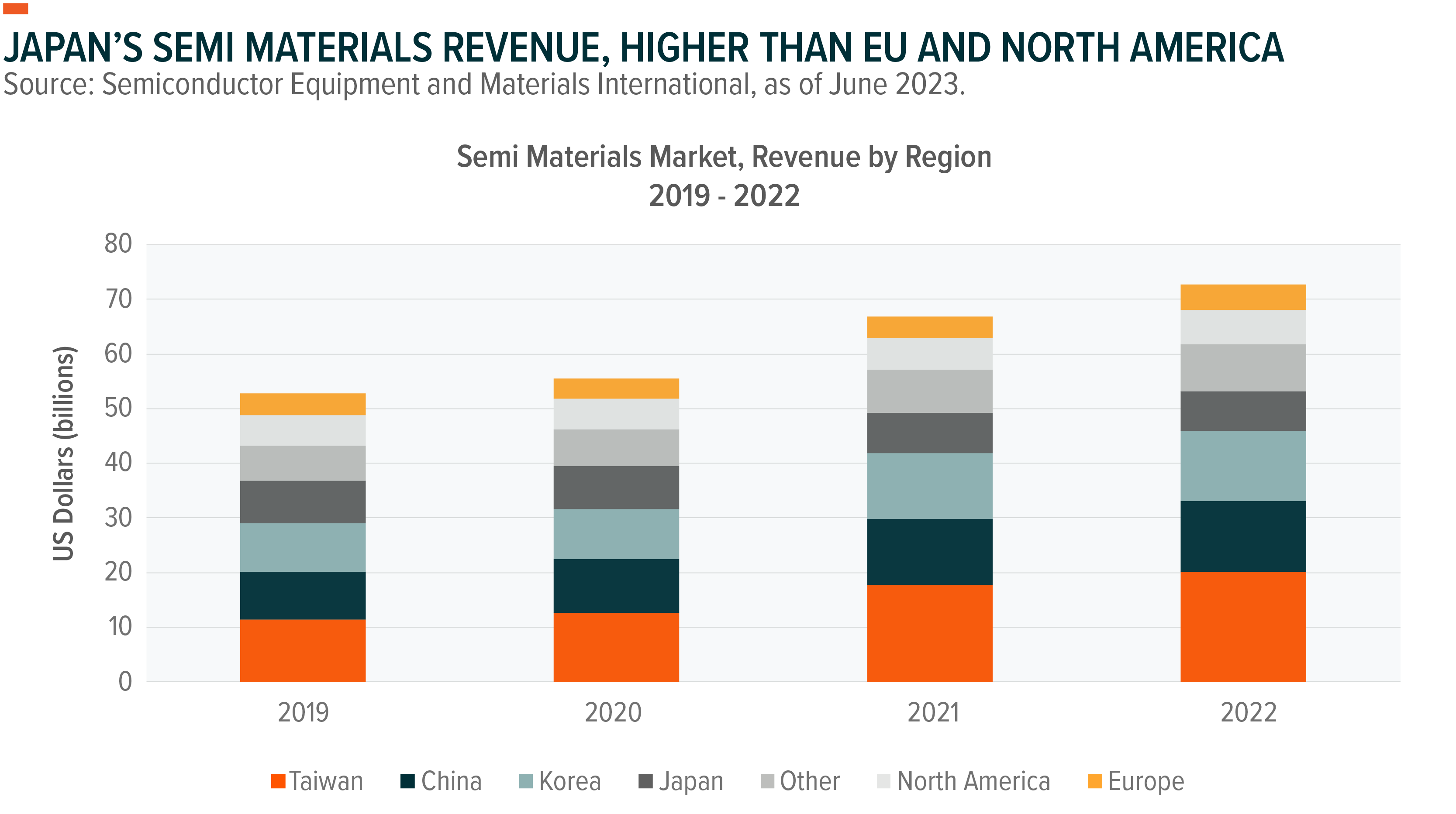

Government Fund Investment in JSR May Trigger Restructuring of Semi Materials Industry

On June 26, The Japan Investment Corporation (JIC), which was established by the Japanese government, announced its plans to acquire semiconductor materials giant JSR, leading many to believe that a restructuring of the semiconductor materials industry could soon follow.1 During an interview with Reuters, JIC’s CEO Shogo Ikeuchi stated that JIC could conduct more mergers and acquisitions and that consolidation of the industry could raise Japan’s competitiveness in the semiconductor materials space.2 JSR specializes in the production of photoresists, which are essential to the production of semiconductors, and currently grasps roughly 30% of the global photoresist market.3 Photoresist is a chemical used to draw specific patterns on chips after exposure to light, and is designated by the Japanese government as a strategic material.4

At the same time, on July 4, the European Union’s commissioner for Internal Market Thierry Breton met with Japanese Minister of Economy Nishimura Yasutoshi and signed a memorandum of understanding on the need to strengthen cooperation to achieve a secure supply of semiconductors.5

Autonomous and Electric Vehicles

With Gigacast and Solid-State Batteries, Toyota Executes Two-Pronged EV Strategy

Toyota announced its plans to implement “Gigacasting” technology in its car assembly lines by 2026, and its expectations of being able to develop and manufacture solid state battery with a range of 745 miles per charge and a charging time of 10 minutes by 2027 at the earliest. Gigacasting is a manufacturing technology pioneered by Tesla that combines multiple car components into one component, opening the way for significant cost reductions.6 Toyota is typically seen as a laggard in production of EVs, but if it can succeed in its stated plans of manufacturing solid state batteries for commercial use, it may be able to secure a more advantageous position in the industry. Solid state batteries are thought to be able to extend driving range, shorten charging times and mitigate some of the weaknesses of current EVs. With these two technologies, Toyota hopes to reduce its manufacturing and investments by half, boldly aiming for 3.5 million EV sales globally by 2023.7

Robotics and the Internet of Things (IoT)

Collaborative and Service Robots Continue to Enter the Japanese Consumer’s Home

On May 17, the Japanese startup Preferred Robotics launched a household robot named “Kachaka.” Kachaka is a robot that moves on the ground and comes with a shelf known as the Kachaka Shelf, which allows users to transport objects around their house by voice or smartphone control. Kachaka is equipped with laser sensors and AI-enabled cameras that can help avoid collisions with objects in the house.8 Meanwhile, on July 4, Japanese startup Yukai engineering launched a new version of its household robot Bocco Emo that can use ChatGPT for natural voice conversations, and on May 16 Panasonic launched a household robot named Nikobo that can only speak in single words.9,10 While Japan continues to be a leader in industrial robotics, the needs created by a labor shortage and aging population, the presence of household robots palatable to humans will likely increase.

Yaskawa Electric and SMC Invest in New Research and Production Facilities in Japan

Amid a backdrop of burgeoning needs for automation around the world, in June, the two Japanese robotics and factory automation giants SMC and Yaskawa Electric announced investments into new facilities in Japan. SMC revealed its plans to invest JPY120bn into a development center located in Kashiwashi, Chiba Prefecture.11 SMC is a leader in using pressured gas and air for automation, a field known as pneumatics, and occupies roughly 64% of the domestic pneumatics market and 39% of the global pneumatics market as of 2022.12 On June 8, Yaskawa Electric announced an investment of JPY150bn into the construction of a new factory on the grounds of its headquarters in Kitakyushu, Fukuoka Prefecture, with plans to have it operational by 2025.13 After operation begins, Yaskawa says it will increase its production of robots by 1.5 times its current amount.14