The Next Big Theme: February 2024

U.S. Infrastructure

IIJA Funding Continues to Flow

U.S. construction starts surged 20% in December 2023 to a seasonally adjusted annual rate of $1.12 trillion, on the back of strong growth from infrastructure and manufacturing projects and continued funding from the Infrastructure Investment and Jobs Act (IIJA).1 Highway and bridge starts increased by 12% and manufacturing starts increased by 75%.2 In late January the Department of Transportation (DOT) announced the deployment of $4.9 billion in IIJA funding for major highway and bridge projects.3 The funding round included 39 competitive grants from the Infrastructure for Rebuilding America and National Infrastructure Project Assistance programs for 37 projects. The largest grant totalled $1 billion and went toward the replacement of the Blatnik Bridge, which links Duluth, Minnesota and Superior, Wisconsin.4 Overall, the infrastructure spending outlook for 2024 looks promising, helped by the stabilization of the planning queue and the potential for lower interest rates which should spur further construction.

Artificial Intelligence & Technology

Big Tech Intensifies Its AI Efforts

Google renamed its generative AI chatbot Bard to Gemini as part of the company’s integration of its latest AI models and to reflect the chatbot’s enhanced capabilities.5 Google also launched a paid version called Gemini Advanced that specializes in complex coding, logical reasoning, and creative collaboration.6 Google will also introduce a dedicated Gemini app for Android that integrates key services like Gmail, Maps, and YouTube.7 Meta announced that it is spending billions on Nvidia AI chips to support AI initiatives, which include open-sourcing Meta’s yet-to-be developed artificial general intelligence (AGI).8 This project requires a massive compute infrastructure, including over 350,000 Nvidia H100 graphics cards by the end of 2024. Assuming Nvidia’s H100’s sell for $25,000 to $30,000, Meta’s total expenditure is likely to exceed $9 billion.9 Meta plans to deploy its own in-house custom chip “Artemis” to complement the chips purchased from Nvidia.10

Healthcare Innovation

Weight Loss Drug Makers Increase Efforts to Boost Manufacturing Capacity

The investment arm of Novo Nordisk’s parent foundation will buy drug manufacturer Catalent for $16.5 billion in a deal aimed to bolster the supply of the highly popular weight loss injection Wegovy and diabetes shot Ozempic.11 In turn, Novo Nordisk will buy three of Catalent’s fill-finish sites from the investment group for $11 billion.12 Catalent, one of the premier contract development and manufacturing organizations (CDMOs), already works with Novo Nordisk to manufacture its wildly successful GLP-1 treatments. The deal, which is expected to close at the end of 2024, is Novo Nordisk’s latest effort to boost manufacturing capacity for its drugs and mitigate future shortages, especially amidst fierce competition from Eli Lilly.13 Demand is robust for Eli Lilly’s new weight loss drug, Zepbound, which generated $175.8 million in fourth-quarter sales despite only receiving regulatory approval in November 2023.14

Social Media

Digital Ad Market Rebounds Sharply After Bleak Year

Quarterly results from tech giants Alphabet, Meta, and Amazon showed a notable rebound in the digital advertising market following a down period.15 Meta’s ad sales surged 24% year-over-year (YoY) to $38.7 billion, bouncing back from a 4% decline in Q4 2022.16 Amazon’s ad business grew 27% to $14.7 billion and Alphabet’s Google ad business increased 11% to $65.5 billion, with YouTube contributing a 16% growth.17 Additionally, Meta and Alphabet’s investments in AI to enhance their ad platforms show positive results. Several factors contributed to the bounce back in sales, including major advertising events like the Superbowl, the upcoming summer Olympics in Paris, and the upcoming U.S. presidential election, alongside a more favorable macroeconomic environment.18 Global ad spending is forecast to increase 10% in 2024, signaling a positive outlook for the industry worldwide.19 Digital advertising spending is expected to account for roughly 70% of total ad spend this year and nearly 75% by 2027.20

Internet of Things

The PC Slump Appears to Be Nearing an End

The PC industry seems to be turning a corner after a challenging 2023, with AI enhancements playing a pivotal role. For Q4 2023, Intel’s client computing division, which houses its consumer chips, grew a notable 33% YoY, alongside reports of normalized consumer inventory levels and unprecedented notebook shipments.21 AMD’s chips sales increased by a substantial 62% YoY, driven by robust demand for its Ryzen 7000 series CPUs tailored for desktop and laptop applications.22 AMD’s bet on AI PCs as the AI race heats up can help accelerate the PC market rebound. Generative AI integrations like these are poised to invigorate PC sales, aligning with consumer preferences for AI-enabled devices. Forecasts suggest that by 2027, 60% of PC shipments will have AI capabilities.23

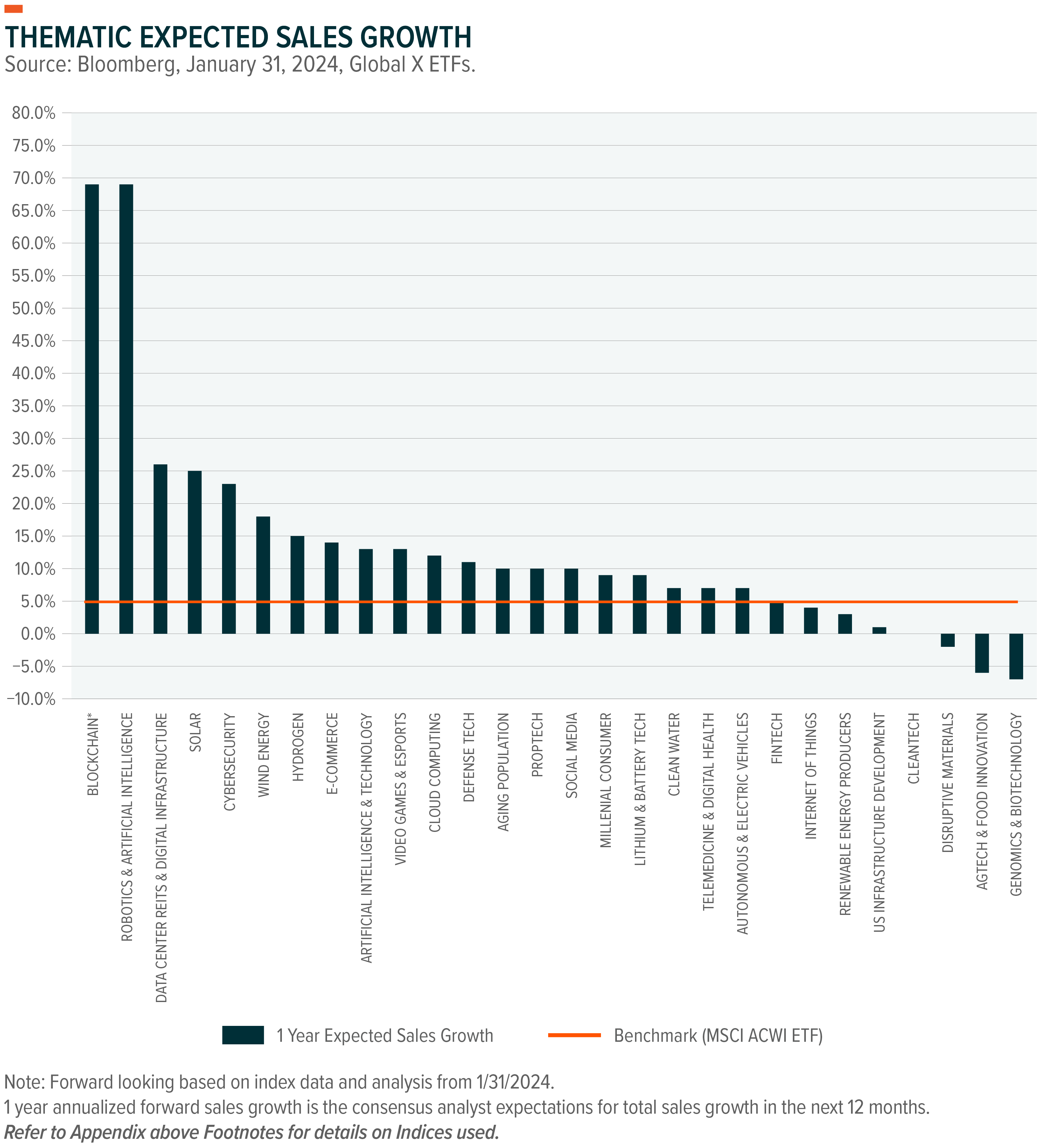

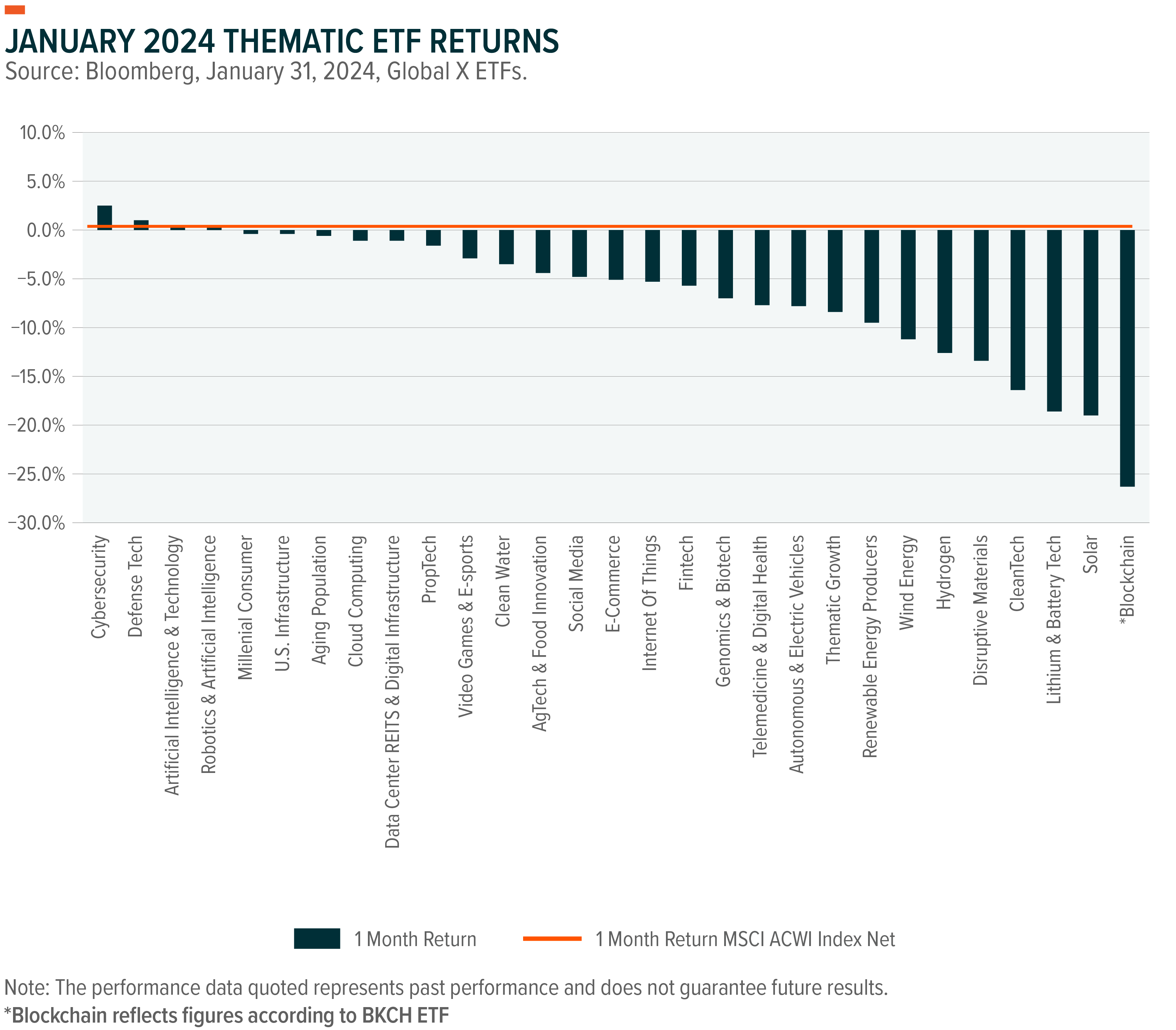

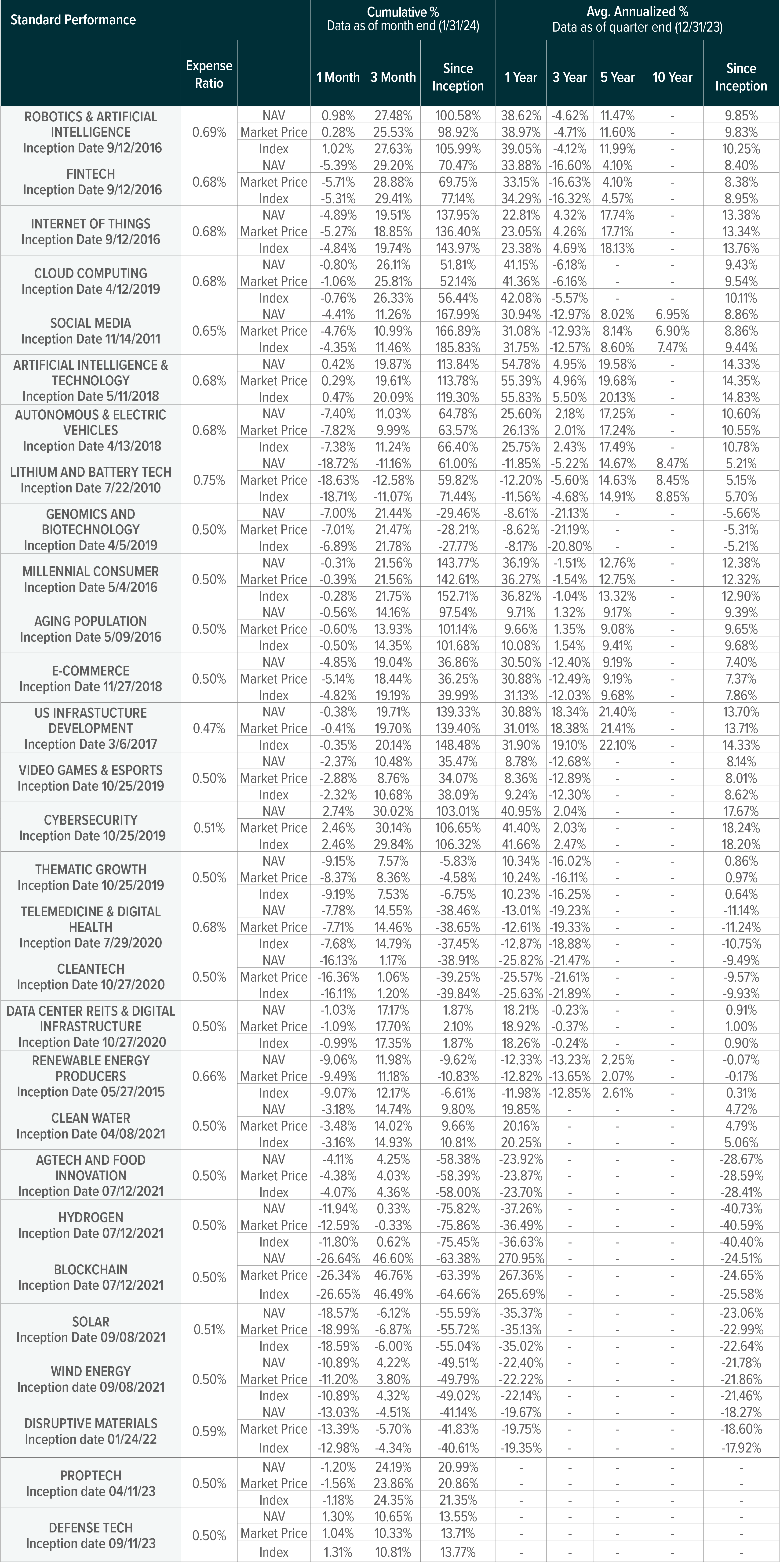

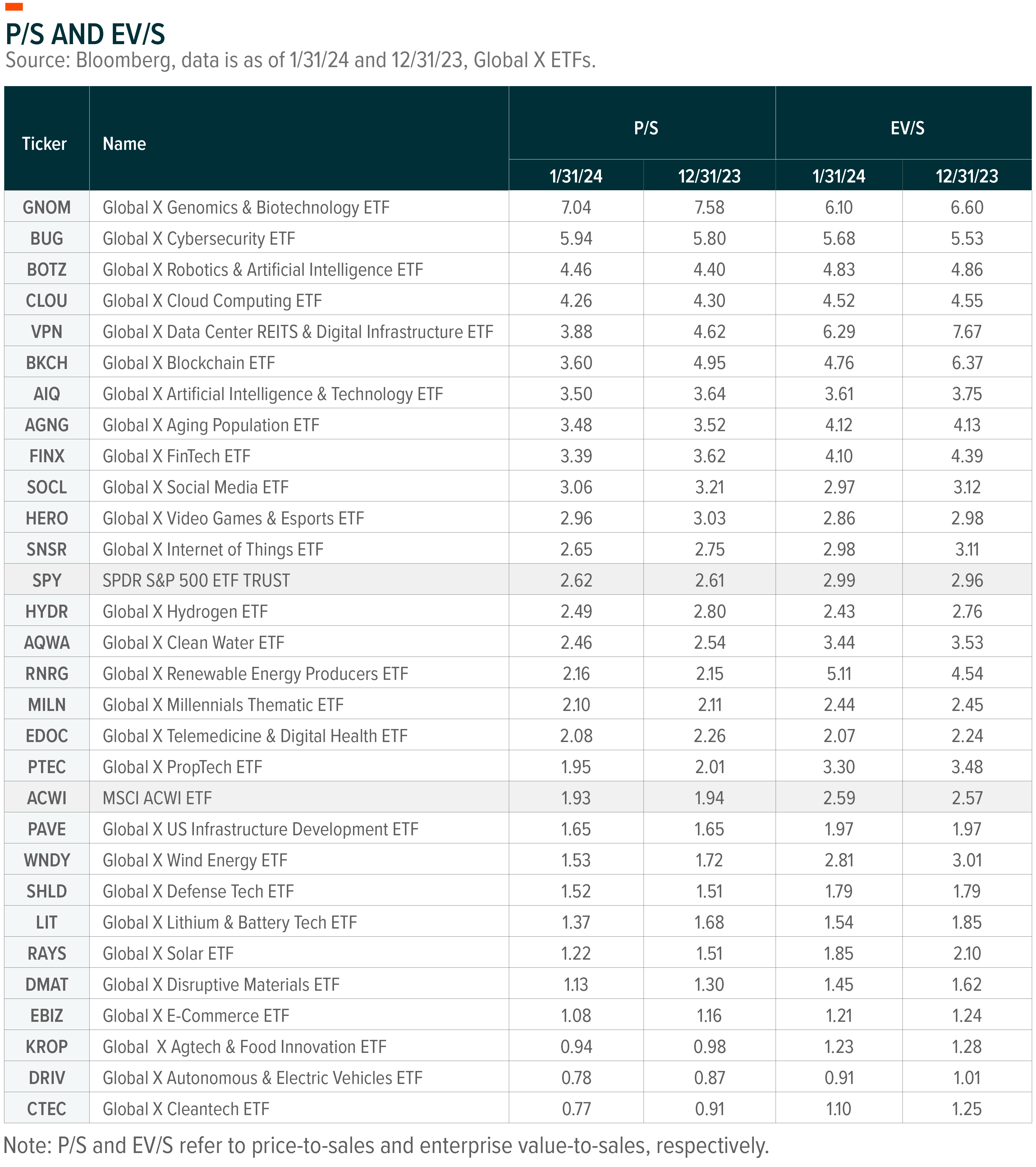

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs or indices.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Monthly Thematic ETF Commentary

- Clean Energy Opportunities: Nuclear & Renewables Complement Each Other

- Q&A with Katherine Hamilton on Climate Change and CleanTech

- Bitcoin Scarcity and Store-of-Value Attributes

- GLP-1s Are Just Getting Started: Prospects Beyond Diabetes and Obesity

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click these links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), Data Center REITs & Digital Infrastructure ETF (VPN), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), PropTech ETF (PTEC), Defense Tech ETF (SHLD)

- People and Demographics:Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC)

- Physical Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT)

- Multi-Theme:Thematic Growth ETF (GXTG)

Appendix: Thematic Expected Sales Growth Graph Indices

AgTech & Food Innovation: Solactive AgTech & Food Innovation Index

Aging Population: Indxx Aging Population Thematic Index

Artificial Intelligence & Technology: Indxx Artificial Intelligence & Big Data Index

Autonomous & Electric Vehicles: Solactive Autonomous & Electric Vehicles Index

Blockchain: Solactive Blockchain Index

Clean Water: Solactive Global Clean Water Industry Index

CleanTech: Indxx Global CleanTech Index

Cloud Computing: Indxx Global Cloud Computing Index

Cybersecurity: Indxx Cybersecurity Index

Data Center REITs & Digital Infrastructure: Solactive Data Center REITs & Digital Infrastructure Index

Defense Tech: Global X Defense Tech Index

Disruptive Materials: Solactive Disruptive Materials Index

E-Commerce: Solactive E-commerce Index

FinTech: Indxx Global FinTech Thematic Index

Genomics: Solactive Genomics Index

Hydrogen: Solactive Global Hydrogen Index

Internet Of Things: Indxx Global Internet of Things Thematic Index

Lithium & Battery Technology: Solactive Global Lithium Index

Millennial Consumer: Indxx Millennials Thematic Index

PropTech: Global X PropTech Index

Renewable Energy Producers: Indxx Renewable Energy Producers Index

Robotics & Artificial Intelligence: Indxx Global Robotics & Artificial Intelligence Thematic Index

Social Media: Solactive Social Media Total Return Index

Solar: Solactive Solar Index

Telemedicine & Digital Health: Solactive Telemedicine & Digital Health Index

U.S. Infrastructure: Indxx U.S. Infrastructure Development Index

Video Games & Esports: Solactive Video Games & Esports Index

Wind Energy: Solactive Wind Energy Index