The Next Big Theme (Japan): August 2023

Artificial Intelligence

ChatGPT Arrives in Kasumigaseki, Boosting Digitalization in the Japanese Government

According to reports, Microsoft will provide the base model of ChatGPT to the Japan Digital Agency, which plans to use it for notetaking in debates in the National Diet and statistical analysis.1 In order to prevent the leakage of confidential information and data, the government plans on using data centers based in Japan. The CEO of OpenAI, Sam Altman, visited Japan and held a meeting with Prime Minister Kishida, which soon followed by the government’s decision to establish a team to explore the effective usage of ChatGPT and generative AI in government affairs.

In an era where data security is an indispensable element of national security, some uncertainty remains over the risks generative AI and conversational AI may present to national security and personal information of users. Yet for governments and corporations alike, failing to adopt the most advanced AI models presents the very real risk of falling behind. Against this backdrop, how governments and corporations respond to the challenges posed by AI is becoming a watershed. At the local level, while the city of Yokosuka in Kanagawa Prefecture announced its plans to use ChatGPT for administrative affairs, the state of Maine in the US instead chose to place a 6-month ban on the use of ChatGPT and generative AI in the state government. At the national level, in March, the Italian government went as far as banning ChatGPT for a month due to concerns around the collection of personal data. In the case of Japan, the problems of a rapidly aging population and concomitant labor shortage particularly stand out. At the same time, the lack of digitalization has been seen as a problem for many years. Driven by these needs, the Japanese government likely aimed to send out a strong signal that it is serious about digitalization.

Semiconductors

America and Japan Consider India as Strengthening Semi Supply Chains Becomes Priority

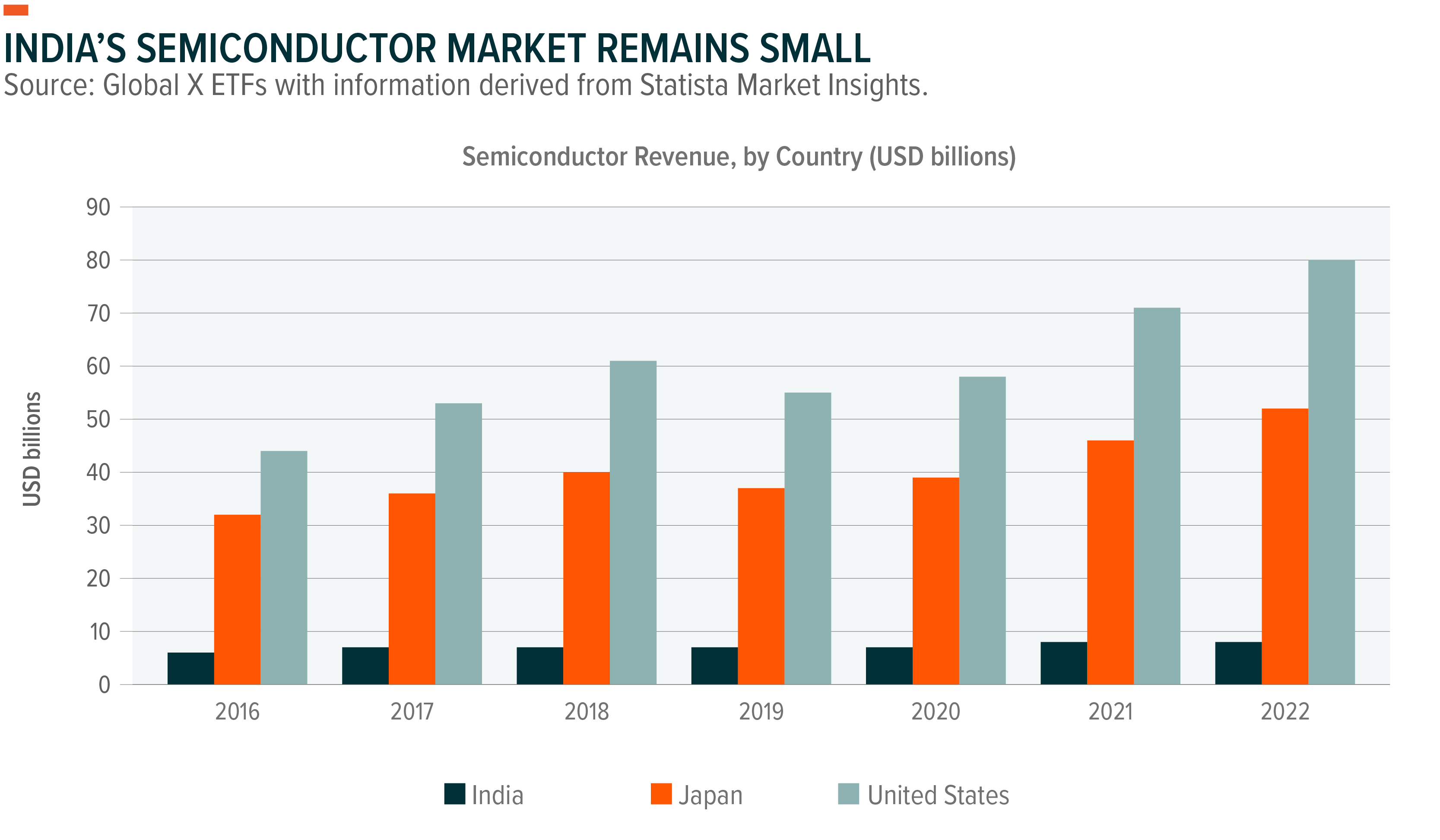

On July 20th, Japanese Minister of Economy, Trade and Industry (METI) Yasutoshi Nishimura visited India. In addition to announcing the “Japan-India Industry Co-Creation Initiative,” Nishimura also signed a memorandum of understanding (MoU) regarding semiconductor supply chain partnership with India. India’s semiconductor industry remains small, but with the passage of the Semicon India program in 2021, the Modi administration is raising of the banner of domestic production for Indian semiconductors. Among these efforts, attracting international partners is an urgent task for the Indian government. Some US semiconductor companies have already started investments into India. In June, Applied Materials announced its plans to build a 400mn USD factory in India, Lam research announced the launch of a program to cultivate semiconductor talent in the country, and Micron revealed its plans to construct a semiconductor testing facility in the state of Gujarat.2

Japanese companies may be moving in line with their American counterparts. In May, Renesas CEO Shibata Hidetoshi held a meeting with Prime Minister Modi, and in August semiconductor manufacturing equipment maker Disco stated it is exploring the possibility of building a facility in India. In response to an interview by the Japan External Trade Organization (JETRO), the state of Gujarat’s Department of Science and Technology stated that Gujarat may be an optimal place for such investments, due to the existing presence of an automobile ecosystem that includes major players like Honda and Suzuki in the state.3 It still remains to be seen how India is successful in its endeavors, but the decision of the Japanese government and semiconductor companies to explore partnerships in India is indicative of the broader trend of “friendshoring,” in which foreign bases of production are moved to allied or “friendly” countries.

Autonomous and Electric Vehicles

EV Charging Standards Reach Critical Moment in US, Japanese Automakers at a Crossroads

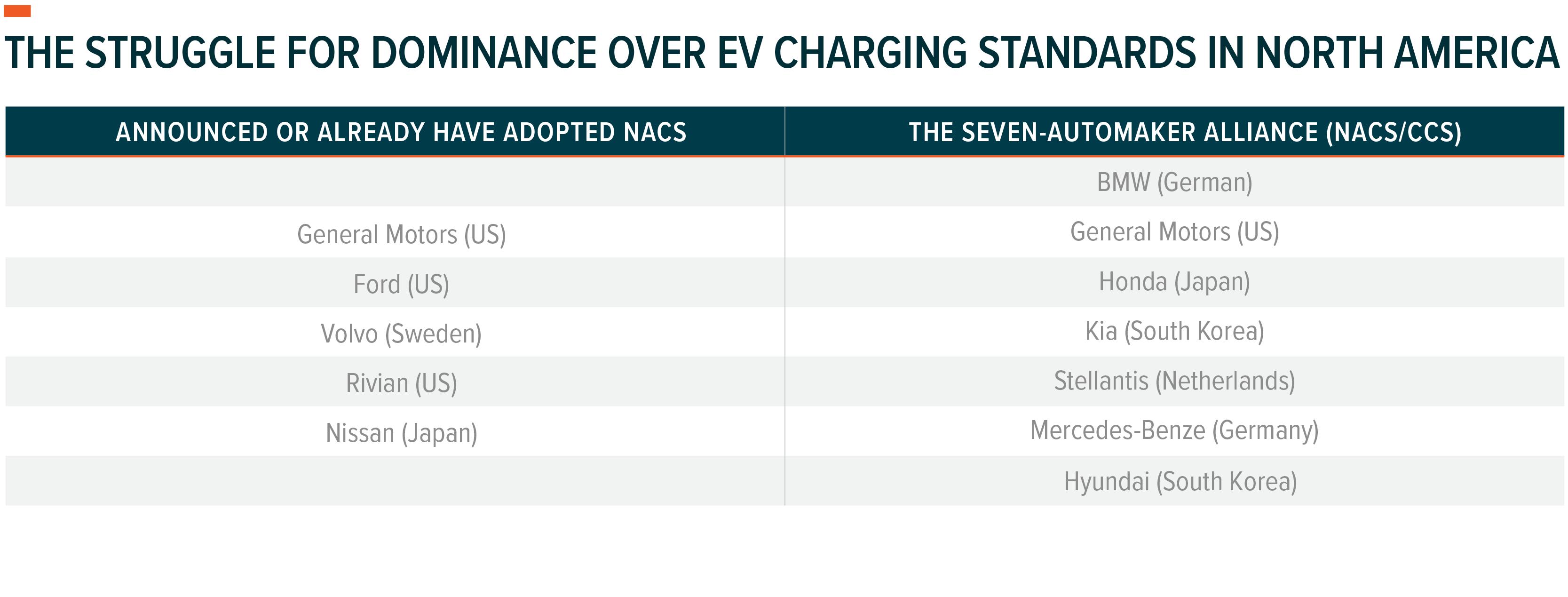

There are several charging standards for EVs. There is the North American Charging Standard (NACS) developed by Tesla, the Guobiao (GBT) standard in China, and the Combined Charging Standard (CCS). Furthermore, there is the CHAdeMo standard (an abbreviation of “Would you like a cup of tea?” in Japanese), which is mainstream in Japan but has lost its presence in the North America region. Currently, there are roughly 5521 CCS charging ports and 6258 NACS charging ports in America.4 In May and June 2023, Ford and General Motors announced their intent to adopt the NACS charging standard from 2025, which strengthened the view that NACS may emerge as the dominant charging standard in North America. As this unfolds, the decisions of Japanese automakers are worth observing. On July 26, Honda and six other large automakers revealed their plans to establish an EV charging equipment joint venture. The seven-automaker alliance is aiming to roll out at least 30,000 chargers in North America by 2030, which will support both NACS and CCS, in a move that can be interpreted as an attempt to prevent Tesla’s dominance over the space.5 On the other hand, on July 19, Nissan made public its plans to adopt NACS in its Ariya model and other future EV models starting in 2025, making it the first Japanese EV maker to embrace NACS, alongside plans to provide NACS adapters for existing Ariya EVs in 2024.6 At the moment, Toyota is neither a member of the seven-automaker alliance, nor has it announced plans to adopt NACS. On July 5th, Tesla CEO Elon Musk made a post on X (Twitter) inviting Toyota to join the NACS coalition.