The Next Big Theme: August 2022

E-commerce

E-commerce Shines a Spotlight on SMBs

Small and midsize businesses (SMBs) are being cast into the limelight as government aid and established commerce platforms lend a helping hand. Last month, India introduced the rollout of their Open Network for Digital Commerce (ONDC) across 100 major cities.1 ONDC is a government-backed initiative which seeks to make the online commerce market more equitable. The initiative will place tens of millions of kiranas, or Indian family businesses, at a more competitive level compared to reputable giants like Amazon, Google, and Flipkart. The ONDC initiative also offers a monetary advantage by capping referral commission to 3%, as opposed to the close to 30% third-party sellers currently pay.2 Companies like Amazon are also recognizing the opportunity within third-party sellers as they were responsible for 57% of the units sold on Amazon during Q2 2022.3 Revenue from these SMBs peaked during Q2 2022 at $27 billion—despite being a non-holiday quarter.4 Similarly, Alibaba announced an Intelligence Connectivity strategy at the annual AIoT Partnership Conference which hopes to reduce research and development costs for SMBs by 50%.5

Electric Vehicles

Inflation Reduction Act Should Make Electrification Accessible

An important implication of the impending Inflation Reduction Act (IRA) is how it impacts electric vehicle (EV) buyers. The provisions of the IRA detail the removal of the 200,000-vehicle limit per manufacturer as well as making the federal tax credit system more flexible.6 Upon purchase, consumers can opt to have the new incentive which will significantly reduce borrowing costs for new car buyers. There are limitations for qualifying price points and incomes, but generally this development is meant to promote America’s competitiveness within the EV market. Alternatively, buyers can choose the currently used system of a $7,500 capped EV tax credit which is being extended for 10 years on EVs placed into service after December 31, 2022.7 There are even considerations for used EVs as the IRA adds a rebate of up to $4,000 for used EVs if they are sold by a licensed dealer.8 If applied, this could be transformative for mass adoption of EVs. Keep in mind that income and materials sourcing requirements mean that few of the EV models currently available in the U.S. are eligible for the new tax credits that begin in 2023.

Renewable Energy Producers

Subsidy Auctions Are a Global Phenomenon

Globally, countries are leaning on subsidy auctions to support new renewable energy projects. As of most recent, Britain successfully held an auction which awarded contracts to projects able to generate 11 gigawatts (GW) of clean electricity.9 This level of clean energy capacity was nearly double previous auctions and could potentially power around 12 million homes in the U.K. and thus reduce reliance on volatile global prices.10 Likewise, Spain is planning an auction of 520 megawatts (MW) of renewable energy capacity in October.11 The auction will grant 140 MW towards photovoltaic projects, 220 MW towards solar thermal, 140 MW for biomass and 20 MW towards other technologies.12 The country aims to auction 20 GW or more of renewable capacity by 2025.13 Spain and the U.K. are not alone in these efforts—Greece plans to conduct four more renewable auctions by the end of 2022 while Croatia is currently holding their 622 MW renewable energy auction which already received admissions to compete from around 150 MW of power projects.14,15

Agtech & Food Innovation

Food Security Concerns Ease Amid Ongoing Political Tensions

Ukraine successfully exported grain out of Odesa for the first time since the beginning of Russia’s invasion. They procured an internationally brokered deal which resumes Ukraine’s agricultural exports. This is the first step towards rectifying the growing global food crisis. The ship carried 26,000 tonnes of corn to Lebanon following a long-winded negotiation between Ukraine and Russia, led by Turkey and the United Nations.16 Since the beginning of the conflicts, 16 loaded vessels carrying 22 million tonnes of grain remained stagnant in Ukraine’s ports and officials plan for ports to regain full transport capacity soon.17 This deal, which allows shipments to leave Black Sea ports once again, is potentially lifesaving for countries where food prices have drastically increased over the past six months. Regions such as Sudan saw prices rise 187%, 86% in Syria, and 60% in Yemen, for example.18

Social Media

Platforms Driven by Engagement

Meta Platforms sales fell 1% Year-over-Year (YoY) to $28.8 billion in Q2 2022, missing estimates and marking the first ever revenue drop for the company in its history.19 Cost grew 22% YoY, which caused operating income to drop by 32%.20 As the company navigates Apple’s privacy changes within the iOS 14 update which is hindering their targeting algorithms, they continue to see progress within engagement and monetization through Reels. The company’s video feature already reached over $1 billion in revenue run rate and accounts for 30% of all of user time on Facebook and Instagram.21 Growing engagement was a positive among all social platforms. Meta, which has over 3.5 billion users across its ecosystem of apps saw monthly active users up 1% YoY, and daily active users up 3% YoY.22 Snapchat had +18% YoY daily active users and Twitter had +17% YoY monetizable daily active users.23

Artificial Intelligence & Cloud Computing

Tech Earnings in a Struggling Macro Environment

Major technology companies released Q2 2022 earnings including Alphabet, Apple, Amazon, and Microsoft. Alphabet topped expected ad revenue at $56.29 billion during the quarter, which lifted the company’s near-term outlook to investors.24 Cloud unit grew 35% YoY, bringing in $6.3 billion in revenue.25 Microsoft, on the other hand, saw much of their growth attributed to their cloud computing sector. Increased enterprise commitment to Microsoft Azure saw revenue within Microsoft’s Intelligent Cloud business grow 20% YoY to $20.9 billion for the quarter.26 Amazon gave a report which exceeded consumer expectations with respect to overall revenue, Amazon Web Services (AWS) revenue, and advertising revenue. Amazon incurred a company-wide 7% revenue jump, while AWS jumped 33% YoY to $19.74 billion.27 Similar to Amazon, Apple’s earnings gave investors hope as Q2 brought in a revenue record of $83.0 billion, led by success in their Services business.28

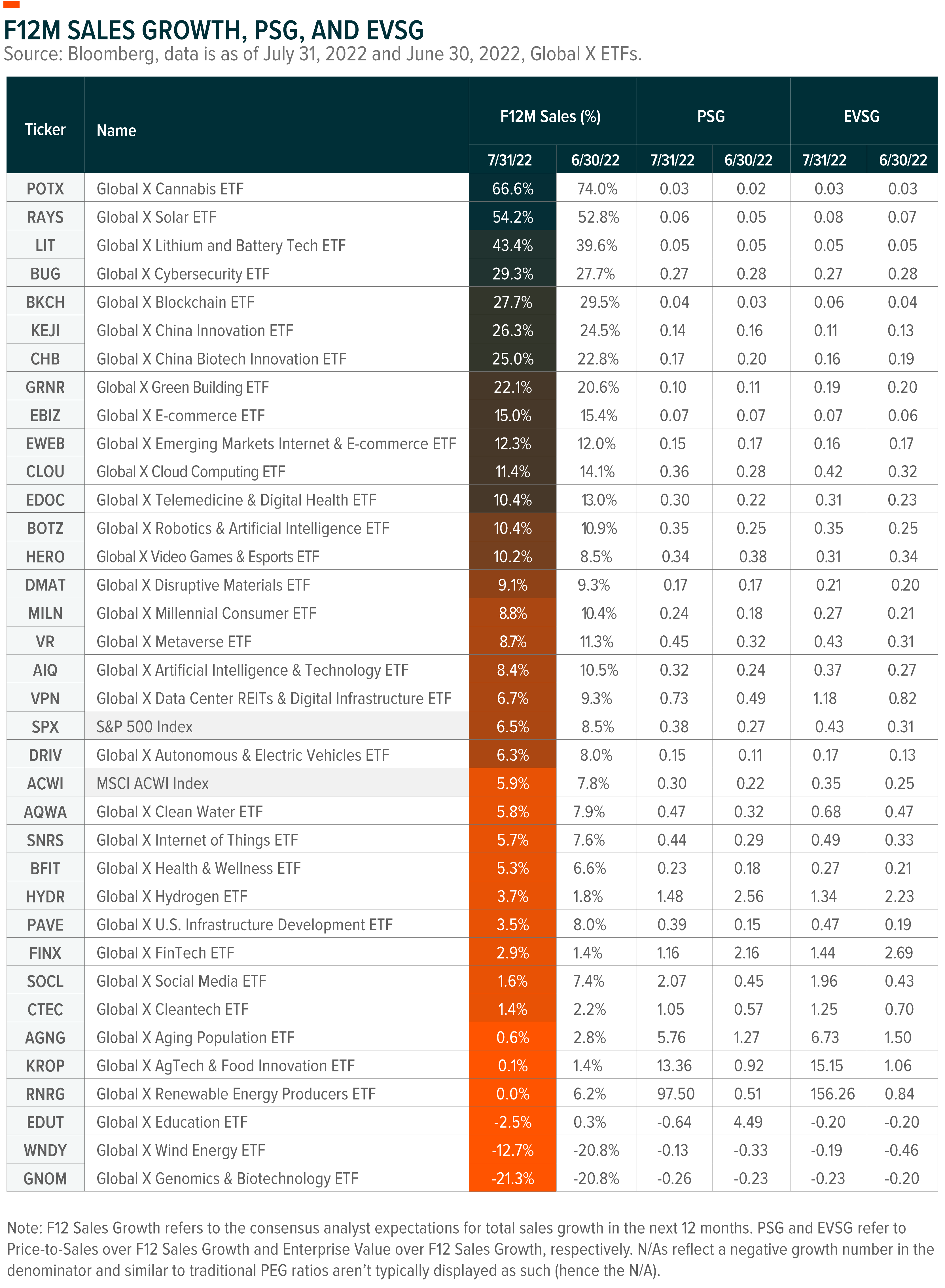

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA® or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Conversational Alpha: This Isn’t Your Parents’ EV Market

- Q&A on the Energy Transition With Chart Industries CEO Jillian Evanko

- An Investor’s Guide to Smart Contract Blockchains

- Global X ETFs Survey: American Familiarity with and Perspective on Disruptive Materials

- Webinar Replay: Thematic Investing – The Energy Transition Accelerates

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click the below links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR)

- People and Demographics:Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR)

- Multi-Theme:Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)