The Next Big Theme: April 2024

Lithium & Battery Technology

Lithium Prices Back on an Upswing

Global lithium prices showed signs of stabilizing as they entered positive territory for the first time year-to-date (YTD) in early April.1 Notably, in China, lithium carbonate traded around 15,550 USD per tonne as of April 10th, up 15% YTD.2 Also positive for prices is that global electric vehicle (EV) sales are projected to increase 27% year-over-year (YoY) to 17.5 million units in 2024.3 A surge of this magnitude could further drive lithium prices, which depend on robust EV demand. On the supply front, the U.S. Department of Energy conditionally agreed to loan $2.26 billion to Lithium Americas to help develop the company’s Thacker Pass mine in Nevada.4 The loan will largely finance the initial phase of the project, which is now estimated to cost $2.93 billion.5 Slated to start production in 2027, the company aims for the mine to produce 40,000 tons of battery grade lithium carbonate per year, enough to supply 800,000 electric vehicles (EVs).6 Thacker Pass contains the largest proven lithium reserve in North America and is expected to play a significant role in bolstering the domestic lithium & battery supply chain.

Artificial Intelligence

Tech Heavyweights Intensify AI Investments

Amazon will invest an additional $2.75 billion in Anthropic, a prominent AI startup and rival to OpenAI, at a valuation of $18.4 billion.7 Amazon’s total stake in Anthropic is now $4 billion, representing Amazon’s largest external venture investment.8 The investment comes shortly after Anthropic launched Claude 3, an AI model suite excelling in multimodal capabilities. Claude 3 reportedly surpasses OpenAI’s GPT-4 and Google’s Gemini Ultra in various benchmark tests, including knowledge and reasoning at various educational levels and basic mathematics.9 As part of the agreement, Anthropic will prioritize Amazon Web Service (AWS) for cloud services and utilize Amazon’s chips for developing and deploying its foundational models.10 The deal continues the trend of escalating AI investments by tech giants, which soared to $24.6 billion in 2023 from $4.4 billion in 2022.11 Nvidia’s recent unveiling of its most powerful AI processor yet, the Blackwell GPU Architecture, is another example of the intensifying AI technology race.12

U.S. Infrastructure

CHIPS Act Funding to Help Build New Semiconductor Facilities

The U.S. Department of Commerce has a non-binding preliminary agreement to allocate $8.5 billion from the CHIPS Act to Intel for the construction of semiconductor facilities in Arizona, New Mexico, Ohio, and Oregon.13 The four projects, which are expected to support 20,000 construction jobs, are part of Intel’s plan to invest more than $100 billion to expand its chip production capacity and capabilities in the U.S. over the next five years.14 Additionally, Intel may receive up to $11 billion in CHIPS Act loans and is eligible for a tax credit covering 25% of specific capital expenditures. All told, the funding for Intel represents the CHIPS Act’s largest allocation to date.15 National Grid announced a $4 billion investment to upgrade upstate New York’s power grid.16 Seventy projects over six years will enhance the grid’s resilience against extreme weather and support renewable energy. Over 1,000 miles of transmission lines will be overhaled.17 Investments like these will help modernize the country’s aging and disconnected power infrastructure and advance the energy shift.

Social Media

Reddit IPO Reignites Social Media Sector

Reddit’s shares surged 48% in their initial public offering (IPO) on March 21st, marking the first major social media IPO since Pinterest in 2019.18 This milestone potentially signals a new era for community-based platforms, as Reddit’s innovative monetization of AI points to emerging revenue opportunities beyond traditional advertising for social networks rich in user data. For example, Reddit anticipates incremental revenue from data licensing after agreeing to several deals with aggregate contract values above $200 million over 2-3 years.19 In 2024, Reddit expects to recognize roughly $66 million in revenue from data licensing deals.20 Among them, Alphabet’s expanded partnership with Reddit allows Google more access to Reddit data to train AI models and improve its products.21 This strategic partnership validates the viability of such monetization efforts and sets the stage for continued growth within social media.

Genomics and Biotechnology

Genomic Medicine and Biotech Approvals and Deal Activity Surge in Early 2024

The U.S. Food and Drug Administration (FDA) has now approved 26 genomic medicines and notably continues to expand approvals for already marketed drugs.22 Most recently, the FDA expanded Vertex Pharmaceutical and CRISPR Therapeutics’ approval of their gene editing treatment to include beta-thalassemia.23 The expanded approval came over two months ahead of schedule and six weeks after the original approval of Casgevy for sickle cell disease (SCD). Sales of Casgevy are expected to be robust, totaling $2.7 billion in 2028.24 The FDA also recently approved the first CAR-T cell therapy for solid tumors. Historically, CAR-T treatment approvals have been limited to blood-based cancers, so this approval opens the door to a wider pool of cancer types. Ongoing genomic and biotech innovation has also accelerated mergers and acquisition (M&A) activity, which includes Gilead Science’s recent acquisition of CymaBay Therapeutics for $4.3 billion to bolster its liver disease portfolio.25

CleanTech

Industry Leaders Collaborate to Accelerate Clean Power

Microsoft, Google, and Nucor announced the Advanced Clean Electricity initiative, aiming to propel emerging 24/7 clean energy technologies such as advanced nuclear, next-gen geothermal, and long-duration energy storage.26 This initiative seeks to mitigate project risks and enhance efficiencies for these types of projects, and it highlights how long-duration energy storage is essential for transitioning to greener power grids, given the intermittency of wind and solar energy. Requests for information about early pilot projects were sent out, and applicants have until mid-April to make submissions. Power purchase agreements for selected projects will be finalized by early 2025.27 Additionally, the U.S. Department of Energy announced $6 billion in funding for 33 projects focused on decarbonizing energy-intensive industries like aluminum, cement, and steel.28 These projects, ranging from metal recycling to hydrogen-fueled steel production, aim to cut annual CO2 emissions by 14 million metric tonnes—equivalent to emissions from 3 million gas-powered cars.29

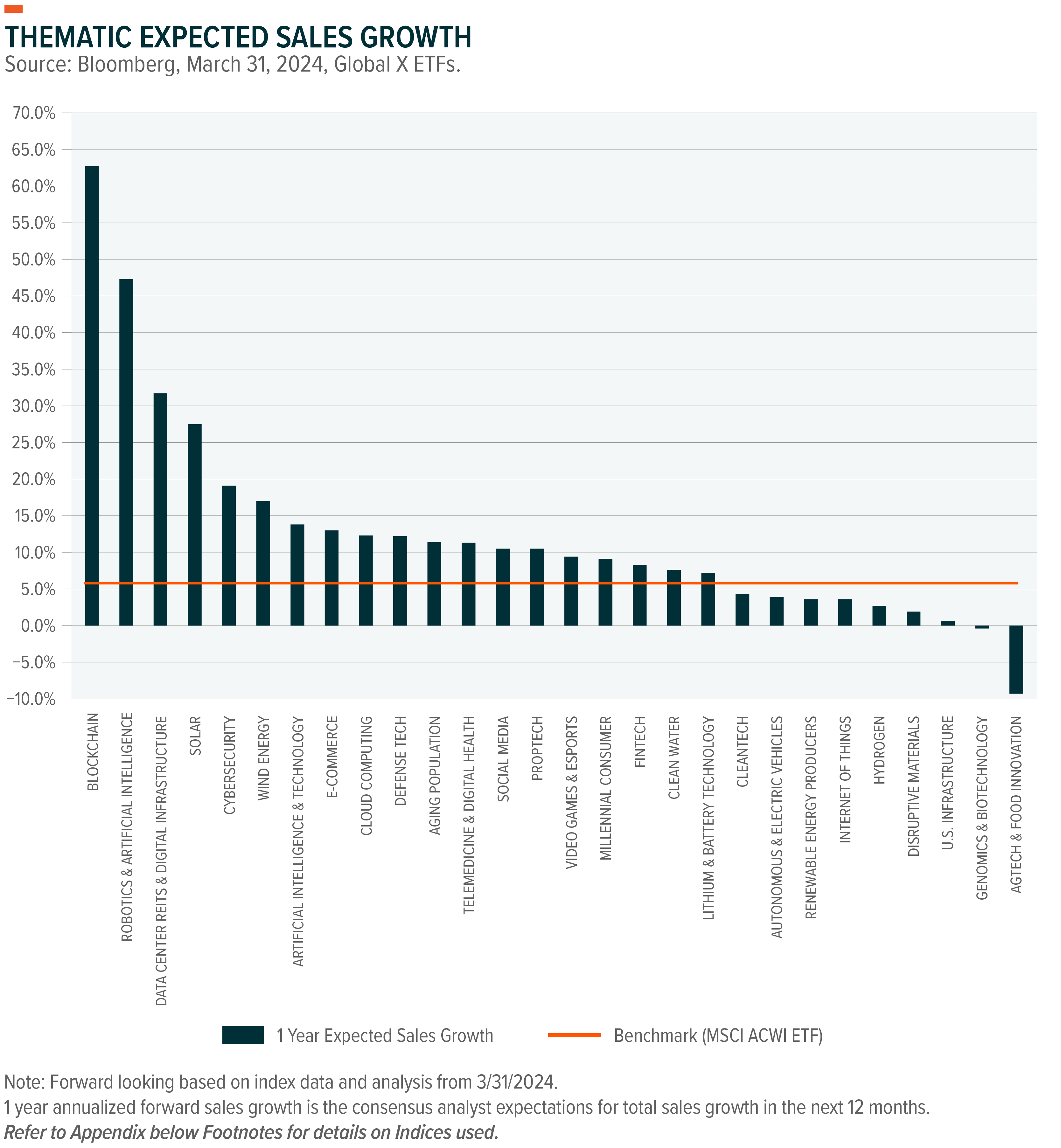

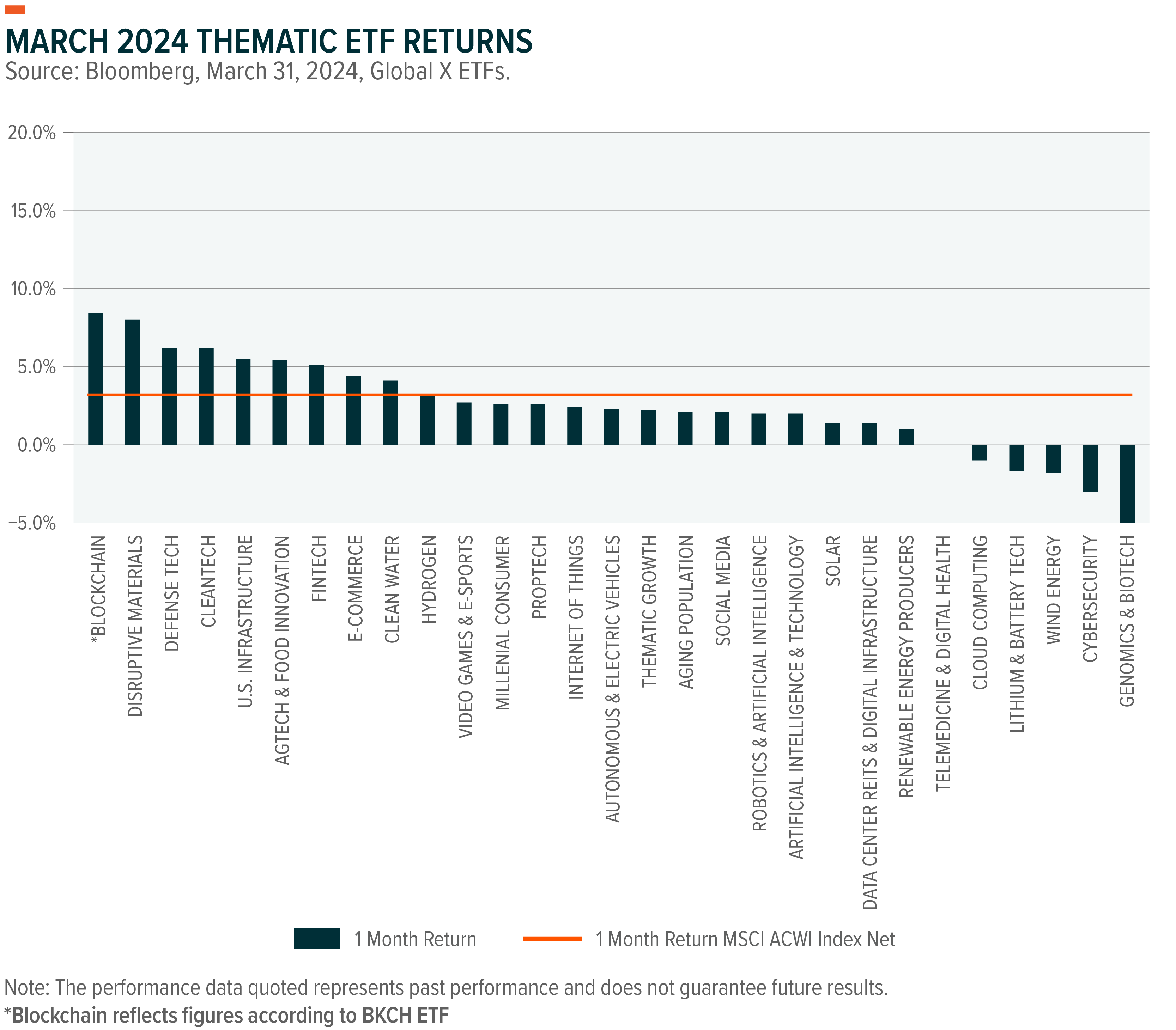

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs or indices.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Inflection Points: AI Doesn’t Rhyme with Dotcom

- Investing in Pharma: How to Spot Leading Drug Candidates

- The Rise of Humanoids, Explained

- U.S. Election Preview: Infrastructure Development is Something Both Sides Can Agree On

- How AI Is Shaping the Future of Data Platforms & Infrastructure in 2024

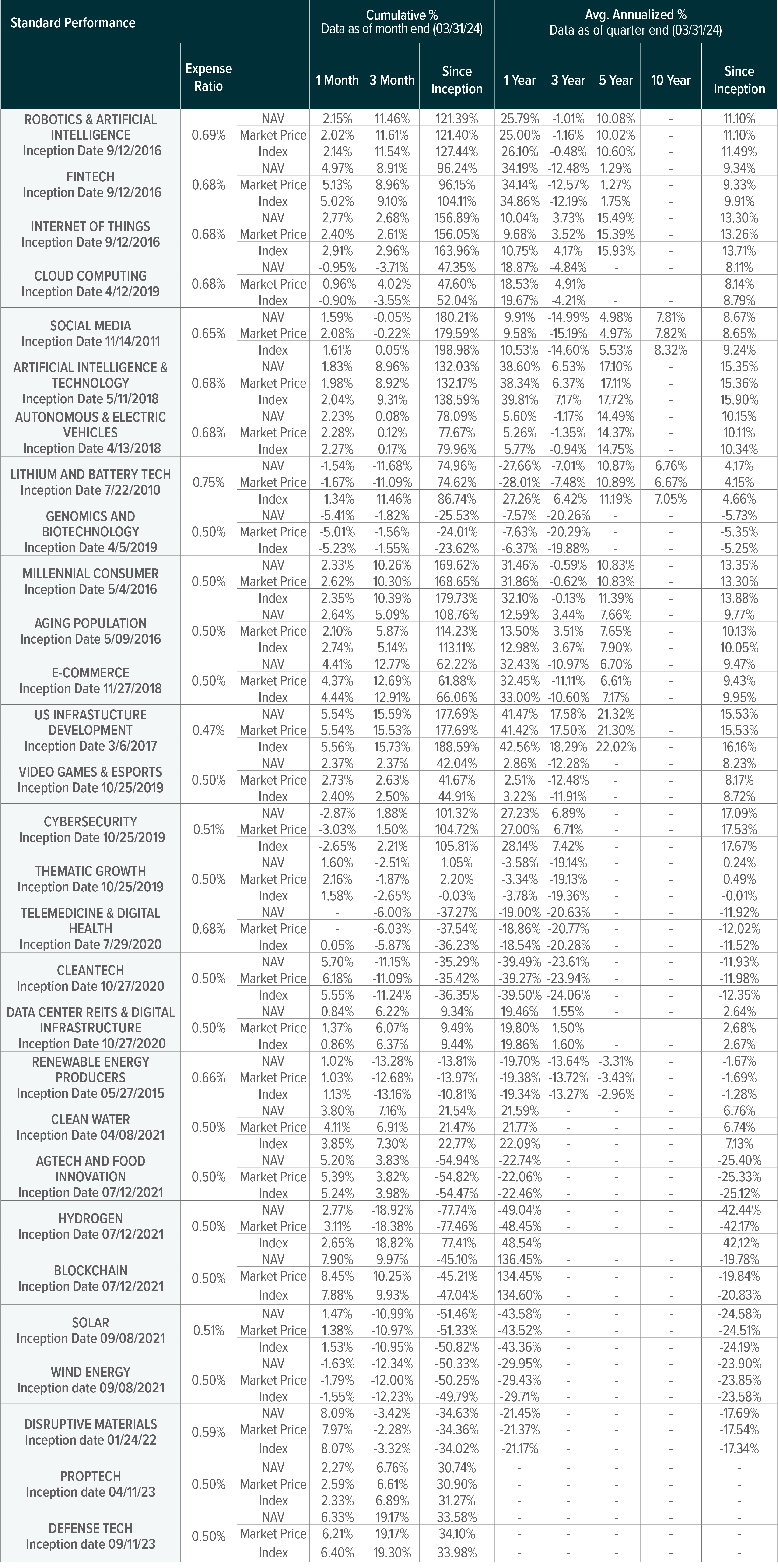

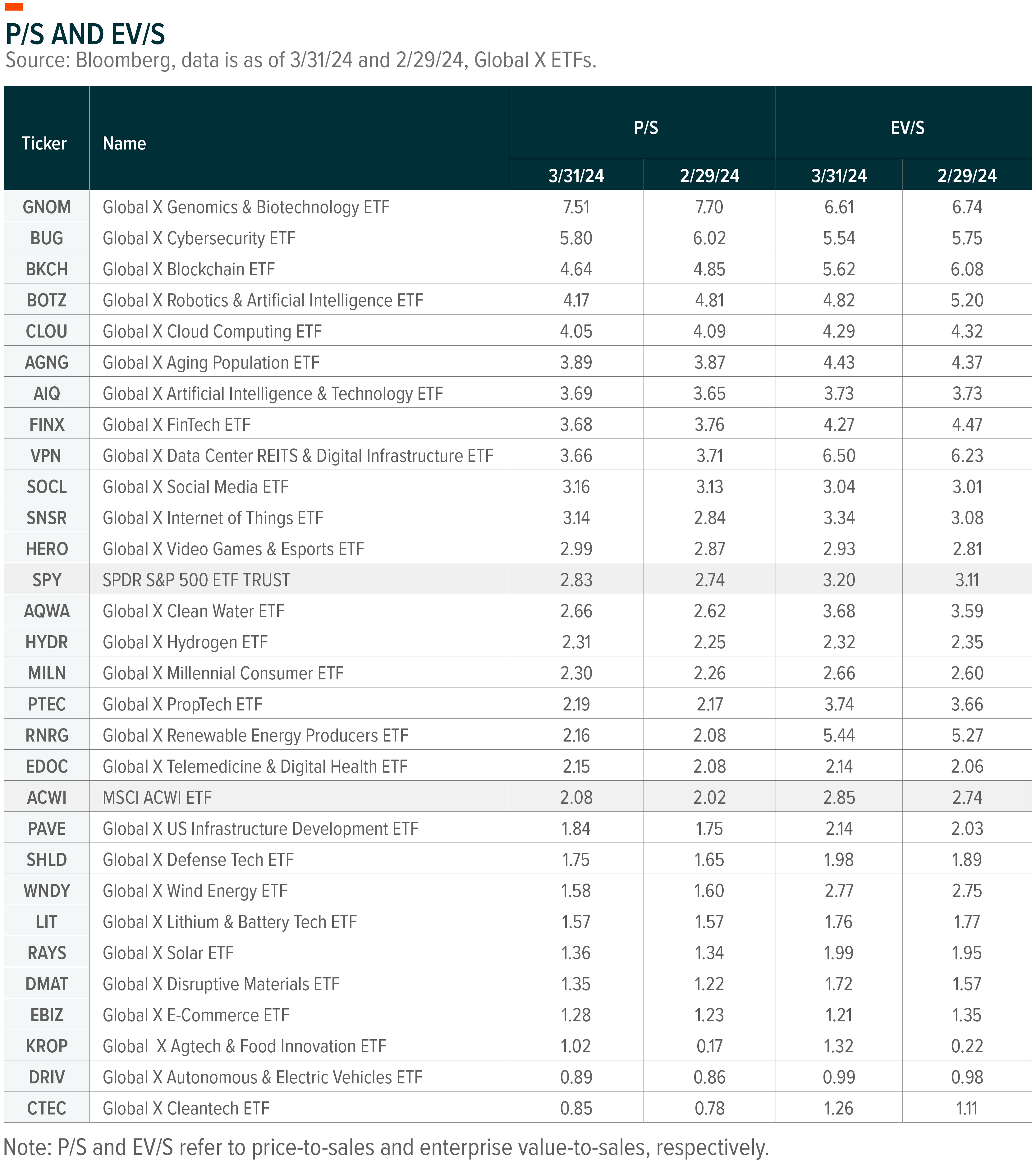

ETF HOLDINGS AND PERFORMANCE

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click these links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), Data Center REITs & Digital Infrastructure ETF (DTCR), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), PropTech ETF (PTEC), Defense Tech ETF (SHLD), Bitcoin Trend Strategy ETF (BTRN)

- People and Demographics:Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC)

- Physical Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT)

- Multi-Theme:Thematic Growth ETF (GXTG)

Appendix: Thematic Expected Sales Growth Graph Indices

AgTech & Food Innovation: Solactive AgTech & Food Innovation Index

Aging Population: Indxx Aging Population Thematic Index

Artificial Intelligence & Technology: Indxx Artificial Intelligence & Big Data Index

Autonomous & Electric Vehicles: Solactive Autonomous & Electric Vehicles Index

Blockchain: Solactive Blockchain Index

Clean Water: Solactive Global Clean Water Industry Index

CleanTech: Indxx Global CleanTech Index

Cloud Computing: Indxx Global Cloud Computing Index

Cybersecurity: Indxx Cybersecurity Index

Data Center REITs & Digital Infrastructure: Solactive Data Center REITs & Digital Infrastructure Index

Defense Tech: Global X Defense Tech Index

Disruptive Materials: Solactive Disruptive Materials Index

E-Commerce: Solactive E-commerce Index

FinTech: Indxx Global FinTech Thematic Index

Genomics: Solactive Genomics Index

Hydrogen: Solactive Global Hydrogen Index

Internet Of Things: Indxx Global Internet of Things Thematic Index

Lithium & Battery Technology: Solactive Global Lithium Index

Millennial Consumer: Indxx Millennials Thematic Index

PropTech: Global X PropTech Index

Renewable Energy Producers: Indxx Renewable Energy Producers Index

Robotics & Artificial Intelligence: Indxx Global Robotics & Artificial Intelligence Thematic Index

Social Media: Solactive Social Media Total Return Index

Solar: Solactive Solar Index

Telemedicine & Digital Health: Solactive Telemedicine & Digital Health Index

U.S. Infrastructure: Indxx U.S. Infrastructure Development Index

Video Games & Esports: Solactive Video Games & Esports Index

Wind Energy: Solactive Wind Energy Index