The Next Big Theme: April 2023

Digital Health & Cybersecurity

FDA Prioritizes Safety in Medical Devices

The Food & Drug Administration (FDA) updated regulations and guidelines for medical device approval. Among the changes, medical device manufacturers must provide more documentation about cybersecurity measures implemented to safeguard devices and contingency plans for responding to potential vulnerabilities.1 Also, the FDA has new patching protocols for medical devices and now requires a software bill of materials to document the components and libraries used in device software.2 These updated guidelines apply to new applications submitted after March 29, 2023. Applications submitted prior to March 29 will continue to be governed by the previous guidelines until October 1, 2023.3

The FDA also released proposed changes to machine learning-enabled device software functions (ML-DSF) that would require manufacturers to provide detailed explanations of planned modifications, the methodology used to implement and validate such modifications, and an assessment of their potential impact within marketing submissions.4 These procedural changes may lead to slightly longer approval times for medical devices.

Electric Vehicles

Early 2023 Sales Surged

Global EV sales increased 23% month-over-month (MoM) in February 2023 with 800,000 units sold, up 45% from the same period last year.5 The main driver of the growth was China, which sold an additional 100,000 units.6 Through February, global sales of passenger cars (PC) and light-duty vehicles (LDV) totaled 1.4 million this year, with 1.0 million sales of battery electric vehicles (BEV) and 0.4 million sales of plug-in hybrid electric vehicles (PHEV).7

New Tax Credit Provisions Set

The U.S. Treasury Department issued further guidance on the EV tax credit provisions in the Inflation Reduction Act (IRA). To qualify for up to $7,500 in EV tax credits, consumers must purchase a new, qualified plug-in EV or fuel cell electric vehicle (FCV) for their personal use and primarily use it in the United States.8 The Internal Revenue Service (IRS) will provide a list of eligible vehicles on April 18, 2023, when the new requirements take effect. Qualifying vehicles must be assembled in North America and source a certain percentage of battery components and critical materials domestically or from desired trading partners.9 EVs that meet only one of the requires are still eligible for a $3,750 credit.10 Among EV manufacturers, Ford confirmed that its entire lineup of EVs, including the F-150 Lightning, Mustang Mach-E, and E-Transit commercial van, are eligible for the tax credit.

Artificial Intelligence & Social Media

Generative AI, Commercialized

Meta set a deadline of December 2023 to expand its use of generative AI through the in-house team that the company established in February.11 Meta’s chief technology officer, Andrew Bosworth, believes that AI can greatly enhance the effectiveness of advertisements.12 By requesting AI to create ads that cater to specific audiences, companies should be able to save time and money. Advertising is a major source of revenue for Meta, and the company plans to apply the technology across its products and services, including Facebook and Instagram. Bosworth also expects generative AI to be used in the Metaverse, particularly for content creation. Amazon Web Services (AWS) plans to launch an accelerator to support the most promising startups in the field.13 This initiative is expected to drive innovation and serve as a catalyst for advancement in the industry.

Robotics & Internet of Things

Auto Industry Accelerated Robotics Adoption

The automotive industry leads all industries with approximately one million robots working in its factories worldwide, accounting for roughly one-third of all robots installed.14 Auto manufacturers continue to use traditional “caged” industrial robots for basic assembling, but most manufacturers are investing in collaborative applications for final assembly and finishing tasks. With the industry investing $521 million in January 2023 and $620 million in February, robotics funding is on an upward trend.15 Companies like Qualcomm are leading the charge with new platforms that feature machine vision capabilities. Qualcomm’s RB1 and RB2 platforms are ideal for low-power, entry-level robotics and IoT applications.

Cloud Computing

Public Sector Reaches for the Cloud

Palantir expanded its strategic cloud computing partnership with Microsoft to include the public sector. The Palantir Federal Cloud Service (PFCS) received authorization from the Federal Risk and Authorization Management Program (FedRAMP) to support workloads at U.S. Department of Defense (DoD) Impact Level (IL) 4 and DOD IL5 on Microsoft Azure.16 This means that the two companies’ strategic partnership, which was previously limited to the private sector, will now extend to the public sector. Customers and industry partners can now access the collaborative capabilities in both Microsoft Azure Government and Azure Commercial ecosystems, giving defense organizations a breadth of new solutions to meet critical needs. Also, Amazon Web Services announced plans to invest over $13 billion in Australia over the next five years.17 As part of this investment, the company aims to power its data centers entirely on renewable energy and create nearly 11,000 full-time equivalent positions.18

Fintech

Fintech Funding Bounced Back

Fintech funding rebounded in Q1 2023 after declining for three consecutive quarters.19 Startups raised $17 billion through 847 deals, up from $11.7 billion in Q4 2022.20 The deals appear to have been structured more carefully amid the challenging economic landscape.21 Among the themes attracting venture capital investment are regtech, fraud prevention, and generative AI. On the Buy Now, Pay Later (BNPL) front, Apple launched a pre-release version of Apple Pay Later to select users, with plans to make it more widely accessible in the coming months. With Apple Pay Later, users can apply for loans ranging from $50 to $1,000 that can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay.22 Like most BNPL platforms, users can split their purchases into four payments spread over six weeks, with no interest and no fees.

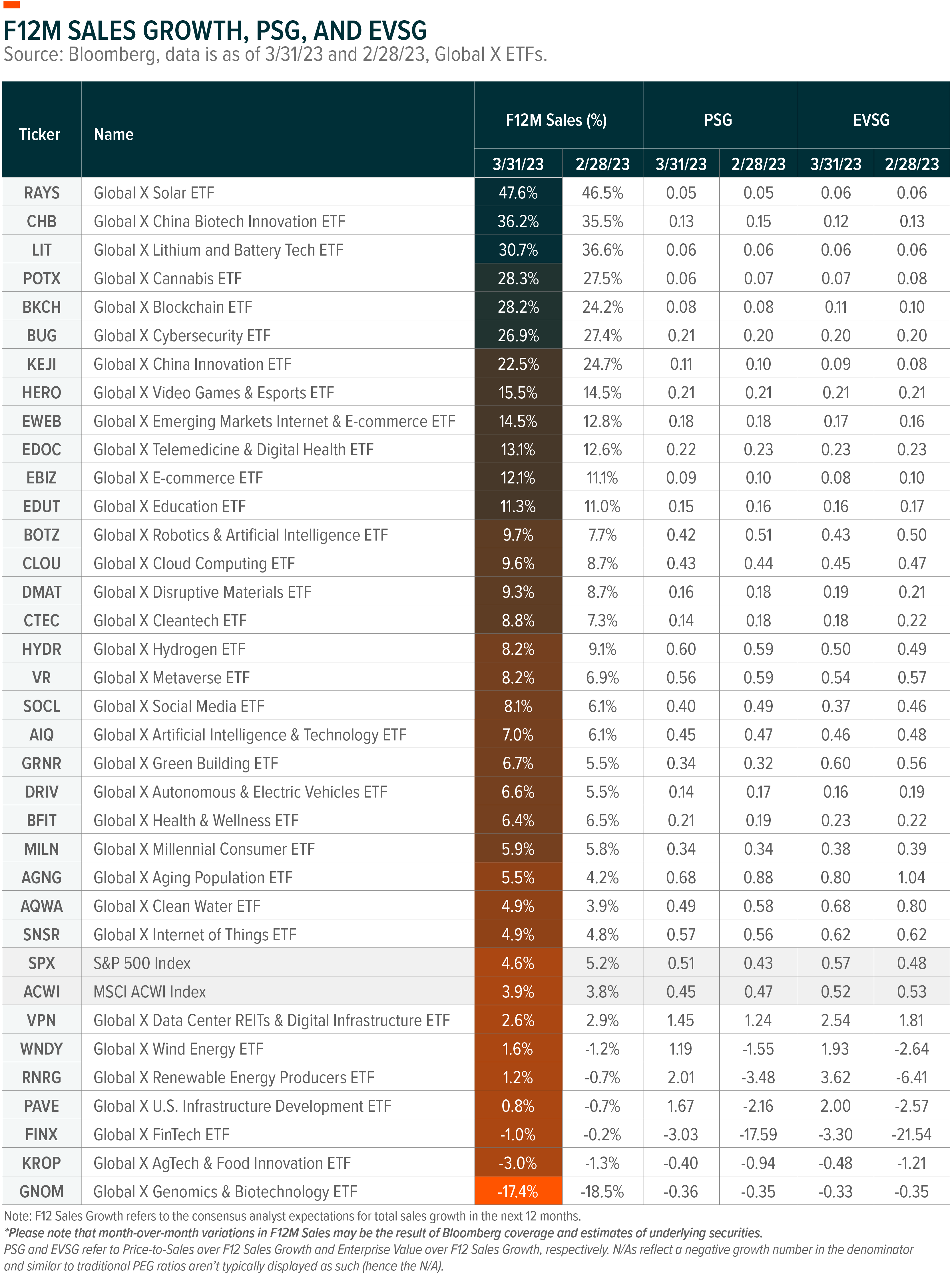

THE NUMBERS

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs.

INTRO TO THEMATIC INVESTING COURSE – ELIGIBLE FOR CE CREDIT

Global X has developed an interactive, self-guided Intro to Thematic Investing course, that is designed to share the latest ideas and best practices for incorporating thematic investing into a portfolio.

This program has been accepted for 1.0 hour of CE credit towards the CFP®, CIMA®, CIMC®, CPWA®, or RMA certifications. To receive credit, course takers must submit accurate and complete information on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

For Canadian course takers: This program has been reviewed by FP Canada and qualifies for 1 FP Canada-Approved CE Credit, in the category of Product Knowledge, towards the CFP® certification or QAFP™ certification. To receive credit, course takers must submit accurate and complete information (including Job Title) on the requested forms, complete the entire course, and receive a 70% or higher on the Intro to Thematic Investing Quiz.

Questions on receiving CE credit may be sent to: Education@globalxetfs.com

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- CleanTech Gets a Big Corporate Push

- Where Do Emerging Markets Stand in the Electric Vehicle Transition?

- Global X ETFs Survey: Digital Health Trends & Technologies

- Digital Economy Discovers a Potential Frontier for Growth Thanks to Generative AI

- Artificial Intelligence in China: Implications and Opportunities

ETF HOLDINGS AND PERFORMANCE:

To see individual ETF holdings and current performance across the Global X Thematic Growth Suite, including information on the indexes shown, click these links:

- Disruptive Technology:Artificial Intelligence & Technology ETF (AIQ), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), Internet of Things ETF (SNSR), Social Media ETF (SOCL), China Biotech Innovation ETF (CHB), Data Center REITs & Digital Infrastructure ETF (VPN), Emerging Markets Internet & E-Commerce ETF (EWEB), AgTech & Food Innovation ETF (KROP), Blockchain ETF (BKCH), Blockchain & Bitcoin Strategy ETF (BITS), Metaverse ETF (VR)

- People and Demographics:Cannabis ETF (POTX), Millennial Consumer ETF (MILN), Health & Wellness ETF (BFIT), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC), Education ETF (EDUT)

- Physical Environment:U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), Disruptive Materials ETF (DMAT), Green Building ETF (GRNR)

- Multi-Theme:Thematic Growth ETF (GXTG), China Innovation ETF (KEJI)