Telemedicine: Rewriting Healthcare Standards as New Policies Emerge

The COVID-19 pandemic has shed light on systemic inefficiencies in the healthcare space and proven that the value of remote medicine goes far beyond a short-term solution during a global pandemic. At the core of its adoption lays an emerging policy framework that extends current Medicare telehealth reimbursement and prescribing waivers beyond the COVID-19 Public Health Emergency (PHE).

We believe the economic and social benefits of telemedicine are creating an environment where the technology will be ingrained across healthcare verticals. In this piece, we highlight different ways industry players are gearing up for the long-term adoption of telemedicine and virtual care offerings.

Key Takeaways

- Recent federal legislation and policy proposals look to ensure telemedicine is accessible long after the pandemic ends.

- Amid policy coverage uncertainty, telemedicine and digital health firms are tailoring their solutions to meet patient needs and facilitate the right balance between in-person care and virtual care.

- The digital health industry is building a foundation for increasingly connected services, including pharmacy fulfillment and diagnostic capabilities, that we expect to increase the industry’s value proposition.

Telemedicine Finds Policy Support Beyond the Pandemic

In response to COVID-19, state and federal governments enacted short-term measures to facilitate the use of telemedicine. These measures allowed for Centers for Medicare & Medicaid Services (CMS) coverage of telehealth services, allowed practitioners to prescribe controlled substances to patients using telemedicine. We also saw physician licensing requirements ease, allowing physicians to treat patients via telemedicine across state lines.1 Largely due to these short-term policies, telehealth use is now 38 times higher than pre-pandemic levels.2

Now that patients and providers have seen that better, more efficient healthcare exists, many are pushing for permanent solutions to the restrictive pre-existing regulations.3 To that end, we’ve seen multiple recent efforts:

- Citing expand access to care, reduced costs, and improved health outcomes, a bipartisan group of 47 senators called for the extension of expanded coverage to telehealth services to be included in must-pass legislation in February.4

- A recent letter, signed by over 300 organizations, urged Congress to establish “a pathway to comprehensive telehealth reform.” Amazon, Teladoc, Walmart, Zocdoc, and Zoom are among the firms calling for change.5

Given increasing pressure, Congress recently introduced the Telehealth Extension and Evaluation Act, bipartisan legislation that looks to extend current Medicare telehealth reimbursement and prescribing waivers for two years after the COVID-19 PHE. The bill would also allow for a study on the impact of telehealth services on Medicare beneficiaries to inform future legislation.6

Payment Parity at the Heart of the Discussion

Though long-term regulations easing the use of telehealth have bipartisan support, there is debate about how exactly to implement them. At the heart of the discussion is payment parity, which would require insurers to reimburse telehealth and in-person services at the same rate.7

There are a few factors informing the logic behind payment parity and the circumstances in which it would be appropriate. In some instances, for example, telemedicine is not an appropriate option for patients as it cannot ensure the same level of care.8 Certain patient interactions, for instance, require a thorough in-person examination to develop a diagnostic or treatment plan. On the flip side, sweeping legislation limiting payment parity could disincentivize physicians from using telemedicine as they would receive less revenue per consultation.9 (See: Telemedicine & Digital Health Are Crossing the Chasm for more detail on how telemedicine fits value-based priorities set by CMS).

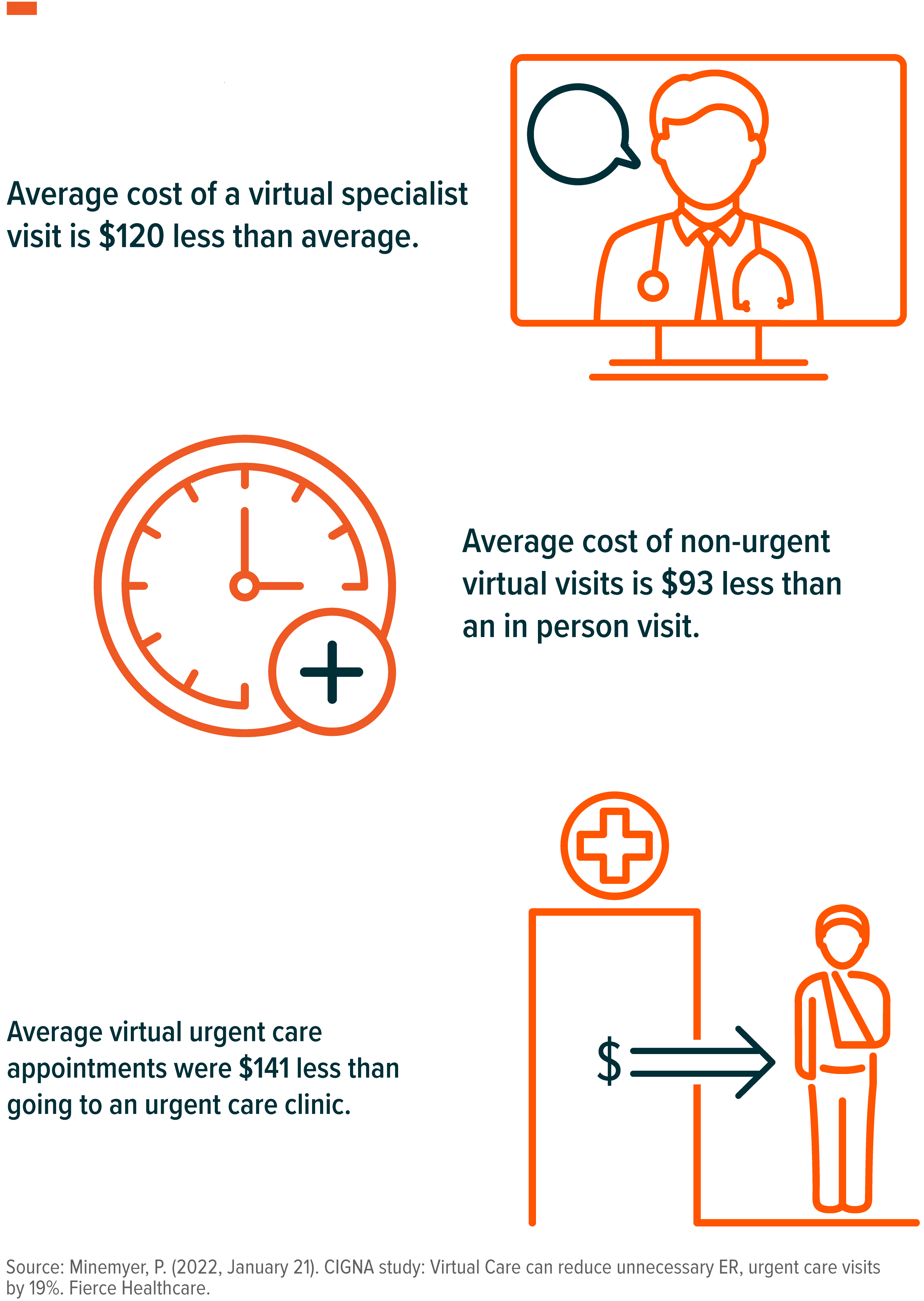

While Congress figures out the specifics of long-term telehealth legislation, private insurers recognize the value of remote and digital care and are moving swiftly to make telemedicine accessible to their customers for the long term. Anthem, UnitedHealthcare, Cigna, and CVS Health’s Aetna all now offer employers virtual primary care plans.10 Cigna, via their recently acquired telemedicine platform MDLive, conducted a study to measure the impact of accessible telemedicine. They report that patients who saw virtual providers also saw 19% fewer visits to the ER or urgent care. Study participants also saw steep discounts vs in-person care:11

Telemedicine Offers Patients and Providers Flexibility

In our view, the firms best-positioned for growth will be able to strike and communicate the right balance between virtual and in-person care. We believe the three major subsegments of telehealth – virtual primary care, virtual chronic care, and virtual mental health – are poised for significant growth as industry leaders tailor their services to these specific use cases.

- Virtual Primary Care encompasses day-to-day healthcare provided by a licensed professional. Services include family medicine, general internal medicine, general pediatrics, and obstetrics and gynecology.12 When appropriate, the provider coordinates with specialists and offers a hybrid approach of telemedicine and in-person care.13 As the virtual primary care segment gets increasingly more competitive, players would be well served to find ways to differentiate themselves. Most recently, Amazon and Teladoc, via a recent partnership, are offering Amazon Alexa-enabled audio consultations for non-emergent visits.14 Anthem, on the other hand, is leveraging AI-backed modeling and data analytics to build out each patient’s personalized care plan.15

- Virtual Chronic Care Management entails continuous care to patients living with chronic conditions like diabetes, congestive heart failure, and chronic obstructive pulmonary disease (COPD). CMS reports that 93% of overall Medicare spending comes from two-thirds of Medicare beneficiaries with multiple chronic.16 Virtual chronic care management, currently more than any other telehealth subsegment, offers a unique opportunity to leverage remote patient monitoring. The advent of new technology to remotely measure vitals and automatically report them to a physician will be key in offering more comprehensive care to patients. To fully engrain the use of digital health, the industry should look to mimic the success diabetes monitoring has seen, where medication is automatically dispensed to the patient when vitals are deemed outside of normal range.

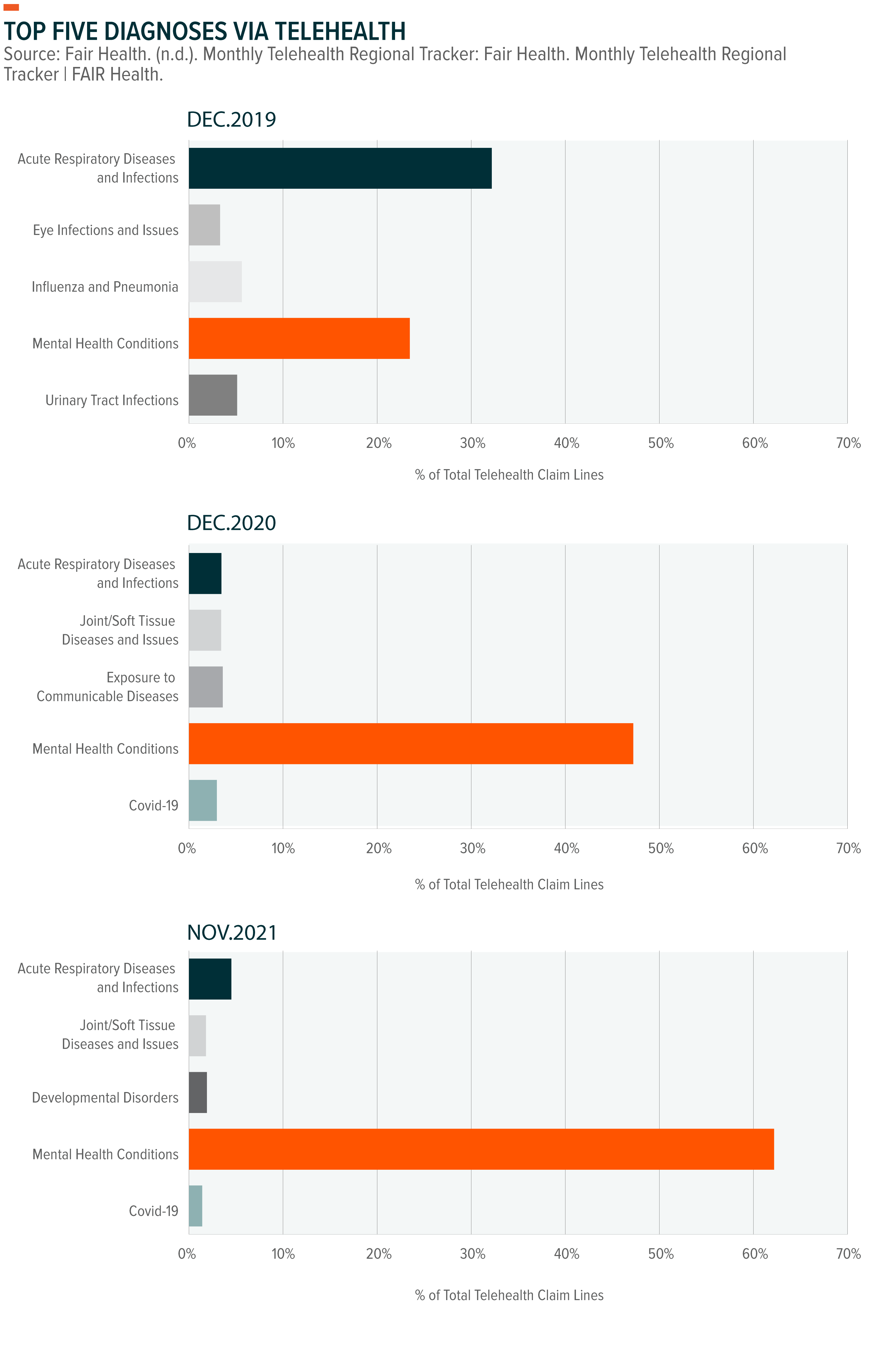

- Virtual Mental Health is the fastest-growing subsegment of telemedicine. It currently makes up 40% of Teladoc’s annual revenue, and the firm estimates a 30-40% compound annual growth rate (CAGR) through 2024.17 About 11% of the global population, an estimated 800 million people worldwide, live with a mental health condition.18 As the space continues to grow and gain acceptance, we expect players that focus on clinical evidence that demonstrates the benefits of virtual mental health to differentiate themselves from the competition. Consolidation across mental health segments is also expected, to provide a hub of services that encompasses therapy, psychiatric care, and meditation, among others.

Healthcare Providers Find a Commonality Around Telemedicine & Digital Health

Convergence across healthcare verticals is helping expand telemedicine’s value proposition. The healthcare industry, for example, has long pushed for ways to increase medication adherence. Telemedicine and integrated pharmacy services now give the industry new hope with direct-to-consumer (DTC) pharmacies partnering with or launching their own telemedicine platforms.19 This shift is expected to help facilitate medication dispensing and provide physicians a clearer view of adherence. Patients not taking medications as prescribed can account for up to 50% of treatment failures and up to 25% of annual hospitalizations in the U.S.20 This represents a $100 billion cost for the U.S. each year.21

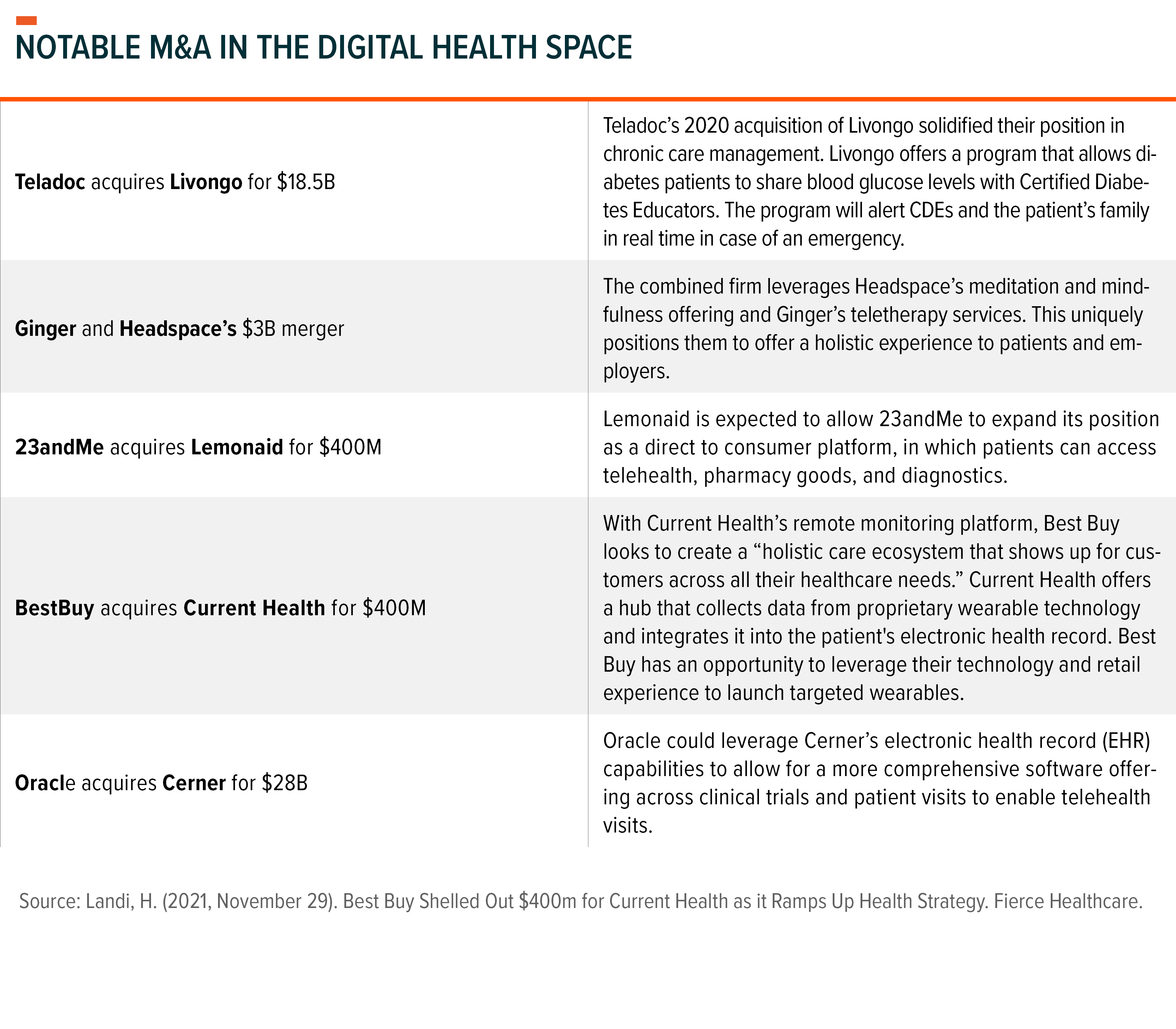

The convergence across healthcare can also help ingrain technology and drive long-term demand. Recent examples include diagnostic firms entering the telemedicine space, such as 23andMe’s acquisition of Lemonaid,22 and healthcare IT firms providing more comprehensive data options for patients and physicians. Oracle’s acquisition of electronic healthcare records (EHR) provider Cerner is a prime example of the latter. Oracle is one of the largest software providers for clinical trials, with solutions for clinical trial management systems and clinical trial randomization. Microsoft also announced a partnership with Cerner, which would allow patients and providers to schedule and conduct virtual visits and access their EHRs through Microsoft Teams.23

Conclusion

We believe the telemedicine and digital health industry has significant long-term growth potential. Industry players are waiting for policy frameworks to catch up to the disruptive promise virtual health offers in a post-pandemic world. In the meantime, they continue to work on making the long-promised value-based and patient-centric models a widespread reality.

Related ETF

EDOC: The Global X Telemedicine & Digital Health ETF seeks to invest in companies positioned to benefit from further advances in the field of telemedicine and digital health. This includes companies involved in Telemedicine, Health Care Analytics, Connected Health Care Devices, and Administrative Digitization.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk. References to securities are not a recommendation to buy or sell.