Tech Advancing, Unlocking Solar Power’s Growth Potential

Every hour, the Earth receives enough energy from the sun to cover the world’s entire annual energy consumption needs.1 This fact provides excitement about continued advancements in solar photovoltaic (PV) technology as it gets better at converting the sun’s rays into electricity and is increasingly used around the world. Solar PV is a highly scalable, cost competitive, and renewable power source that can be utilized in a wide variety of ways and locations. In the coming years, we expect advancements in solar modules and related technologies to support strong growth in solar power capacity and generation and create compelling investment opportunities throughout the energy transition.

Key Takeaways

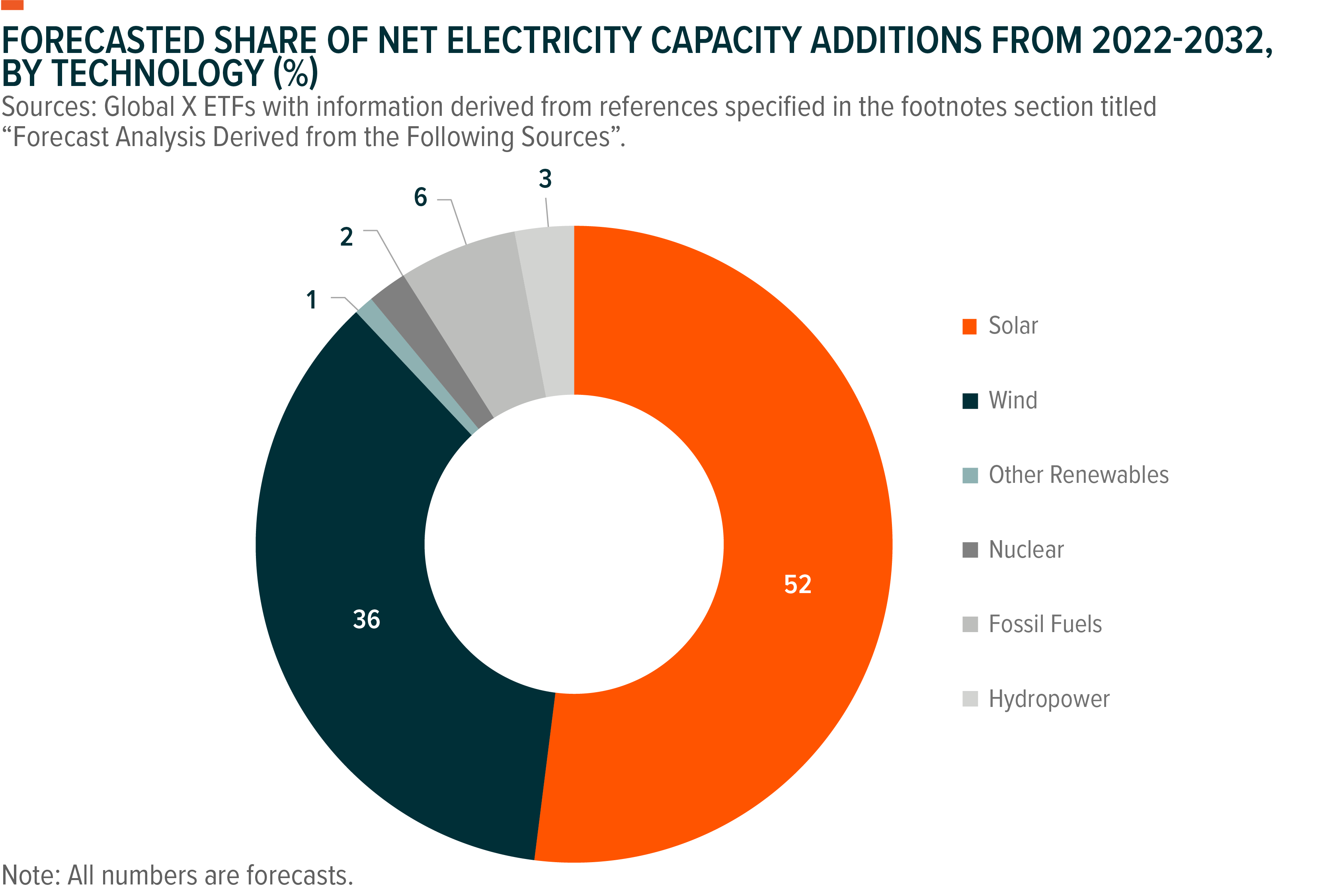

- The solar power sector is forecast to account for 52% of power capacity growth globally between 2022 and 2032, with its share in global power generation forecast to increase from 3% to just under 11%.2

- Improvements to solar modules, solar cells, tracking and mounting systems, and software could yield additional cost declines across the solar value chain over the coming decade, supporting the strong growth outlook.

- Leading solar module manufacturers continued to make significant strides towards the commercialization of next-generation modules in 2022.

Solar Power Scaling With New Investment, Cost Declines

We expect solar power to expand more than any other power source over the next decade, accounting for more than half of total electricity capacity additions between 2022 and 2032.3 Solar power is one of the cleanest energy sources given that PV systems have short carbon payback periods and can produce energy with zero greenhouse gas emissions for up to 30 years.4 It’s one of the reasons why governments around the world have made solar power adoption a priority through tax credits, subsidies, and solar power project tenders and auctions. For example, in the U.S., the Inflation Reduction Act includes incentives aimed at building out a domestic solar equipment supply chain and encouraging solar power growth.5 Globally, corporations are also increasingly developing solar power projects or buying solar power through power purchase agreements to meet sustainability goals.

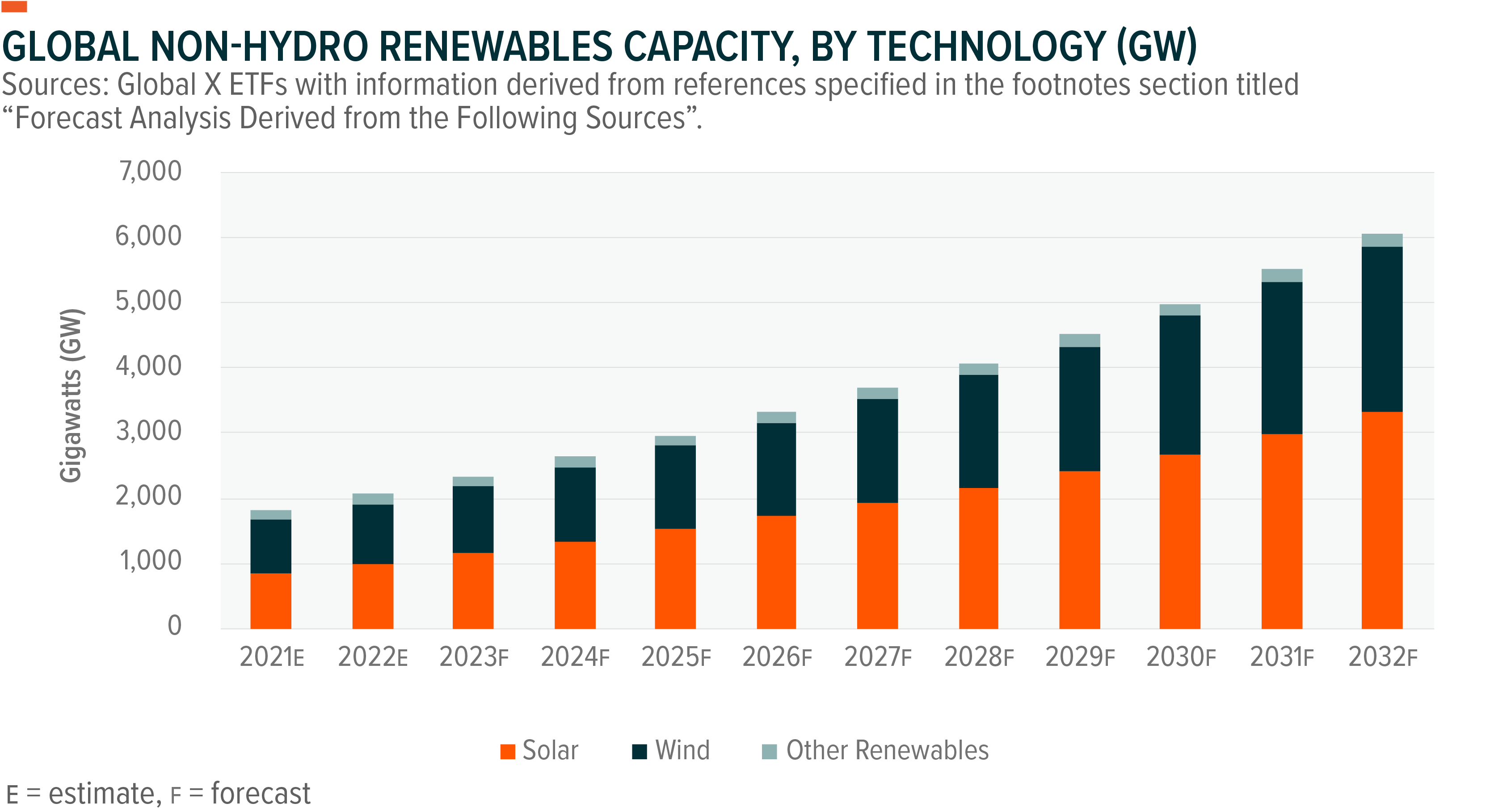

Helped by such public and private sector support, we forecast global solar power capacity to increase from 991 gigawatts (GW) in 2022 to 3,322GW in 2032, with a compound annual growth rate (CAGR) of 11.6%.6 Subsequently, solar’s share of total global power generation is forecast to rise from 3.4% to 10.9% over that period.7 Historically, solar power capacity growth has been strongest in China, the U.S., and the European Union, and we expect these regions will remain leaders over the next decade.

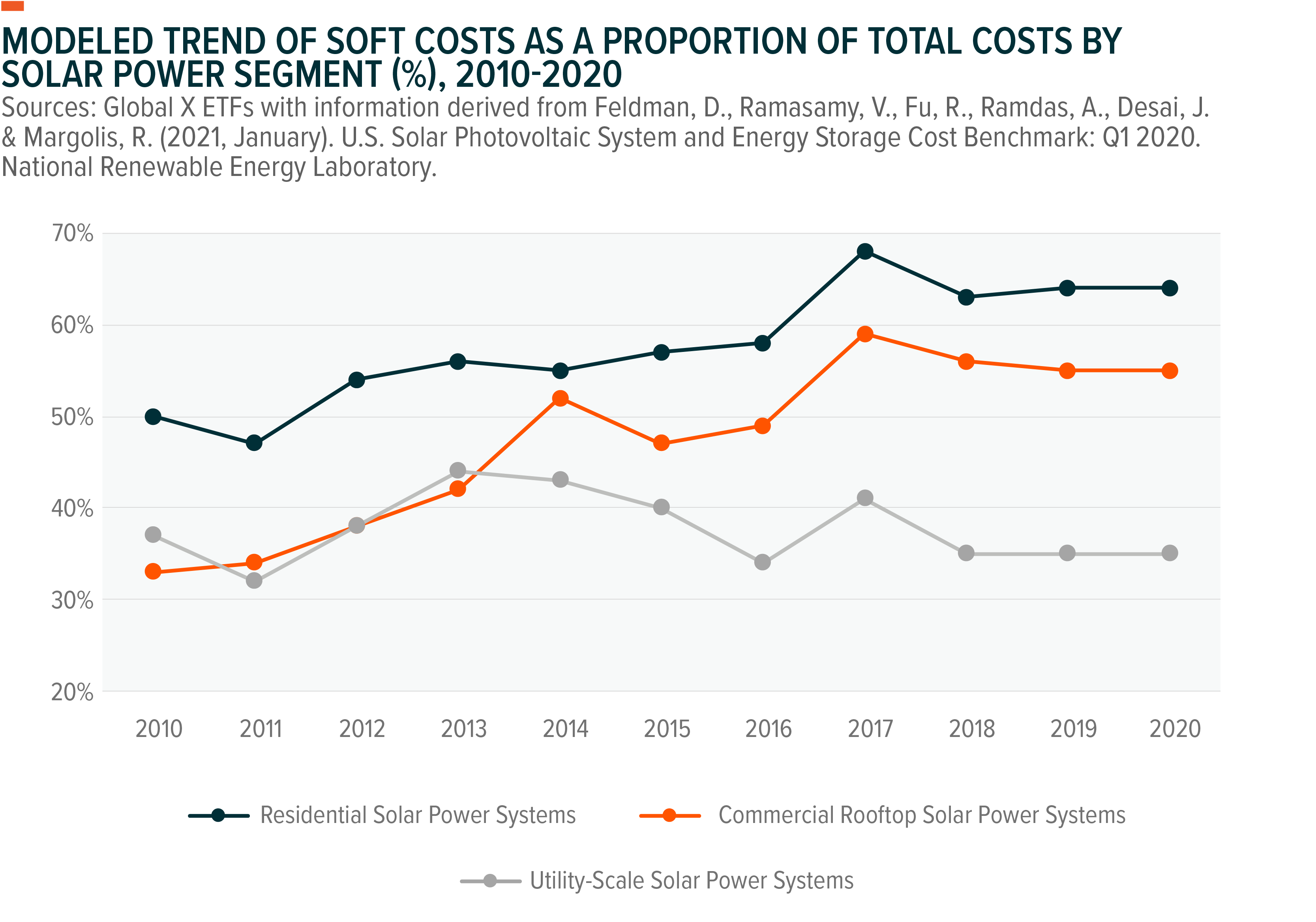

The solar power sector’s increasing cost competitiveness against traditional power sources is also critical to its growth potential. Between 2010 and 2021, the global weighted levelized cost of electricity (LCOE) for utility-scale PV projects fell by 88%.8 The steep decline resulted from the development of more powerful, durable, and efficient solar panels, as well as improvements to inverters, racking, and tracking components. Companies improving manufacturing processes and economies of scale leading to more efficient installation processes also played a role in price declines.

Supply chain issues and elevated shipping and polysilicon prices caused the price decline trend for certain projects to reverse in 2021 and 2022, and solar power project costs are likely to remain elevated into 2023.9 However, solar remains highly cost-competitive, with its competitiveness even improving due to increases in natural gas and coal prices.10

Advancing Tech Has Solar Power Becoming More Viable

Enhanced solar PV technology can make solar power an even more viable option within a larger number of countries, supporting the potential for widespread growth amid climate change mitigation and adaptation efforts. For example, the solar industry is working towards more powerful and ultra-high efficiency solar modules with higher outputs. Solar modules now have power ratings well over 600W for utility-scale projects and 400 watts (W) for residential projects.11 Efficiency is also improving, with modules now reaching efficiencies of over 22.5%.12 For context, five years ago the leading solar modules had a power rating of 385W and efficiencies of 16% to 19%.13,14 These latest modules can lead to better project performance and lower costs by reducing the number of modules needed in a project.

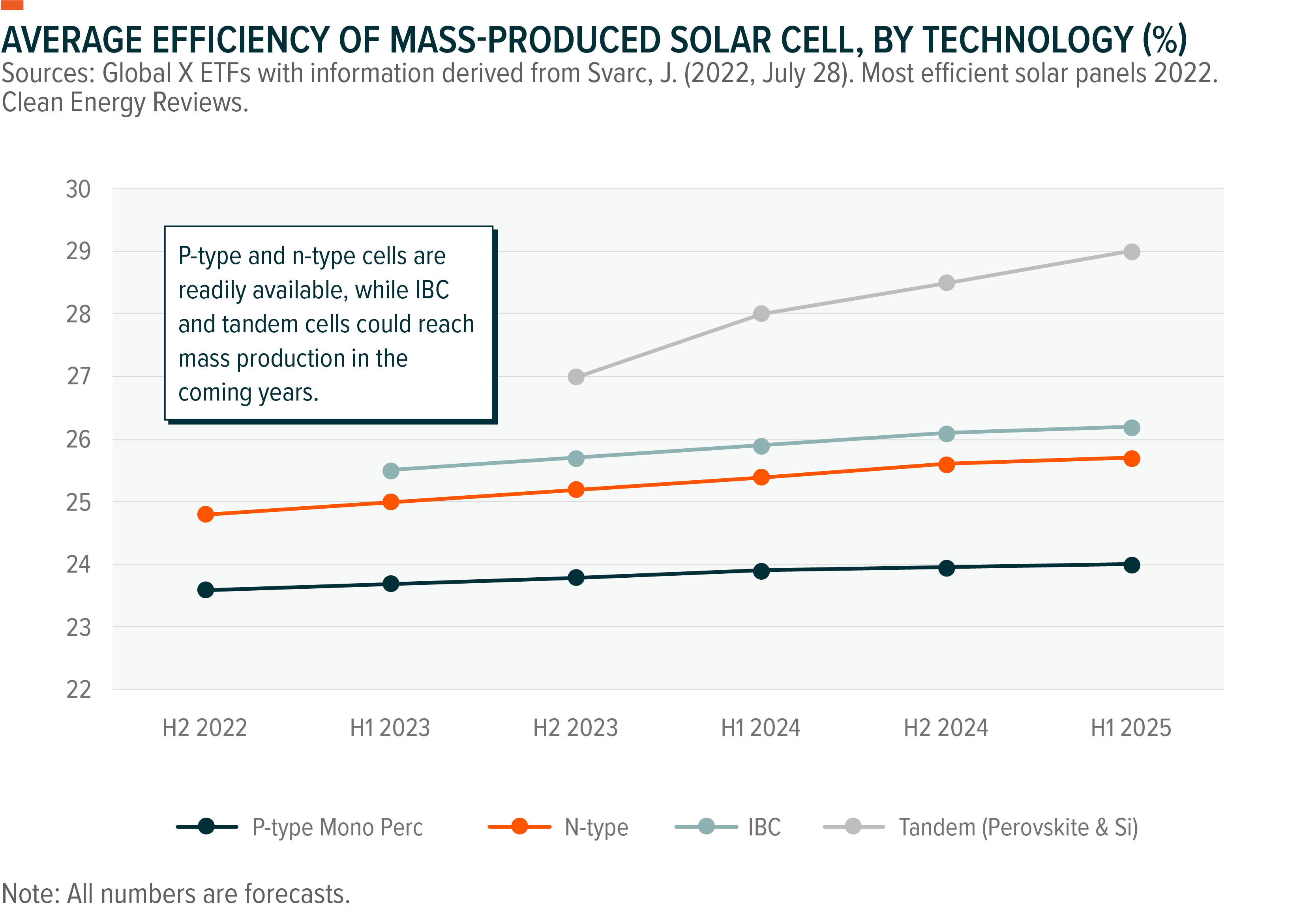

Key to the next generation of modules are advancements in solar cell technologies such as multi-junction cells, tandem cells, thin film cells, and interdigitated back content (IBC) solar cells, which can boost performance and lower costs.15,16 Additionally, solar modules built from new materials, such as perovskite, could be bigger, cheaper, and more efficient than those made from silicon.17 P-type and n-type cells are readily available, with the market’s shift towards n-type cells well underway, and IBC and tandem silicon perovskite cells could reach mass production by the end of the decade.18,19

Elsewhere along the solar value chain, manufacturers continue to improve tracking and mounting systems, which creates opportunities for PV system installation on historically difficult, unsuitable, and high-cost terrain, such as landfills, hilly landscapes, active agricultural land, and even bodies of water. While tracking systems can lead to higher upfront costs than traditional fixed-tilt systems, they can also cut costs by removing the need to flatten terrain, expanding suitable land area, and reducing labor costs associated with installation.

Increasing digitalization through machine learning, advanced analytics software, data-driven failure prevention technology, and automated vegetation management can also help reduce costs. Potential cost benefits span the early design stages to installation and operation and maintenance (O&M). Digitalization can help better integrate solar PV systems into energy grids, boosting profitability and durability.20

Additionally, ongoing policy efforts to streamline permitting in many countries should have a positive impact on future solar power prices and growth of the technology. Notably, soft costs, such as permitting, installation labor, and operation and maintenance costs, now make up the largest share of solar PV project costs given the decline in hardware prices.21

Solar PV Module Manufacturers Continue to Increase Power and Efficiency

In 2022, leading solar module manufacturers continued to make strides towards the next generation of powerful and ultra-high efficiency modules that we expect will lead to price declines and strong solar power growth.

- Canadian Solar:In December 2022, Canadian Solar announced that mass production of its 690W n-type solar module will begin in Q1 2023.22 The module offers cell efficiency of 25.0%, which is roughly 1.5% higher than the average cell efficiency of current mainstream models. The modules are expected to account for 30% of the company’s total module shipments in 2023.23

- JinkoSolar:In December 2022, JinkoSolar set a record 26.4% efficiency for an n-type solar cell. Previously, the company reached 25.7% in April 2022 and 26.1% in October. Dr. Jin Hao, the company’s chief technology officer, said these research and development (R&D) achievements lay groundwork for future large-scale production of modules with highly improved efficiencies.24

- Longi:In November 2022, Longi set the world record for efficiency in silicon solar cells with 26.81% for an unspecified heterojunction solar cell.25 While there is no timeline for when this cell could reach mass production, it points to the company’s ongoing focus on R&D to improve solar cell efficiencies for future module generations.

- Trina Solar:In October 2022, Trina Solar announced its latest module for commercial and industrial projects.26 The Vertex N 595W module is about 30W higher than conventional n-type modules in the commercial and industrial (C&I) market. Production is underway, with deliveries expected to begin in Q1 2023. Also among the new generation of modules are a 690W module for utility-scale projects and a 445W module for the rooftop segment. In October, Franck Zhang, Head of Global Product Strategy and Marketing, noted that modules above 700W could be mainstream in about three years.27

- JA Solar:In May 2022, JA Solar unveiled its first generation of n-type solar modules, raising its power range from 415–600W to 435–625W and boosting efficiencies. The module also offers higher potential durability than previous products and a 30-year output warranty.28

Conclusion: Technology Advancements Making Solar the Green Energy of Choice

The sun’s abundance has the world finally turning to it for clean energy on a massive scale. Advancements in solar PV technology are increasingly expanding the suitability range for solar power, and projects now range in size from a few kilowatts (kWs) for residential systems to more than 1,000GW for the largest utility-scale systems. We expect further advancements in technology to increase solar energy’s capabilities while making it cheaper to do so. As an intermittent power source, solar power isn’t perfect. However, we expect advancements such as the continued development of solar plus storage hybrid projects to help boost grid reliability, and in the process support the industry’s significant long-term growth potential.

Related ETFs

RAYS: The Global X Solar ETF seeks to invest in companies positioned to benefit from the advancement of the global solar technology industry. This includes companies involved in solar power production; the integration of solar into energy systems; and the development/manufacturing of solar-powered generators, engines, batteries, and other technologies related to the utilization of solar as an energy source.

CTEC: The Global X CleanTech ETF seeks to invest in companies that stand to benefit from the increased adoption of technologies that inhibit or reduce negative environmental impacts. This includes companies involved in renewable energy production, energy storage, smart grid implementation, residential/commercial energy efficiency, and/or the production and provision of pollution-reducing products and solutions.

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.