Second Half Outlook – The Year of Efficiency and What Comes Next

Writing an outlook in the current macro environment is like trying to see clearly through a cloud of Canadian wildfire smoke. Structural changes have introduced conflicting forces that support corporate investment despite weaker demand expectations. In the past 18 months, structurally higher cost of capital, persistent inflation, and expectations of slower economic growth have influenced market sentiment and continue to impact market expectations. Economic growth is decelerating, and we anticipate a mild recession in Q4 or the first half of 2024. The nature of this contraction is likely to be different, potentially offering markets some support. Having recently experienced an earnings recession, markets may already be looking ahead and focusing on areas poised to benefit from the ongoing productivity arms race.

Key Takeaways

- Although we are expecting a shallow U.S. recession, select cyclical market areas may benefit from continued targeted investment.

- AI, reshoring, and infrastructure investment are powerful structural forces reshaping productivity globally.

- With the era of free money behind us, companies and investors must adopt new strategies that prioritize efficiencies.

A Slowdown Where Opportunities Abound

After a decade of near-free money, we are entering a period where the cost of capital is likely to remain high. While we believe that the Federal Reserve’s (Fed) rate-raising trajectory is nearing its end, we expect rates to stay elevated through the end of 2023. Additionally, we anticipate a higher terminal floor in the coming cycle relative to the prior decade. From a business perspective, this increased cost of capital, along with softer economic growth expectations, emphasizes the need for efficiency. This has economic implications that range from prioritizing between business units to streamlining processes. If these were the only factors, we would expect a more significant decline in economic growth. However, unless there are any unexpected exogenous shocks, we believe that the long-anticipated U.S. recession may be shallow. Here are a few key elements that we believe will likely be different during the current economic slowdown.

- Asynchronized economic contractions are likely to keep global real economic growth positive during 2023 and 2024.1 Continued growth in certain regions, combined with the asynchronized nature of this slowdown, is likely to result in a smaller impact on commodity demand relative to prior contractions.

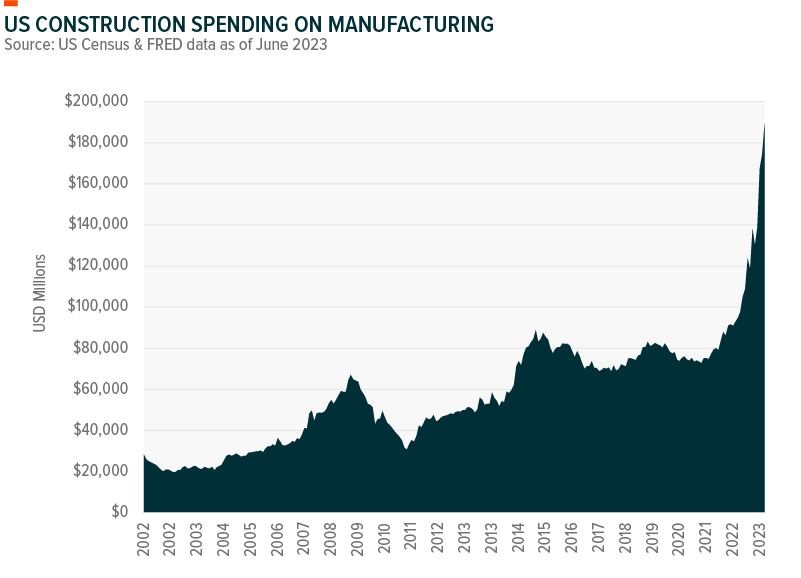

- After more than a decade of underinvestment in capital expenditure (CapEx), this is an area where companies are spending to enhance productivity. Continued CapEx spending despite weakening credit conditions and the decline in profits has contributed to the strength of the U.S. economy.2 Onshoring and nearshoring have increased factory investment in and around the U.S. Inflation-adjusted construction spending in the manufacturing sector jumped from $90 billion in June 2022 to $189 billion a year later – boosted by the CHIPS Act and the Inflation Reduction Act.3

- The Artificial Intelligence (AI) revolution increases the need for companies to invest in productivity enhancements, pivoting in line with this mega-trend that is reshaping all aspects of work-place efficiency. The application of this technology has the potential to change market leadership across multiple industries, from the tech titans all the way to the manufacturing floor.

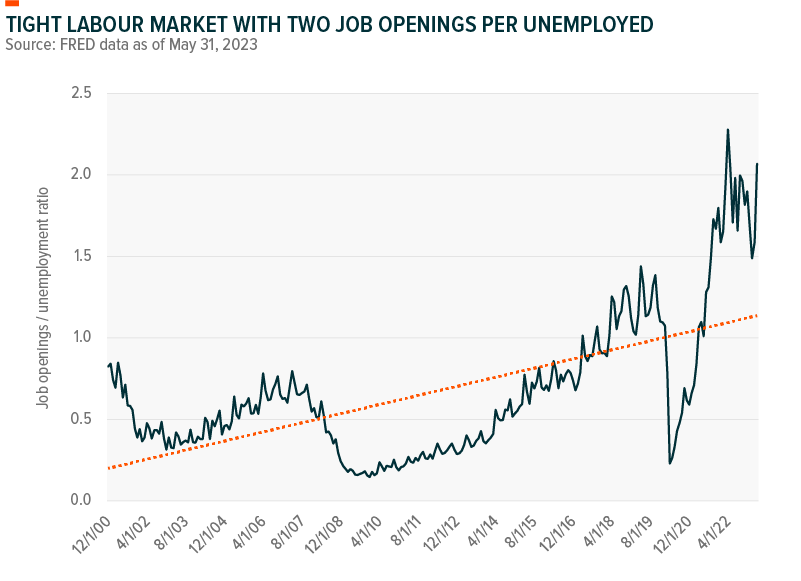

- Labor hording has altered the nature of this anticipated economic contraction, boosting the resilience of the U.S. economy. Challenges hiring and training workers over the last few years, combined with current labor market tightness, have deterred companies from laying off workers as sales slowed. As a result, labor productivity has declined, with the output per hour worked declining 2.1% in Q1 relative to the fourth quarter of 2022, while contracting 0.8% on an annualized basis.4

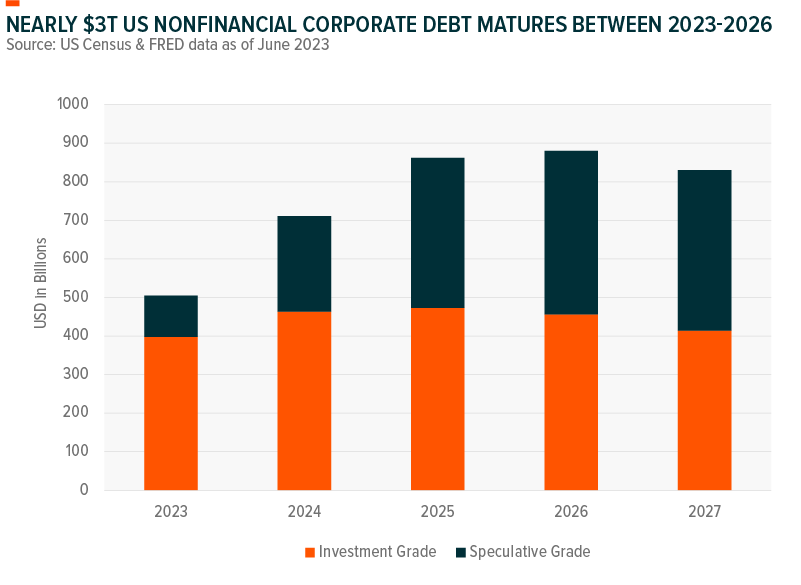

- The corporate credit cycle is an element that could draw out this economic slowdown. Corporates entered this period with reasonably healthy balance sheets. Additionally, given the long-expected nature of this pending recession, businesses have had plenty of time to adjust to lower growth expectations – thus minimizing the shock factor. However, the impact from higher yields is expected to feed into the system slowly, as entities refinance fixed-rate debt. Through 2024, S&P Global Ratings estimates that speculative-grade firms in the U.S. have $354 billion in debt coming due. Of this, 35%, or around $125 billion, is fixed-rate debt that will need to be refinanced, likely with much higher coupon rates.5

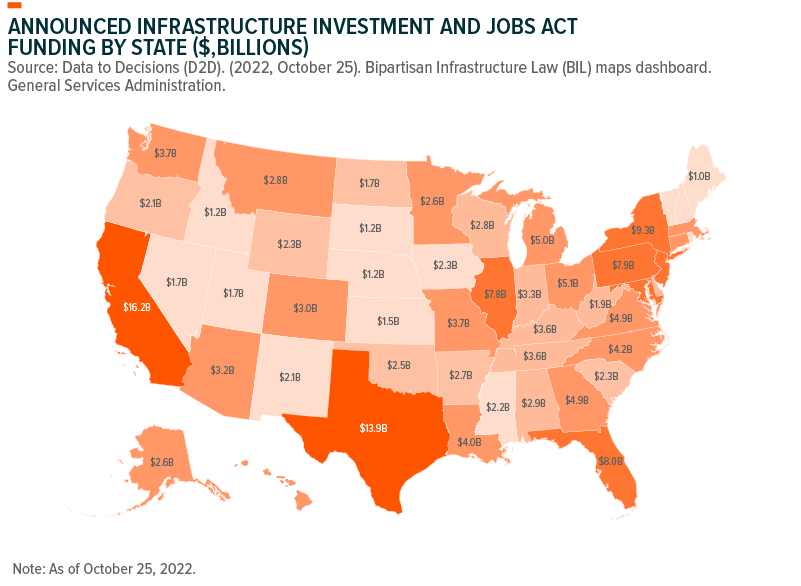

- Infrastructure investment remains an essential counter-cyclical element. This area continues to benefit from Infrastructure Investment and Jobs Act (IIJA) funding. Many projects remain in the planning stage, with investments likely to occur during this decade.

Positioning Opportunities Despite Slower Economic Growth

These factors point to a contraction where cyclical market areas may hold up better than in previous down cycles. Conventional investing wisdom says that investors should position more defensively in the lead up to a recession, increasing exposure to areas that are less impacted by the market cycle. However, given the drawn-out nature of this slowdown and that S&P 500 earnings have potentially already bottomed, we could be in a period where greater exposure diversification is more important.6 Below are a few key areas we believe are essential for portfolio positioning in the current environment.

- A defensive and quality focused core:Defensive companies such as Consumer Staples, Health Care, or Utilities are less sensitive to economic growth – reflecting areas where consumers have less discretion on spending. Complementing this with a quality focus that looks at balance sheet and cash flow strength can establish a solid core that is well positioned for an economic slowdown but is likely to be sluggish as expectations improve.

- Dedicated exposure that benefits from increased investment in AI, onshoring, and infrastructure:Productivity enhancements and pivoting with the waves of technological change are an important part of remaining competitive longer term. AI is a revolutionary technology that is likely to set off a productivity arms race as companies pivot to maintain and fortify their competitive advantages in a rapidly changing world. This applies at both the corporate and national level, with both economic and geopolitical benefits accruing to the regions leading this technology. This is likely to result in a CapEx cycle that has a lower dependence on the economic cycle.

- Balanced with some cyclical exposure:Countercyclical investment combined with an asynchronized economic slowdown is likely to support cyclical market areas more than a typical economic contraction. Commodities, and particularly industrial commodities, currently reflect expectations for a more severe economic pullback, potentially offering pockets of value.7 While commodity demand expectations have decreased, these are areas where supply is limited, and commodities remain essential to multiple key structural trends – infrastructure investment, onshoring, the clean energy revolution, and even increased AI investment.

Stay the Course

Recessions constitute a normal part of the business cycle. They provide an opportunity to reset and are typically the shortest phase of the economic cycle. We believe it is crucial to maintain market exposure throughout the cycle. Current structural changes are encouraging companies to invest through the entirety of the cycle to build their competitiveness in a rapidly changing landscape.

Timing the market is challenging – while the economy may be decelerating, the market is already focusing on future growth drivers. Missing a few of the best days can significantly impact one’s returns relative to the overall market.