QYLD: A Covered Call Strategy for Rising Yields

The Nasdaq 100 Index (NDX) enjoyed a strong 2020 amid an accelerated shift to digitalization and rock-bottom interest rates. But its future is less certain as we exit the worst of the COVID-19 pandemic and enter the New Normal Economy. As early as Q4 2021, the Federal Reserve could begin tightening extremely easy monetary policy and allow rates to normalize. This would likely create a headwind for equity valuations, especially Nasdaq 100 Index stocks that are largely valued on expected long term cash flows. In addition, bond markets could have a ‘tantrum’ with rate volatility scaring away fixed income investors. These conditions would present challenges to both growth and income-focused investors alike. Few investment strategies thrive in volatile markets, particularly income-focused strategies, but we believe that covered call approaches could be well-positioned. Expectations for higher volatility should enhance option premium income, while duration risk should be minimal. In this piece, we discuss how covered call strategies based on the Nasdaq 100 Index could help investors navigate a challenging environment.

Key Takeaways:

- The Nasdaq 100 experienced strong returns over the past decade, largely due to its high-tech growth-oriented exposure

- The Nasdaq 100 is sensitive to bond yields, and therefore may face pressure if there are rate increases

- Covered call strategies on the Nasdaq 100 are a powerful solution for investors to potentially generate income and monetize volatility amid choppy markets

The Nasdaq 100’s Growth-Oriented Profile

The Nasdaq 100 Index did not disappoint over the last decade. The index, made up of 100 of the largest non-financial companies listed on the Nasdaq stock exchange, outperformed many broad market indexes. From 2011–2020, the NDX returned 17.56% annualized, while the S&P 500 returned 10.44%.

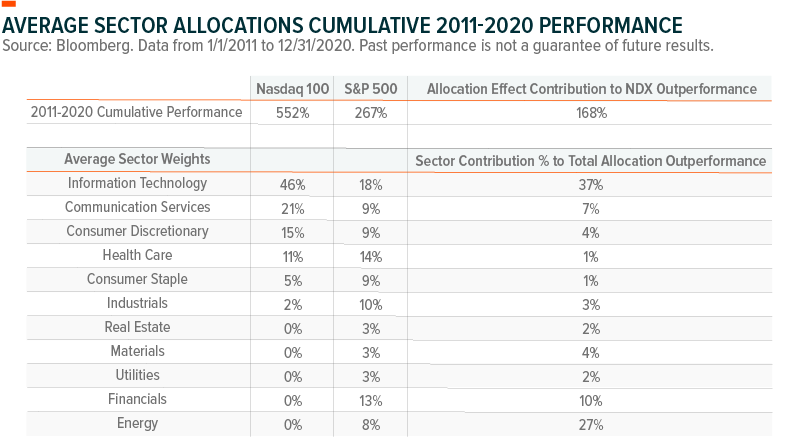

Contributions from growth-oriented sectors like Information Technology and Communication Services helped drive the index’s performance, given their large weight and strong performance over that time frame. An attribution analysis of the Nasdaq 100 Index from 2011 to 2020 cumulative performance shows that nearly three-fifths of NDX’s outperformance versus the S&P 500 (168% of the 285% total) came from the allocation effect, meaning its sector over and underweights. NDX’s 46% average weight to Information Technology versus 18% for the S&P 500 was the largest contributor to this outperformance. NDX’s 21% average weight to Communications Services compared to 9% for the S&P 500 further contributed to NDX’s outperformance. Also important to returns however was NDX’s underweight of traditional value sectors like Financials and Energy. The index had 0% weight to both of these sectors, and given their poor performance over the decade, this underweight contributed to 10% and 27% of the outperformance respectively versus the S&P 500.

Rising Interest Rates Presents Risks to The Nasdaq 100

But after a 10-year stretch of growth’s sustained performance versus value, a shift may be underway. MSCI USA Value’s year-to-date return is 10.40% as of 3/31/21, compared to MSCI USA Growth’s 0.58%.

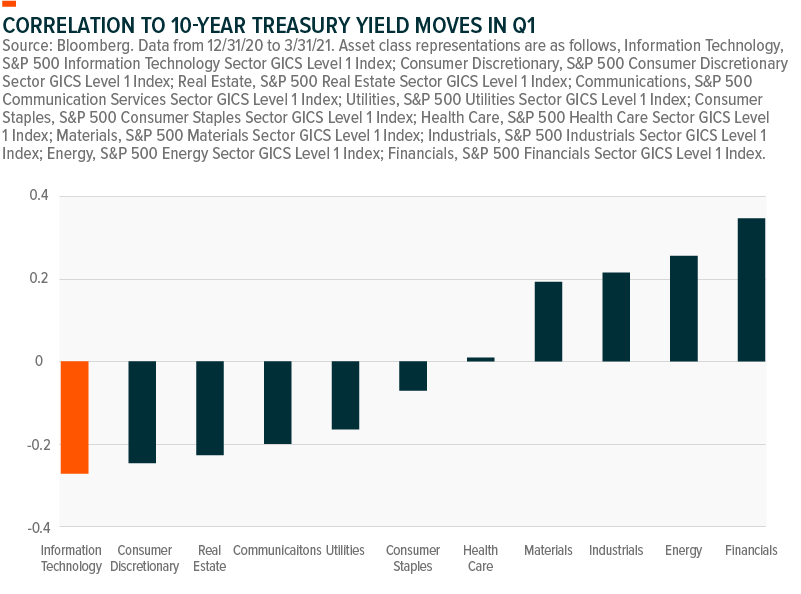

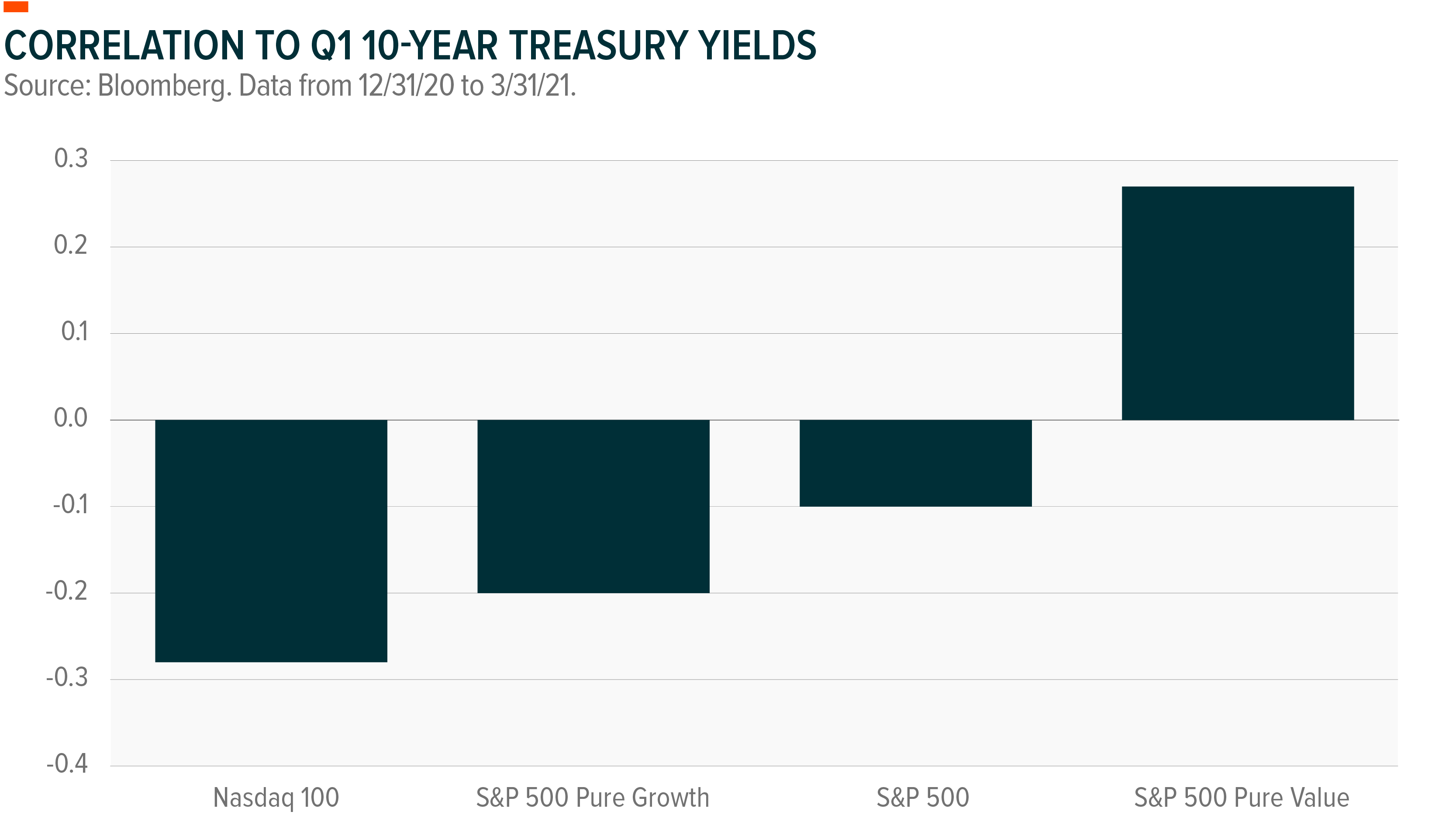

Part of the reason is the reflationary environment of the re-opening economy. With strong fiscal and monetary stimulus, coupled with accelerating economic growth, inflation expectations are rising. This has a positive impact on value and cyclical sectors like Financials, Energy, and Materials, which are typically underweight in the Nasdaq 100. It also means that longer term bond yields are rising. The 10-year treasury yield moved from 0.91% at the end of last year to 1.74% by the end of Q1. The NDX exhibited an aversion to rising bond yields this year, with the NDX displaying a -0.28 correlation to 10-year Treasury yields in Q1. And no sector had a more negative correlation to the 10-year Treasury yield than Information Technology in Q1.

Tech Sector Sensitive to Higher Bond Yields

Information Technology stocks are often sensitive to interest rates as their valuations are based heavily on expected future cash flows. Higher rates reduce the present value of those distant cash flows, therefore impacting the valuations of growth stocks more so than value stocks, which are more heavily influenced by near-term cash flows.

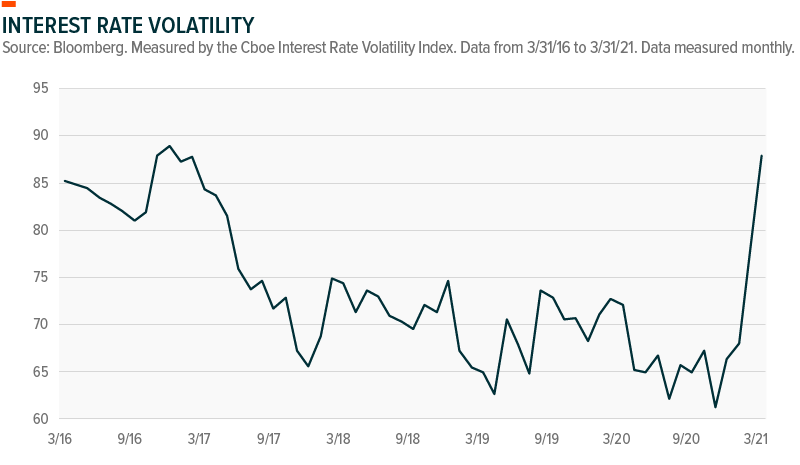

Investors expect rates to increase over the next few years as economic conditions normalize, but exactly when, and by how much, is up for debate. On one hand, the Fed is reluctant to tighten monetary conditions in the near term because they believe current inflationary pressures are transient, and likely to peak in 2021 before declining. The Fed believes 2023 is an appropriate timeframe to hike rates, as it will allow time for the economy to reach full employment, but several market participants believe rising inflation data could force the Fed’s hand to move sooner. Expectations of tapering the Fed’s $120 billion per month asset purchase have been pulled up to Q4 2021, according to some economists. This disconnect is contributing to spiking interest rate volatility. In our recent Income Outlook piece, we discussed how rising inflation is likely, but we do not believe to a level that will materially shift the Fed’s projected interest rate path.

While rates are likely to rise from here, the Nasdaq 100 has powerful tailwinds as well. Its higher exposure to disruptive technologies in areas like Cloud Computing, FinTech, Robotics & AI, and Electric Vehicles offers long term growth potential that could continue to thrive in the New Normal Economy.

Covered Call Strategies Can Thrive in Volatility

Should a period of rising interest rates present a headwind for the Nasdaq 100, one way to potentially enhance returns is to generate income from a covered call strategy. This involves purchasing the stocks in the Nasdaq 100 Index and subsequently writing call options on the index. Covered calls strategies limit upside participation but can generate income through collecting the premiums received from option-writing. In volatile markets, option premiums tend to rise, and therefore, covered call strategies tend to perform best in choppy or sideways markets rather than in major bull or bear markets.

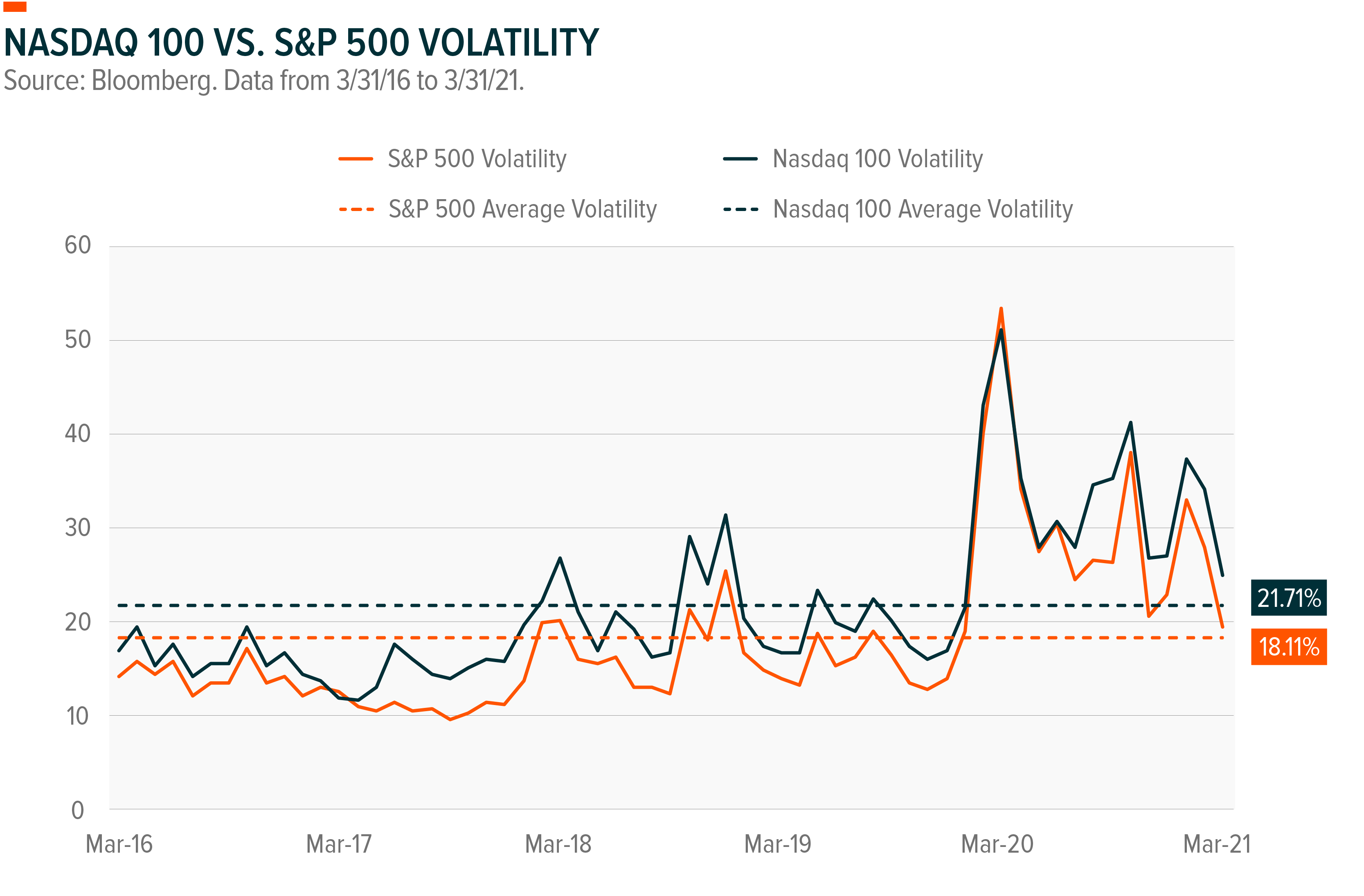

While covered call strategies can be implemented on a variety of indexes or underlying assets, selling calls on the Nasdaq 100 offers a couple of distinctive features. First, historically the NDX has consistently exhibited higher volatility than the S&P 500, which can fuel greater income from selling options. NDX volatility averaged 21.71% over the last five years, compared to 18.11% for the S&P 500.

Nasdaq 100’s Growth Profile Makes It More Volatile Than S&P 500

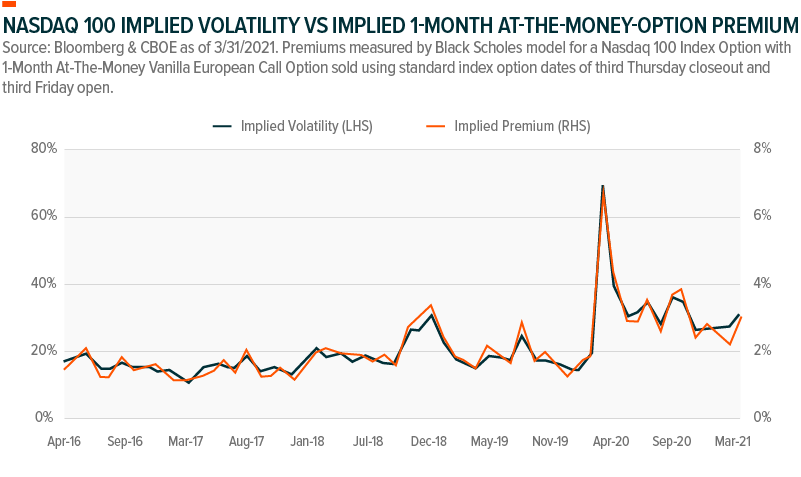

Currently, implied volatility levels – i.e. the volatility expectations priced into NDX options – remains higher than it was prior to the pandemic. This means that option premiums are higher than usual, supporting higher return potential in Nasdaq 100 covered call strategies.

High Correlation of Nasdaq 100 Volatility to Options Premiums

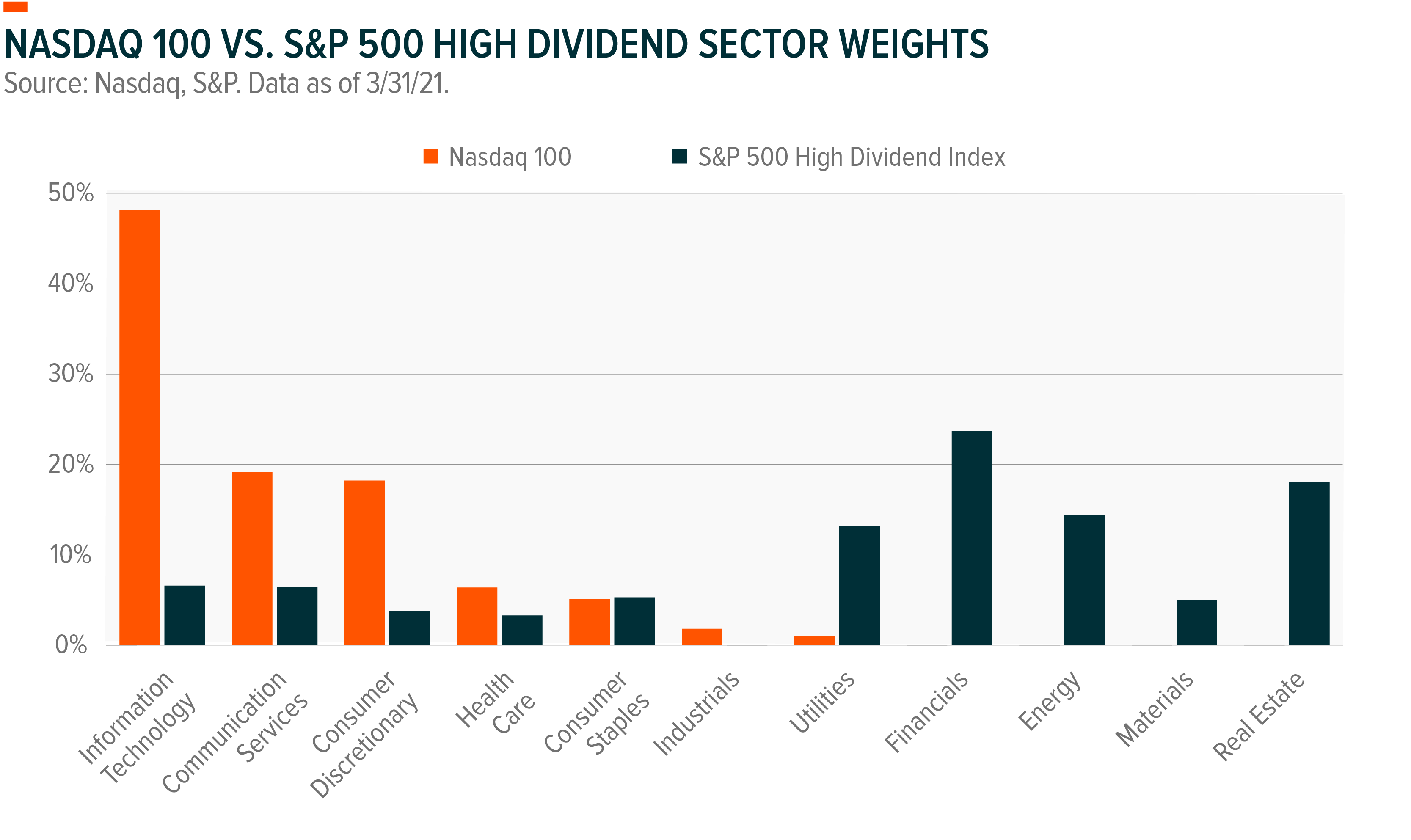

The second distinctive feature of a Nasdaq 100 covered call strategy is its potential to help diversify an income-oriented portfolio. Due to the Nasdaq 100’s tech-heavy exposure, its performance has differed greatly from traditional dividend funds commonly found in income-oriented portfolios.

Diversifying Away From Traditional Dividend-Paying Sectors

Implementing a Nasdaq 100 Covered Call Strategy

Despite strong returns over the last decade, the Nasdaq 100 is at a bit of a crossroads. Value has stormed back in 2021 alongside rising 10-year treasury yields. Should yields continue to rise from here, it could present headwinds for the Nasdaq 100 and traditional sources of income. Yet at the same time, the transition to the New Normal Economy and the rise of digitalization presents potential long-term tailwinds for disruptive tech. Competing forces could result in choppy or sideways returns for the Nasdaq 100.

Covered call strategies like the Global X Nasdaq 100 Covered Call ETF (QYLD) or the Global X Nasdaq 100 Covered Call & Growth ETF (QYLG) could be valuable in an uncertain environment. Higher volatility tends to increase the options premiums received from selling calls, which can enhance returns even in a trendless market. In addition, the income from tech-based covered call strategies can help diversify an income portfolio away from traditional sources like dividend paying stocks or fixed income.