Quarterly Income Commentary: Enhancing Yields Through Preferred Stocks and Fixed Income

The Global X Income Outlook for Q1 2024 can be viewed here. This report seeks to provide macro-level data and insights across several income-oriented asset classes and strategies.

The potential for the Federal Reserve (Fed) to cut interest rates makes 2024 something of a transitional year. Economic conditions remain robust, as reflected by recent labor and GDP reports, but we think that it’s important for investors to not become complacent. The elevated cost of credit remains a double-edged sword, offering the most attractive yields in decades, but also encumbering business investment and household spending. Nevertheless, with bond yields at their highest levels in 15-years, we believe that this environment presents a good opportunity to increase exposure to fixed income, potentially enhancing yields while benefiting from higher short-term rates.1

Key Takeaways

- Long-term rates plummeted in Q4 2023, as the market attempted to front-run the Fed’s projections for policy easing.2 Rising rates walked back much of this enthusiasm in early 2024, and interest rate volatility may reemerge the longer uncertainty remains.

- The consensus outlook for rate cuts argues for more fixed income exposure. Preferred stock funds like the Global X U.S. Preferred ETF (PFFD) and the Global X Variable Rate Preferred ETF (PFFV) provide flexibility in targeting duration while potentially delivering attractive carry, which is the return obtained from holding an investment.

- Stronger than expected economic data continue to push back the prospect for rate cuts. We believe this calls for a measured approach to allocations, balancing reinvestment risk against duration risk, which represents the risk of price movements from changes in interest rates. Ultra-short bond funds like the Global X 1-3 Month T-Bill ETF can potentially offer high yields while insulating against duration and credit risks, otherwise known as the risk of default.

Volatility May Be Over the Horizon as the Market Tracks the Fed’s Balancing Act

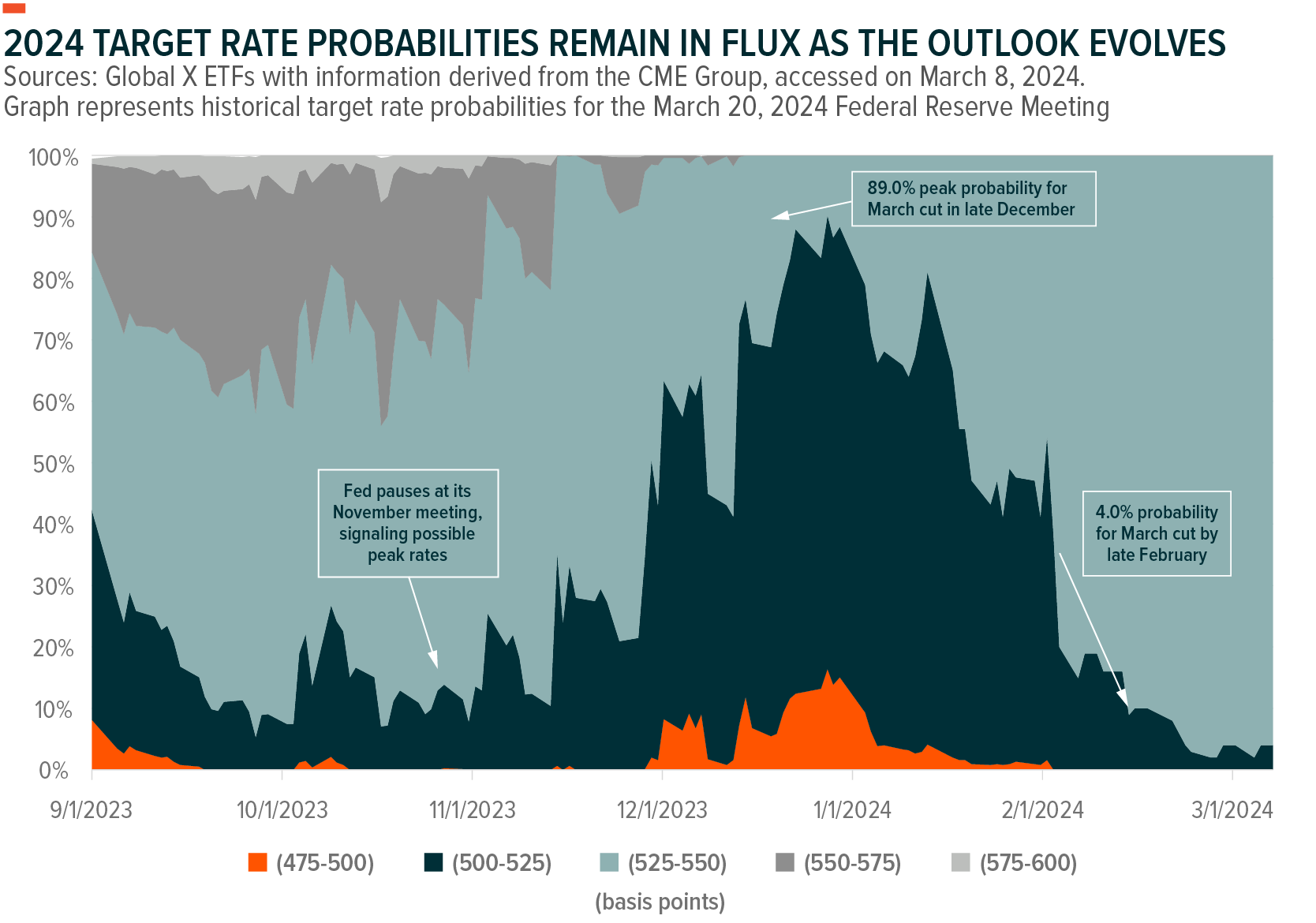

The Fed’s unanimous decision to pause rate hikes in Q3 2023 sparked a frenzy among investors, promptly shifting attention toward the timing of the first rate cut. Fixed income rallied through the end of 2023, as long-term yields tumbled and hopes for easier monetary policy soared. Futures data initially suggested that the market was pricing up to six rate cuts, highlighting a wide disparity between market expectations and the Fed, which had forecast just three rate cuts in 2024.3

This gap began to converge in January as data from the Consumer Price Index (CPI) and the Producer Price Index (PPI), two inflationary measures of goods and services, registered “sticky” inflation readings and little justification for rate cuts in Q1 2024. By late February, the probability of a March rate cut dwindled to just 4%.4 In response, the expected timing for the first rate cut was pushed back to the summer and market projections for rate cuts in 2024 fell to three.

We believe risks may materialize in 2024 given uncertainties about Fed policy and the heightened cost of credit for businesses and consumers alike. We believe these risks lurk ahead in the Fed’s continued balancing act of guiding inflation toward its 2% target rate and avoiding an economic downturn. Any obstacles encountered in the pursuit of one goal will likely materially impact the other. In this environment, investors will need to carefully balance duration and credit exposure.

The Unfinished Fed Narrative Highlights the Argument for Fixed Income

We believe that the combination of strong economic data and the consensus outlook for rate cuts in 2024 can potentially benefit long-duration fixed-income assets like preferred securities. And should the Fed succeed in engineering a soft landing, preferred securities could benefit from the combined tailwinds of falling rates and expansive monetary policy.

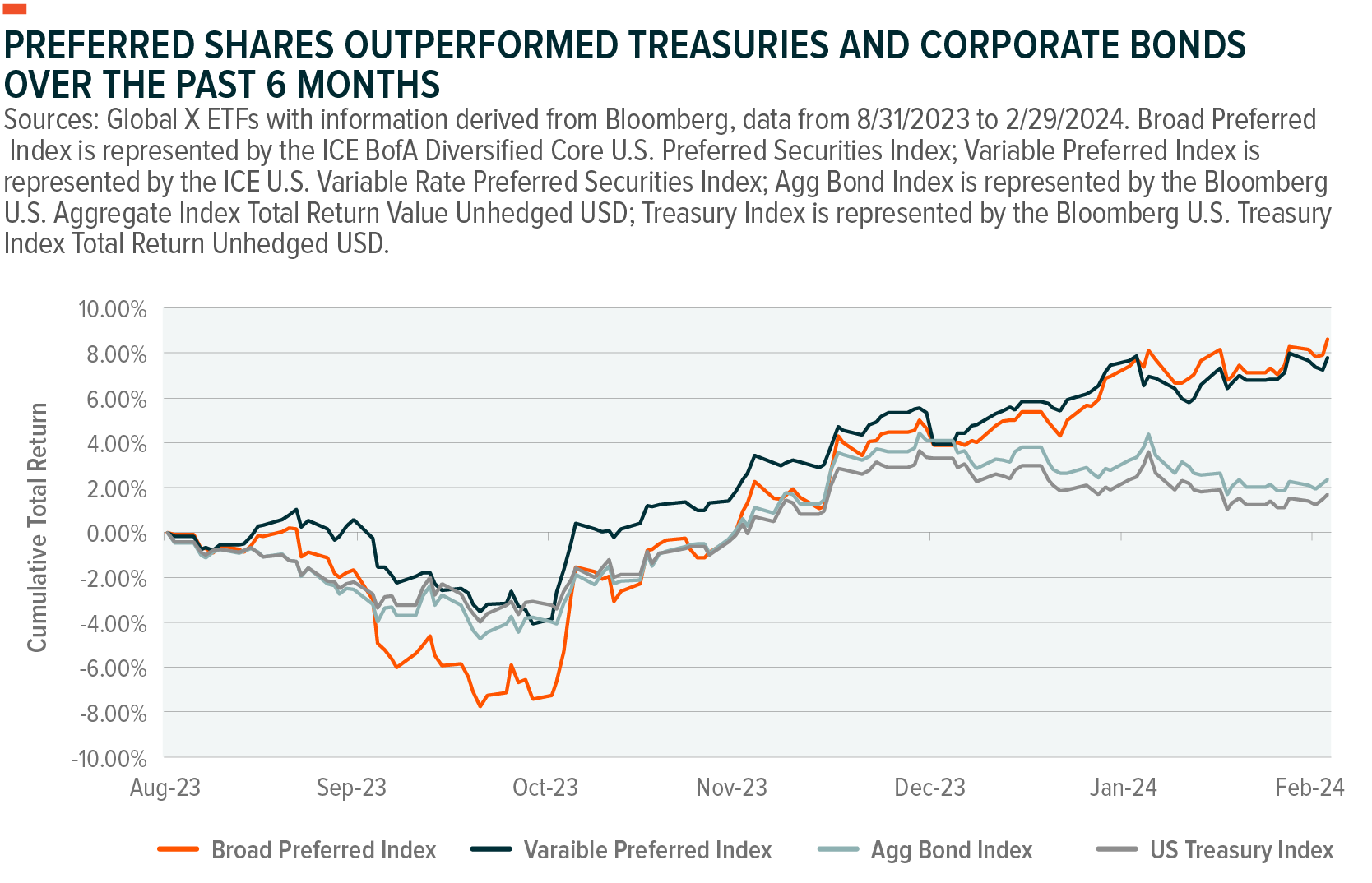

Historically, fixed income performs well after tightening cycles end, as long-term yields typically fall in anticipation of rate cuts. Following these cycles, preferred securities tend to benefit from their high interest-rate sensitivity. The ICE BofA Diversified Core U.S. Preferred Securities Index’s (the Preferred Index) illustrates this sensitivity with an option-adjusted duration of 6.23, option-adjusted duration is a duration metric which considers the effects of any embedded options on its expected maturity. Interest rates falling by 1% would translate to a nearly 6.23% return from capital appreciation alone, without factoring in impacts for credit or convexity.

Long duration credit excelled in Q4 2023, with the Preferred Index returning 5.62%. The ICE U.S. Variable Rate Preferred Securities Index (the Variable Index), which more wholly represents credit exposure, returned 3.36% due to continued support from credit spreads, which measure the difference between two-similar maturity bonds of varying credit quality.5 We believe this performance illustrates the underlying strength in the U.S. economy, which includes a robust labor market, with an unemployment rate still beneath 4% as of late February.6 Generally, these represent favorable conditions for credit-related assets like preferred stock and high yield corporate debt.

Indexes are unmanaged, do not incur management fees, costs or expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Preferred Shares Provide Their Most Attractive Yields in 15 Years

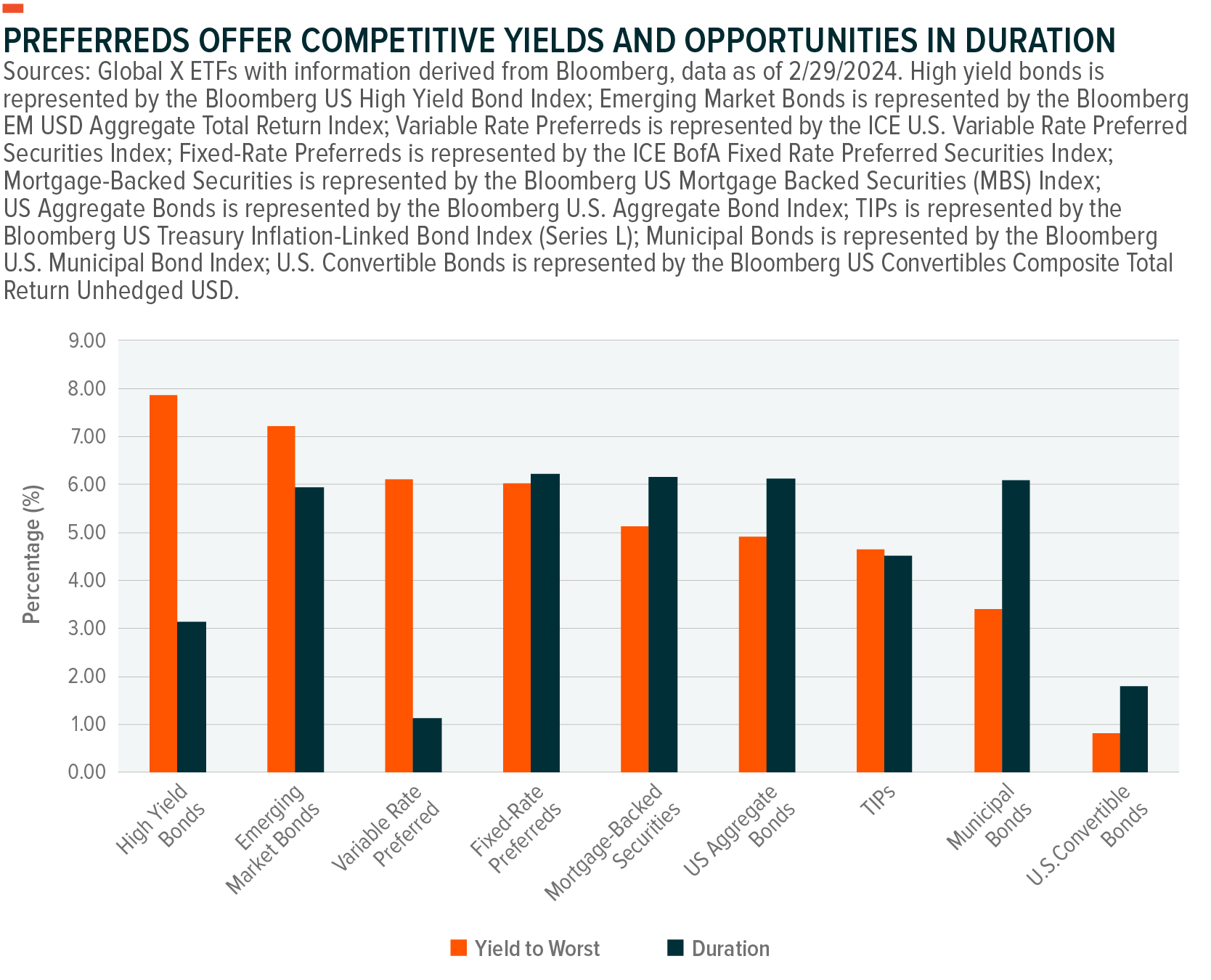

We believe that the higher yields offered by preferred stocks present attractive carry opportunities for investors while presenting a defensive income buffer against duration and spread widenings, which can negatively impact the relative value of fixed income holdings. As of February 2024, the ICE BofA Fixed Diversified Core US Preferred Securities Index yielded 6.03%, substantially above its five-year historical average of 4.03% and close to comparable asset classes like high yield bonds (7.86%) and emerging market debt (7.22%). Variable rate preferreds yielded an attractive 6.11% as of February 29, 2024.7

Preferred shares may offer lower yields currently, but they have a credit advantage over high yield bonds and emerging market debt that helps position them against moderate widenings in credit spreads, should economic conditions deteriorate. Investment-grade credits comprise the majority of the preferred space; as of February 29, over 65% of the preferred issues in the Preferred Index were rated investment-grade or better by one of the three major credit ratings agencies.8

Additionally, while acknowledging the asset class’s high allocation towards the financial sector, approximately 39% of issuance came from large, diversified banks, with just under 6% of the index allocated toward smaller regional and community banks. Also, the index has no direct exposure to European preferred issues like contingent convertibles (Co-cos).9 We think these holdings underscore the higher credit quality of the U.S. preferred stock market versus high yield bonds, which is comprised of speculative grade issuers.

The Global X U.S. Preferred ETF (PFFD) offers broad exposure to the U.S. preferred share market, which predominantly consists of retail fixed rate preferreds, allowing it to maintain a high overall duration measure. By contrast, the Global X Variable Rate Preferred ETF (PFFV) largely consists of preferred stocks that carry floating rate, which can fluctuate over the life of the investment, or fixed-to-floating rate variable coupon structures, allowing it to maintain proximity with prevailing market rates. Should rate cuts take longer than expected to materialize, we believe PFFD and PFFV offer investors the flexibility to dynamically adjust their target duration in response to shifts in the U.S. yield curve, which reflects the prevailing rates on a series of U.S. Treasury maturities.

Indexes are unmanaged, do not incur management fees, costs or expenses and cannot be invested in directly. Past performance is no guarantee of future results.

A Barbell Fixed-Income Portfolio Can Help Balance Duration and Reinvestment Risks

The barbell investment strategy has been popular with bond investors leading up to the Fed’s de-facto pivot. A fixed-income barbell strategy seeks to allocate to both short and long-duration securities across high-quality and subprime assets to balance both duration and credit risks within a fixed-income portfolio. We believe that this strategy makes sense in 2024 as the forecast for rate cuts continues to be delayed amid consecutive hotter than expected inflation reports.10

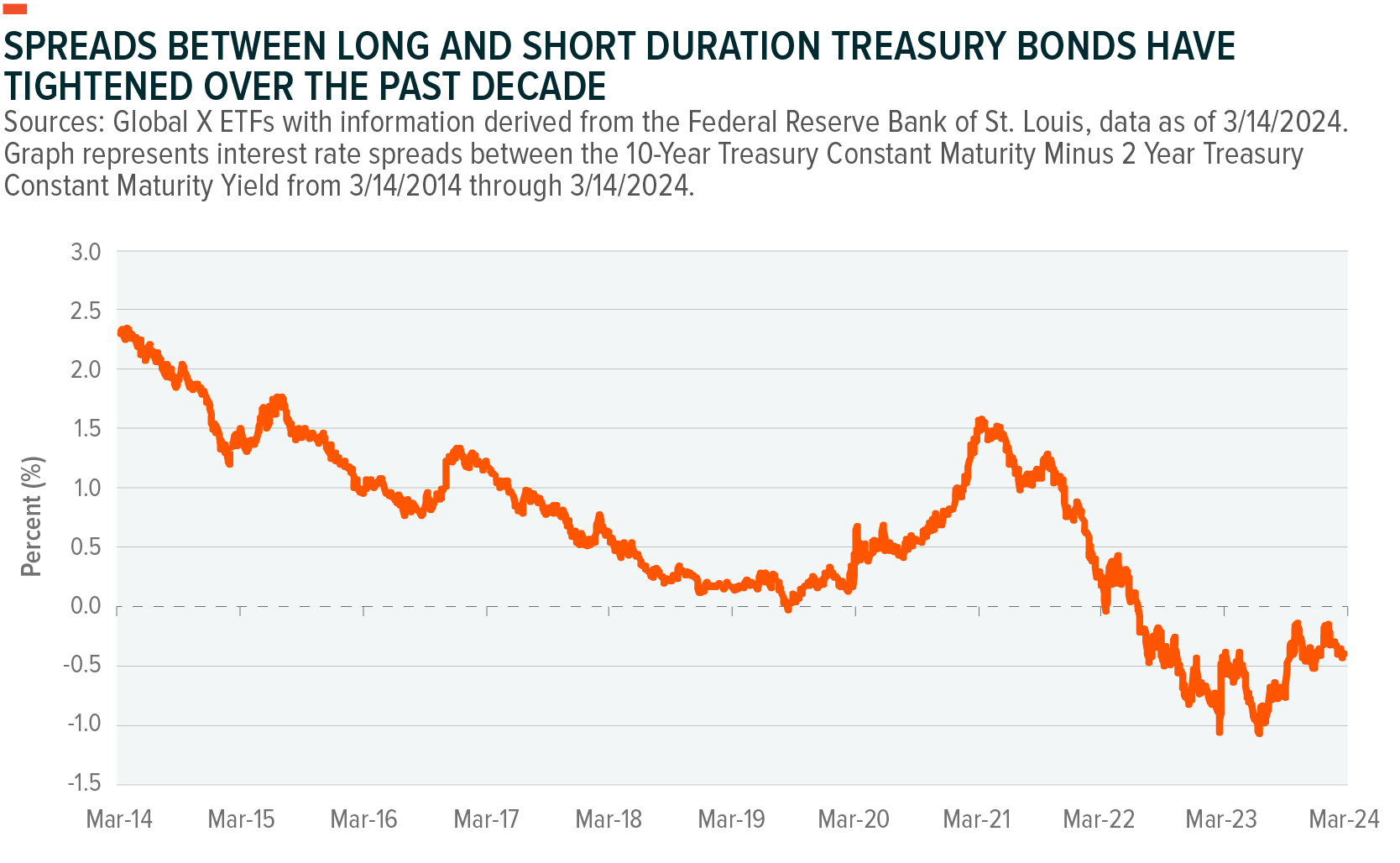

By allocating to both short and long-duration bonds, investors may be able to achieve a better weighted-average yield across their fixed income holdings. As of the end of February, the spread between long-duration 10-year Treasury bonds and short-duration 2-year Treasury Notes rose to -0.39%, a differential that remains tight relative to the long-term average (0.87%) as well as recent history (-.89%, 1-yr ago).11 This differential is even more pronounced at the longest maturities, where 20-year Treasury bonds trade at spreads nearly a dozen basis points (0.12%) tight to 2-year Treasury bonds. This presents opportunities for investors to potentially capture value by securing yields on longer duration bonds.

By selectively positioning where yields are highest, investors may be able to achieve a higher level of income per unit duration while reducing both duration and reinvestment risks. These yields may be further enhanced by selectively adding credit exposure at either end of the curve. According to the CFA Institute, yields are often the best long-term predictor of total returns for bonds and given the elevated level of both nominal and real yields, which represent the yields before and after inflation adjustments respectively across all maturities relative to the past decade, we believe it makes sense to capitalize on these opportunities.12 A measured approach to duration targeting may allow investors to potentially enhance carry returns in the short run, while also positioning for the eventuality of Fed rate cuts.

Having already covered longer-duration assets in our segment on preferred stocks, we believe investors should also consider opportunities in short-term bonds. 1–3-month Treasury Bills currently offer yields over 5.3% while effectively insulating against both credit and duration risks. The Global X 1-3 Month T-Bill ETF (CLIP) aims to provide exposure to 1-3 Month T-Bills at a competitive expense ratio of 0.07%,13 a fee one-third the cost of comparable ultra-short bond ETFs at 0.22%.14 We believe a high-quality short-term investment vehicle like CLIP could serve as an attractive counterbalance to a portfolio of longer duration bonds, lowering the portfolio’s weighted average duration, thereby reducing the portfolio’s overall sensitivity to interest rates, while enhancing its overall credit quality.

For illustrative purposes only.

Conclusion: Fixed Income Securities Can Pave the Rocky Road to Rate Cuts

We believe that the current market environment offers attractive income opportunities with bond yields at their highest level in 15 years and economic conditions conducive to credit overall. For investors, extending portfolio duration while tactically positioning for potential shifts in the yield curve may be prudent. In the coming year, a barbell portfolio, consisting of long and short duration bonds across different credit qualities could offer a suitable approach for managing both duration and credit risks. The path to interest rate cuts is likely to be turbulent as the economic narrative unfolds; factors such as duration, credit, and reinvestment risks are all likely to influence the road ahead.

Related ETFs

PFFD – Global X U.S. Preferred ETF

PFFV – Global X Variable Rate Preferred ETF

SPFF – Global X SuperIncome Preferred ETF

CLIP – Global X 1-3 Month T-Bill ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.