MLP Insights Q3 2022: Midstream Expected to Be a Haven Amid Broader Market Volatility

The energy markets have been volatile for most of 2022, continuing a two-year trend that dates to the early days of the coronavirus pandemic. We expect broader market fears and a host of macro factors, including high inflation, rising interest rates, the strengthening U.S. dollar, and the war in Ukraine, to keep price volatility in the energy markets high. However, we believe midstream equities can sustain their positive momentum and outperform both other energy segments and other global equities and credit in this environment, helped by their lower correlation to oil prices. U.S. production is also on the upswing, with activity in the Permian Basin rising and positioned to help address the energy crisis in Europe. In our view, midstream equities continue to present a compelling investment case, particularly for investors looking for income.

Key Takeaways

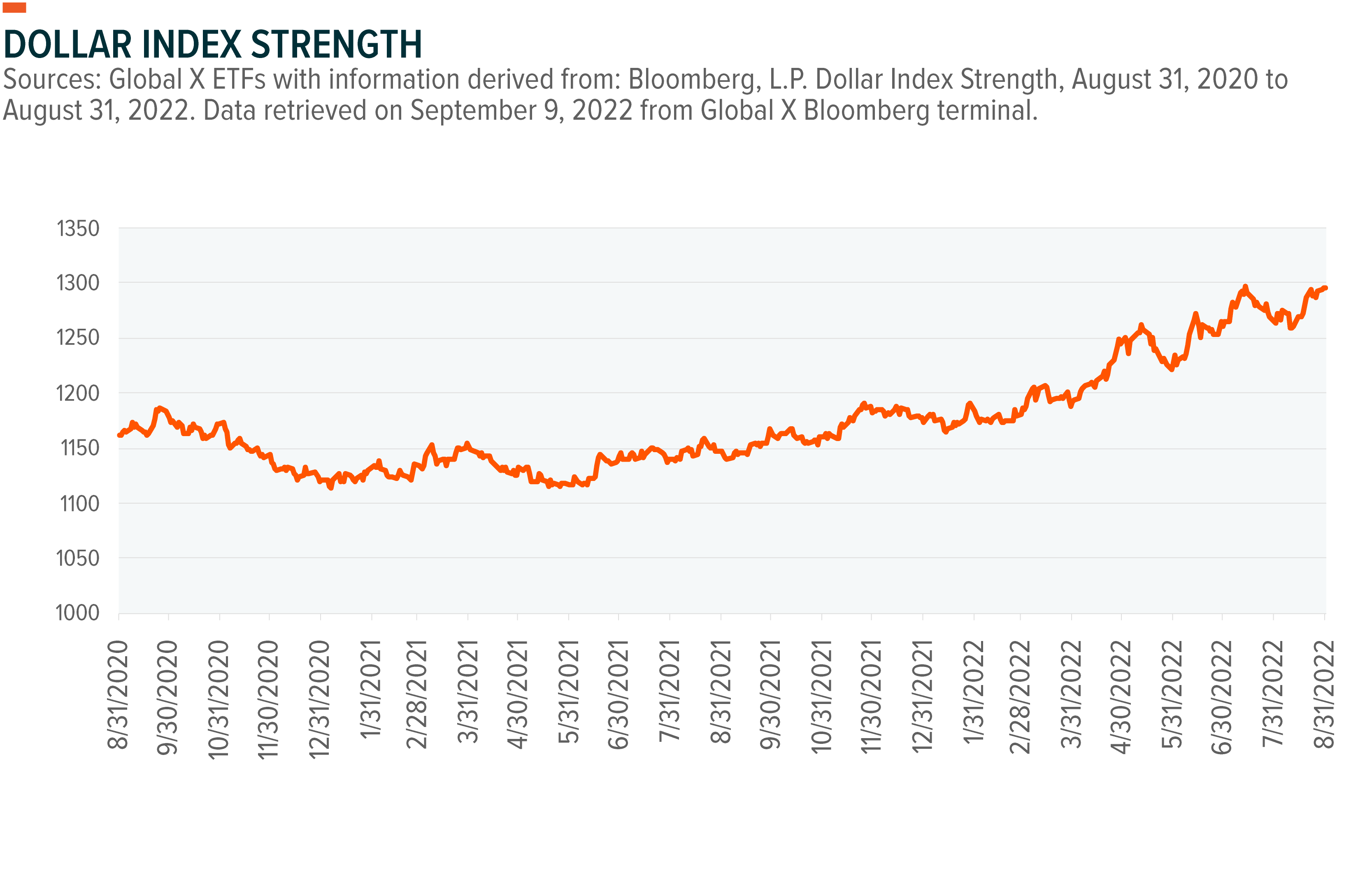

- A byproduct of the Federal Reserve’s (Fed) aggressive interest rate hiking cycle is a stronger dollar, which can put downward pressure on oil prices. However, persistently tight oil supply and the energy shortage in Europe is likely to provide a ballast to oil prices.

- We believe the nature of midstream’s role in oil and gas production and the defensive nature of its contracts and fee structures leave it better positioned in this environment than other segments of the energy market.

- Additional free cash flow for midstream equities through increasing U.S. energy production could result in further dividend and buyback activities, highlighting their potential balance sheet strength.

Dollar Strength the Latest Factor Contributing to Oil Market Volatility

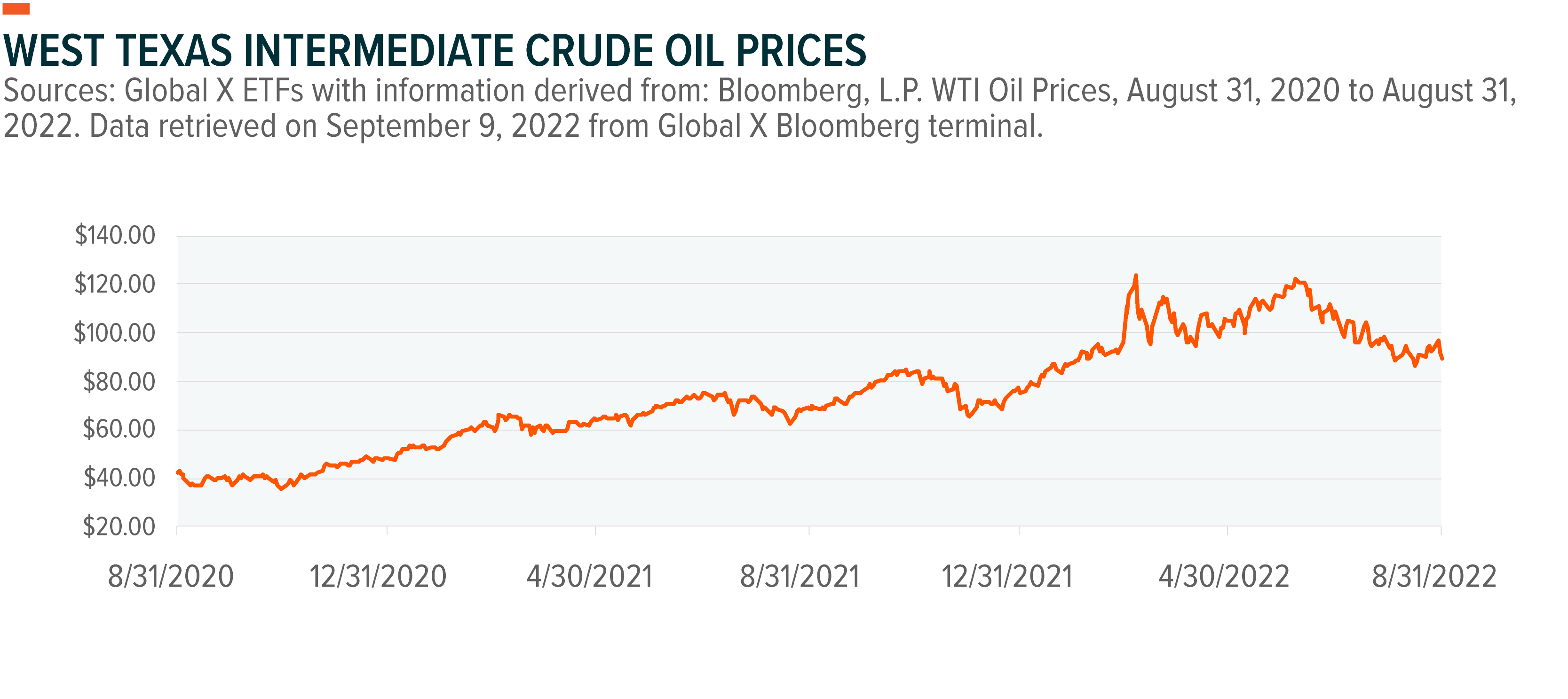

Over the last two-plus years, oil prices swung from as low as $20 a barrel in April 2020 to as high as $125 barrel in March 2022.1 In addition, natural gas price volatility reached an all-time record in 20 years for both European and Asian gas markets as a result of unprecedented uncertainty.2 COVID-19, OPEC policies, the war in Ukraine, and the global economy’s energy transition all played a role. The Fed hiking interest rates by 225 basis points (bps) so far this year in an effort to curb inflation is another major factor in oil’s recent behavior.3

The drop in price since the March high can be attributed to rising interest rates and fears of a market downturn strengthening the U.S. dollar, which had a negative correlation of -0.22 with oil.4 Generally, a stronger dollar causes oil prices to fall because oil is traded in USD, making it more expensive for other nations, particularly emerging markets (EMs) to purchase. And with EMs still recovering from COVID, fiscal spending and economic performance remains sluggish. Ongoing COVID-19 concerns in China and the subsequent lockdowns in China, the world’s largest oil importer, also added pressure.

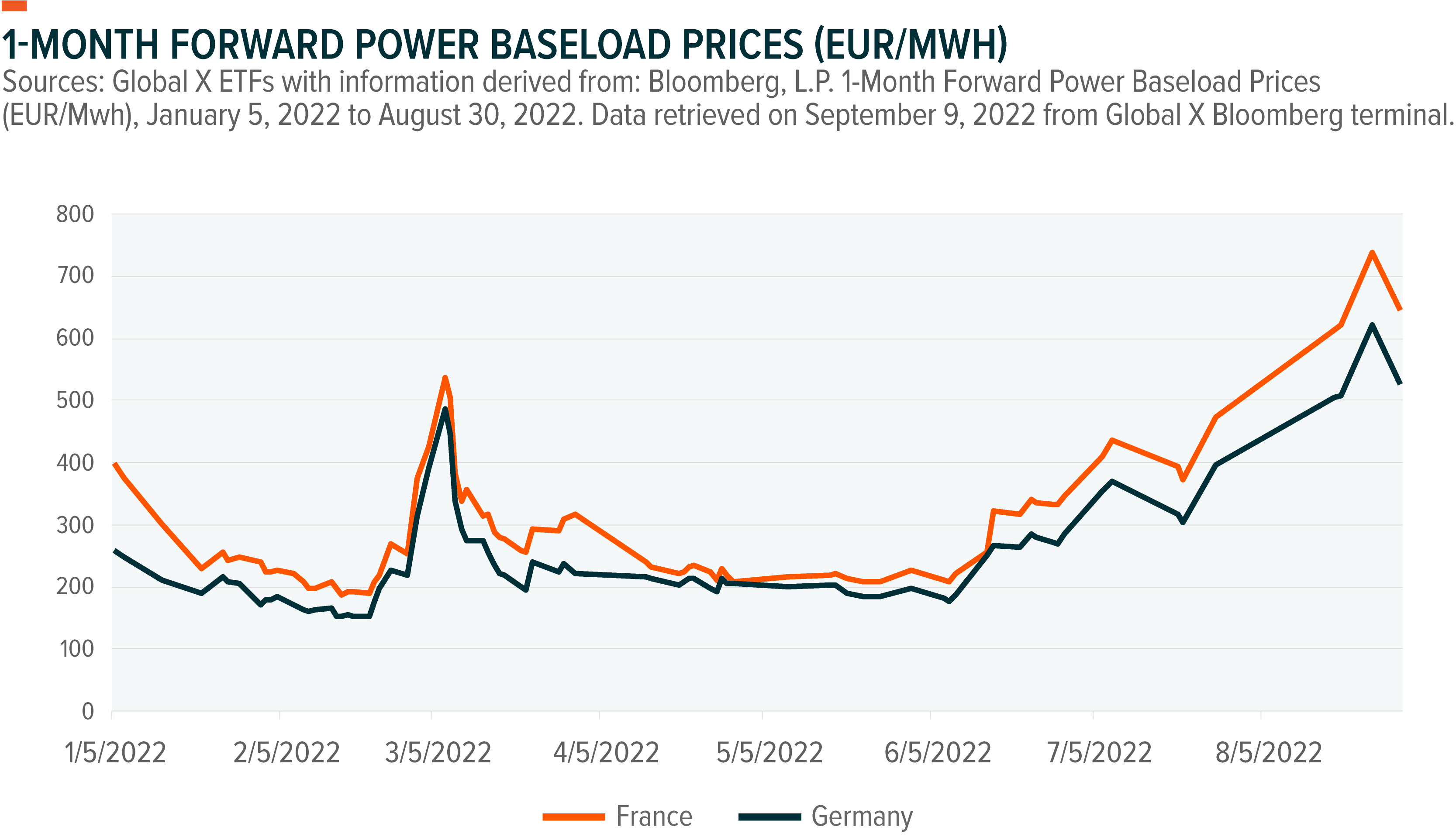

However, natural gas prices remain a bright spot. The energy crisis in Europe and heavy reliance of the continent on Russian gas supplies is causing both localized and global price hikes of natural gas. Europe imports approximately 45% of its natural gas from Russia, leading to the exorbitant price spikes seen below. US natural gas prices still moved heavily also, multiplying from $3.68 million British thermal unit (mmbtu) to start the year all the way to $9.13 mmbtu at the end of August.

The midstream sector may be well positioned to capitalize on these dynamics both in the short-term and long-term. The North American midstream sector skews towards natural gas as its primary revenue driver. 79% of revenue comes from natural gas as opposed to oil.5 Natural gas production in the US is forecasted to grow from around 97 billion cubic feet per day (bcf/d) to over 100 bcf/d by April 2023.6 In the long-term, countries are likely to reduce their reliance on unstable energy sources like Russia, creating an opportunity for US midstream infrastructure. This could result in additional spending to the sector for long-term growth.

Correlation Between Oil and the Midstream Lower than Other Energy Companies

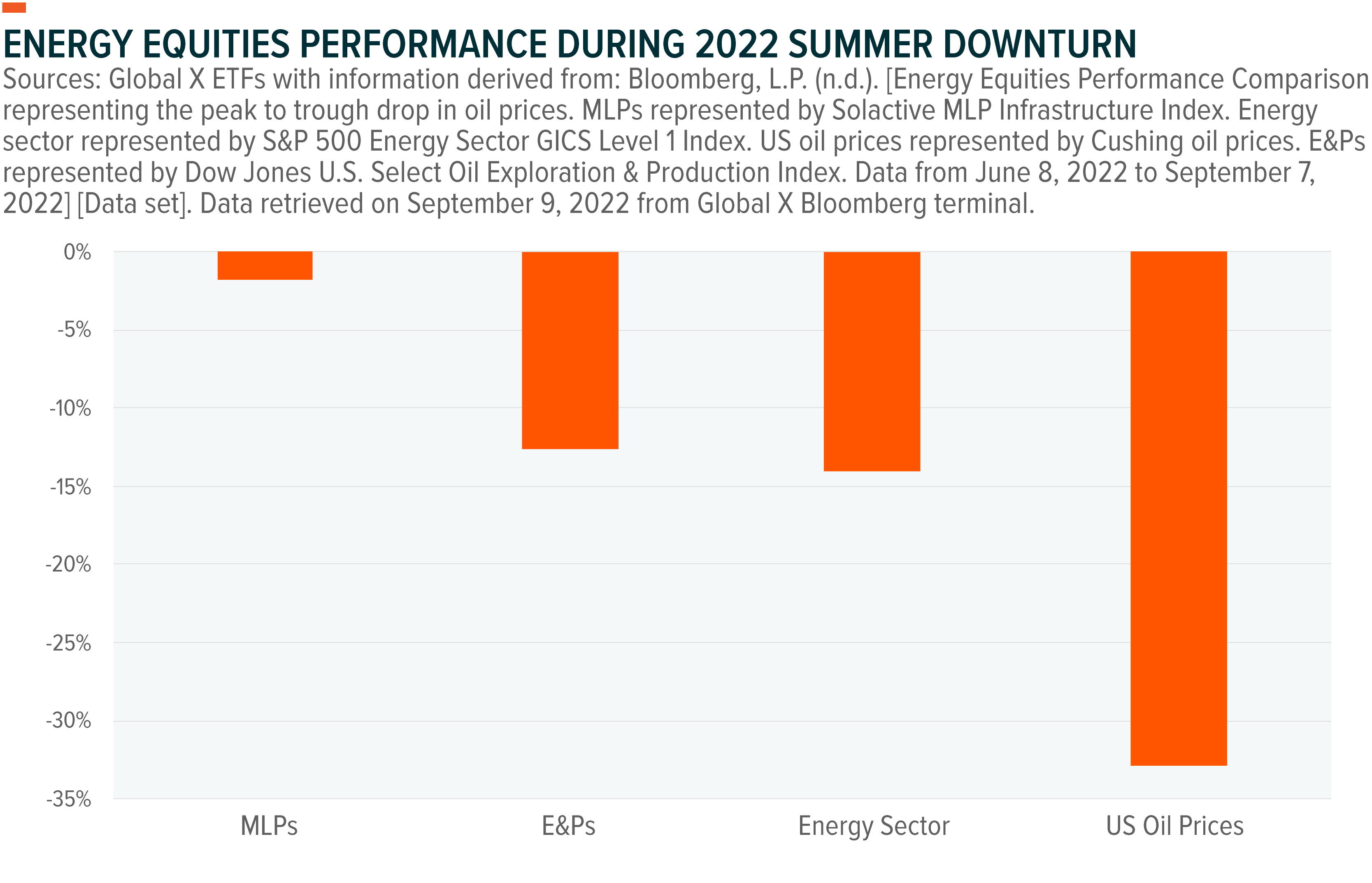

Midstream companies handle the processing, storage, and transportation phases of oil and gas production, making their correlation with oil prices unique relative to other energy segments, and perhaps lower than expected. Currently, the correlation between midstream companies and oil prices is 0.55.7 For other energy segments, like exploration & production (E&P) companies and refining companies, the correlation tends to be higher, in the 0.6–0.7 range.8

Also, given MLPs typically operates fee-based business model, the long-term correlation between midstream and oil tends to be lower than other energy segments. MLPs set certain contractual escalators that increase payments by a certain percentage, or they are based on the Producer Price Index (PPI) for finished goods. Shorter in duration, these escalators make MLPs less susceptible to energy price moves.

MLPs’ correlation to oil tends to increase more during periods of declining oil prices. In particular, the correlation tends to increase when oil prices fall below $45–50 a barrel, which we attribute to possible concerns about counterparty risk and volume risk. For example, when oil prices dropped more than 50% from June 1, 2014 to June 1, 2016, the correlation between MLPs and oil was roughly 0.5. 9 Conversely, when WTI oil prices increased more than 300% from June 30, 2020 to June 30, 2022, the correlation was roughly 0.47. However, when prices are high or elevated like we’ve seen in June 2014 and this year and there is a price drop, midstream equities tend to be more immune to that price drop because there isn’t as big of a risk of a forecasted production drop since most North American E&Ps continue to profit at those prices.

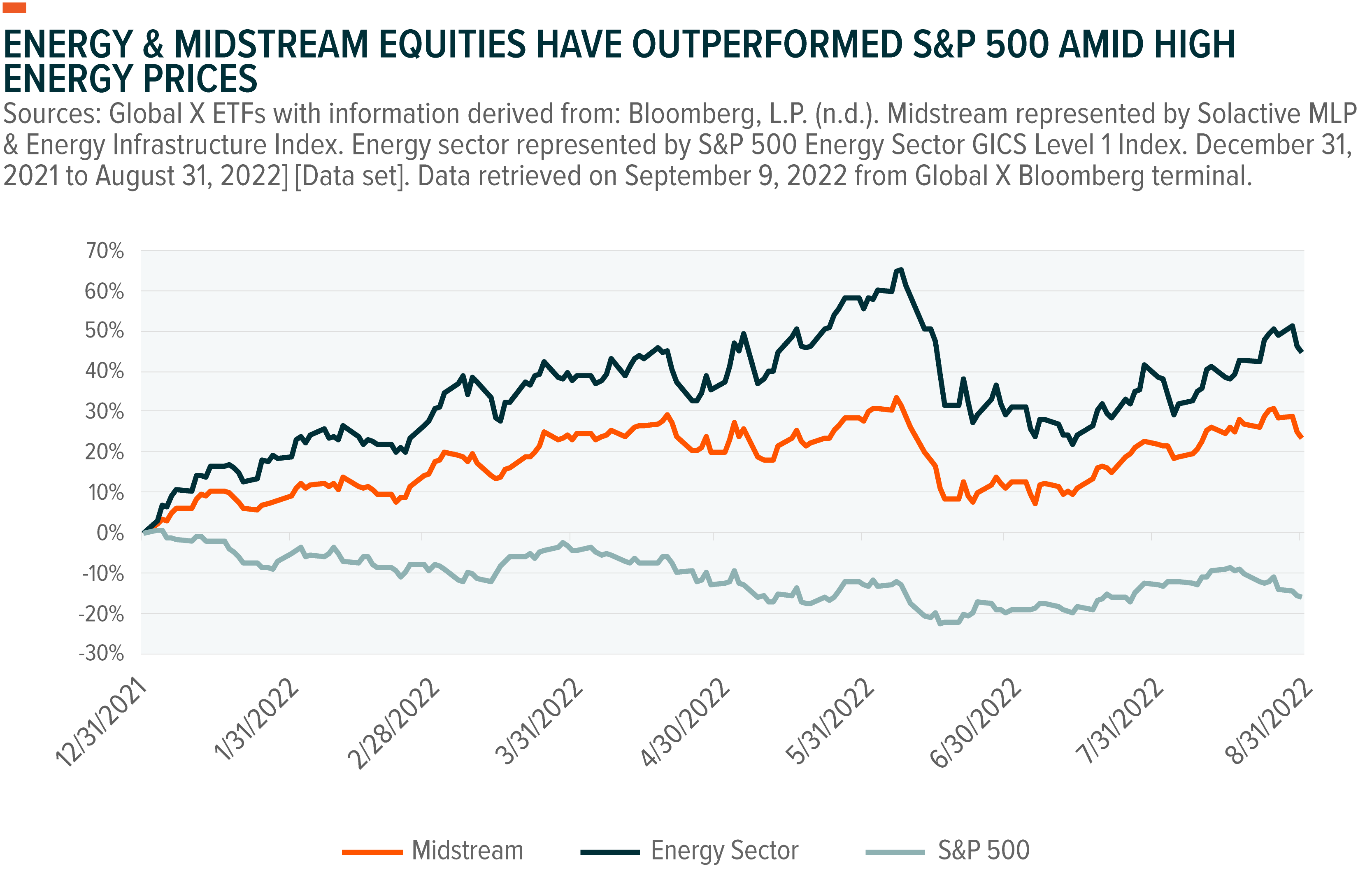

The lower correlation to oil has dampened some of the performance relative to the Energy sector though because high oil prices have been a boon for the broader sector However, midstream has captured a lot of this positive momentum because of the strength of the sector and higher production outlook. The Energy sector is the best performing sector by far based on the S&P 500 Global Industry Classification Standard sector (GICS), and the only positive performing one year to date.

Permian-Focused Midstream Equities Appear Well-Positioned

The rising rig count and share buyback and M&A activity in midstream, especially in the Permian Basin, indicate strength in the space. The Permian is the largest oil-producing shale area in the U.S., accounting for over 40% of total U.S. oil production.10 U.S. oil production is expected to average 11.9 million bpd in 2022 and 12.7 million bpd in 2023, which would be a record high for the U.S. in a year.11 Permian production is projected to increase from 5.6 million barrels in 2022 to 6.5 million barrels in 2023.12 Oil giants Chevron and ExxonMobil aim to increase production by 15% and 25%, respectively, this year. 13

Higher oil prices and increased domestic production that goes to address the supply disruptions in Europe may create income opportunities for U.S. midstream, especially those that have exposure to the basin. It is expected that the production in the Permian Basin will increase by 2.1 billion cubic feet per day (Bcf/d) in 2022 and an additional 1.7 Bcf/d in 2023 to meet exploding natural gas demand.14

On the M&A front, midstream companies including DCP Midstream, Enterprise Products Partners and Crestwood Equity Partners expanded their gathering and processing business in the Permian Basin through mergers and acquisitions. If completed as planned, the recently announced pipeline projects are expected to boost the Permian Basin’s capacity by a combined 4.18 Bcf/d over the next two years.15

MLPs May Provide Income Opportunities in This Market

The S&P 500 declined 20% in the first half of the year due to investor concerns about inflation and the potential for earnings contraction. Headline inflation fell more than expected from 9.1% in June to 8.5% in July, but it remains well above the Fed’s preferred 2% target. Equities bounced back in July and into August, before selling off on Chair Jerome Powell’s hawkish warnings from Jackson Hole. Treasury yields rising above 3% and market expectations for interest rate hikes to rise to 3.75–4% by end of 2023 have negatively affected interest rate-sensitive assets.16

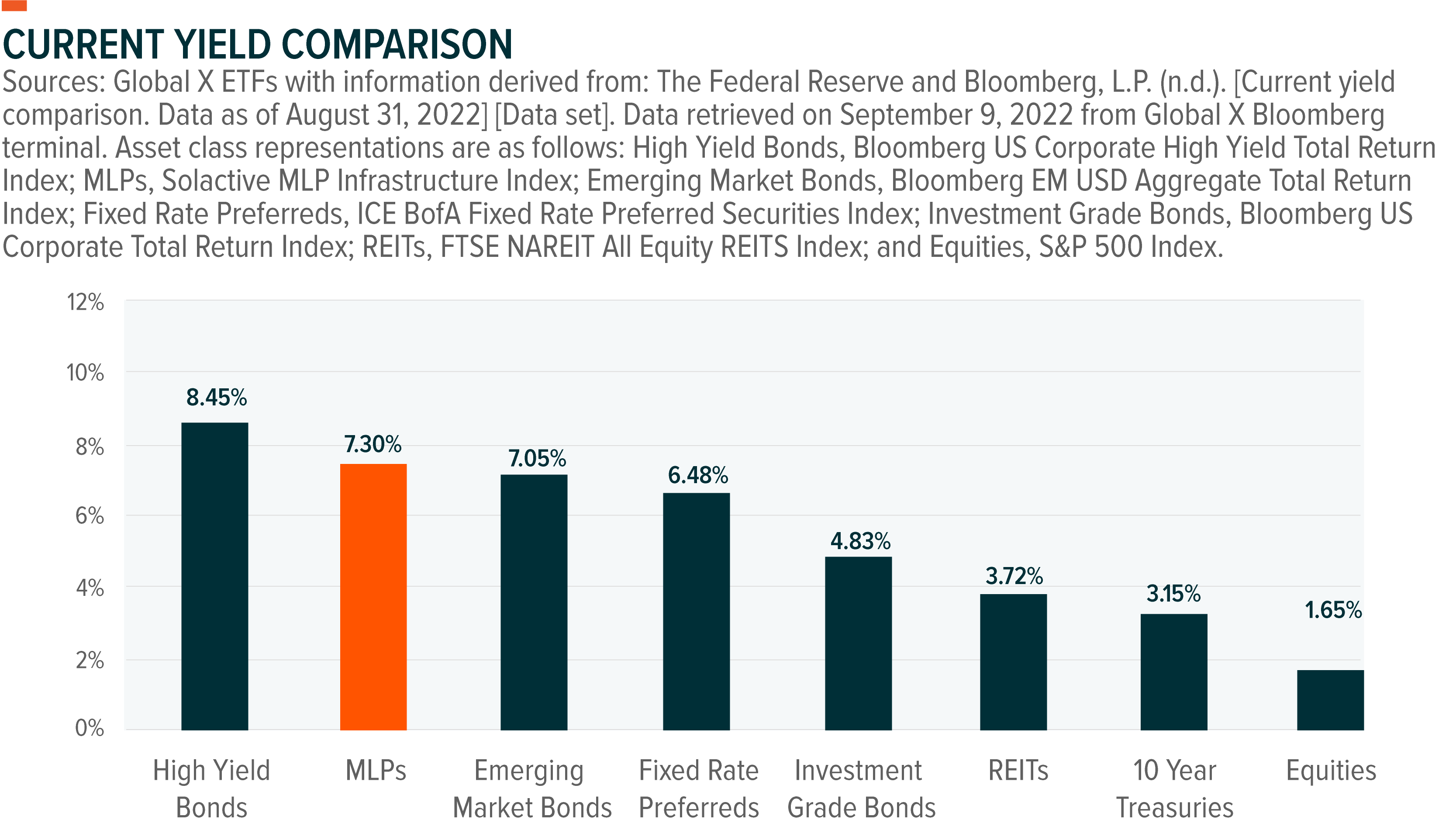

For yield-seeking investors, MLPs posted an attractive current yield of 7.3% as of August, substantially higher than the average yield of equities. Also, midstream distributions remained strong, increasing 2.68% to $0.51 per share in Q2 2022.17 Steady midstream cash flows may permit further distributions and share buybacks.

Conclusion: Outlook for Midstream and MLPs Remains Positive

We expect the oil market to remain volatile in this higher inflationary environment, as interest rates rise. China may have a big say in oil prices given recent sluggish economic activity due to its zero-COVID policy and real estate crisis.18 However, we believe the midstream space can be an attractive potential income alternative for investors. Oil supply in the global market remains tight, and U.S. domestic producers appear well-positioned to step in to meet rising oil demand from Europe.