Lithium Market Update: Elevated Prices Are Creating Favorable Dynamics for Miners

In October 2022, prices for battery grade lithium carbonate in China hit an all-time high of $74,475 per tonne, eclipsing the record set just a month prior.1 Lithium pricing trends are deeply rooted in the transportation segment’s ongoing shift toward electrification. In recent years, accommodative government policy, declining costs, consumer preference, and technological improvement have supported rapidly increasing adoption of electric vehicles (EVs). So far lithium supply upgrades have not kept pace with this surge in demand. As a result, we expect the lithium market balance to tilt toward a supply deficit for several years, presenting opportunities for the mining companies that dictate supply.

Key Takeaways

- Surging demand for EVs and the inelastic nature of lithium supply are the primary drivers behind the increase in lithium prices in 2022.

- Supply is unlikely to grow in lockstep with demand through the first half of the decade, likely generating deficits that could support elevated lithium pricing.

- Elevated lithium pricing has generally translated into strong results for lithium miners in recent quarters, including Albemarle, SQM, and Ganfeng.

EV Sales and Inelastic Supply Likely to Support Lithium Prices

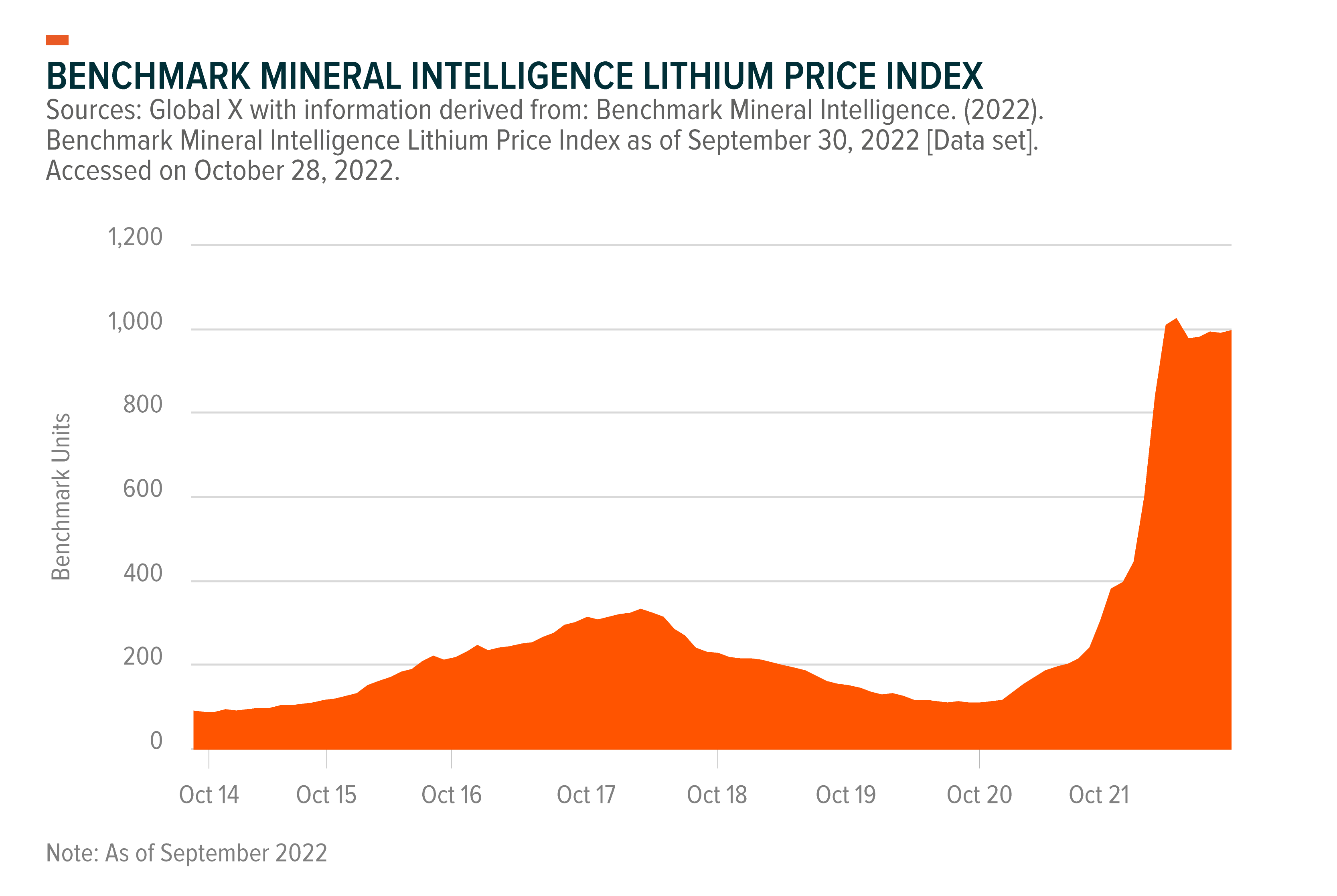

Lithium prices have surged 123% year-to-date and are up as much as 10x versus historical levels, according to the Benchmark Minerals Intelligence lithium price index.2 As momentum accelerated toward EVs in recent years, so too did aggregate demand for lithium. On average, the lithium-ion battery packs found in EVs contain about 9kg of lithium, thousands of times more than most consumer electronics.3 Global EV sales doubled from 3.3 million units to 6.6 million units between 2020 and 2021 and are expected to increase by another 52% in 2022.4

Meanwhile, lithium miners have been unable to scale supply as rapidly. Depending on the method of extraction, bringing new capacity online can take 3–5 years or more.5 This time is needed to conduct studies, secure permitting, raise capital, and deploy capital before any lithium is produced. As such, it is challenging for miners to react quickly to rising demand without considerable preemptive efforts.

Historically, miners have also been hesitant to boost production, fearing what flooding the market with supply could do to lithium prices. This scenario occurred between 2015 and 2018 when miners hiked lithium production in anticipation of rapid EV sales growth in the immediate term. This speculation turned out to be premature, leading to lithium price volatility during that period. We believe the current favorable lithium pricing environment and now well-established EV adoption trends have made miners more inclined to commit to ramp future capacity.

Market Balance Forecasts: Lithium Demand to Outpace Supply Through 2025

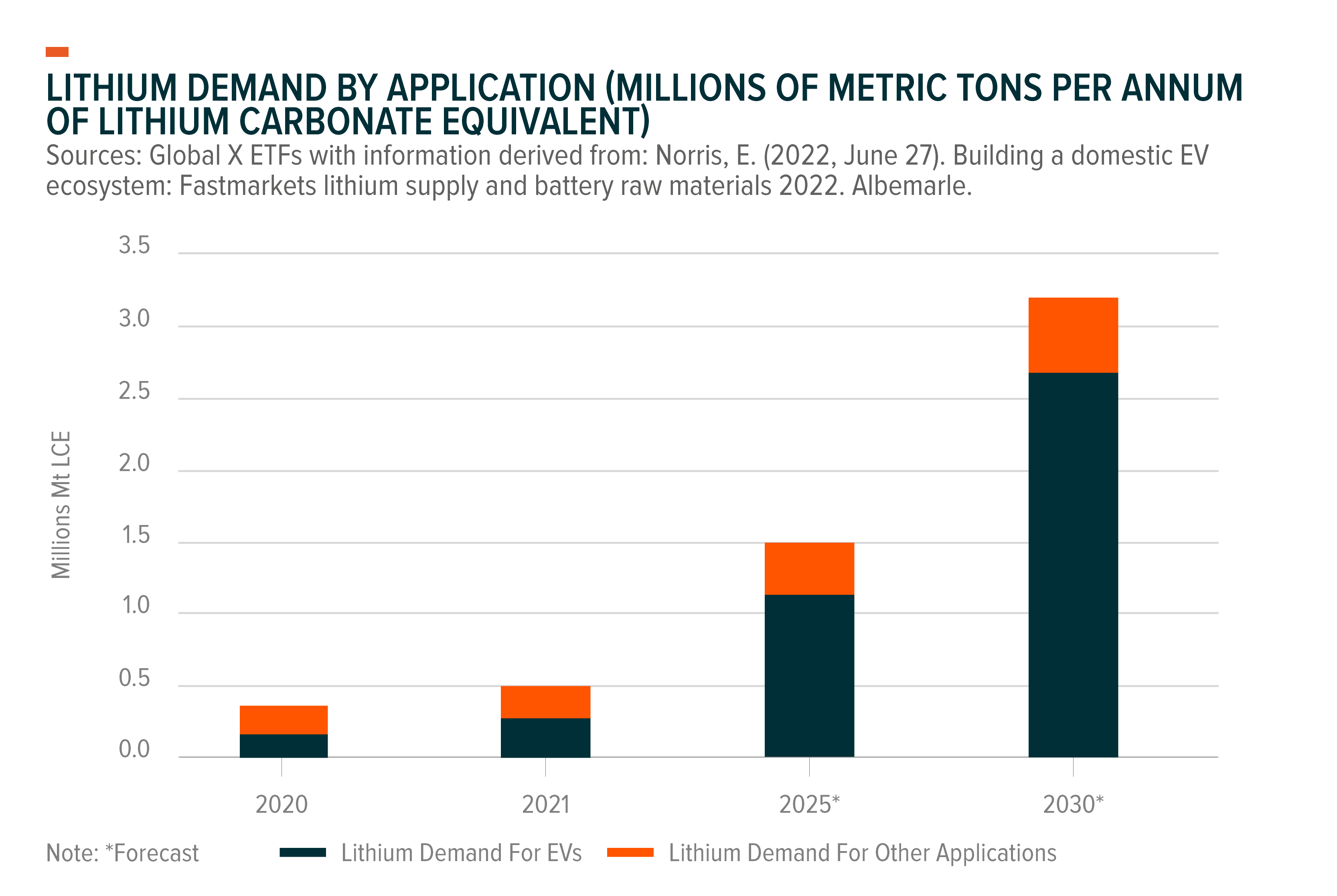

Annual lithium demand is projected to reach roughly 1.5 million metric tons of lithium carbonate equivalent by 2025 and over 3 million tons by 2030.6 This 2025 forecast calls for triple the demand seen in 2021.7 EVs could account for about 84% of total lithium demand in 2030, up from about 55% in 2021.8 Consumer electronics, energy storage, and other industrial applications are likely to account for the balance of demand. Over the longer run, demand for lithium is forecast to far exceed the scale of the industry’s capacity today. More lithium could be needed on a monthly basis in 2040 than all of the lithium mined in 2021.9

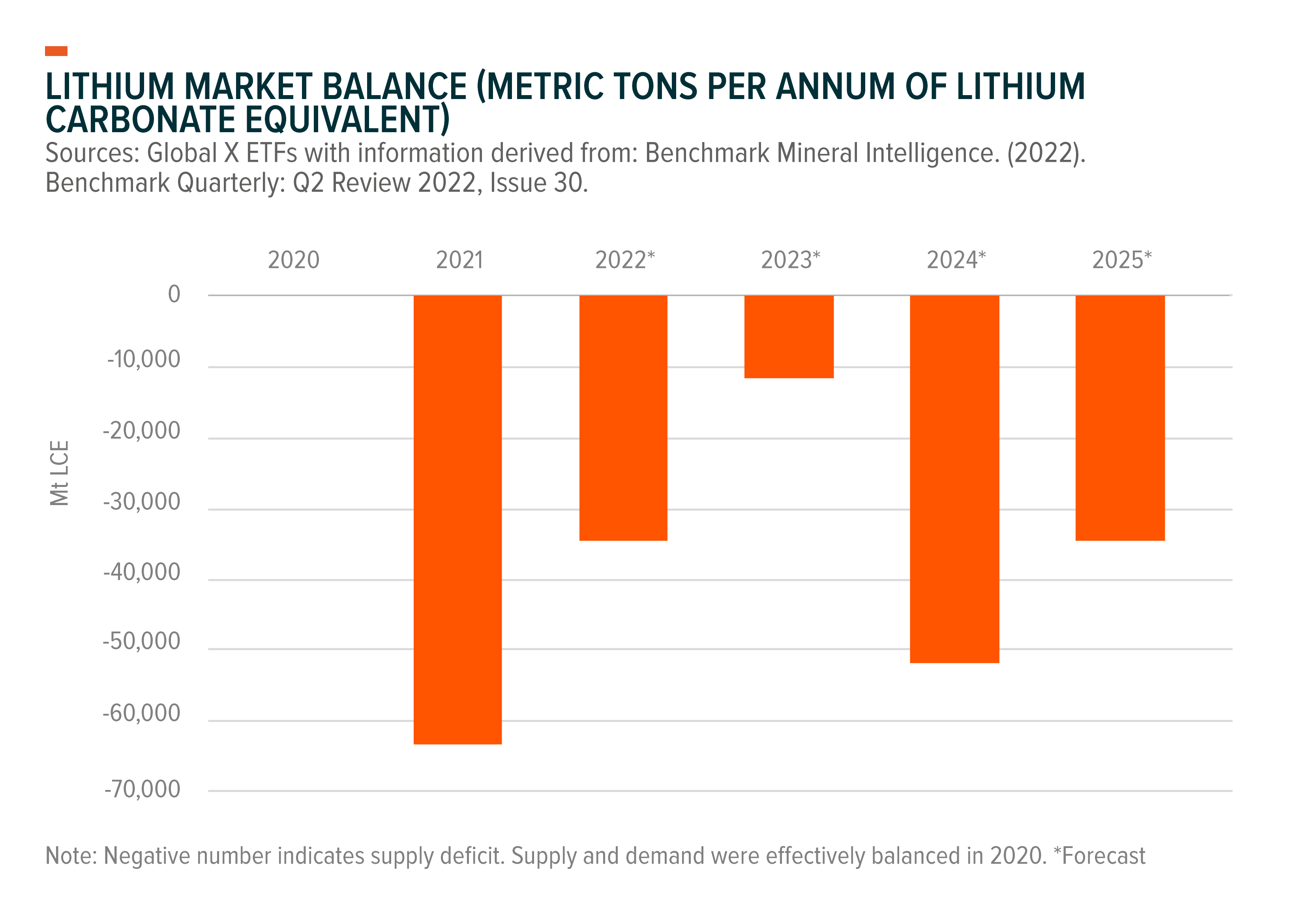

Lithium supply is likely to lag lithium demand through the first half of the decade. In the short term, notable lithium mining capacity is set to come online in late 2023 and early 2024.10 These new projects could cut into the deficit in 2023, but surging EV sales are expected to result in sizeable shortages again in 2024 and 2025.11 By 2025, EVs could account for more than 20% of global light duty vehicles sales, up from 9% in 2021.12 This degree of EV adoption is expected to hold lithium prices in ranges comparable to 2022 levels until the market stabilizes around 2026, according to miner Sigma Lithium and Benchmark Mineral Intelligence.13 Likewise, even after more projects bring resources to market later in the decade, lithium prices could remain above historical averages.14

Solid Earnings and Guidance Encouraging Miners to Boost Future Supplies

Elevated lithium prices have boosted the top and bottom lines for relevant miners. Albemarle, one of the top suppliers of lithium, issued guidance in Q2 2022 that recognized lithium prices could increase 225–250% for fiscal year (FY) 2022, which could correspond to 5x year-over-year (YoY) earnings per share (EPS) growth.15 Similarly, Chilean lithium producer Sociedad Quimica Y Minera de Chile (SQM) reported that Q2 2022 revenue more than doubled year over year.16

Along with strong earnings outcomes, several prominent lithium miners recently announced capacity expansion ambitions:

- Albemarle: During a Q3 2022 U.S. processing plant announcement, Albemarle unveiled a goal to increase overall lithium capacity fivefold to 500,000 tonnes by 2030.17

- SQM: In Q2 2022, SQM announced a lithium carbonate production goal of 210,000 tonnes by early 2023, more than double 2021 levels.18,19

- Ganfeng: In Q3 2021 Ganfeng announced a plan to boost lithium carbonate capacity fivefold to 600,000 tonnes on an undefined timeframe.20

Governments trying to build out lithium and EV supply chains are also incentivizing lithium producers to increase capacity. For example, Albemarle will receive $149.7 million and Piedmont Lithium $141.7 million in federal grants from the Infrastructure Investment and Jobs Act to develop lithium facilities in the United States.21

We view this increased willingness to expand future lithium supplies as a positive development for the EV space, with the commitments made now potentially promoting healthier market dynamics in the coming decades. However, even with these recent commitments, growth in demand for lithium is expected to outpace supply for some time.

Conclusion

The lithium market remains red hot, even as broader commodity markets have moderated in the latter stages of 2022. Used in most of the world’s batteries, this specialty chemical’s importance to the global economy is likely to continue. The electrification of transportation, highlighted by the mass adoption of EVs, is the major reason why. For lithium miners, we expect strong demand coupled with lithium’s long supply lead times to sustain a favorable pricing environment for a prolonged period.

Related ETF

LIT: The Global X Lithium & Battery Tech ETF invests in the full lithium cycle, from mining and refining the metal, through battery production.

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.