Key Themes for the New Normal Economy

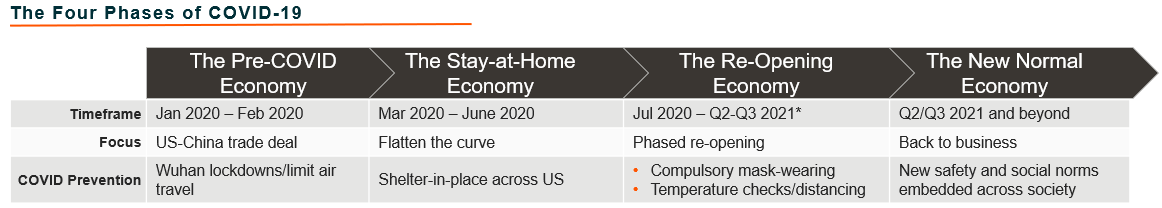

As vaccines are distributed more broadly, population-wide immunity to COVID-19 is getting closer to reality. In the United States, the pandemic could largely be over by mid-year 2021. Europe, Asia, and other regions could join later this year or early 2022, depending on local factors. But while the public health risks associated with COVID-19 may soon be behind us, lingering effects from the pandemic will continue to impact our society and the economy for years to come. In the post-pandemic world, which we dub the New Normal Economy, governments, companies, and organizations will need to address lasting challenges from the pandemic, like higher debt burdens, changed consumer preferences, choked supply chains, and weakened economies, while also collaborating to build greater resilience to future crises, like climate change.

*Estimated

In this piece, we will discuss the long-term impacts of the pandemic and the five key themes that we expect to thrive during the multi-year New Normal Economy phase, including:

- Paying Down the Debt: Governments large and small must reconcile an explosion of debt from the pandemic with a more competitive landscape where workers have more flexibility than ever to decide where to earn and spend their money. Embracing new revenue sources, beyond raising tax rates, are likely to be in the limelight, such as legalizing and taxing cannabis.

- Catering to Omnichannel Consumption: With a fully open economy, consumption activity is expected to surge as consumers unleash pent-up demand for goods, travel, and services. Yet preferences changed during the pandemic with many embracing online shopping and digital services. In the new normal, businesses must bridge this digital-physical divide with FinTech solutions, making transactions seamless wherever they occur and accepting several new forms of payment.

- Alleviating Choked Supply Chains: Surging consumption will clash with fragile and overwhelmed supply chains. Reduced production during the pandemic could result in persistent shortages of key inputs. The result may be inconsistent access to goods and rising inflation amid accelerating economic activity. Companies may rethink global supply chains in an effort to avoid uncertainty in the future, resulting in onshoring and investment in robotics and AI.

- Rebuilding for Long Term Growth: A macro environment featuring low interest rates, elevated unemployment, and a GDP output gap offers governments a unique window to invest in programs that stimulate economic growth over both the short and long-term. In the United States, the most glaring opportunity lies in rebuilding and modernizing the nation’s infrastructure after decades of negligence.

- Preparing for the Next Crisis: The lessons learned from this pandemic will likely reshape international responses to global crises for years to come. While future pandemic preparedness is likely top of mind, we believe the next impending challenge for the international community is climate change, which will require accelerated and coordinated efforts to rapidly adopt cleantech and renewable energy.

Paying Down the Debt: Cannabis

Many U.S. states are facing severe budget shortfalls. New Jersey is expecting more than a $5 billion revenue decline for the 2021 budget year, a 13% drop from pre-COVID 19 projections.1 New York faces a $17.5 billion revenue shortfall over the next two years.2 The list goes on, with at least 26 states seeing declines during the pandemic.3 The revenue declines are a direct result of COVID-19: layoffs and business closures hurt income tax collections, reduced consumer spending impacted sales tax revenues, and lockdowns stopped business and leisure travel from bringing additional revenues to localities.

In the short-term, some of these issues will be alleviated with federal aid. The $1.9 trillion American Rescue Plan designates $350 billion to help state and local governments close their debt as a one-time stopgap measure. But because of the rise of work-from-home, deficits are likely to persist in the future. With greater work flexibility, the exodus from high tax, high cost of living areas reduces these localities’ tax collections and ridership of public transportation, potentially ballooning municipal deficits. While raising taxes is one option that will likely be explored, this approach runs the risk of accelerating the exodus trend from states like New York and California, particularly among their highest earners. Instead, state and local governments could find more success in collecting taxes from new sources.

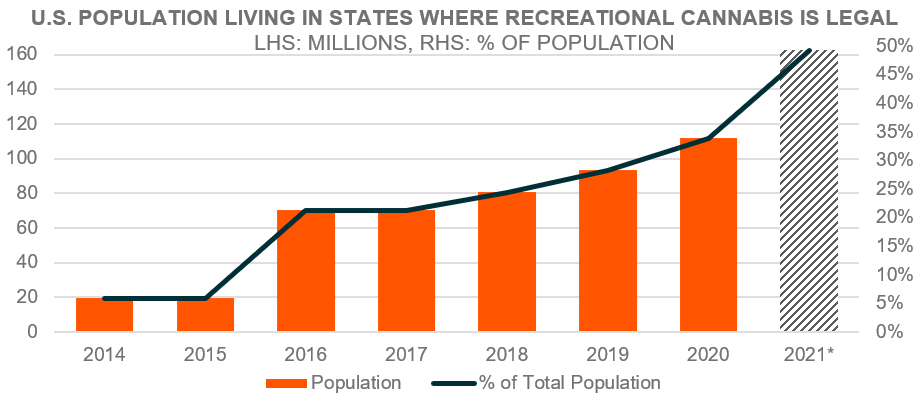

Legalizing recreational cannabis is one such avenue. Currently, 18 states allow recreational use, with Colorado offering the longest case study of its impact on the economy and tax revenues. Since cannabis sales began in 2014, the Colorado Department of Revenue reports cumulative tax revenues of $1.7 billion.4 In 2020 alone, the state generated $388 million in direct taxes, a 28% increase from the previous year.5 Tax revenue comes from the state sales tax (2.9%), the state retail cannabis sales tax (15%), and the state cannabis excise tax (15%) on wholesale sales/transfers of retail cannabis. Beyond increased tax revenues, estimates hold that cannabis legalization created roughly 18,000 direct jobs, boosted another 23% by spurring indirect employment in areas like construction, security, and legal services.6

The experience in Colorado and cannabis-friendly states, coupled with the financial burden of the pandemic, has set in motion tailwinds for further legalization across the country. Last Fall, cannabis’ legal status appeared on five state election ballots, with voters approving all measures: Arizona, New Jersey, and Montana for recreational use; South Dakota for recreational and medical use; and Mississippi for medical use. So far in 2021, 18 million more Americans have gained access to adult-use recreational cannabis through state-initiated legalization in New York, Virginia, and New Mexico. Rhode Island, Pennsylvania, Maryland, Delaware, and Connecticut, all added cannabis to their 2021 legislative agendas, as well. If measures in these states are approved, over 50% of Americans will live in a state with legalized recreational cannabis by year- end.

Such progress could prove to be a tipping point for cannabis in the United States, not only accelerating sales for cannabis-industry companies involved in areas like production, growth, and distribution, but also potentially paving a pathway for decriminalization of cannabis at the federal level, enhanced access to financial institutions for cannabis companies, and even country-wide legalization.

Source: Global X ETFs, DISA, World Population Review. As of March 2021. *2021 estimate: assumes VA, NY, RI, PA, NM, MD, DE, and CT legalize recreational cannabis this year.

Catering to Omnichannel Consumption: FinTech

During the height of the pandemic, thousands of businesses opened online storefronts or shifted resources to further support their online sales efforts. Shopify, an online platform that helps small businesses open and operate online stores, saw its revenue increase 86% in 2020.7 Walmart, known for its big-box retail stores, shifted its focus online too, with e-commerce sales in the U.S. rising 79% in 2020.8

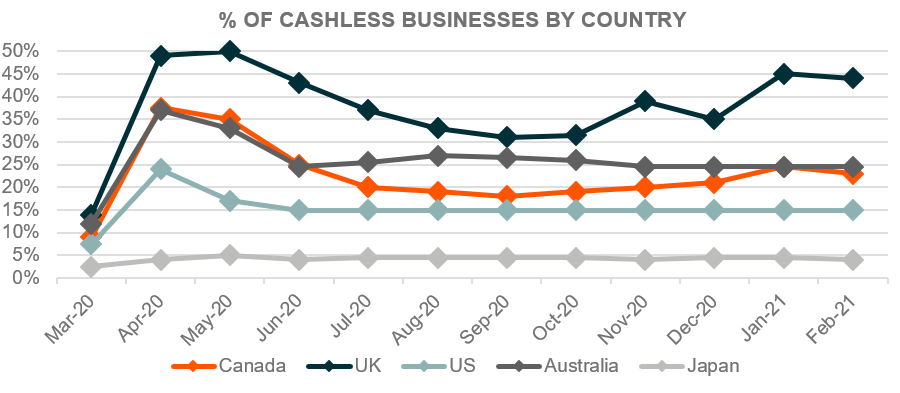

Beyond just building their e-commerce presence, many businesses also shifted to accepting various forms of digital payments. Digital payments allow customers to purchase goods using a variety of methods from credit cards, to smart devices, payments apps, buy now pay later (BNPL) plans, or even crypto-currencies. For example, CVS and PayPal’s new partnership means customers can pay at in-store checkout stands using the Venmo or PayPal mobile apps via QR scanning. Part of the impetus for this shift was simply the more hygienic nature of contactless digital payments compared to accepting physical cash. But also driving this shift was the need to integrate payments methods that work both in-store and online, and that cater to the ever-changing preferences of consumers.

Some businesses ditched cash payments altogether. Relative to pre-pandemic levels, the share of cashless businesses nearly doubled in the U.S., Australia, Canada and the UK. In the U.S., approximately 15% of merchants were cashless, up from 8% pre-pandemic.9 We believe the dramatic shift away from cash to digital payments would have taken approximately three years under normal circumstances, but the pandemic greatly accelerated this trend. A recent survey showed that nearly two thirds (65%) of consumers say that post-vaccine, they would prefer to use contactless payments as much as, or even more than, they are using them currently.10

Source: Square.

The early stages of the New Normal Economy will be critical for businesses to capture robust consumption activity and cater to the new consumer preferences forged during the pandemic. In March 2021 retail sales accelerated 9.8%, and total retail sales in the U.S. are expected to grow between 6.5% and 8.2% in 2021.11 With approximately a $2.2 trillion increase in household cash and equivalents, consumers could be ready to unleash a spending frenzy.12 But it’s likely that consumers maintain habits they formed during the pandemic, particularly those that take advantage of convenient features. Grocery delivery, for example, is now a deeply imbedded service in many consumers’ routines. Skipping the lunch line by ordering ahead on an app is likely to remain popular too. And using cryptocurrencies as a form of payment looks ripe for continued growth as well.

The companies that will likely thrive in the New Normal Economy are therefore those that meet customers where they want to be met, whether that’s offering online, in-store, or app-based purchases, and accepting several digital payments options. But perhaps the biggest beneficiaries of this trend will not be the retailers themselves, but the FinTech companies building the integrated platforms and solutions that allow merchants to seamlessly accept a range of digital payments both online and in-store.

Alleviating Choked Supply Chains: Robotics & AI

While consumption may be surging, global supply chains look ill-equipped to handle increasing demand. In the U.S., effective vaccine distribution and trillions in economic stimulus helped facilitate a relatively quick V-shaped domestic economic recovery and increase consumption. But large portions of the developing world remain mired in uneven control of the virus, which continues to hobble those economies and limit their production and export of key raw and finished goods in the near term. Limited shipping capacity, and shortages in labor and

semiconductors, threaten to compound these supply chain issues and lead to persistent bottlenecks around world.

As vaccinations progress, global economic output continues to recover from depressed levels. In March, the pace of global economic expansion rose to near decade highs. The J.P. Morgan Global Composite Output Index reached a long-term high of 58.4 and signaled an expansion for nine consecutive months.13 U.S. consumer confidence soared to 121.7 in April 2021, its highest reading since February 2020.14 And Chinese exports climbed 30.6% year-over-year (y-o-y) in March, after a 60.6% surge in January and February, as demand for Chinese goods and manufacturing inputs intensifies.

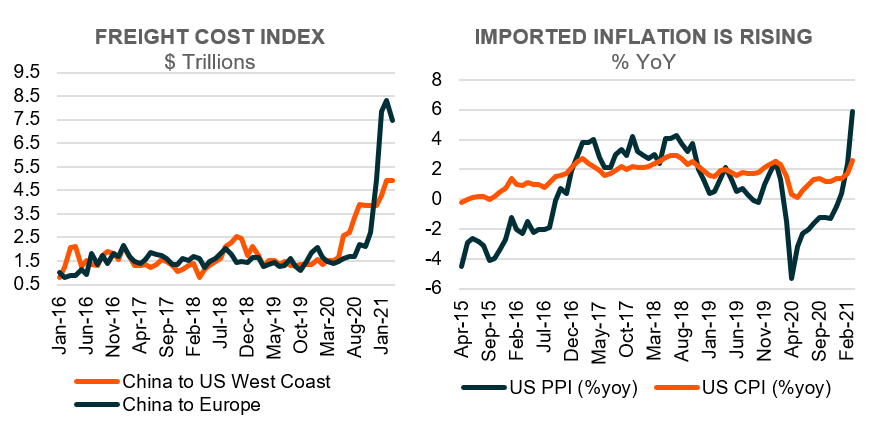

Source: Bloomberg, China Customs General Administration, as of 31 March 2021 (3-month moving average).

But current global maritime transport, which accounts for 80% of total international trade, is struggling to keep up, leading to supply chains disruptions and higher costs. Part of the issue is the surging Chinese exports, as well as the Suez Canal blockage in March. But these challenges are compounded by the pandemic, with shutdowns interrupting the carefully balanced continuous flow of shipping containers, and additional cleaning protocols adding to container scarcity. The confluence of these factors caused the cost of shipping to double since last October, putting immense pressure on input prices. The price of goods rose for the ninth straight month and at the steepest pace since October 2009.

CPI: Consumer Price Index. PPI: Producer Price Index. Source: left graph: Freightos Baltic Index (FBX), right graph: Bureau of Labor Statistics, as of 31 March 2021.

Some industries are more affected than others. The accelerating pace of adoption of new digital technologies such as the Internet of Things (IoT), cloud computing, autonomous vehicles, and robotics, has drastically increased the demand for semiconductors over the past few years, contributing to global shortages. The pandemic, along with severe weather in Texas that shuttered semiconductor production, and the Suez Canal blockage, further exacerbated the backlogs which could take several months to unclog. Semiconductors are an essential component for the automobile industry with the rise of the smart car, which includes Bluetooth connectivity, driver assist features, navigation and hybrid electric systems. Until supply chains rebalance, the automobile industry could face headwinds.

Even beyond public health crises, rising geopolitical tensions and extreme weather continue to reinforce the fragility of existing supply chains. Therefore, in the New Normal Economy, we expect companies to invest heavily in strengthening supply chains in an effort to avoid disruptions in the future. The likely answer is better use of technology and re-shoring of production. According to the World Economic Forum’s global survey in 2020, companies across the world are quickly adopting technologies to keep their supply chain flowing. Two-thirds of respondents implemented or considered new technologies to reconfigure the value chain, while more than half of the respondents declared that they increased the visibility of value chain data by digitalizing previously manual processes.15 For example, sensors are increasingly used to monitor the conditions of goods during transport or to track inventory levels so companies can more efficiently manage their stocks. Robotics and automation will play an increasingly important role in manufacturing and supply chains as they can help reduce the costs of onshoring production to developed markets in the U.S. and Europe, as well as improve productivity and safety.

Rebuilding for Long Term Growth: U.S. Infrastructure Development

During the height of the pandemic, the U.S. workforce shrunk by more than 25 million jobs and unemployment increased from 3.5% to 14.8%.16 Over a year later and the economy is still struggling to re-absorb those workers, with nearly 8 million fewer jobs in March 2021 than February 2020. To stimulate the economy and accelerate job creation, the U.S. Federal Reserve is committing to keeping interest rates near zero until the country reaches full employment. And while the U.S. economy is recovering this year, there remains a GDP output gap estimated at -1.8% in 2021, -0.9% in 2022, and -0.6% in 2023, meaning the economy will continue produce below-potential output for several years.17 The trifecta of low rates, high unemployment, and an underperforming economy creates an entry point for aggressive government spending that can both create jobs in the near-term and accelerate economic growth over the long-term.

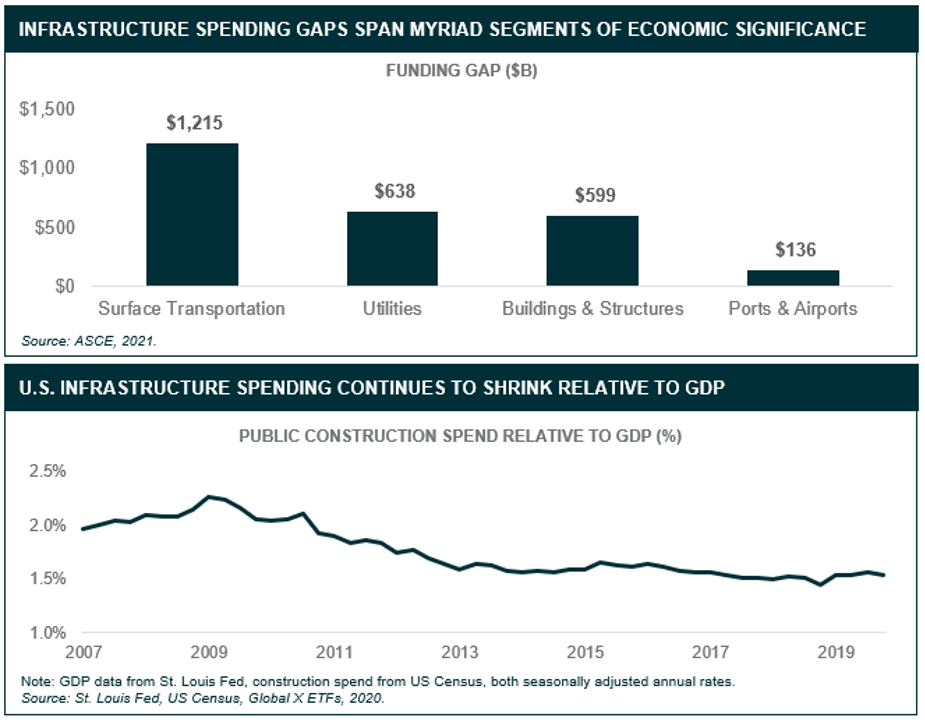

Perhaps the most glaring opportunity lies in the revitalization and development of U.S. infrastructure. Much of the nation’s transportation infrastructure was built in the 1930s and 1950s, but it has largely been underfunded and left to decay over decades of neglect. The American Society of Civil Engineers (ASCE) assigned U.S. infrastructure an overall letter grade of C-, highlighting that 43% of roads are in poor or mediocre condition, 7.5% of the nation’s bridges are structurally deficient, and 22 million Americans are drinking water from lead pipes.18 Repairing existing infrastructure is a basic first step, but more important will be modernizing the country’s infrastructure for greater climate resilience, changing trends in urbanization and commuting, and the rise of digital connectivity.

President Biden’s $2.25 trillion American Jobs Plan seeks to address these infrastructure-related issues, earmarking billions for several broadly defined categories of infrastructure including transportation, buildings, energy, water, and digital (see list below). The ambitious plan represents additional infrastructure spending equivalent to 1% of U.S. GDP for 8 years.19 Overall, S&P estimates that such a plan could create 2.3 million jobs by 2024 and inject $5.7 trillion into the economy, raising per-capita income by $2,400.20 The beneficiaries of such a plan are numerous, ranging from construction and engineering companies, to commodities, and heavy machinery. Digital infrastructure like cell towers and data center REITs could benefit too, along with water infrastructure and building-focused cleantech firms.

Funding for Infrastructure in the American Jobs Plan:

Physical Infrastructure

- Transportation Infrastructure ($621B)

- Buildings, Schools, and Hospitals ($250B+)

- Infrastructure Resilience ($50B)

Energy, Water, and Digital Infrastructure

- CleanTech, clean energy, and related infrastructure ($300B+)

- Water utilities ($111B)

- Digital infrastructure ($100B)

Preparing for the Next Crisis: CleanTech & Renewable Energy

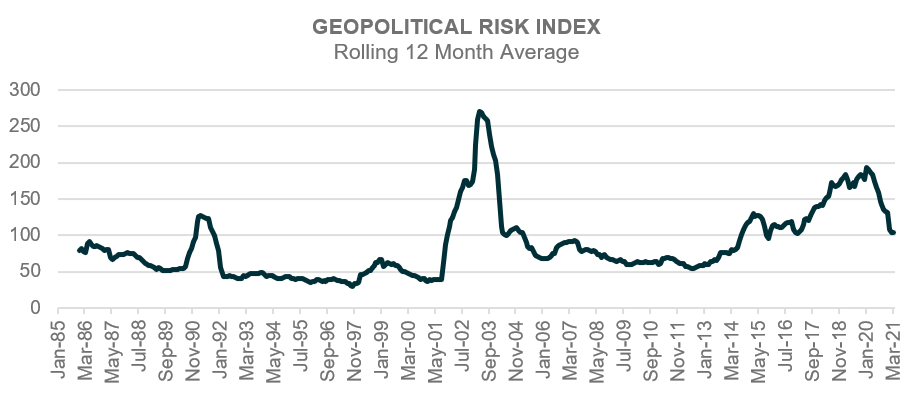

Prior to COVID-19, geopolitical tensions underwent a multi-year rise. US-China trade wars, UK-Europe Brexit negotiations, Russia-Ukraine confrontations, and many more strained international relationships pushed some measures of geopolitical risk to their highest levels since 2003. In some ways, the pandemic poured fueled on the fire, with politicians around the world looking to deflect blame externally for the public health and economic crisis. Yet at the same time, COVID-19 highlighted an important feature of many of the 21st century’s most dire challenges: they rarely adhere to international borders. Containing airborne viruses, cutting carbon emissions, slowing natural resource depletion, providing asylum for refugees, and reversing nuclear proliferation require multilateral solutions.

Source: “Measuring Geopolitical Risk” by Dario Caldara and Matteo Iacoviello. Data from Jan 1985 to March 2021.

If there’s a silver lining to COVID-19, it could be renewed enthusiasm for international coordination, particularly on the topic of climate change. At an international Earth Day summit in April, 40 countries attended and several announced revamped efforts to curb carbon emissions. The U.S. unveiled plans to reduce emissions to 50-52% of 2005 levels by 2030, while Japan raised its emissions-cutting goal from 26% to 46%, and Canada raised its goal from 30% to 40-45%.21

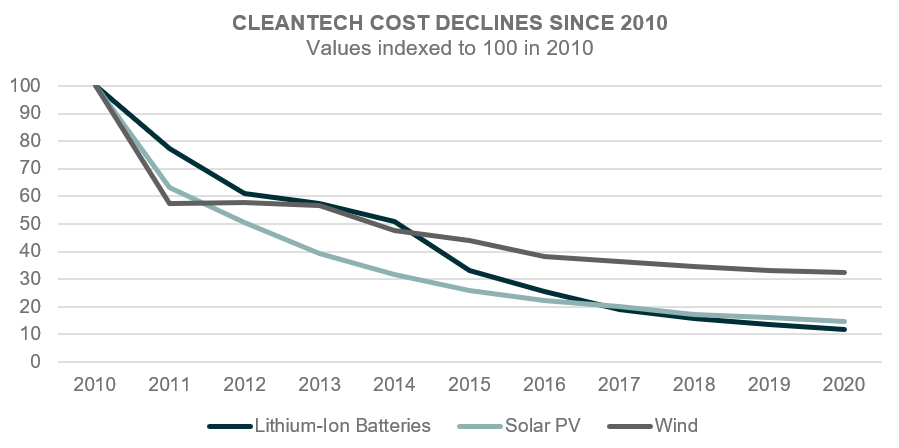

Multi-national agreements and goal-setting are just the initial stages of a several-decade-long process that could require up to $110 trillion in investments in cleantech and renewable energy.22 More mature clean technologies, like solar, wind, and lithium-ion batteries, have benefitted over the last decade from government grants and subsidies, which helped improve efficiency and achieve scale. As witnessed by cost declines ranging from 68-88% since 2010, early government support can play a critical role in making cleantech affordable and effective compared to their dirtier alternatives. But a similar trajectory for several early-stage technologies will be required to meet multinational climate goals. Advancing areas like carbon capture, green hydrogen, electric heat pumps, and plant-based and alternative protein sources will be essential to achieve net neutral emissions. And while governments are often the best-positioned to tackle such a broad challenge as climate change, changing attitudes of consumers and corporations will likely help accelerate adoption as well.

Source: Global X ETFs, BNEF, Lazard. Lithium-ion batteries measured by the volume-weighted average battery pack cost. Solar Photovoltaic (PV) and Wind measured by average levelized cost of energy.

Conclusion

Nearly a year and a half since the beginning of the COVID-19 crisis, there are several signs that the worst of the pandemic is likely behind us. Whether the world fully eliminates COVID-19 or just more carefully manages mutations and outbreaks in the future, we will soon enter a post-pandemic environment featuring looser restrictions and recovering economies. While supportive government policies and strong global growth may paint a rosy economic picture overall, several challenges and opportunities await, which could drive a divergence in the markets. Thematic investments that target specific areas that could thrive in New Normal Economy may be well-positioned for multi-year growth.

Related ETFs

POTX: The Global X Cannabis ETF seeks to invest in companies across the cannabis industry value chain, including companies involved in the legal production, growth and distribution of cannabis and industrial hemp, as well as those involved in providing financial services to the cannabis industry, pharmaceutical applications of cannabis, cannabidiol (i.e., CBD), or other related uses including but not limited to extracts, derivatives or synthetic versions.

FINX: The Global X FinTech ETF seeks to invest in companies on the leading edge of the emerging financial technology sector, which encompasses a range of innovations helping to transform established industries like insurance, investing, fundraising, and third-party lending through unique mobile and digital solutions.

BOTZ: The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

PAVE: The Global X U.S. Infrastructure Development ETF seeks to invest in companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering, and construction.

CTEC: The Global X CleanTech ETF seeks to invest in companies that stand to benefit from the increased adoption of technologies that inhibit or reduce negative environmental impacts. This includes companies involved in renewable energy production, energy storage, smart grid implementation, residential/commercial energy efficiency, and/or the production and provision of pollution-reducing products and solutions.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.