Investment Strategy Monthly Insights, August 2022

Equities rebounded in recent weeks as investors considered the prospects of a possible pivot by major central banks, especially after China’s central bank unexpectedly cut interest rates. However, the 10-basis point (bp) cut is unlikely to reverse plummeting consumer and business sentiment in China amid worsening economic conditions. In the eurozone, the risk of a recession is at its highest level since November 2020 as energy shortages threaten to drive already record headline inflation even higher.

In contrast, it seems U.S. headline inflation peaked in June, though the U.S. job market continues to tighten and wage pressures are building. Similar to Europe, core inflation and services inflation are expected to rise in the U.S. We expect the Federal Reserve (Fed) to remain aggressive and increasingly look to core inflation to inform its rate hikes, possibly with a more hawkish 75bp hike in September than the 50bps markets expect. The expectations for a dovish pivot may be premature, but perhaps not by much. In our view, the Fed is unlikely to extend its tightening cycle beyond spring 2023.

Investment strategies highlighted this month:

- International Earnings Weaker in Q2:Excluding the Energy sector, U.S. dollar strength in the second quarter helped U.S. S&P 500 companies that generate more than 50% of their revenue domestically outperform companies with international exposure. Companies exposed to U.S. infrastructure development and CleanTech should benefit from cooling headline inflation and the Inflation Reduction Act.

- Heading Toward a Global Recession:Inflation continues to increase globally while economic data deteriorates, particularly in Europe and China. The U.S. Treasury yield curve inversion points to an upcoming recession; however, still-strong labor market data suggest economic resilience and support for U.S. equities.

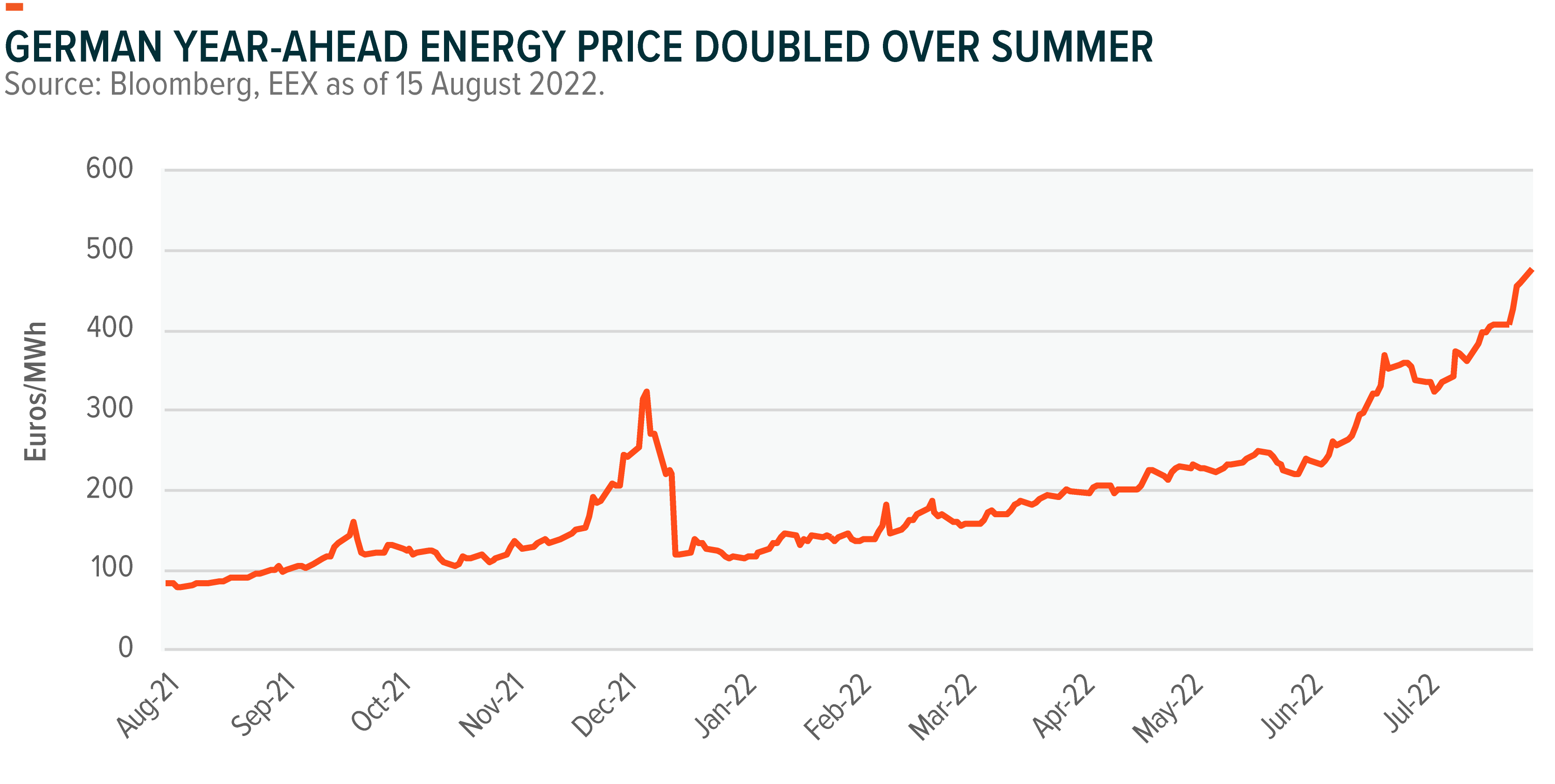

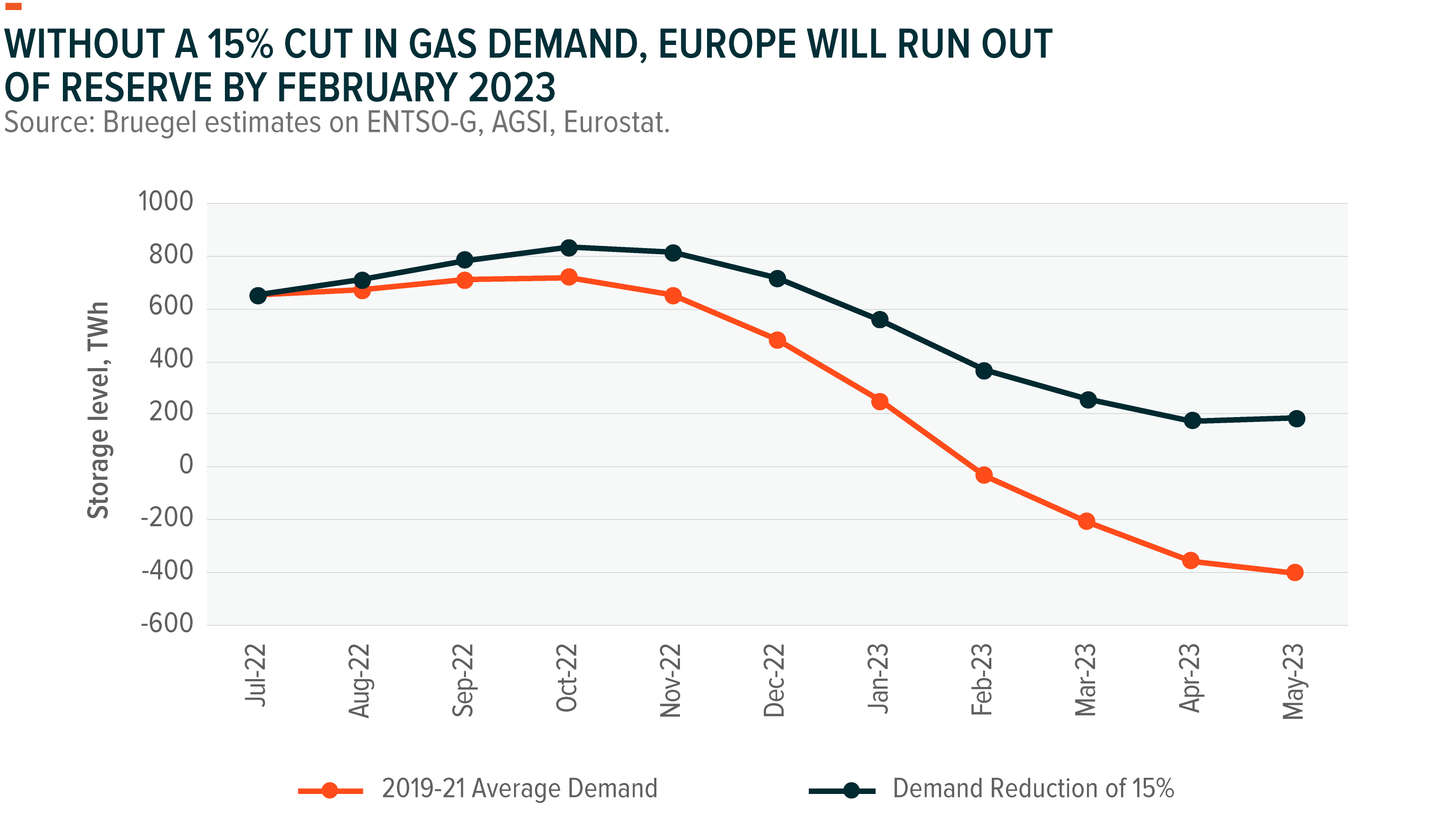

- European Energy Prices Continue to Rise:Russian energy company Gazprom drastically reducing its natural gas exports to Europe leaves the region with no choice but to cut its gas consumption by 15%.1

Q2 Earnings: Stronger USD Favored U.S.-Focused Companies

S&P 500 earnings grew at a 6.7% rate in Q2, but only six sectors reported positive year-over-year (YoY) earnings growth, led by the Energy sector. Excluding Energy, earnings for the S&P 500 would be down 3.7% YoY.2 Beyond energy dynamics, another key consideration for U.S. earnings in this environment is the strength of the dollar versus major currencies over the last quarter. The U.S. Dollar Index (DXY) rose by 6.4% in Q2, reaching its highest point since September 2002.3 The stronger USD that resulted from the Fed’s rate hikes had a negative impact on revenues for internationally oriented companies.

Excluding Energy, data shows that S&P 500 companies generating more than 50% of sales outside the U.S. would report a Q2 earnings growth rate of 0.5% instead of 10.2%. And their revenue growth rate would fall to 9.1% from 14.6%. In contrast, S&P 500 companies that generate over 50% of sales in the U.S. would report an earnings growth rate of 1.2% and a revenue growth rate of 9.4%.4

Headline inflation possibly trending downwards and global economic conditions deteriorating should reduce political headwinds for President Biden’s infrastructure spending. Fiscal spending is usually countercyclical, which should benefit domestically oriented construction and infrastructure companies like the ones in the Indxx U.S. Infrastructure Development Index. This index has outperformed the S&P 500 by 5.3% year-to-date.5 Also, U.S.-focused industrials may be more defensive than global industrials in the current macro environment given the relative resilience of the U.S. economy compared to its European and Asian counterparts.

For the all-important U.S. Technology sector, Q2 earnings reports were mixed, but the prospect of an economic slowdown and a dovish pivot at the Fed helped tech stocks rally in recent weeks. In our view, this rebound suggests investors are confident that tech companies can show resilience amid an economic downturn as the digitalization of the economy continues to provide strong tailwinds. Within the sector, CleanTech companies are major beneficiaries of the newly passed Inflation Reduction Act. And as of August 18th, the Indxx Global CleanTech Index, roughly 40% of which is U.S. companies, rose 7.3%.6

Recession Watch: Global Economic Data Deteriorate Week by Week

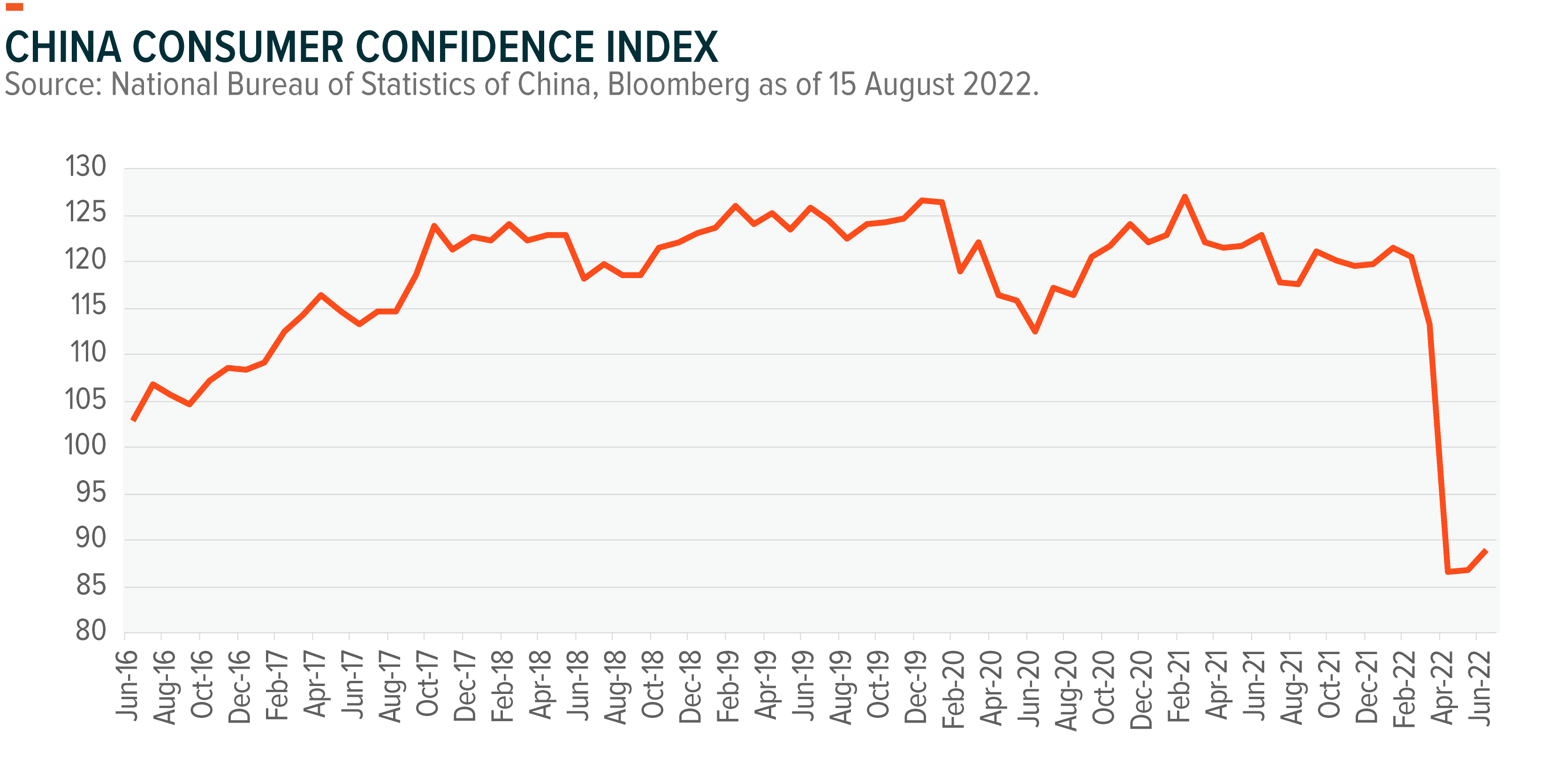

In Europe, business and consumer surveys reveal sentiment is at its lowest levels since 2011, and in China, consumer confidence fell off a cliff. As first trading partners, these two regions could be headed toward sharp recessions together. In contrast, labor market strength and positive earnings growth signal a relatively shallow recession in the U.S.

A recession may occur sooner in Europe as the energy shortages become more acute and demand from China falls. In July, the European Central Bank (ECB) surprised by hiking its key benchmark rates 50bps, and it is expected to hike by another 50bps in September. The ECB has a history of hiking at the top of the economic cycle, so this hawkish turn might be a signal of a recession coming soon, possibly before year-end.

For investors, defensive sectors like Healthcare, Utilities, and Consumer Staples might be the least vulnerable to upcoming rate shocks and economic slowdown. Cyclical sectors like Materials and Industrials, especially European Industrials, might be more vulnerable to rising energy prices. For example, Germany, Europe’s leading manufacturer, faces the growing prospect of a recession as energy prices continue to rise and Chinese economic activity decelerates.

The Chinese economy is slowing at a rapid pace due to the worsening property downturn and ongoing COVID lockdowns. July retail sales, industrial output, and investment data all slowed by more than the markets expected. Also weighing on sentiment is the youth unemployment rate, which climbed to a record high 19.9%.7

In the U.S., the 2y-10y segment of the Treasuries yield curve inverted, historically a sign of peak pessimism about the economic outlook and heightened recession risk. In the coming weeks, markets will eye the National Bureau of Economic Research (NBER) for official word on whether the economy is in a recession after two consecutive quarters of negative GDP growth. The key inputs for the NBER’s assessment will be the second and third revision of the U.S GDP numbers on 25 August and 29 September, respectively.

Currently, it seems unlikely that the NBER declares that the U.S. is in a recession without a significant negative revision of the GDP numbers. Most of the negative contribution to Q2 U.S. GDP came from inventory and fixed investments, a highly volatile component of GDP. Domestic consumption remained strong, especially services.9 At the same time, services inflation is trending higher, giving the Fed good reason to remain aggressive with its rate hikes. In our view, the most likely scenario is a soft landing in 2023 and 2024 rather than a V-shaped recession in the near term.

Following the Federal Open Market Committee (FOMC) meeting in July and declarations from Treasury Secretary Janet Yellen in early August, the markets seemed to acknowledge that the U.S. economy is slowing from its pandemic rebound in 2021. In recent weeks, market responses to new economic data have been more pronounced, suggesting that investors are looking for cues on the timing of the next recession. The FOMC is likely to revise its dot plot for the Fed funds rate in September, possibly to show continued aggressiveness in the short term and a dovish pivot in 2023. Fed funds futures now price at a slightly higher rate than the FOMC’s median for 2022 and a significantly lower median rate at 3.25% than the dot plot’s median at 3.55%.8

Markets are possibly getting ahead of themselves with their expectations of a dovish pivot, as the chance of a hawkish surprise at the FOMC meeting in September is high. With rate expectations being data dependent, global equity markets are likely to trade sideways in the coming months. Relative to other regions, U.S. equities should find support from stronger U.S. fundamentals versus the rest of the world, particularly Europe, which faces much more severe headwinds. The divergence in headline inflation trends between the U.S. and Europe will likely keep the EUR/USD currency pair relatively stable throughout the second half.

European Economic Outlook: Increasingly Tied to Energy Independence

Following Gazprom’s announcement in late July to drastically cut its gas supply to Europe, the European Union (EU) moved to transition away from Russian gas with initiatives that promote investment in renewables and nuclear energy. However, the main near-term alternative is liquefied natural gas (LNG), which Europe only started to import heavily starting in 2020, mostly from the U.S. LNG storage capacity in the region is already stretched, leaving it with no other options but to reduce gas demand by 15% from August to next March.

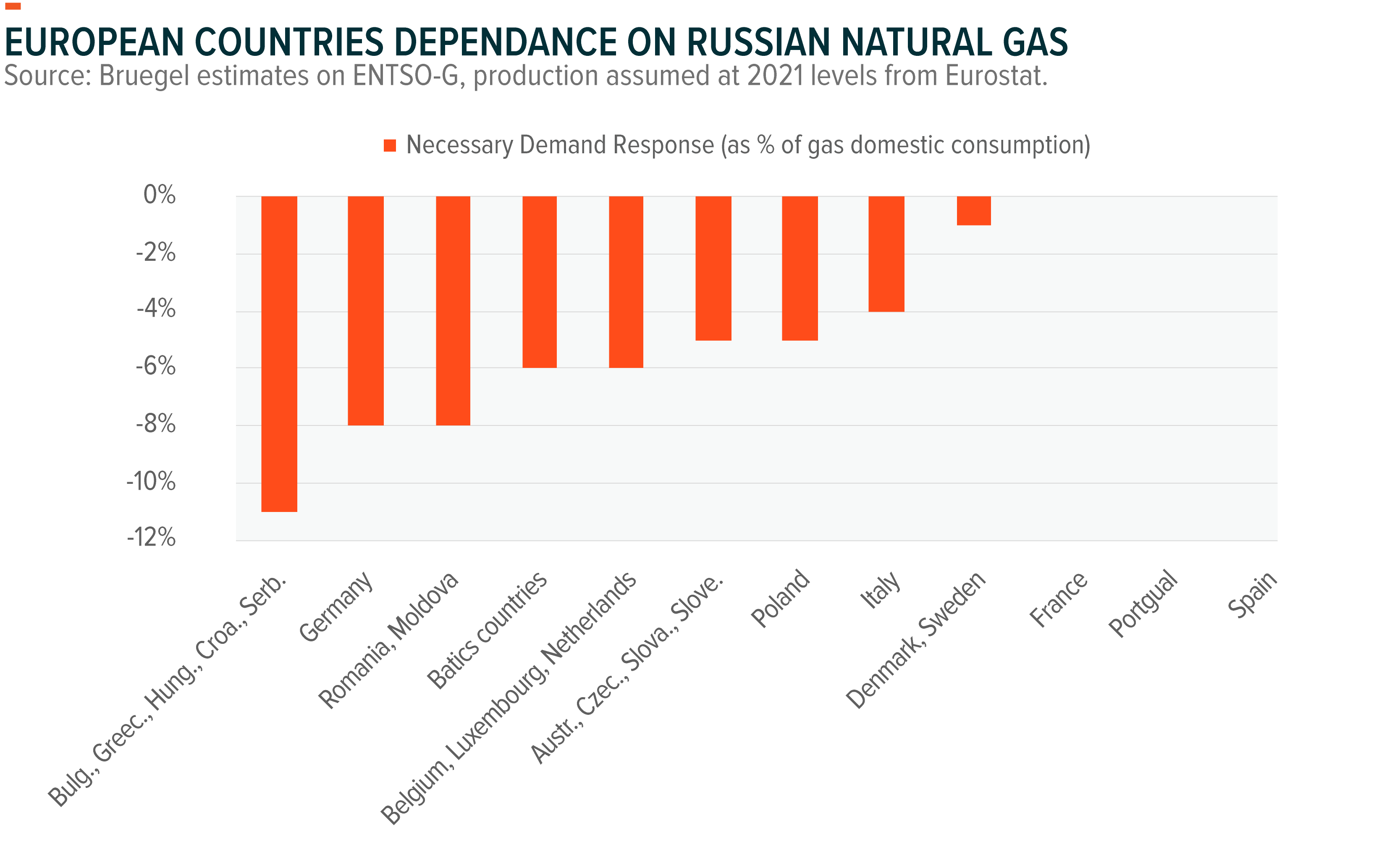

The coordinated approach required to reduce Europe’s dependance on Russia’s gas, the share of which dropped from over 40% in 2021 to just 20% in June 2022, will be a solidarity test for the region.10 Certain countries will require much steeper demand cuts. Complicating matters is the political instability that the economic slowdown and high inflation are creating in certain countries, such as Italy.

The graph below shows the disparate dependence on Russian gas across the region. France, Portugal, and Spain are the least vulnerable countries to a complete cut of Russian natural exports, while Germany and the Baltics likely face the strongest headwinds. The implications are significant, especially for Germany, which already shows signs of an economic contraction with PMI below the expansion threshold and business surveys at their lowest point since 2011.

We expect economic fragmentation to increase across Europe with the low gas-dependent countries showing more resilience than Germany and Eastern European countries. Continued ECB rate hikes amid rising headline and core inflation are likely to contribute to lowering gas demand, but at the cost of reducing economic activity.

European investments in renewables and nuclear energy should continue to increase at a strong pace because of their strategic long-term importance to the region’s growth and security. Themes like CleanTech, and Renewable Energy and commodities like uranium should continue to find support from these initiatives.