Introducing the U.S. Cash Flow Kings 100 ETF (FLOW)

On July 12th, 2023, we listed the U.S. Cash Flow Kings 100 ETF (FLOW) to provide investors meaningful exposure to a portfolio of U.S. companies exhibiting robust profitability characteristics. In the current macroeconomic environment of elevated interest rates, investors may be re-evaluating the core components of their equity portfolios to try to obtain a potential edge relative to a strategy tracking a free-float market cap weighted equity index. Utilizing free cash flow (“FCF”) as this key profitability metric may prove useful as these companies offer potential corporate flexibility to drive returns for their investors in the near and long term.

Key Takeaways

- Free cash flow as a profitability measurement can offer a level of insight into a company’s financial health and corporate flexibility.

- Strategies that invest in companies based on their free cash flow yield may indirectly expose investors to other investment factors that may positively impact portfolio fundamentals.

- We believe that FLOW, the U.S. Cash Flow Kings 100 ETF, can be a differentiator within the core of an equity portfolio by capturing U.S.-domiciled companies with the highest free cash flow yields.

Free Cash Flow Can Offer Beneficial Insights into a Firm’s Profitability

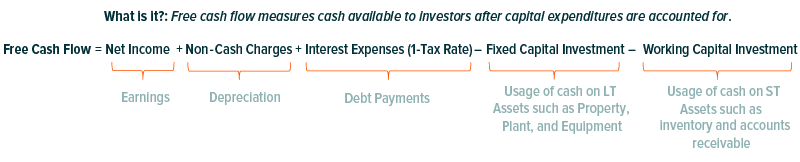

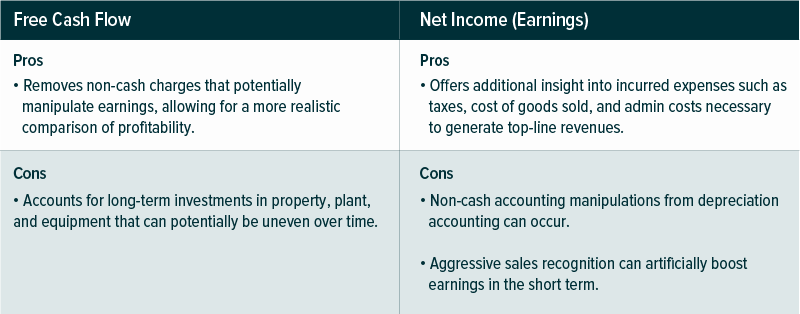

A firm’s profitability can be measured in multiple ways. Investors may utilize measurements from the income statement, such as net income, to determine how profitable a company is. However, the cash flow statement may offer a deeper level of insight into the current standing of a company’s financial health since it shows how much cash a business has on-hand to meet near and long-term obligations.

Corporate Flexibility Through Free Cash Flow

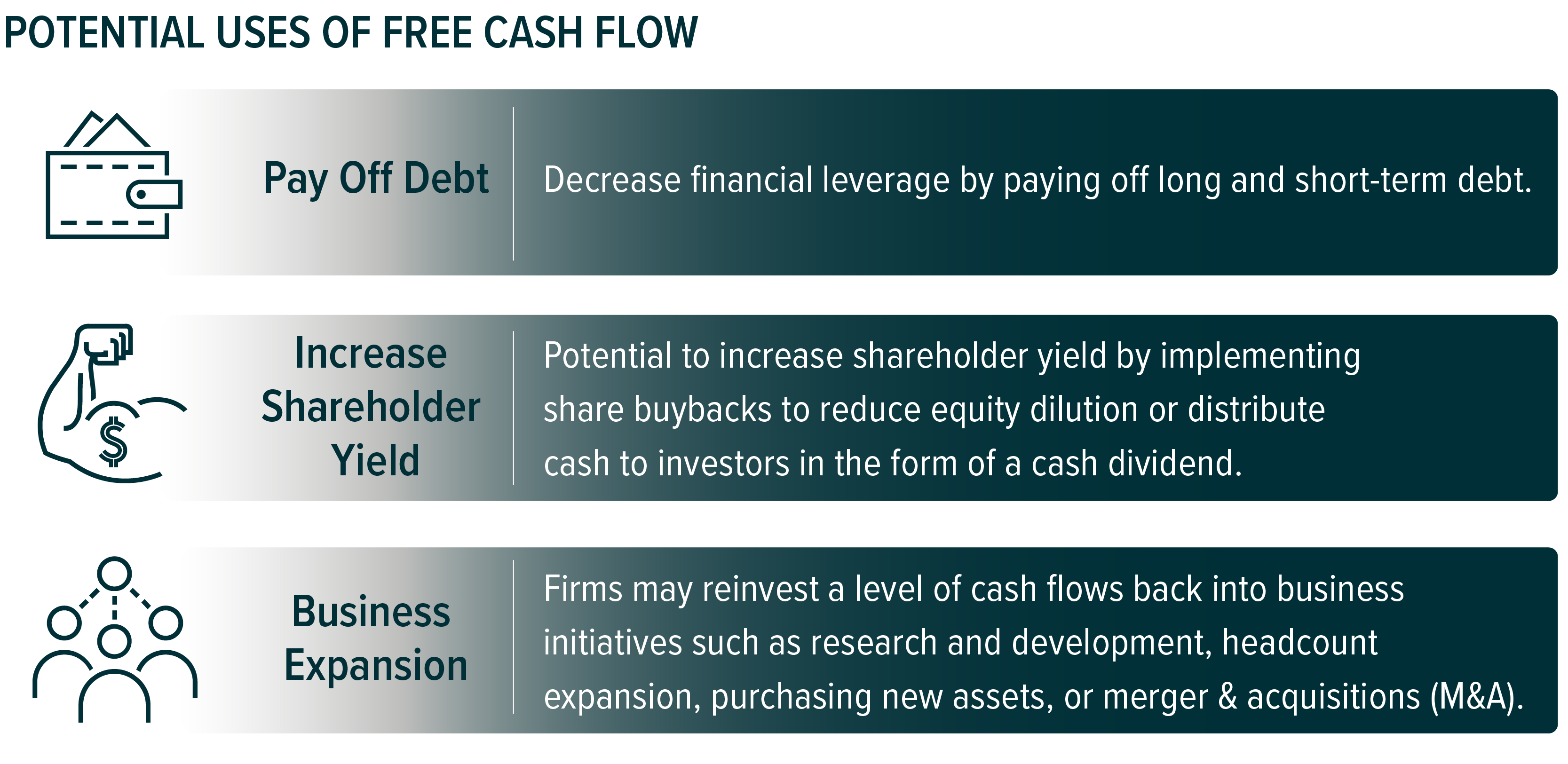

Having a high cash position leaves company leadership with additional flexibility into how they can continue to create value for their shareholders. One way may be in the form of increasing shareholder yield through purchasing back common equity or by distributing a cash dividend. Companies seeking to proactively expand market share in their respective industry may seek to acquire another firm. With a federal funds rate of 5.25%, companies generating high levels of free cash flow may be less susceptible to interest rate risk due to being less reliant on debt markets to maintain business operations amidst the current period of elevated interest rates.1

Corporate Earnings Are Subject to Accounting Manipulations

Net income, while offering sufficient insight in a corporation’s profits, may be subject to levels of manipulation from accounting measurements eligible to be used in the financial statement preparation process. For example, an accelerated depreciation accounting method can be used to recognize higher levels of depreciation expenses in the early lives of a company’s asset(s). The end goal of doing this is to weaken earnings in the short-term while expanding earnings later in the asset’s life as depreciation expense recognitions fall. Free cash flow is relatively conservative relative to accounting income-based metrics since it removes non-cash charges from the equation.

Free Cash Flow Yield and Its Potential for Quality at a Reasonable Price (“QAARP”)

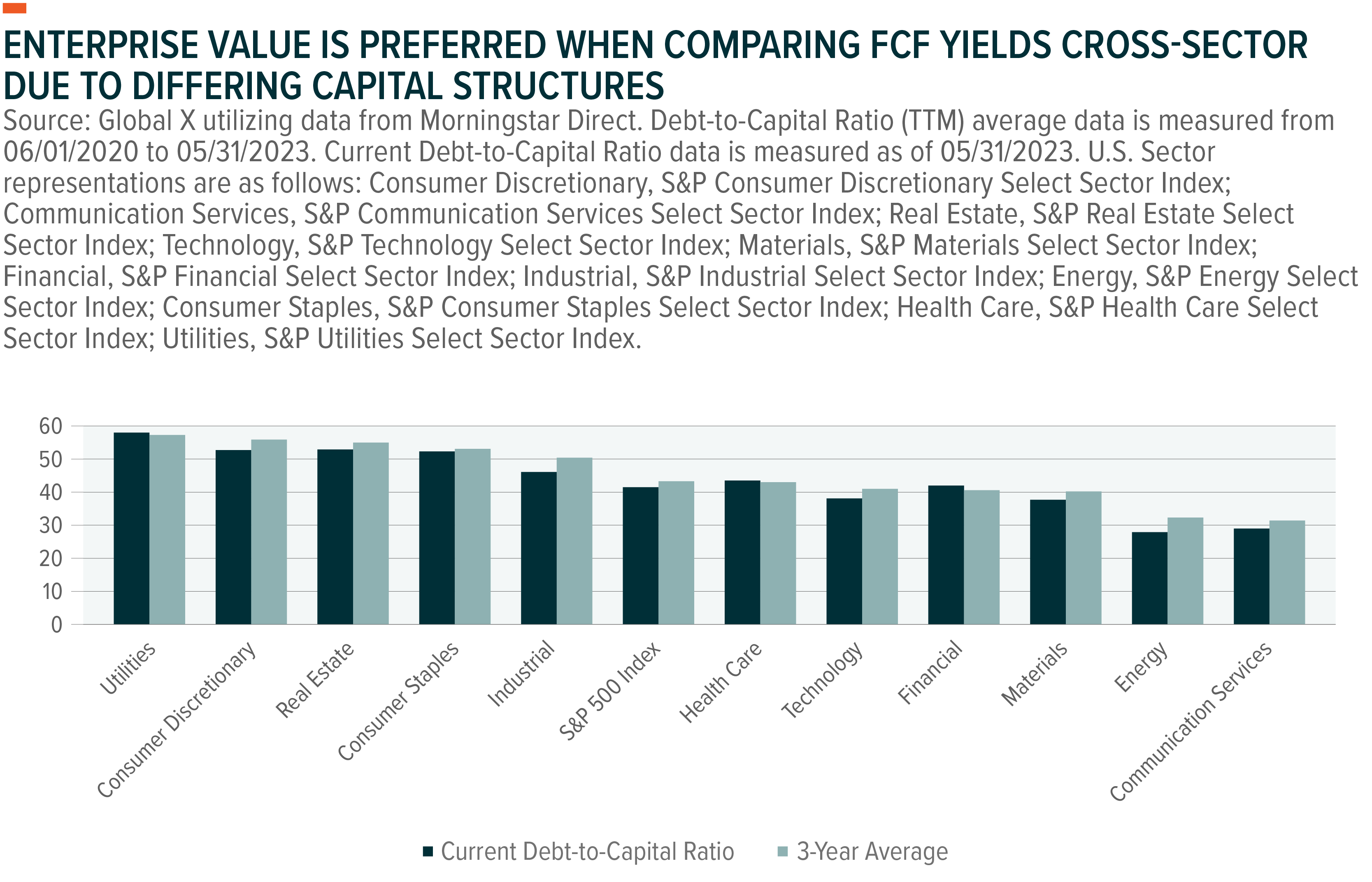

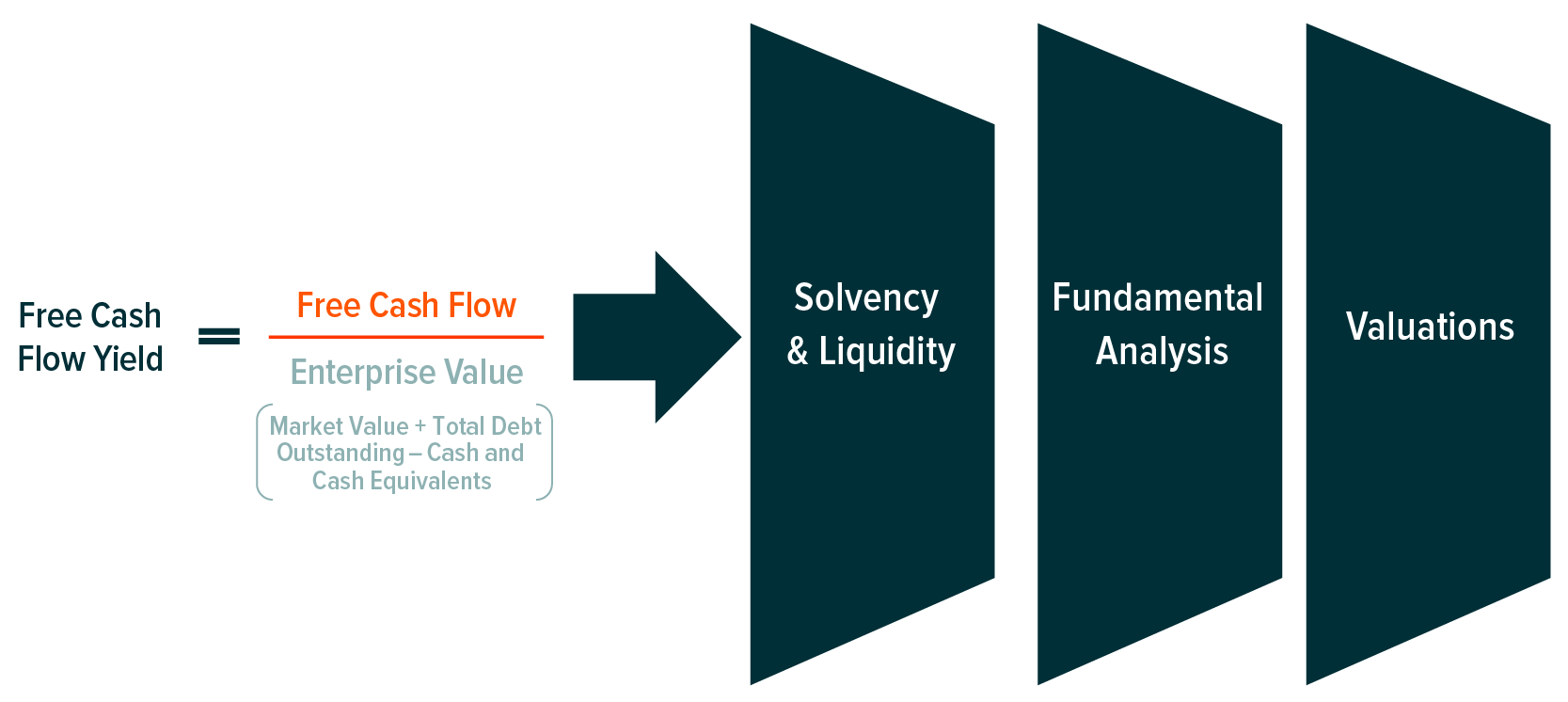

A way to compare the free cash flows of companies within differing sectors is to utilize free cash flow yield. This offers a level playing field by dividing free cash flow by a company’s enterprise value, instead of free-float market capitalization, since enterprise value is a measurement of total business value and not just equity valuations. Therefore, sectors whose business models call for differing levels of leverage can be compared to one another. For example, companies within the utilities sector typically utilize more leverage due to having a higher level of predictability for future revenues from energy distribution.

Free cash flow yield can be a multi-purpose tool for analytical insights. Companies with high free cash yields are potentially more solvent with higher levels of liquidity to meet financial obligations such as long-term debt. In addition, these same companies may also be attractively valued relative to peers.

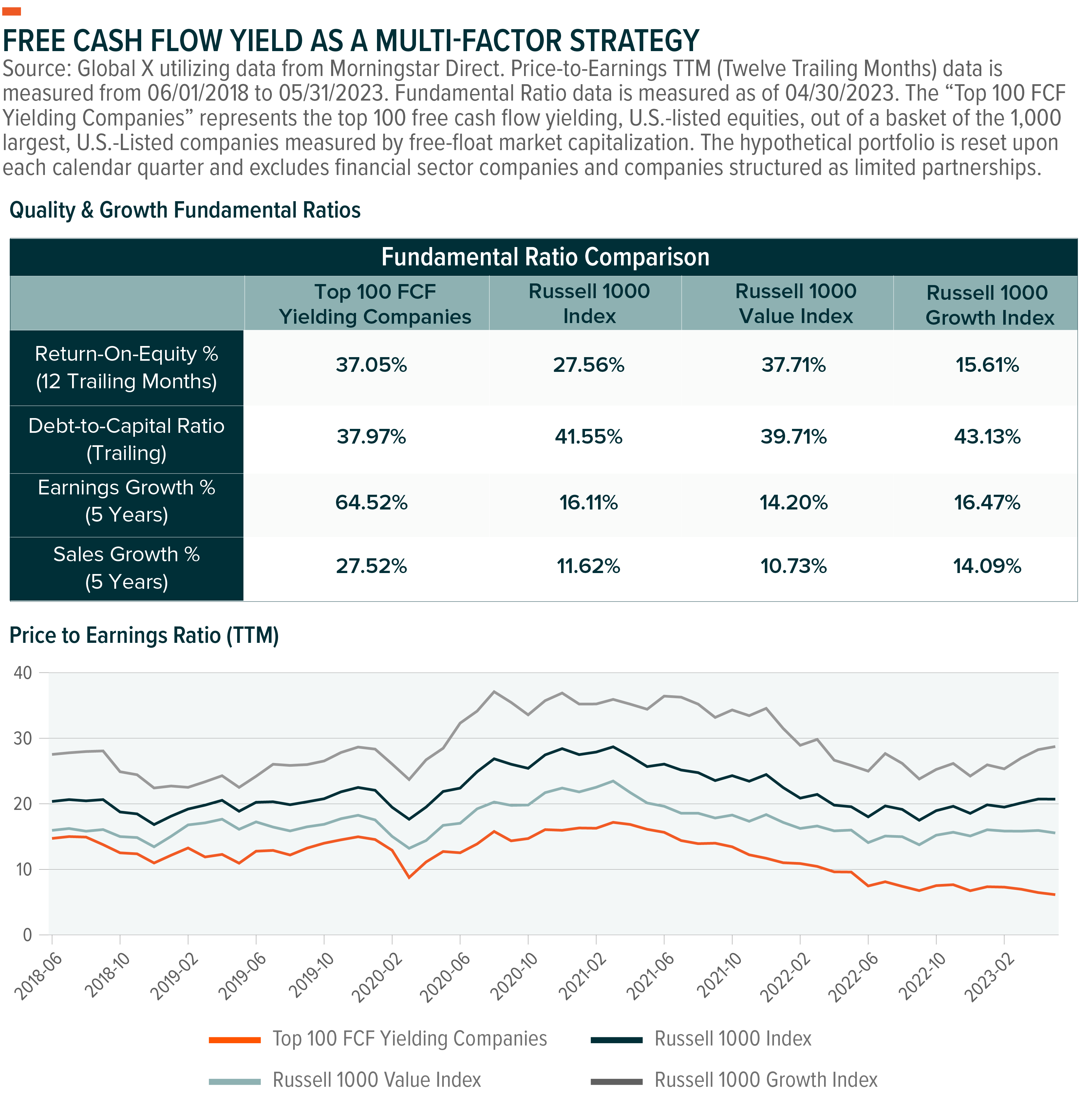

Relative to a broader U.S. equity index, the Russell 1000, companies with high levels of free cash flow currently exhibit a higher level of return-on-equity, another quality factor measurement of profitability. In addition, high free cash flow yielding companies have grown their earnings at a much faster rate, a growth style characteristic, than the same broad market index. All while demonstrating historically lower price-to-earnings ratios, an alignment towards the value factor.

FLOW: A U.S. Free Cash Flow ETF for the Core of a Portfolio

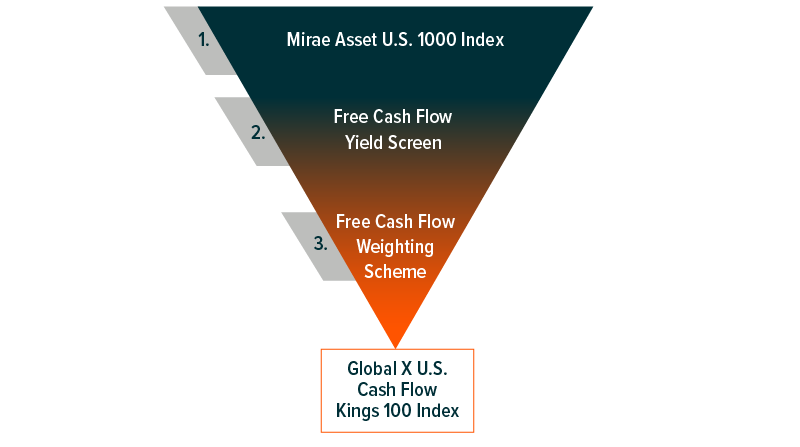

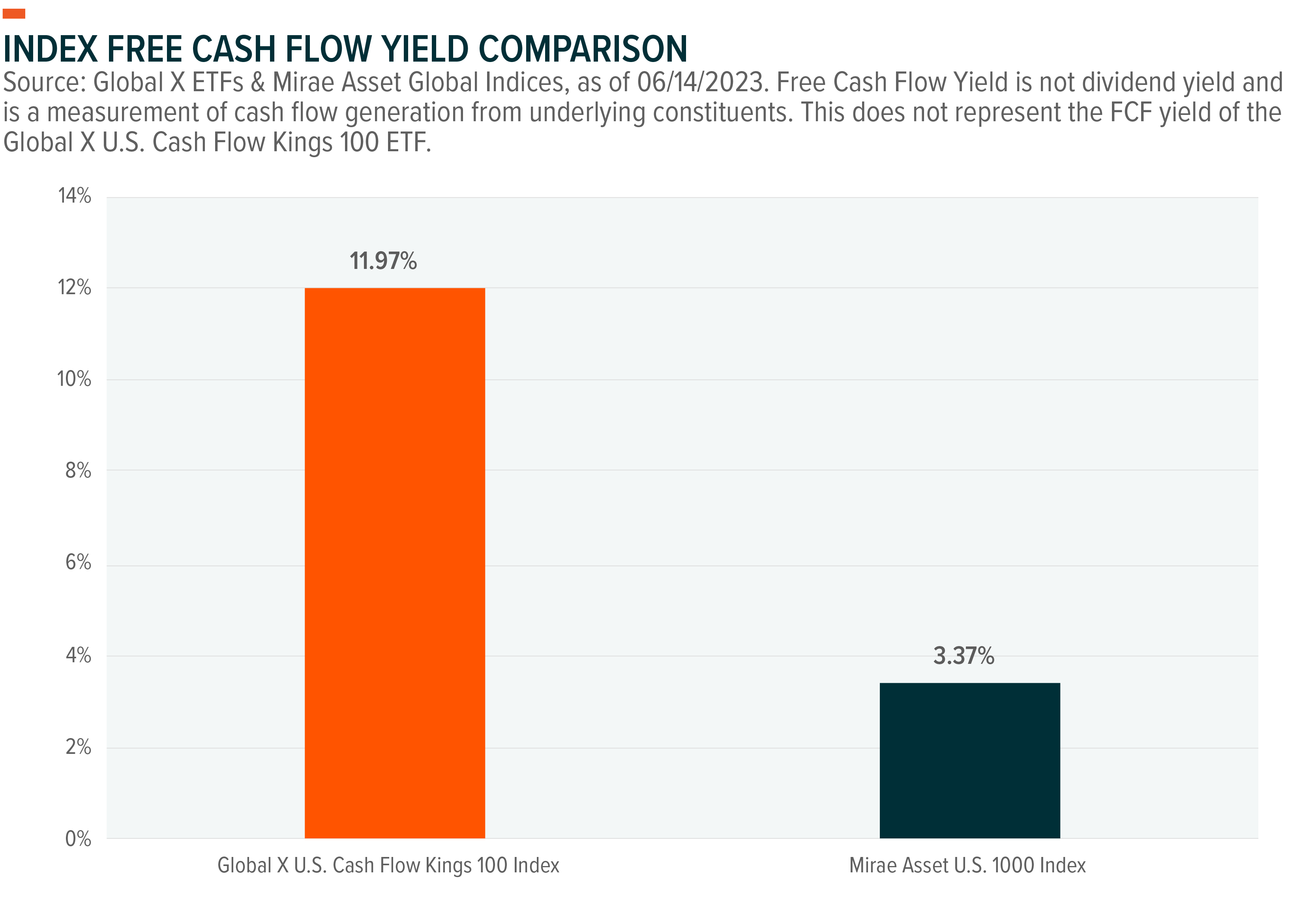

FLOW offers exposure to quality companies by tracking the Global X U.S. Cash Flow Kings 100 Index (before fees and expenses), an index which implements a screen using free cash flow yield as its primary screening metric. This makes FLOW the fourth Global X ETF tracking a Global X-branded index and demonstrates our commitment to provide access to investment opportunities through self-indexing.

Starting with the Mirae Asset U.S. 1000 Index, the Global X index removes financial services firms from consideration since FCF has historically been difficult to compute. When a manufacturing company invests capital, it typically purchases fixed assets like equipment. However, financial firms invest in intangible assets such as headcount and brand recognition, making operating cash flow less insightful.2 However, real estate investment trusts (REITs) are still considered for the final index, even if they are categorized in the financial sector.

Of the remaining companies, the 100 final constituents are selected and weighted by their free cash flow yields. To potentially minimize idiosyncratic risks, the index also implements constituent weighting caps.

- Sector Cap = 25%

- Individual Constituent Cap = 2%

By tracking an index that reconstitutes on a quarterly basis, the Global X U.S. Cash Flow Kings ETF offers the potential to maintain consistent exposure to the highest free cash flow yielding companies.

Conclusion: Free Cash Flow Can Be a Sound Investment Strategy

Amidst an elevated interest rate environment, companies exhibiting high levels of free cash flow are potentially better positioned to add shareholder value from share buybacks and cash dividends in addition to potentially mitigating balance sheet expansions by accessing the debt markets for cash. Free float market-capitalization weighted, index-tracking strategies may be exposed to higher levels of idiosyncratic risks by overweighting volatile sectors such as technology. With a competitive expense ratio of 25bps, the Global X U.S. Cash Flow Kings 100 ETF offers access to the highest FCF yielding companies in an effective manner by tracking an index with a defined set of rules.

Related ETFs

FLOW – Global X U.S. Cash Flow Kings 100 ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.