Introducing the Global X Variable Rate Preferred ETF (PFFV)

On June 24th, the Global X Variable Rate Preferred ETF (PFFV) began trading on the New York Stock Exchange. PFFV is the third ETF from Global X in the preferred stock space, which includes a broad preferred market offering, the Global X U.S. Preferred ETF (PFFD), and a high yield strategy, the Global X SuperIncome™ Preferred ETF (SPFF).

Preferreds are considered hybrid securities because they possess characteristics of both fixed income and equity securities. Like bonds, they are yield-bearing instruments that typically pay a fixed distribution to investors. They are often issued at a par value, assigned credit ratings, and do not have voting rights. Like equities, however, preferreds trade daily on a stock exchange, have the opportunity for price appreciation or depreciation, can have their dividends suspended, and fall in the lower portion of a firm’s capital structure.

Yet within this asset class, not all preferreds are the same. Many have embedded features that can impact yield, duration, and maturity, like optional call dates, scheduled coupon resets, and more.

In this piece, we’ll focus on the variable rate preferred segment of this asset class, including discussing how this low duration corner of the preferred market could play an important role in reducing interest rate sensitivity for income-oriented portfolios.

Variable Rate Preferreds: A Low Duration Debt Instrument

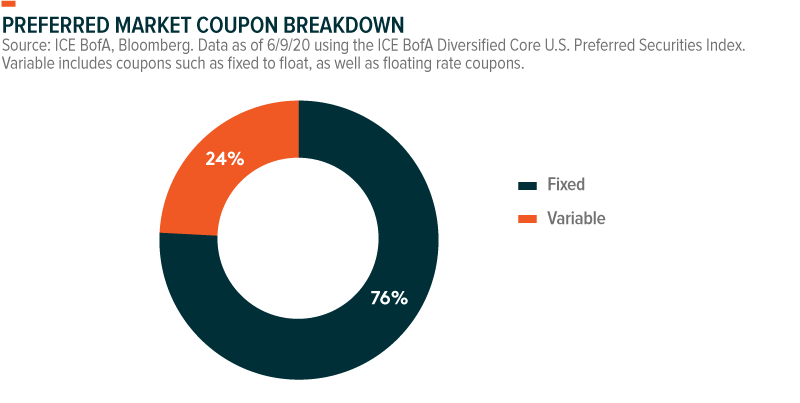

The preferred stock universe broadly consists of two coupon types: fixed rate preferreds and variable rate preferreds. We can see most preferred stocks carry fixed rate coupons, meaning they pay the same coupon amount throughout the life of the preferred.

Variable rate preferreds, on the other hand, have coupon payments that adjust at certain points over their life. These issuances typically structure their coupon payments as floating rate or fixed-to-float. Floating rate preferreds are a subset of the market that adjust their coupon payments on a regular schedule. Typically, the coupon is adjusted on a quarterly or semi-annual basis and is determined by adding an interest rate benchmark, like 3-month LIBOR to a predetermined, credit spread. Fixed-to-float preferreds are more common than floating rate. They offer a coupon payment that is fixed for a certain number of years, most commonly ten, before transitioning to becoming a floating rate preferred with regular coupon resets.

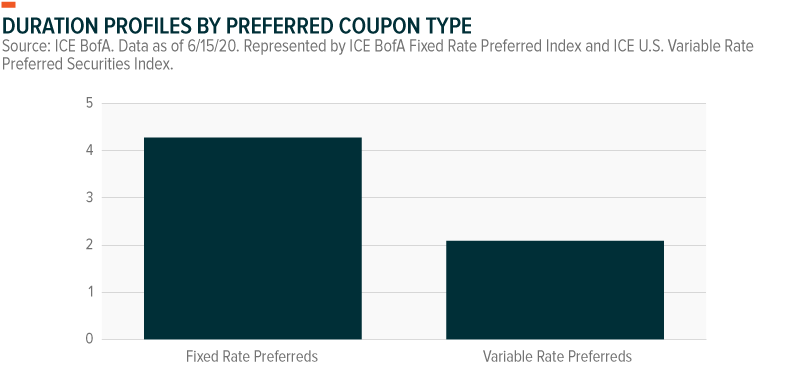

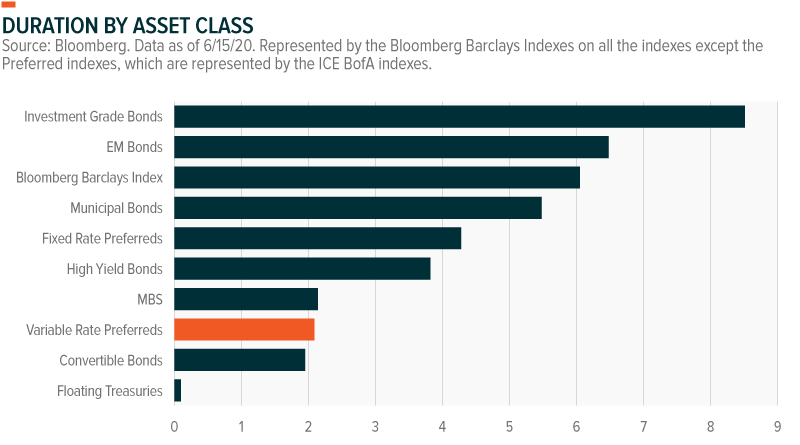

Whether floating or fixed-to-float, these variable rate preferreds can play an important role in investors’ portfolios as a low duration income-oriented asset class. Alongside other debt instruments that reset their coupons based on interest rates, like senior loans and floating rate treasuries, investors can use variable rate preferreds to reduce the duration, or interest rate risk, of their portfolios. This can be a particularly important feature during a rising interest rate environment, where investors are likely looking to reduce their portfolio’s duration.

Fixed rate preferreds, on the other hand, tend have higher duration due to their often perpetual nature. While this can provide a tailwind for performance in a falling rate environment, it can be a headwind in a rising rate scenario.

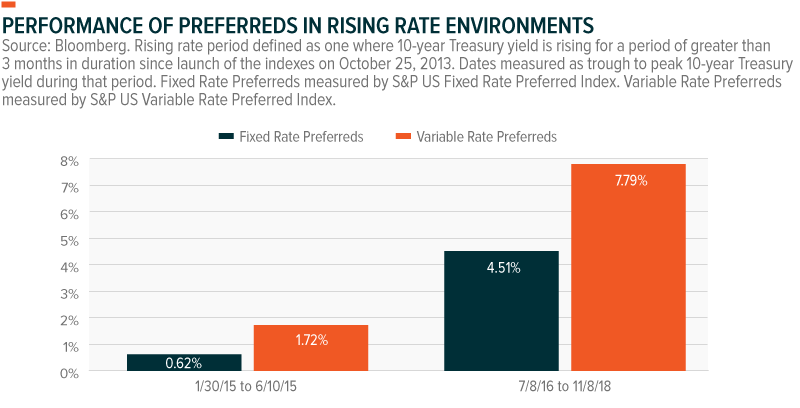

Looking at recent rising rate environment periods, we can see the potential benefits variable rate preferreds provide. Since late-2013, the two major rising rate periods resulted in the 10-year Treasury rate increasing by 84 basis points and 188 basis points, respectively.1 Variable rate preferreds outperformed fixed rate preferreds by 1.10% and 3.28%, respectively, in those two periods. The broader bond market fell by -2.77% and -2.47%, respectively, by comparison.2 This shows that variable rate preferreds can be a prudent strategy for reducing duration during rising rate periods.

How to Use Variable Preferreds In a Portfolio

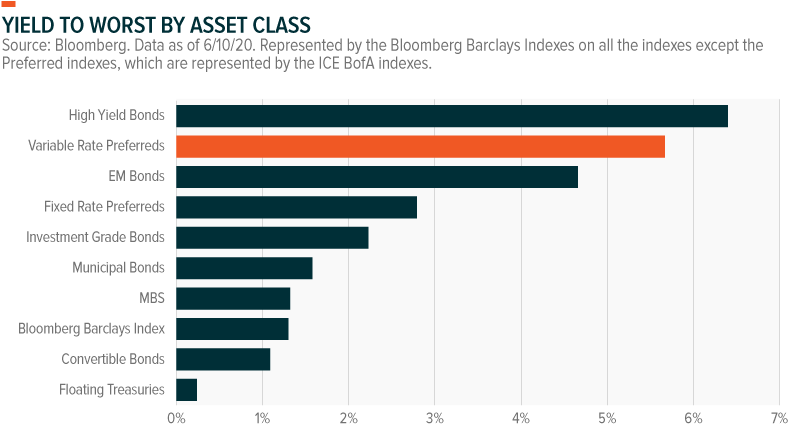

Variable rate preferreds can play useful role in income-oriented portfolios. First, the high income nature of the preferred asset class means they can often improve the overall yield of a portfolio. In this capacity, they are often found alongside other high yielding asset classes like junk bonds or emerging market bonds. It’s important to note high yielding securities can be riskier. Investors should look to balance these risks in a portfolio.

As a low duration subset of the preferred asset class, variable rate preferreds can also be used to reduce a portfolio’s duration. They can be added alongside fixed rate preferreds to strategically reduce duration or used tactically to adjust duration based on one’s interest rate outlook. Variable rate preferreds are often found alongside other variable-rate debt instruments like floating rate treasuries to help further reduce interest rate risk.

The macro environments best suited for variable rate preferreds, relative to broad fixed income benchmarks, are when interest rates are low or rising, or when credit spreads are tightening.

Rising Rate Environment: While variable rate preferreds carry some limited duration risk, it tends to be much lower than other fixed coupon segments, like most investment grade bonds. This means variable rate preferreds could outperform longer duration instruments in a rising rate environment.

Low Rate Environment: When interest rates are low, investors tend to struggle to find meaningful yield for their portfolios. Given their higher yield nature, preferreds in general could provide an important source of income to a portfolio, often exceeding the yield of investment grade bonds. In a low rate environment, however, variable rate preferreds may be particularly useful as investors may want both high current yield and to mitigate the risk of rising rates in the future.

Tightening credit spreads: Because preferreds are junior on the capital structure to bonds, they carry higher credit risk than bonds from the same issuer. This credit risk is compensated by higher yields. When credit spreads are tightening, investors believe that the macro environment and corporate performance is improving, such that credit risk is reduced. This can be a tailwind for preferreds and other instruments with higher credit risk.

Variable Rate Preferreds In The Current Market Environment

In light of COVID-19 and the economic fallout from the pandemic, interest rates around the world are at extreme lows. The Federal Funds Rate in the US is set to 0-0.25%, and other major central banks, like the ECB and the Bank of Japan have set rates at or below zero. While interest rates are unlikely to rise soon, they also appear to have little room to fall further. Assuming interest rates are at least stable for the near term, investors may enjoy the high yielding coupons from variable rate preferreds in meantime. If the global economy begins to improve, we could see credit spreads tighten and interest rates begin to normalize at higher levels, an environment ripe for variable rate preferreds to potentially outperform traditional fixed income instruments.

PFFV’s Features

The Global X Variable Rate Preferred ETF (PFFV) is designed to offer investors efficient access to a broad basket of variable rate preferred issuances at a low expense ratio.

Key Features

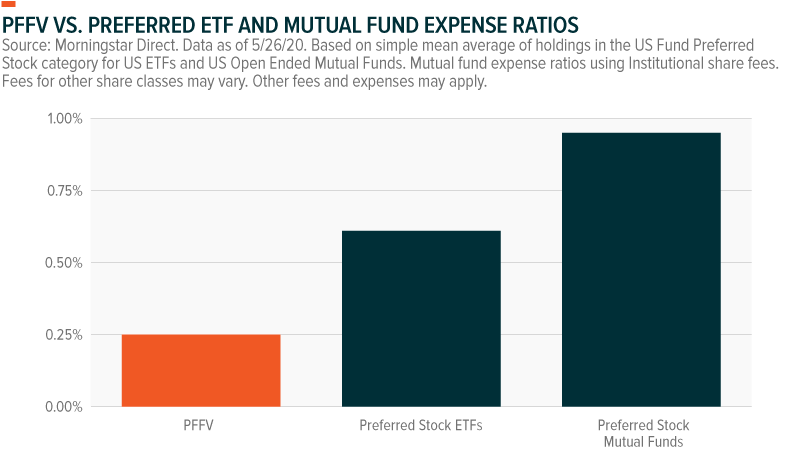

- Low Fee: PFFV has an expense ratio of just 0.25%, comparing favorably to its category average of 0.61% for preferred ETFs, and 0.95% for preferred mutual funds.

- Eligible Securities:

- Fixed-to-float and floating rate preferreds denominated in USD, and exchange listed on NYSE or NASDAQ

- Convertible preferreds with at least one year remaining to maturity and $50 million USD outstanding

- Preferreds from foreign issuers that list the issuance in the US, such as American Depository Shares/Receipts (ADS/ADRs). If the preferred is from a foreign issuer, the issuer’s country must receive an investment grade credit rating to be included

- Preferreds with par amounts of $25, $50, or $100, if they have greater than $100 million outstanding

- $1000 par Dividends Received Deduction (DRD)-eligible securities, if they have at least $250 million outstanding

- Liquidity: PFFV’s index requires the variable or floating preferred to be listed on either the New York Stock Exchange (NYSE) or NASDAQ to be eligible for inclusion

- Weightings/Caps: The index tracked by PFFV caps any one issuer at a maximum of 10% of the index to improve diversification

- Distributions: The fund expects to pay dividends to shareholders on a monthly basis

Related ETFs:

PFFV: The Global X Variable Rate Preferred ETF invests in a broad basket of U.S. variable rate preferred stocks, providing benchmark-like exposure to the asset class.