Introducing the Global X Dow 30 Covered Call ETF (DJIA)

On February 24th, 2022, we listed the Global X Dow 30 Covered Call ETF (DJIA) on the New York Stock Exchange (NYSE). DJIA is designed to provide exposure to the approximately 30 companies in the Dow Jones Industrial Average, while simultaneously writing covered calls on the Dow Jones Industrial Average Index in an attempt to generate income. DJIA now represents the sixth fund in the Global X covered call suite of ETFs that currently has over $8 billion in assets under management.1

DJIA brings an at-the-money covered call strategy to the Dow Jones Industrial Average Index through the ETF structure. The fund gains exposure to equities in the Dow Jones Industrial Average Index and writes a call option on the index as well. DJIA collects premiums from selling the call option in exchange for forfeiting the upside potential of the Dow Jones Industrial Average Index.

In this blog post, we explore the history of the reference Dow Jones Industrial Average Index, how DJIA is constructed, and how investors can use DJIA in a portfolio. We believe that covered call strategies like DJIA can serve a variety of objectives for investors, particularly with its income potential in the rising rate environment we are seeing today.

The Dow Jones Index, Explained

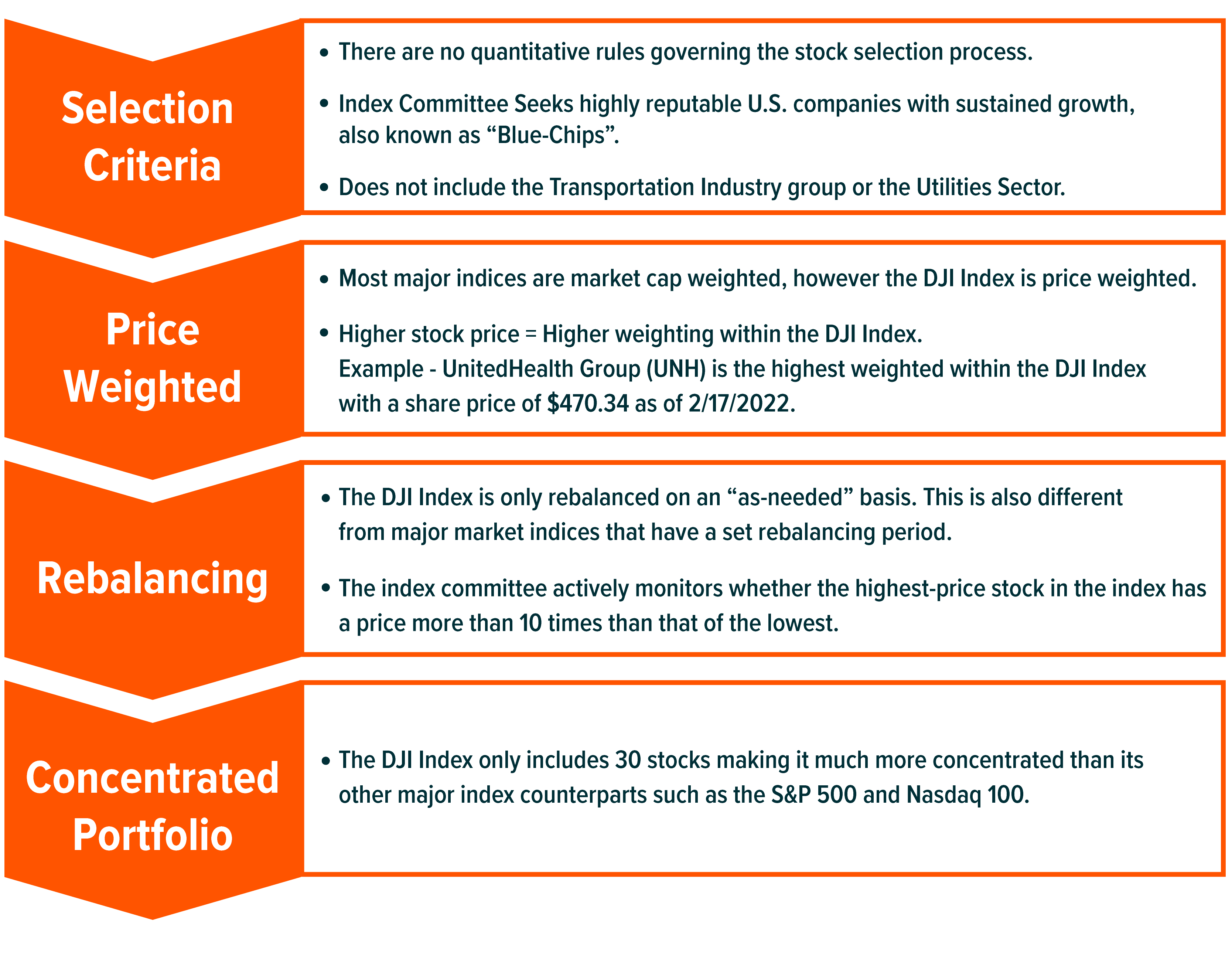

The Dow Jones Industrial Average Index (DJI) is one of the most popular stock market indexes in the US, and often used as a barometer of US market health in tandem with S&P 500. It’s the second oldest U.S. equity index in existence, founded in 1896. The DJI is fairly unique compared to other major indexes though. The index is price weighted, unlike most broad market indices, which are market cap weighted. The Nikkei 225 Index covering the Japanese equity market may be the most prominent example of a price weighted index aside from the DJI. Below is a visual representation of how the DJI is constructed.

Dow Jones Industrial Average Index Basics

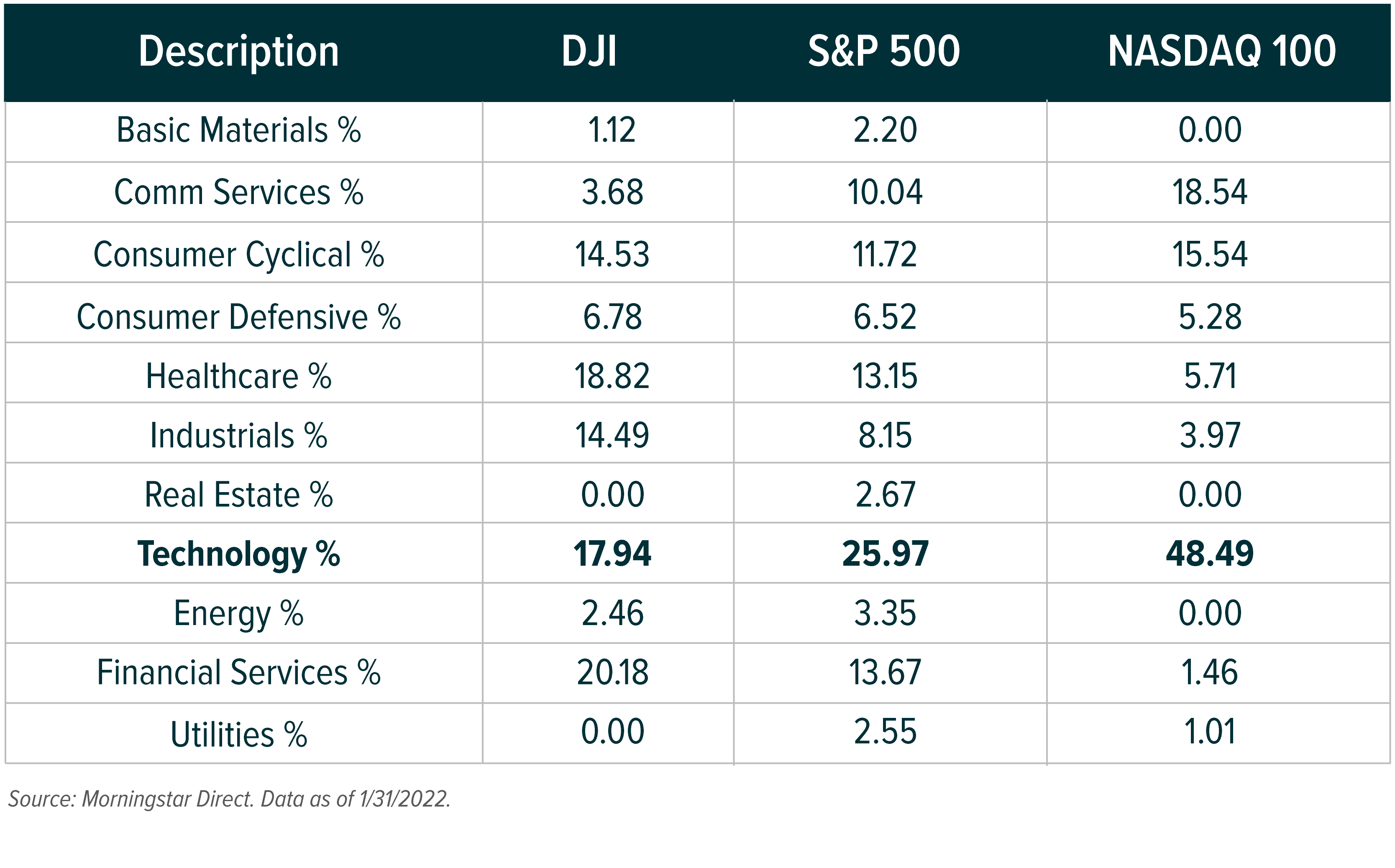

For a comparison on how the DJI compares in sector construction to other broad market indexes like the S&P 500 and Nasdaq 100, we can see below DJI is underweight Technology sector names and overweight sectors like Industrials and Financial Services. These sector differences can be attributed to the price weighting aspect of the DJI.

Naturally, the DJI’s underweight to technology sector names and overweight in sectors like Industrials and Financial Services will also lead to differences in performance amongst these major indexes. The Nasdaq 100, a growth-oriented index, outperformed the S&P 500 and Dow Jones Industrial Average Index, by an annualized 10.16% and 13.10%, respectively, in the five-year period from 2017-2021.2 However, the construction of the DJI can also benefit the index when growth or large caps are out of favor, such as the start of 2022. Year to date, the DJI has outperformed the S&P 500 by 2.11 percentage points and the Nasdaq 100 by 7.47 percentage points through February 22.3

Explaining the Global X Dow 30 Covered Call ETF (DJIA)

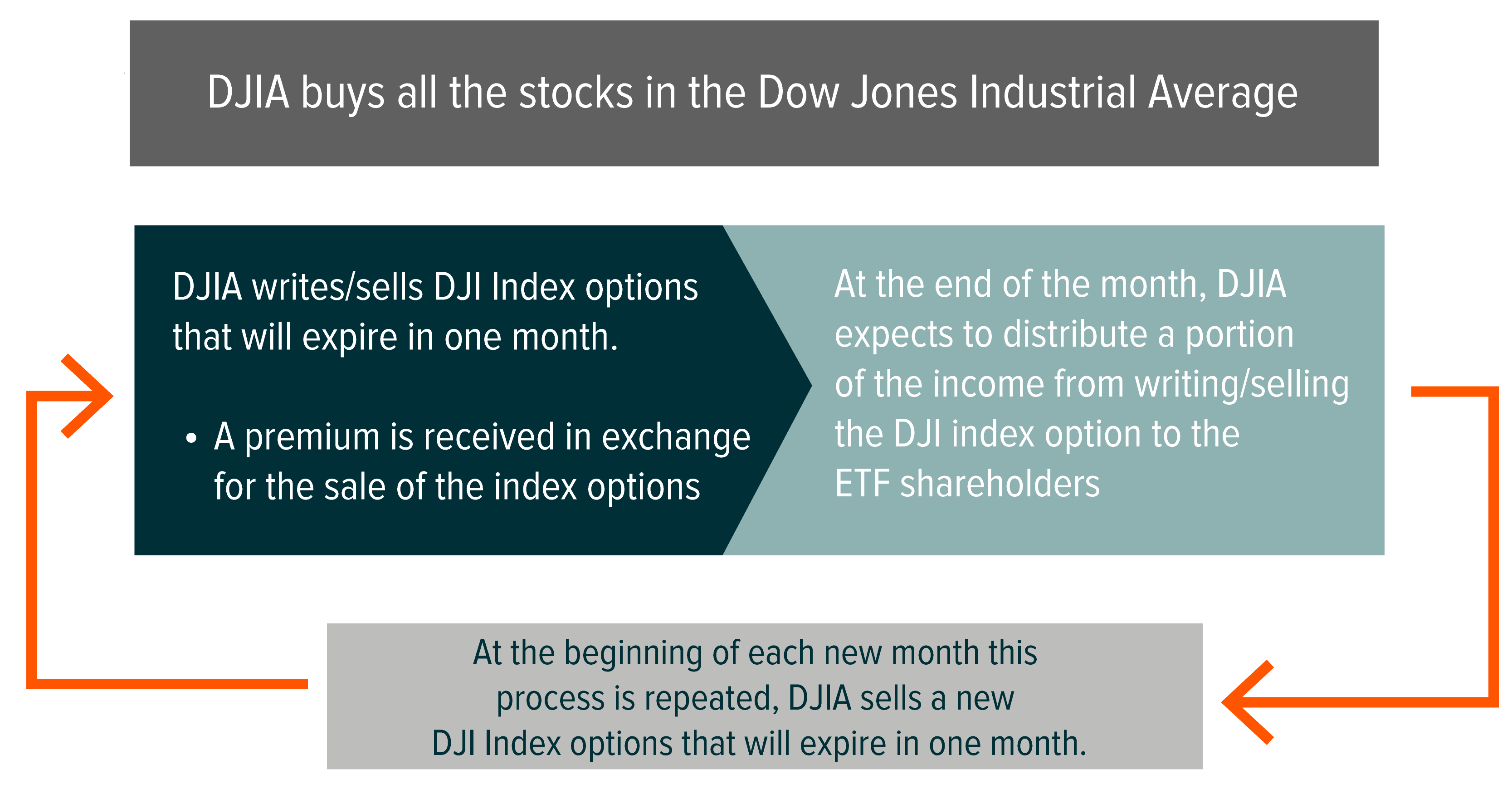

The Global X Dow 30 Covered Call ETF (DJIA) is the sixth ETF in our covered call suite. This ETF follows a similar process as the Global X Nasdaq 100 Covered Call ETF (QYLD), Global X S&P 500 Covered Call ETF (XYLD), and Global X Russell 2000 Covered Call ETF (RYLD). The equities in the Dow Jones Industrial Average Index (DJI) are purchased and weighted accordingly as in the index. An index call option is written at-the-money (ATM) on the DJI on 100% of the notional value of the portfolio. This process is repeated once a month, with the index option maturing on the third Friday of each month and a new option opened shortly after, known as the monthly ‘roll’ process. Shortly after the roll process, DJIA expects to make a monthly distribution to investors. Below is a visual representation of this process.

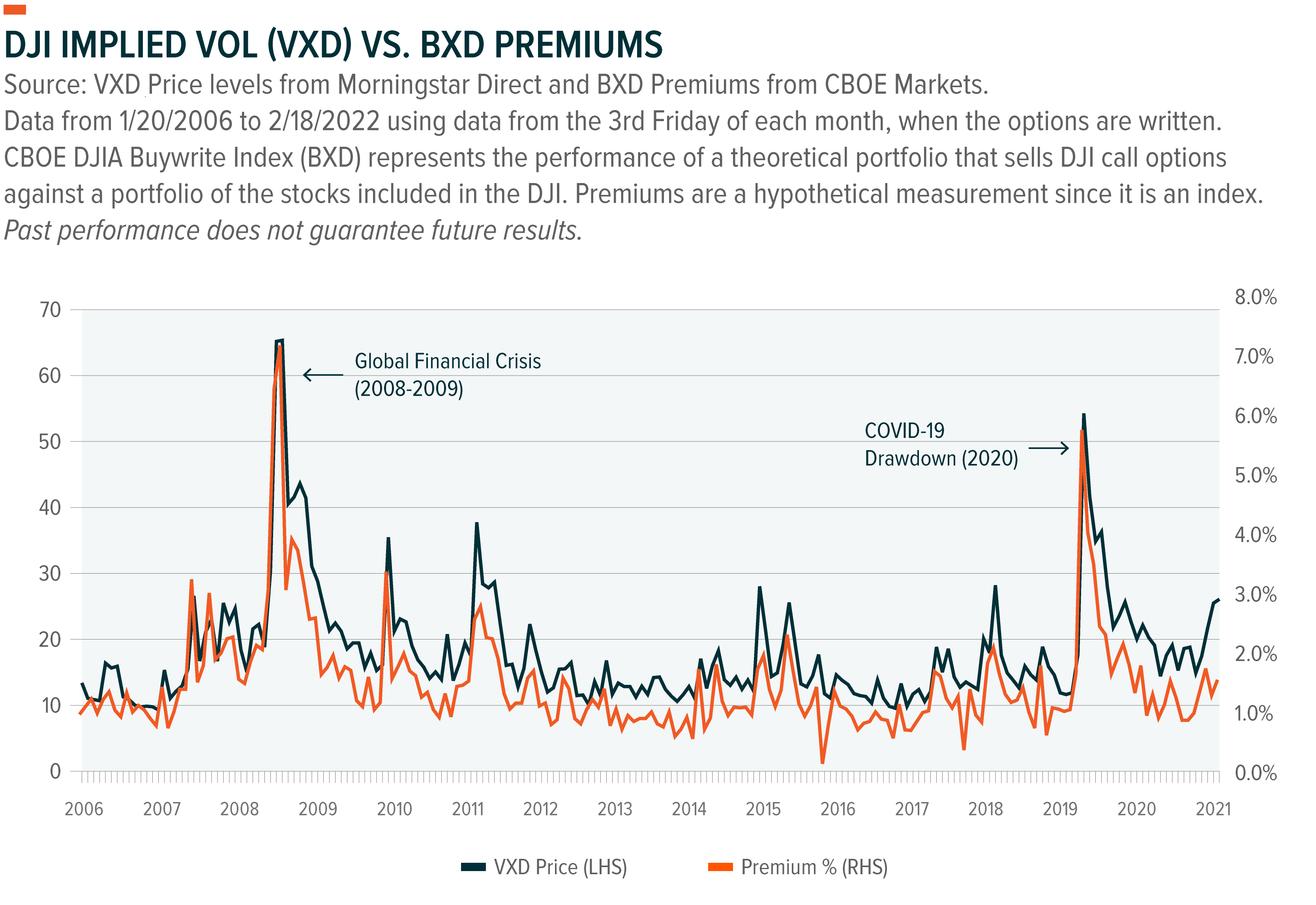

For investors, the premiums generated through writing the call options are an attractive potential source of income. Premiums from writing options historically are positively correlated to the volatility levels of the asset the option is written on. Historically, in higher volatility environments this means more premiums for the option writer, and vice versa in a lower volatility environment.

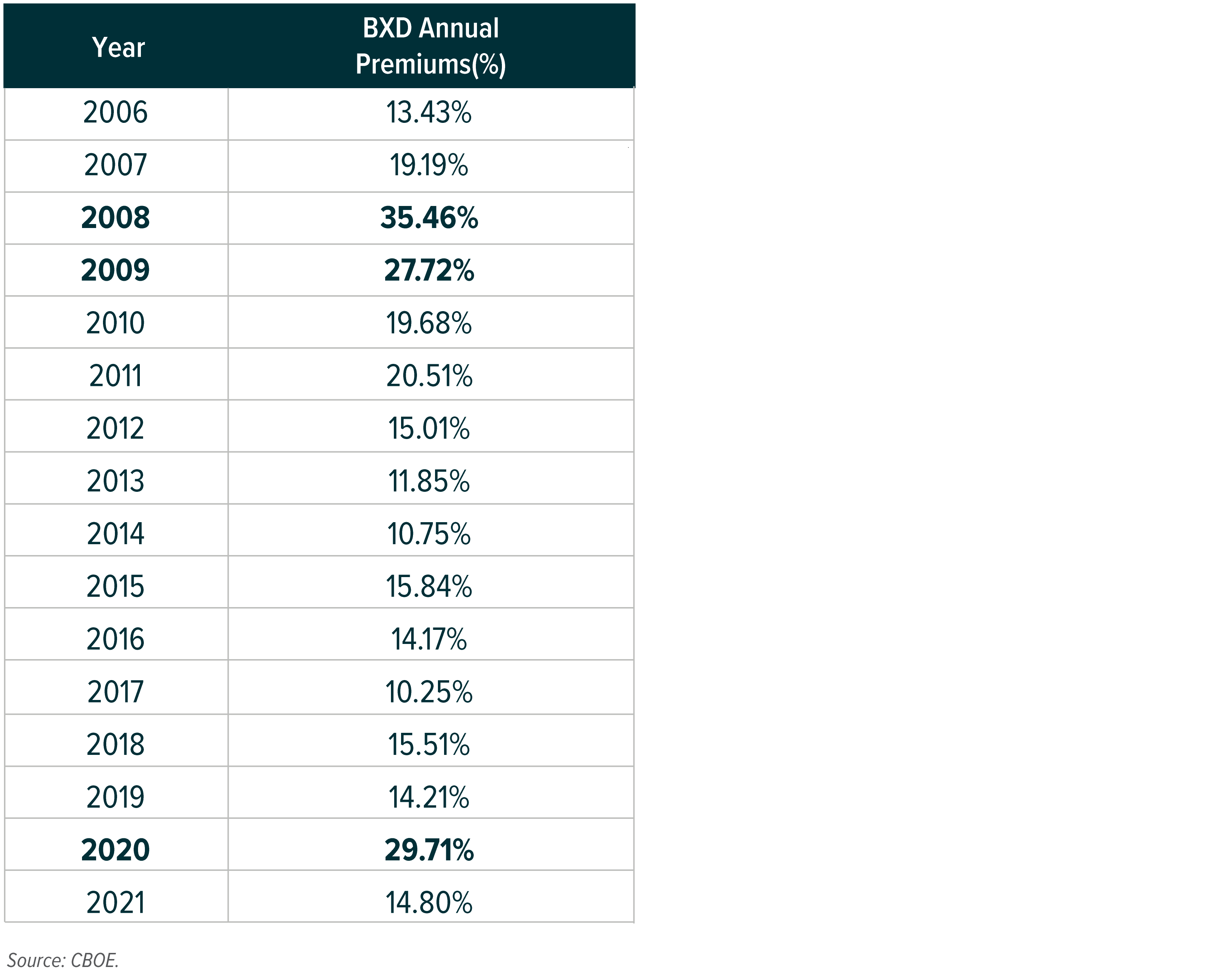

The nature of the premiums can also potentially mitigate in the case of lack of upside on the DJI, given that the call options are written at-the-money (ATM), meaning the strike price equals the current price of the underlying security. Historically, BXD’s premiums resulted in the below total annual levels. Bolded in the below chart, we can see key years where premiums received as a percent of the index price were at high-points due to the implied volatility in the market (VXD). The tradeoff of potential upside return for income could be attractive for an income investor.

Potential Benefits of Covered Call Strategies in a Rising Rate Environment

Finding appropriate sources of yield can be a key challenge for income investors in rising rate environments like the one we’re seeing today. Fixed income presents duration risk, and in some higher yielding fixed income assets like long duration treasuries and corporate bonds, this duration risk can be significant.4 Corporate bonds offer a duration of 8.2 years currently, and long duration treasuries sit at 19.3 years.5 With 10-year treasury yields having moved from 1.44% at the end of November 2021 to 2.04% on 2/15/22, duration risk may start cutting into returns even further if rates continue moving higher from here.6

Equities haven’t been immune either. Major broad market indices are struggling this year with rising rates, as the S&P 500 is down -9.65% YTD.7 Equity indexes like the S&P 500 tend to yield approximately 2% or less, making it challenging with inflation starting to cut into purchasing power of the income received.8

Covered call strategies like DJIA may be an intriguing alternative for investors, as they don’t present duration risk and can diversify return streams in a portfolio given potentially different sector exposures. From a portfolio construction perspective, strategies like DJIA give investors the opportunities to scale back in riskier pockets of the credit market like high yield bonds, or duration sensitive areas like corporate bonds and may generate the income investors may need.

Covered call strategies can also offer investors higher income potential than other traditional income strategies because of the positive correlation of volatility to premiums received. Recently, rising rates have led to increased volatility in many parts of market, including growth assets. For equity investors, the reduced Technology exposure in DJIA relative to the S&P 500 and Nasdaq 100, as well as overweight to a sector like Financials that tend to benefit from rising rates through activities like lending, may be an attractive value proposition.

Related ETFs

DJIA: The Global X Dow 30 Covered Call ETF follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Dow Jones Industrial Average and “writes” or “sells” corresponding call options on the same index.

Please click the fund name above for current fund holdings and important performance information. Holdings are subject to change.