Introducing the Global X Covered Call & Growth ETFs (QYLG & XYLG)

On September 21st, we launched the Global X Nasdaq 100 Covered Call & Growth ETF (QYLG) & the Global X S&P 500 Covered Call & Growth ETF (XYLG). QYLG & XYLG, the latest additions to Global X’s covered call ETF suite, are designed to offer investors both income and upside potential.

For the last decade, income investors have struggled to find diversified sources of meaningful income for their portfolios. Amid a historically low interest rate environment, traditional sources of income, like bonds, often failed to meet investors’ income needs. At the same time, lengthening life expectancies and desires for preserving multi-generational wealth have tilted investors’ preferences towards more growth-oriented solutions. In turn, investors have increasingly sought alternative asset classes and strategies that offer both high income potential and long-term growth opportunities.

We launched QYLD & XYLG to help investors effectively balance these goals.

QYLG & XYLG: Covered Call ETFs Designed for Income and Growth Potential

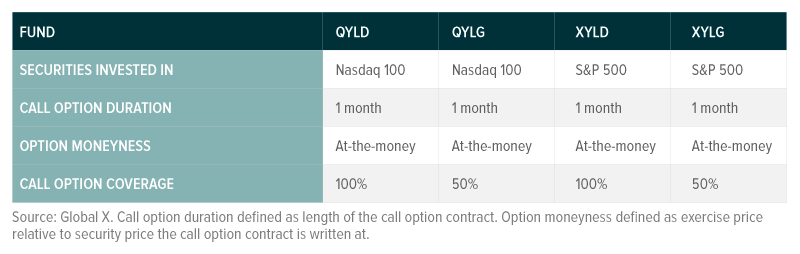

QYLG & XYLG employ covered call writing strategies in an attempt to achieve both income and growth potential. Below are a few key characteristics of QYLG & XYLG:

- The ETFs buy the securities represented in the Nasdaq 100 (QYLG) and S&P 500 (XYLG) at the respective weights in those indexes

- Each month, the ETFs write at-the-money (ATM) index call options on the Nasdaq 100 (QYLG), and S&P 500 (XYLG) in an attempt to generate income

- The options written cover 50% of the value of the stocks held in each fund. This means each fund retains roughly half of the upside potential of the index they track

The QYLG & XYLG share similarities with other covered call strategies in our suite, QYLD and XYLD, respectively. The primary difference is that QYLG and XYLG write options that cover 50% of their stock holdings, whereas QYLD and XYLD cover 100%. This means that QYLG and XYLG have exposure to approximately 50% of the upside of their underlying indexes, but should generate half of the income of QYLD or XYLD.

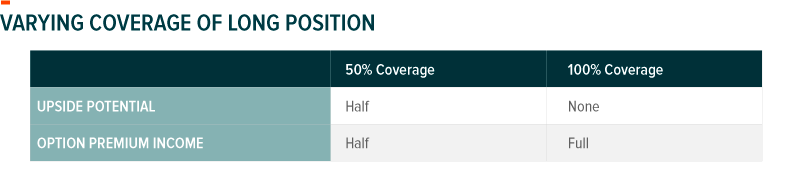

Coverage Percentage: The Tradeoff Between Growth & Income

There are numerous decisions that can go into constructing a covered call strategy, including which indexes or assets to hold, the moneyness of the options written, and the amount of the portfolio covered by call options, to name a few. With the last example, typically an investor will either fully cover or under-cover their underlying positions. If there was a 1% gain on the index, a full covered investor would not partake in the gains, but a 50% covered investor would take part in 0.5% of the upside. If there was a 1% decline on the index, a fully covered investor would still take part in the equity decline, but the decline may be partially offset by the options premium received. A 50% covered investor would also take part in the equity decline, but the decline would be greater than the 100% fully covered investor’s decline because the 50% covered investor only received half the options premiums.

Full coverage entails writing calls on 100% of the value of the underlying securities owned in the portfolio. If the portfolio owns $100m worth of stocks in the Nasdaq 100, then a fully covered strategy would write call options on the Nasdaq 100 with a notional value, or an investor’s portfolio value, of $100m. Because the notional value of the written call options is equal to the value of the stocks in the portfolio, when the options are in-the-money, they fully cancel out any gains in the underlying portfolio. A 1% gain in the index is offset by a 1% loss in the written calls. This means that with 100% coverage, the investor has little or no upside potential, particularly when the options are written at-the-money, as they are in QYLD and XYLD. Compared to an under covered strategy, however, a fully covered strategy will typically generate higher income because it is selling more call options.

Under covering a portfolio means the notional value of the written call options is less than the value of the stocks held in the portfolio. For example, if a portfolio holds $100m worth of stocks in the Nasdaq 100, a 50% covered strategy would write call options on the Nasdaq 100 with a notional value of $50m. Such an approach means that if the value of the stocks held by the portfolio increases by 1%, the losses of the options position will reduce gains by -0.5%. In other words, the portfolio participates in 50% of the upside of the underlying securities. QYLG & XYLG use this type of strategy. The tradeoff for more participation in the upside compared to fully covered strategies is lower income. Therefore, this strategy can be well-suited for investors looking for both income and growth potential.

Nasdaq 100 & S&P 500 Characteristics

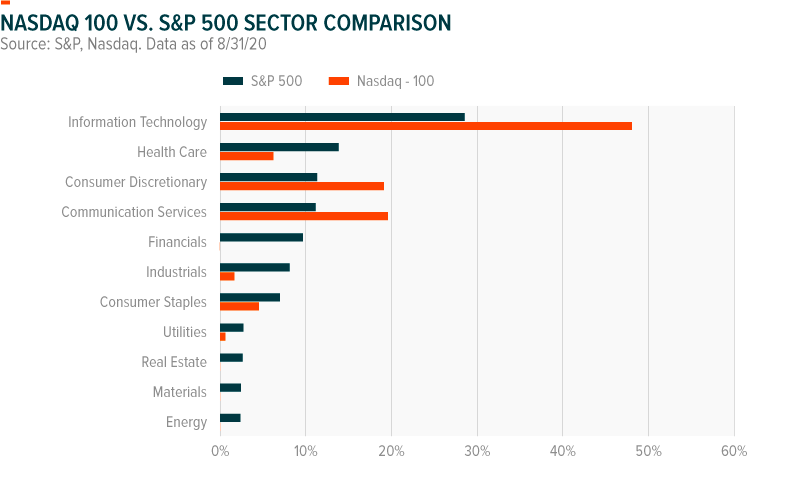

While both QYLG & XYLG follow 50% covered strategies, they offer exposure to different indexes. QYLG buys the stocks held in the Nasdaq 100 Index and writes call options on the Nasdaq 100, while XYLG owns the stocks in the S&P 500 and writes index call options on the S&P 500. How should one choose between a covered call strategy involving the Nasdaq 100 versus the S&P 500? It depends on portfolio exposure, investor objectives, and market outlook.

The Nasdaq 100 is primarily an Information Technology sector-focused index and excludes Financials, whereas the S&P 500 Index is more sector-diverse. Because of these sector differences, the drivers of these two indexes, as well as performance, volatility, and correlation to other income strategies can vary significantly.

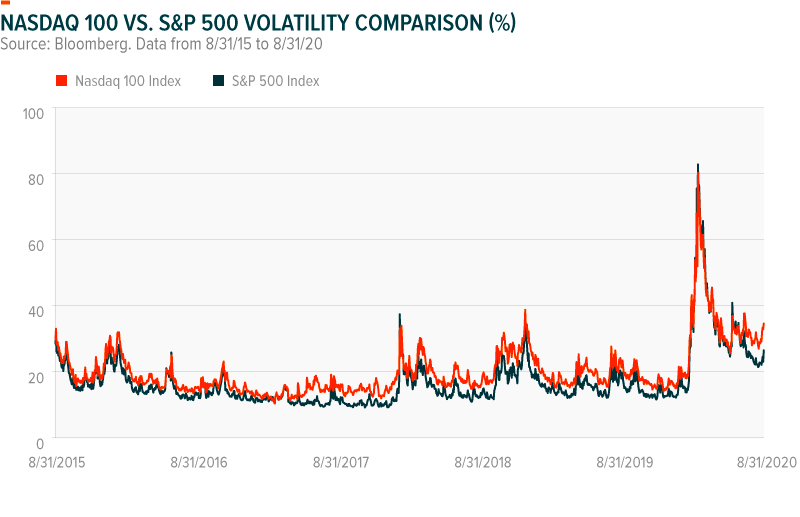

Historically, higher volatility is another distinctive component of the Nasdaq 100. In the past, the Nasdaq 100 has routinely exhibited higher volatility than S&P 500. Because option premiums are higher when volatility increases, investors may generate greater income from selling options on the Nasdaq 100 than the S&P 500.

The Nasdaq 100 could offer higher growth potential by nature of its concentrated allocations in ‘new economy’ sectors like Information Technology and Communications Services. The S&P 500, on the other hand, has more exposure to Consumer Staples, Utilities, & Financials, which tend to exhibit lower growth characteristics. These sectors can dampen volatility and potentially serve as a buffer in falling markets, but they may also drag on the indexes long term growth.

Using 50% Covered Call ETFs In a Portfolio

A 50% covered call approach is designed to balance growth potential with income, and therefore aligns best with investors seeking both outcomes. For example, investors who recently retired and are looking to live off their savings for 20-30 years may want both current income as well as growth to head off inflation. More tactically, an investor may see a more bullish view of the markets and shift from a fully covered strategy to a 50% covered strategy in an attempt to capture more upside potential in the near term.

Some investors may find that they already have substantial exposure to specific sectors and want to diversify their portfolio. For example, typical income-oriented portfolios tend to have greater weightings to dividend paying sectors like Financials, Utilities, and Real Estate, while being underweight Information Technology, Communications Services, and Health Care. Using 50% covered call strategies may offer investors greater exposure to these sectors, while still generating income.

A 50% covered call strategy still gives up half of the upside, so if an investor is bullish on the markets and doesn’t have a strong preference for income, then forgoing half the upside may be a challenge. There is also less income generated than an identically run 100% covered call strategy, but the decision on which type of strategy revolves around an investor’s objectives and their market views.

While investors may be able implement covered call strategies on their own, investing in covered call ETFs could be a more efficient option. Rather than buying the 100 stocks in the Nasdaq 100 Index and selling call options on the index each month, one can buy a single ETF and outsource those responsibilities to a professional portfolio manager.

Today’s environment appears particularly well-suited for the 50% covered call approach. Income is challenging to find in most asset classes, as central banks set rates at extremely low levels. At the same time, equity markets are exhibiting robust growth. Allowing half of one’s exposure to participate in upside potential, while generating income from the other half, could be an attractive solution for addressing this unique environment.