Introducing SHLD: The Case For Defense Tech

On September 13th, 2023, we listed the Global X Defense Tech ETF (SHLD) on the New York Stock Exchange. SHLD seeks to invest in stocks that potentially stand to benefit from increased adoption and utilization of defense technology (“Defense Tech”). This includes companies that build and manage cybersecurity systems, utilize artificial intelligence (AI) and big data for local and/or national defense applications, and build advanced military systems and hardware such as robotics, fuel systems and aircrafts.

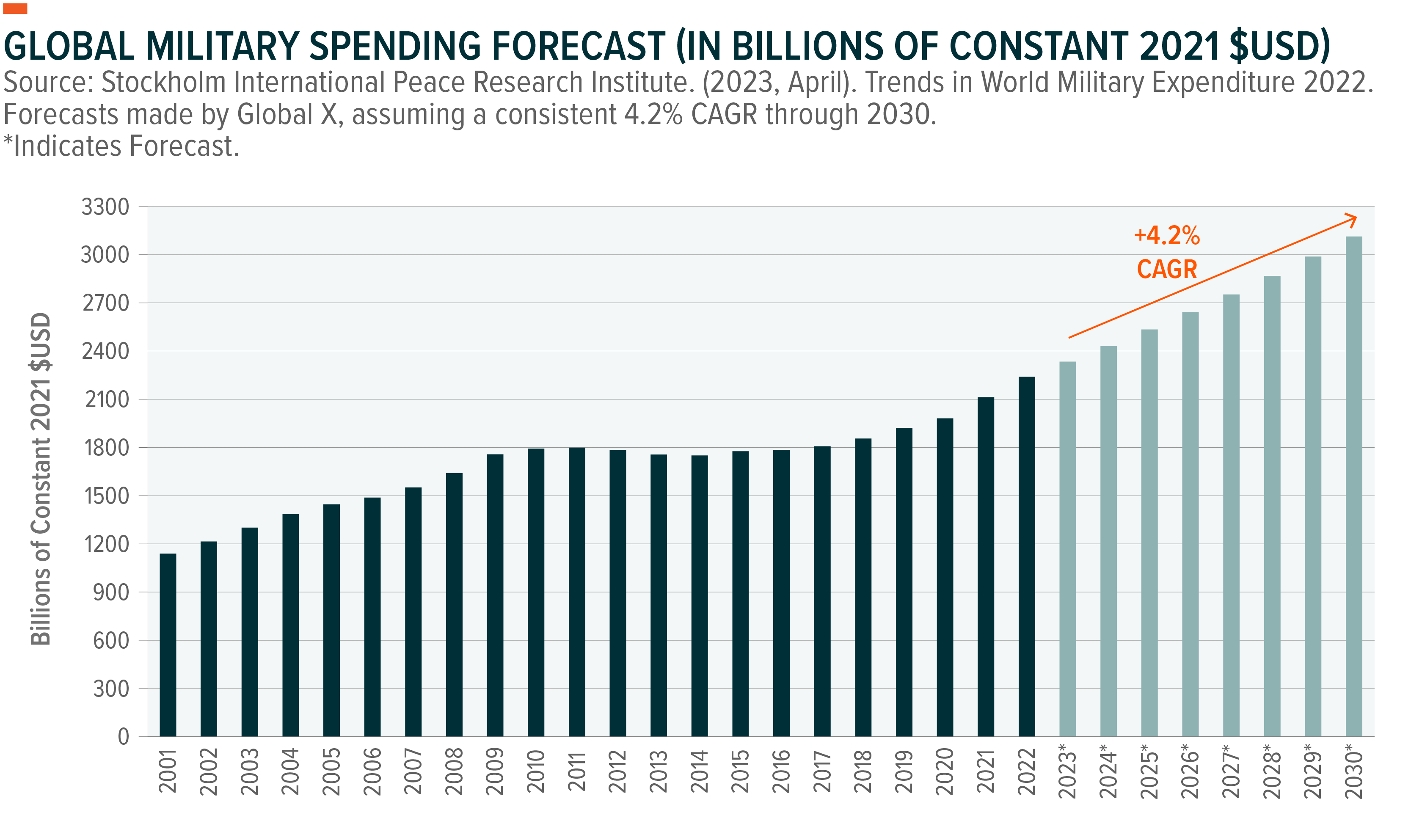

Mounting geopolitical challenges, the rapid deglobalization of the economy, and the emerging use of technology in defense and national security apparatus are driving a broad uptick in military and defense expenditures. By 2030, we project global military and defense spending will grow nearly 40% to top $3.1 trillion, an increasing share of which is likely to go towards artificial intelligence (AI), cybersecurity, and other defense technologies.1 We expect businesses and solutions providers across the value chain to benefit, including large military contractors with domain knowledge, suppliers of emerging components and hardware, and suppliers of defense-specific security software. For investors, we believe that this secular growth opportunity offers exposure to a compelling macro trend rooted in innovation.

Key Takeaways

- Since 2020, military spending growth accelerated by about 4x to 4.2% Year-over-Year (YoY) Compound Annual Growth Rate (CAGR).2 Growth is expected to remain at these elevated levels through 2030.3

- The defense sector’s uptick in software and systems development requires specialized hardware, creating demand for providers of sensors, advanced components, AI chips, and other hardware-based processing, sensing, and networking solutions.

- Cyberspace transcends geographical boundaries, and safeguarding citizen, corporate, and military interests in the digital realm is a focus for countries.

Global Defense Spending Has Continued to Trend Higher

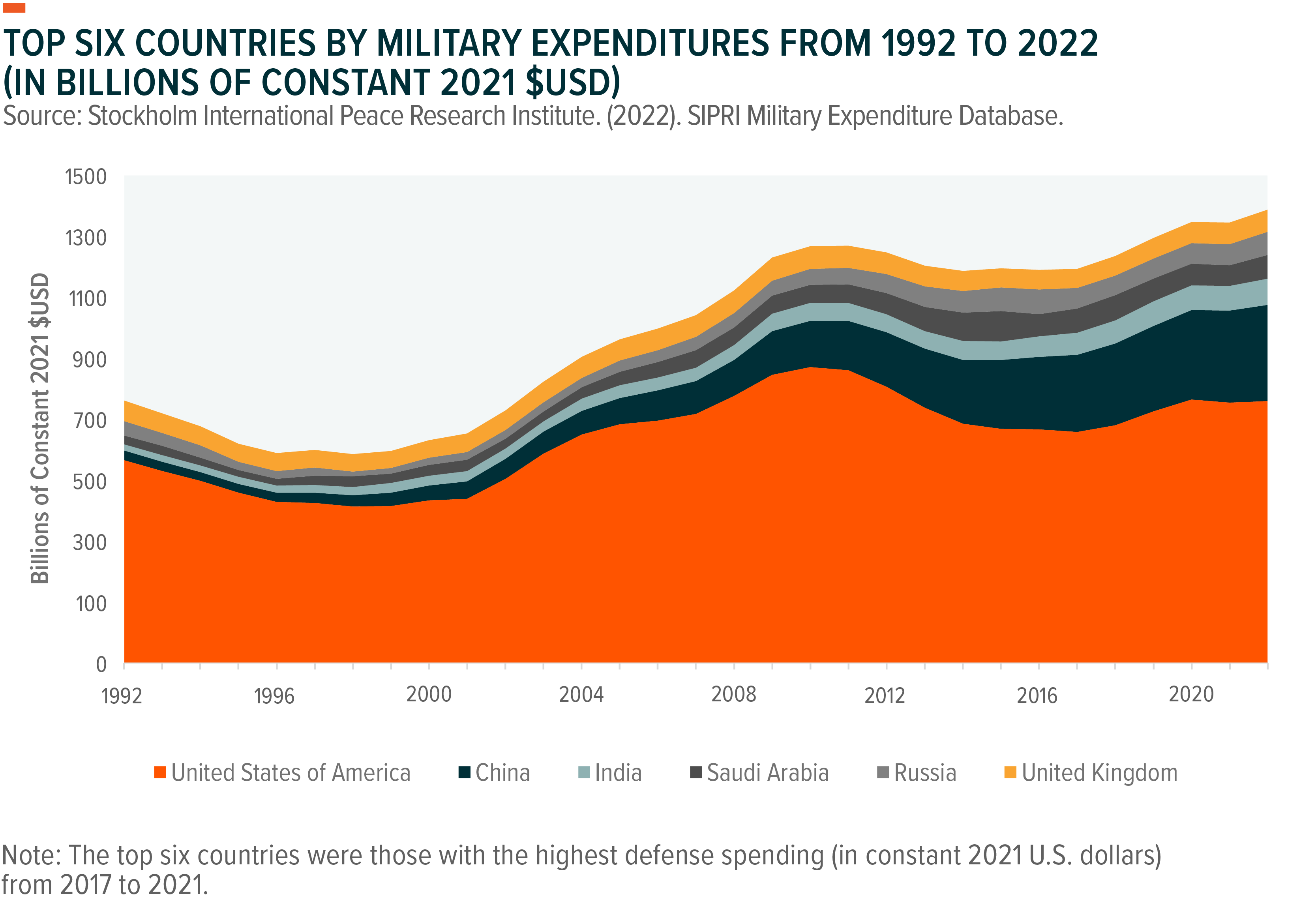

In 2022, global military spending increased for the eighth consecutive year to reach a record $2.24 trillion.4 The United States stood out as the world’s foremost military spender with total military expenditures at a staggering $877 billion.5 That outlay was 39% of total global military spending and three times more than what China spent as the world’s second-largest spender.6 Russia, India, and Saudi Arabia rounded out the top five. Jointly, this group accounted for a 63% of the world’s military expenditure.7

In our view, geopolitics, deglobalization, and technological advancements are likely to sustain the upward trajectory in defense spending. Between 2010 and 2020, global military spending grew at an approximate CAGR of 1%.8 But since 2020, military spending growth accelerated by roughly 4x to 4.2% YoY CAGR.9 We anticipate growth to continue at these elevated levels through 2030, surpassing $3 trillion.10

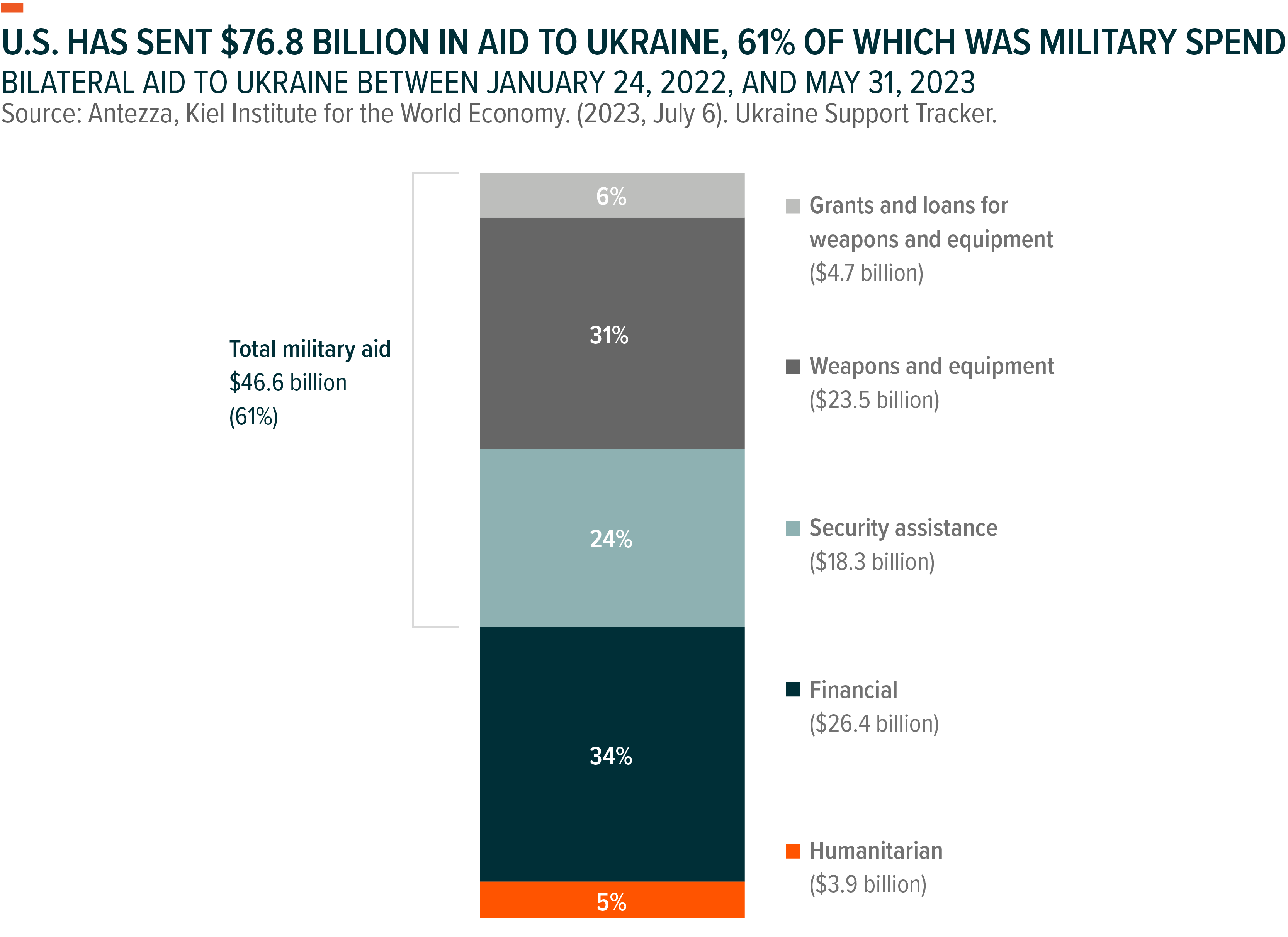

Instability in Eastern Europe is one of the factors driving the recent uptick in spending. The U.S. government has provided more than $75 billion in humanitarian, financial, and military aid to Ukraine since the start of the war.11 Many other countries, including NATO and European Union members, are also contributing sizeable aid packages to Ukraine.12

Europe’s military expenditure has reached its highest levels since the Cold War, driven by Russia’s invasion of Ukraine.13 2022 saw a significant 13% increase in defense investments compared to the previous year.14 The United Kingdom was a top spender among the European nations, securing the sixth rank globally and contributing 3.1% to the global defense budget, surpassing Germany at 2.5% and France at 2.4%.15 These expenditures are inclusive of contributions aimed at supporting Ukraine.16

Shifting focus outside of the Russia-Ukraine War, China boosted its defense budget for the coming year by 7.2% YoY reaching $224 billion, despite broad economic weakness.17 Similarly, Taiwan, in response to China’s extensive military exercises, proposed a record-high defense budget of $19 billion for 2023, a 13.9% increase compared to 2022.18

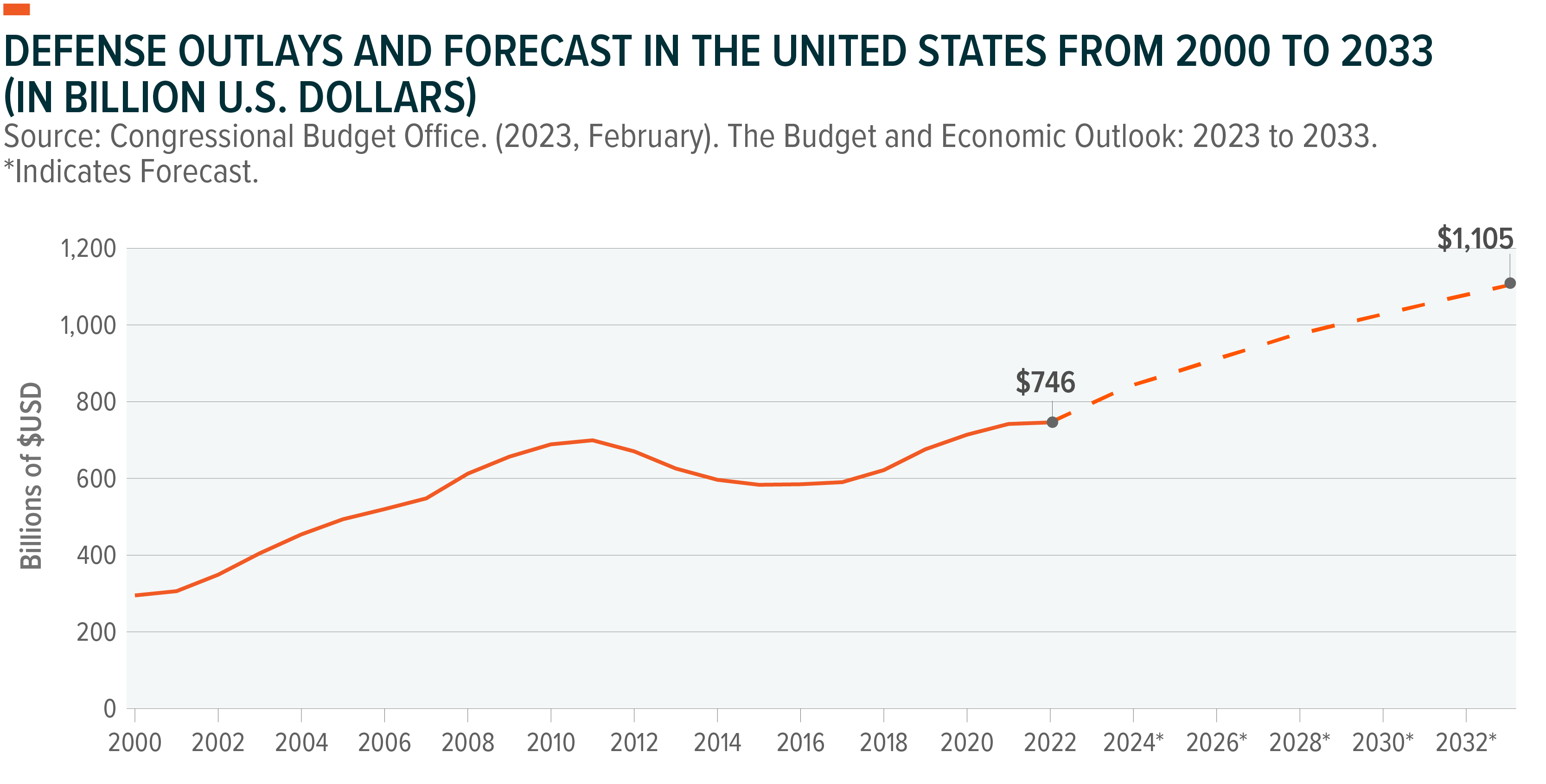

Not surprisingly, U.S. investments in military and defense initiatives show no signs of abating. The Biden Administration’s Fiscal Responsibility Act of 2023, signed into law in early June, adopted a proposed topline of $886 billion for fiscal year 2024 defense spending, a 3.2% increase from FY 2023. Of that $886 billion, $842 billion is earmarked for the Defense Department.19

Projections from the U.S. Congressional Budget Office suggest that defense spending will reach $1.11 trillion and represent 2.8% of the GDP by 2033.20

The Digitization of Defense Is Upon Us

In the past, military spending primarily focused on acquiring conventional hardware and ammunition. Now, the budget allocation landscape’s shifting towards digitization. Emerging military and security technologies, such as artificial intelligence, cybersecurity, and technology convergence, are major drivers behind this surge in defense technology spending.

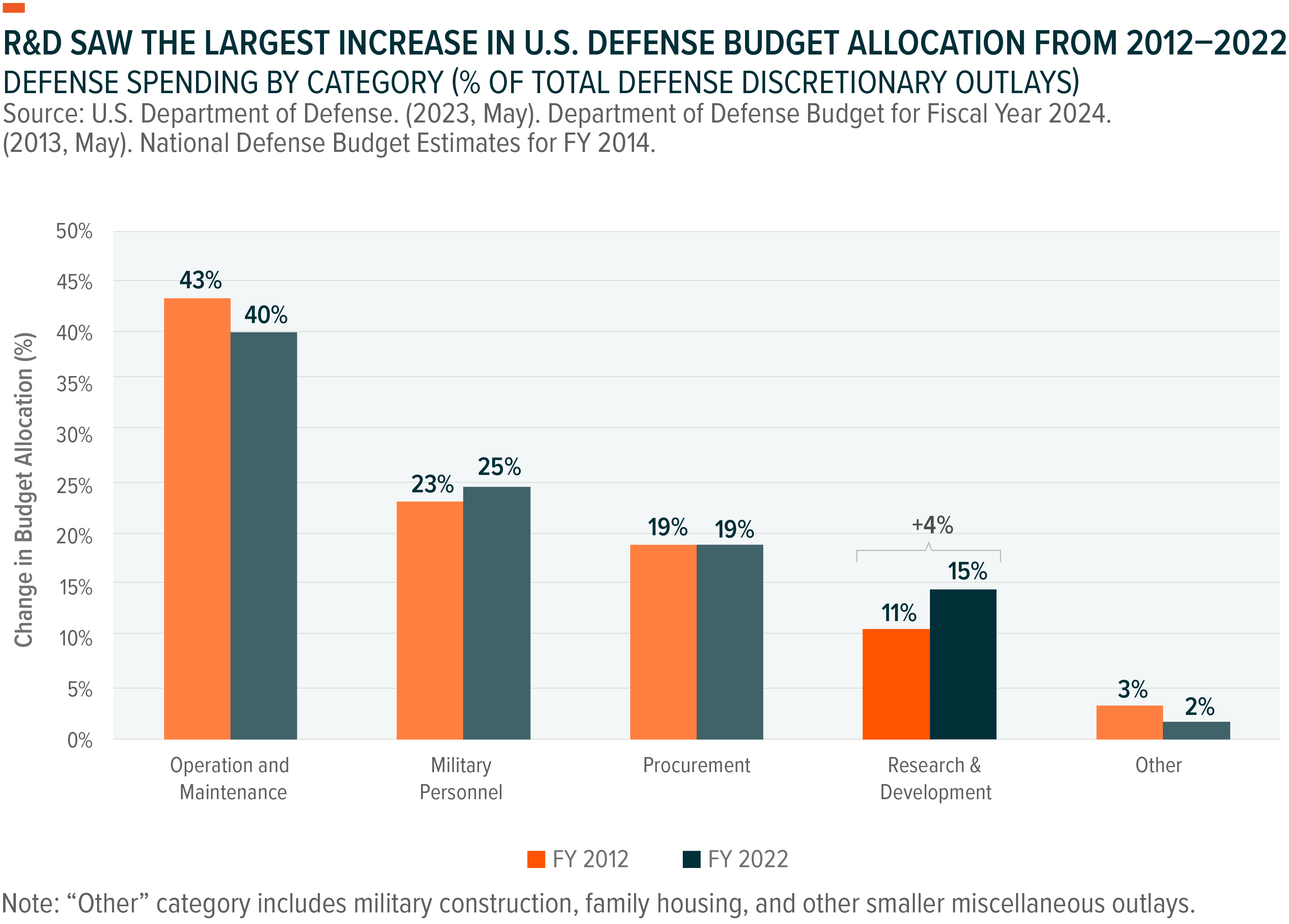

A reliable indicator of a country’s commitment to advancing defense technology is its research and development (R&D) budget. For the United States, the notable increase in R&D over the past decade from 11% of its total defense budget allocation in 2012 to 15% in 2022 is a strategic shift for the Department of Defense (DoD).21,22 The DoD’s Fiscal Year (FY) 2024 budget allocates $145 billion to R&D, a 4% increase from FY 2023’s.23 It earmarks $17.8 billion for science and technology initiatives and $1.8 billion to advancing AI capabilities.24

Among the more notable emerging technologies in development are lethal autonomous weapon systems (LAWS). Defined as weapons that autonomously identify, target, and engage adversaries with limited human intervention, LAWS harness the power of high-speed computers, the interconnectedness of the Internet of Things (IoT), and sophisticated big data algorithms. Governments around the world, the United States and China especially, believe that they can secure a competitive military advantage through the development and deployment of LAWS.25

In the growing defense technology market, the software and hardware industries’ presence takes on added significance. The global defense information technology (IT) spending market was valued at $79.68 billion in 2020 and is projected to reach $137.65 billion in 2030.26 The defense sector’s uptick in software and systems development requires specialized hardware, creating demand for providers of sensors, advanced components, AI chips, and other hardware-based processing, sensing, and networking solutions.

This uptick also creates opportunities for new partnerships between the U.S. government and industry participants, including those who specialize in data analytics and the artificial intelligence/machine learning realm (AI/ML). One notable partnership involves big data and AI company Palantir Technologies and the U.S. Army Research Laboratory (ARL). In 2018, Palantir joined forces with ARL to equip frontline personnel with cutting-edge operational data and AI capabilities.27 Their platform has played a pivotal role in integrating, managing, and deploying relevant data and AI model training to all branches of the Armed Services, combatant commands (COCOMs), and special operators.28

In July 2022, Palantir secured a contract valued at $99.9 million over two years to implement data and AI/ML capabilities across the COCOMs.29 Then in September 2022, the ARL extended its collaboration with Palantir, aiming to expand AI/ML capabilities across the DoD. The extended contract is worth up to $229 million over one year.30

The U.S. government is also collaborating with defense tech companies like General Dynamics who is actively involved in replacing the aged U.S. Army’s Bradley Fighting Vehicle using detailed digital designs and prototypes for testing, a project valued at around $45 billion.31 Lockheed Martin has boosted its directed energy weapon for the DoD, scaling its 300 (kilowatt) kW laser to an impressive 500 kW.32 This laser’s accuracy is refined through precise target tracking data from radar and sensors, promoting effective target destruction.

Cyberspace is the New Battleground

Modern warfare is not restricted to bullets and missiles. Cyberspace transcends geographical boundaries, and safeguarding citizen, corporate, and military interests in the digital realm is a major challenge for countries. Parallelly, countries increasingly exploit cyber vulnerabilities to achieve and attain military objectives. Organized and criminal hacking is rampant, often causing massive public disruption.33

Cybersecurity is a vast frontier in comprehensive defense operations. Recent U.S. legislation designed to modernize and secure defense systems, government agencies, and critical infrastructure underscore the commitment required. The Infrastructure Investment and Jobs Act included roughly $1.9 billion in cybersecurity funding for state and local government grants, the electrical grid, and Department of Homeland Security (DHS) cybersecurity research.34

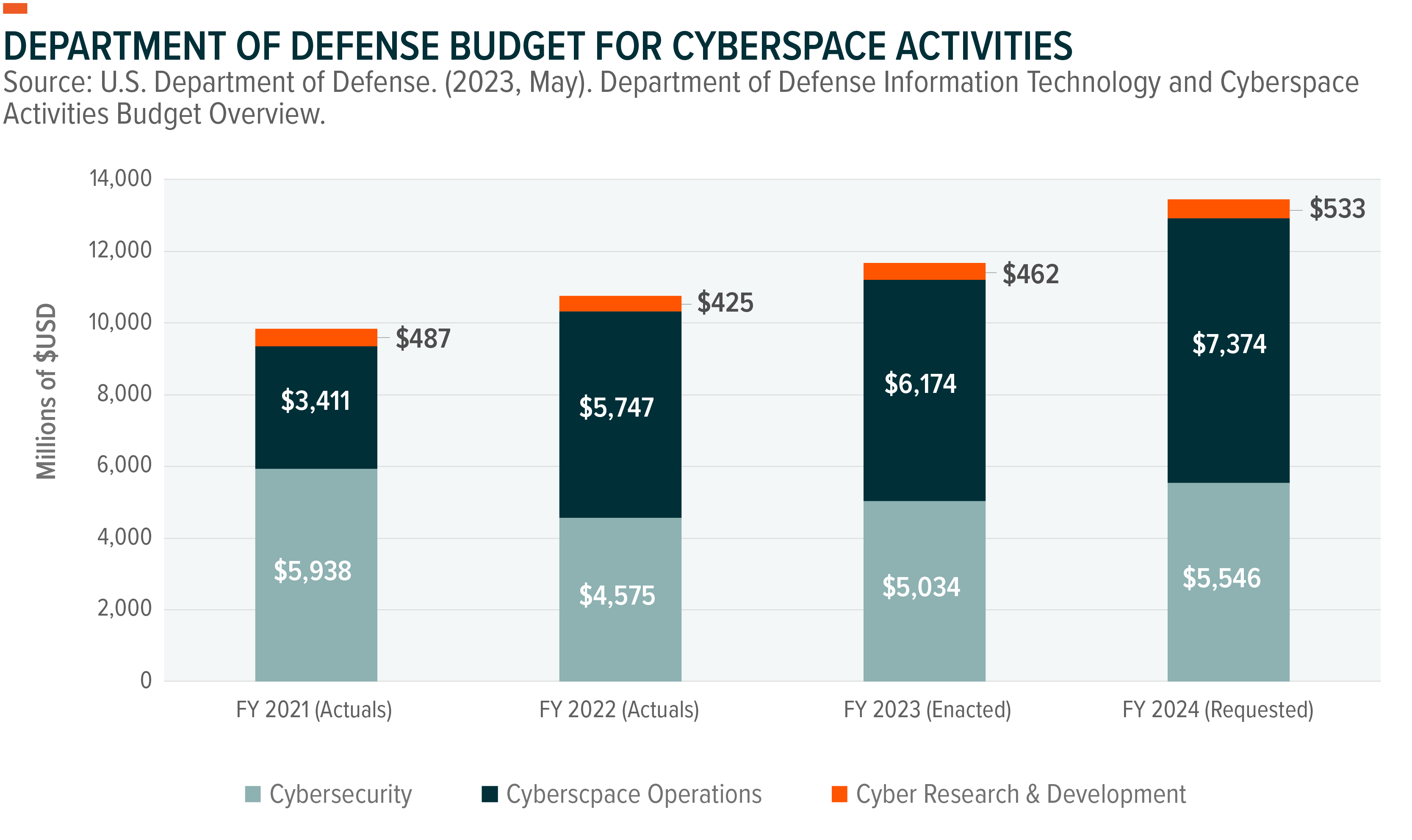

Cybersecurity is a primary concern for the Department of Defense, which divides its cyberspace activities (CA) budget into three portfolios: cybersecurity (requested $5.5B FY24), cyberspace operations (requested $7.4B FY24), and R&D (requested $.5B FY24). The requested CA budget for FY 2024 is $13.5 billion, a nearly $1.8 billion increase from FY 2023.35

Also, the DoD devised their Software Modernization Strategy, which outlines FY 2023–24 priority tasks such as accelerating the DoD enterprise cloud environment, establishing a department-wide software factory ecosystem, and transforming processes through digitization to enable resilience and speed.36 The DoD’s Future Years Defense Plan states that air platforms and platform systems, hypersonic and strategic strikes, air and missile defense systems, and space and space-based systems are among the areas receiving the greatest portion of funding for defense tech innovation through 2027.37

As emerging technologies like AI present new cyber challenges and vulnerabilities, the onus is on governments to devise solutions, which can include diplomacy. For example, in February 2023, at the first ever Responsible Artificial Intelligence in the Military Domain (REAIM) Summit at The Hague, the U.S. State Department proposed the “Political Declaration on Responsible Military Use of Artificial Intelligence and Autonomy,” a plan to ensure that military AI adheres to international humanitarian law and requires each country to establish its own principles for AI-enabled systems.38 Additionally, the proposal mandates that AI capabilities must disengage from the system if they operate unintentionally.39

SHLD: An ETF Targeting Innovative Defense Tech

The Global X Defense Tech ETF (SHLD) invests in pureplay defense technology companies that derive 50% or more of their revenues from the sub-categories outlined below. The fund is generally unconstrained by geographical limitations and seeks to cast a wide net capturing disruptive defense technology companies. The sub-categories for inclusion involve:

- Cybersecurity:Companies involved in the development and management of defense-related security protocols preventing intrusion and attacks to systems, networks, applications, computers, and/or infrastructure for local and/or national defense applications.

- Defense Technology:Companies involved in the development of artificial intelligence (AI), internet of things (IoT), augmented/virtual reality (AR/VR), human-machine collaboration, big data, specialized 3D light detecting and ranging (LiDAR), geospatial intelligence, and/or security scanning solutions (e.g., biometrics, credential authentication, etc.) for local and/or national defense purposes.

- Advanced Military Systems and Hardware:Companies involved in the development of robotics, drones, advanced weapon systems and military munitions, defense-specific power and fuel systems, sensor arrays, processors and networking equipment, space launch systems (including satellites), radar systems, and/or military aircraft/vehicle production, for local and/or national defense purposes.

Conclusion: Defense Tech May Offer Secular Growth

The global defense industry is an expansive, rapidly growing market with annual spending in the trillions. Escalating geopolitical concerns, the digital transformation of warfare, and the increasing importance of cybersecurity are growth drivers. As the world becomes more interconnected, cyberattacks are more frequent and sophisticated, prompting militaries to adopt cutting-edge technologies such as artificial intelligence, drones, and cyberwarfare capabilities. Their adoption creates a growing market for defense companies and, in our view, presents a compelling opportunity for investors seeking exposure to a sector with sustained growth. Exposure to the future of the defense industry means exposure to technological innovation and development.

Related ETFs

SHLD – Global X Defense Tech ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.