Introducing BITS: The Case for Blockchain Equities and Bitcoin Futures

On November 16, 2021, the Global X Blockchain and Bitcoin Strategy ETF (BITS) began trading on Nasdaq. BITS is an actively managed fund that seeks to capture the long-term growth potential of the blockchain and digital assets theme. The Fund takes long positions in U.S. listed bitcoin futures contracts and invests in companies positioned to potentially benefit from the increased adoption of blockchain technology. BITS will not invest directly in bitcoin. For more information on BITS and its holdings, please click here.

In this piece, we discuss important elements of both blockchain equities and bitcoin futures, and why we believe combining these two exposures in one fund can provide an efficient and comprehensive approach to the blockchain and digital assets theme.

Blockchain Equities: The Picks & Shovels of Cryptocurrencies and Beyond

In its most basic sense, a blockchain is a type of database focused on recording and maintaining data. Its unique properties stem from its decentralized – or distributed ledger – approach. In a centralized database, a singular authority retains total control over all aspects, including entering data, ensuring its validity, and maintaining that data. In the blockchain’s decentralized approach, data is recorded in “blocks” that are distributed to and independently validated by all participants, or nodes, in the P2P (peer-to-peer) network.

The advantages of a decentralized ledger are based on removing the necessity of trust. First, all the network participants have access to a copy of the blockchain in real time, including its history. In other words, it is fully transparent. Second, once a block has received a sufficient number of confirmations, the transactions inside it cannot be duplicated, corrupted, modified or eliminated by any one actor or node. Because of this immutable nature, it can provide superior security and traceability. And third, since it removes the figure of a central authority, there is no need for third-party verifications or reconciliations, eliminating middle-men costs.

To understand how the blockchain can provide value, it’s important to contrast it with traditional record-keeping. Historically, each party managed their own centralized ledger and tried to reconcile transactions between them. For example, businesses and their suppliers must relay information to each other on invoices, goods sold, deliveries, inventory, and more. Each group must be satisfied that the other’s data is valid, while discrepancies can create major headaches that need to be resolved. With blockchain, all groups operate with the same datasets, trust that the data and transactions are recorded accurately, and have transparency into historical transactions.

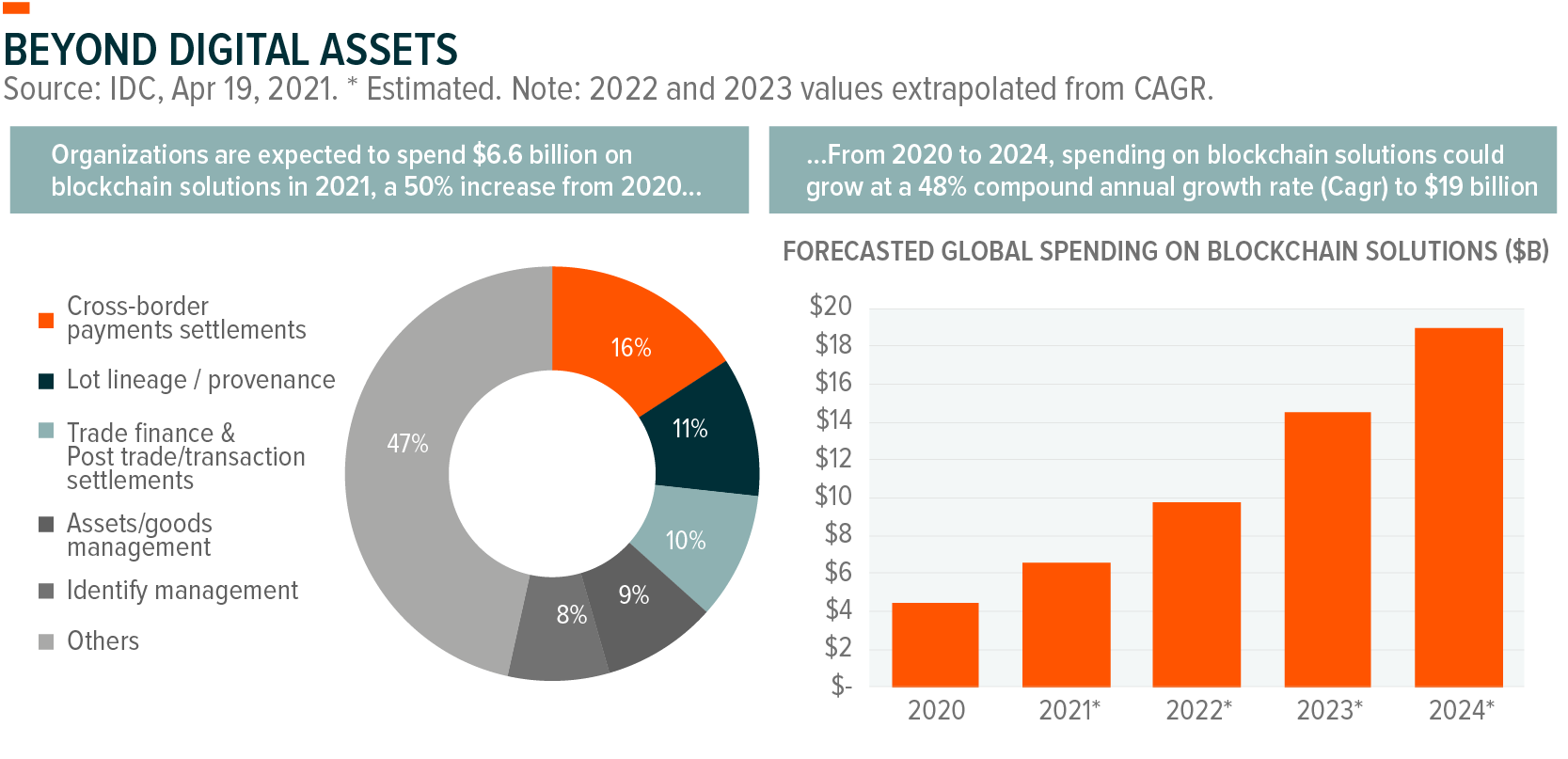

Blockchain is often times referenced synonymously with cryptocurrency, largely due to the Bitcoin network being the first application of blockchain technology. However, it’s clear that the benefits of this technology can accrue beyond just cryptocurrencies today, improving operational efficiencies across many different types of businesses. One particularly interesting use case is in the grocery industry. When a grocer receives a contaminated food shipment, like the 2019 romaine lettuce E-coli incident in the U.S., grocers have traditionally pulled their entire inventory off the shelves, unable to precisely identify the contaminated inventory. Blockchain technology can be a solution to these scenarios, providing grocers the ability to efficiently track the contaminated inventory through their supply chain, allowing them to make a more precise resolution while preserving their uncontaminated inventory. Other commonly cited use cases for blockchain include payments, transaction settlement, voting, event ticketing, authenticity tracking, and much more.

Due to an accelerating pace of Initial Public Offerings (IPOs), SPACs, shifting business models, and rising market capitalizations, there are now a couple dozen public equities that are clear beneficiaries of blockchain technology and can provide targeted exposure to this theme. These companies hail from several sub-themes within the blockchain ecosystem, including digital asset mining, blockchain & digital asset transactions, blockchain & digital asset hardware, and blockchain applications & integration.

Bitcoin Futures: Linking Returns to The World’s Largest Cryptocurrency

Prior to October 2021, U.S. investors seeking exposure to the growing adoption of cryptocurrencies through a regulated investment vehicle were largely limited to the aforementioned equities in the blockchain ecosystem. While it’s still not feasible to provide significant exposure directly to bitcoin in an ETF today, recent regulatory developments now allow ETFs to purchase bitcoin futures contracts. Bitcoin futures are a derivative instrument that provide indirect access to the price of bitcoin. In our view, this development presents a unique opportunity to expand the investment scope of the blockchain and digital assets theme, capturing a greater portion of the investment ecosystem that stands to benefit from its materialization.

Performance shown is past performance and it does not guarantee future results. Index returns are for illustrative purposes only and do not represent actual fund performance. There is no guarantee that any forecasts will come to pass.

Futures contracts are exchange traded derivatives with standardized terms indicating the notional size of the contract, the expiration date, and the method of settlement. As an example, bitcoin futures’ contracts each represent five bitcoin and they expire on the last Friday of their respective expiration month. Unlike many commodity futures such as oil, where barrels of oil are delivered to the buyer at contract expiration, bitcoin futures are a cash settled instrument. At contract expiration, the price of a bitcoin futures contract is expected to converge to the spot price of bitcoin, and the direction of this convergence, upwards or downwards, will determine the cash payment that must be made from the buyer to the seller, or vice versa.

Bitcoin futures provide indirect exposure to bitcoin while removing the complexities of the bitcoin blockchain itself. Investors don’t need to establish a bitcoin wallet, nor do they need to worry about the custody of bitcoin private keys, or the broadcasting of transactions on the blockchain. An ETF investing in futures will additionally obfuscate the end buyer from the tax complexities of directly transacting in digital currencies. Overall, bitcoin futures provide an efficient access point for bitcoin exposure while maintaining the convenience of being inside the rails of the traditional financial system.

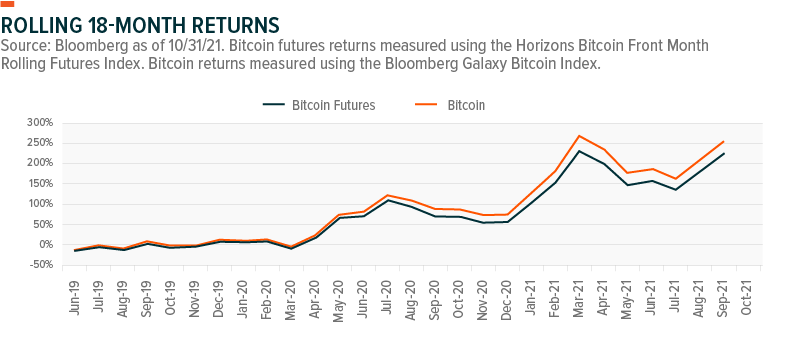

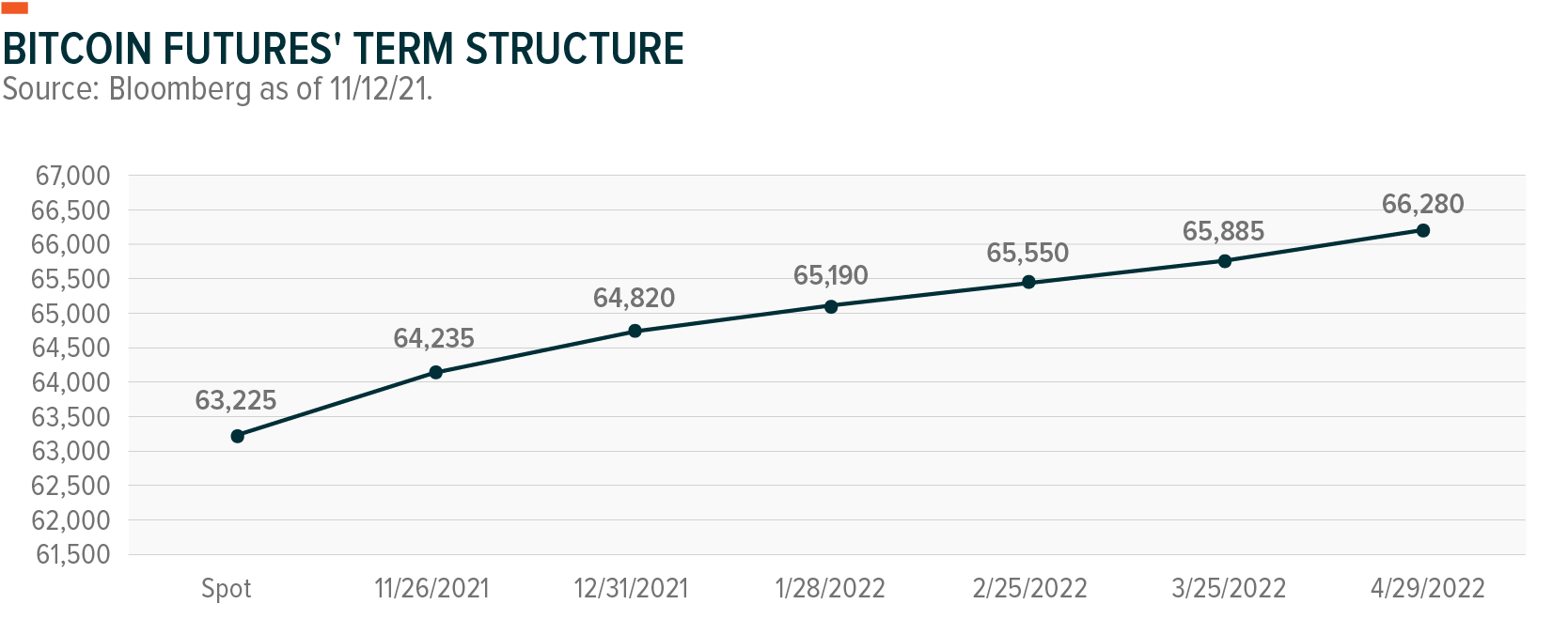

These conveniences do come at a cost, however. Bitcoin futures have historically traded in contango, meaning that the longer expiration futures trade higher than the spot price. This dynamic in bitcoin futures is often attributed to two primary factors. First is the demand for leveraged exposure which can be achieved through futures. Second is the inability to post spot bitcoin as collateral to short bitcoin futures, making it capital inefficient to arbitrage futures positions versus bitcoin itself. Assuming the shape of the term structure stays the same over the holding period, a future’s position in contango will roll down the futures curve and underperform spot bitcoin by the amount of the premium. This is referred to as the roll cost and has resulted in bitcoin futures generally underperforming bitcoin since their launch. As of October 2021, rolling front month futures generated a 1-year return of 325%, underperforming spot bitcoin’s 361% return due to the roll cost embedded in the futures over this period.1

The investment case for bitcoin, in our view, is a more transferrable version of gold; a finite supply asset with a substantial network of users’ that have come to agreement on its value as a form of money that cannot be controlled by a singular entity. Bitcoin’s transparent monetary policy and decentralized control structure has gained substantial interest from investors in the current economic environment of extreme monetary and fiscal stimulus. Many investors believe these aforementioned properties should make bitcoin an attractive hedge to inflation. Additionally, bitcoin’s historical return stream has been very idiosyncratic, delivering positive returns that have been largely uncorrelated to stocks and bonds, improving the efficiency of traditional investment portfolios. While it remains to be seen if bitcoin will maintain this correlation profile as its presence in the financial system continues to expand, these characteristics have piqued the interest of institutional investors, with many hedge funds, endowments, and even pension funds investing in bitcoin in recent periods.

The Global X Blockchain & Bitcoin Strategy ETF: A Holistic and Long-Term Approach to the Digital Assets Theme

The Global X Blockchain & Bitcoin Strategy ETF takes a holistic approach to the digital assets theme by balancing exposure between bitcoin futures and blockchain equities. Over the long term, we believe as blockchain technology advances and digital assets see widespread adoption, there will be numerous beneficiaries, including the companies involved in the blockchain ecosystem and digital assets themselves. Therefore, we designed BITS’ portfolio with the intent of allocating approximately 50% of the portfolio’s notional exposure on average to both bitcoin futures and blockchain equities. The Fund’s blockchain equity exposure is primarily achieved by investing in the Global X Blockchain ETF (BKCH), our thematic ETF providing targeted exposure to publicly traded companies across the blockchain ecosystem, including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration. BITS’ bitcoin futures exposure is actively managed with long term investors in mind, seeking to reduce roll costs and turnover.

Beyond our investment case supporting ownership of both blockchain equities and bitcoin futures, there are several structural reasons why we believe combining these distinct exposures in one fund is advantageous for investors, particularly when compared to approaches that own 100% bitcoin futures. First, targeting approximately 50% bitcoin futures exposure should enhance the fund’s capacity, given futures position limits at the CME. Second, we expect to see reduced turnover given our ownership of fewer futures and less portfolio concentration. Third, we expect to reduce the fund’s taxable distributions resulting from futures ownership at year-end. Fourth, maintaining a smaller allocation to bitcoin futures allows us to be nimbler, navigating the futures market to potentially find better value and reduce roll costs.

Together, we believe the investment case for owning bitcoin futures alongside blockchain equities, combined with the structural advantages of maintaining such exposures together in a fund, and a low management fee of 0.65%, creates a compelling and comprehensive approach to the digital asset theme optimized for long term investors.