Income Outlook: Q4 2021 – Tightening Monetary Policy Driving Rising Rates

The Global X Income Outlook for Q4 2021 can be viewed here. This report seeks to provide macro-level data and insights across several income-oriented asset classes and strategies.

Last quarter we discussed the threat of rising rates amid persistent inflation, and it now appears the Federal Reserve is ready to act. Inflationary pressures are proving stickier amid extended supply chain disruptions and strong demand, causing the Federal Reserve (Fed) to likely quickly tighten monetary policy. The spread of the Omicron variant poses another unknown, but so far is influencing the markets less than the Fed’s hawkish plans. Profitability and valuations are starting to be scrutinized more in the equity markets, with growth sectors like Technology acutely affected. Many investors are looking for segments of the market that can withstand inflation and rising rates, with income investors particularly motivated given their typical overweight to interest rate-sensitive securities.

Key Takeaways:

- Value-oriented segments like Financials and Energy may benefit if inflation remains persistent and interest rates rise.

- Master limited partnerships (MLPs) and preferred stocks are two options for income investors looking to balance exposure to the Energy and Financials sectors with high yield potential.

- Income investors may also find dividend strategies more appealing than before. Its value-like characteristics could be better suited for a period of rising rates.

Equity and Credit Performance in Q4 Was Positive Despite Looming Macro Pressures

Headline inflation accelerated from 5.4% at the end of Q3 to 7.0% at the end of Q4, continuing its massive increase from 1.4% at the end of 2020.1

In response, the Federal Reserve has clearly pivoted to a more hawkish stance, and rate expectations are following suit. The futures curve is pricing in the first rate hike this year to take place in March, with four total by the end of 2022.2 Short term bond yields historically rise when the Federal Reserve begins hiking rates. Asset purchase tapering already began in November 2021, initially reducing Treasury purchases by $10 billion and mortgage-backed securities (MBS) by $5 billion.3 The Fed later announced more aggressive measures in mid-December. Beginning in January 2022, the Fed will purchase only $60 billion in bonds, half its $120 billion a month purchases prior to tapering.4 This aggressive tapering implies an end to its bond buying program by March of this year, when the first rate hike is expected.

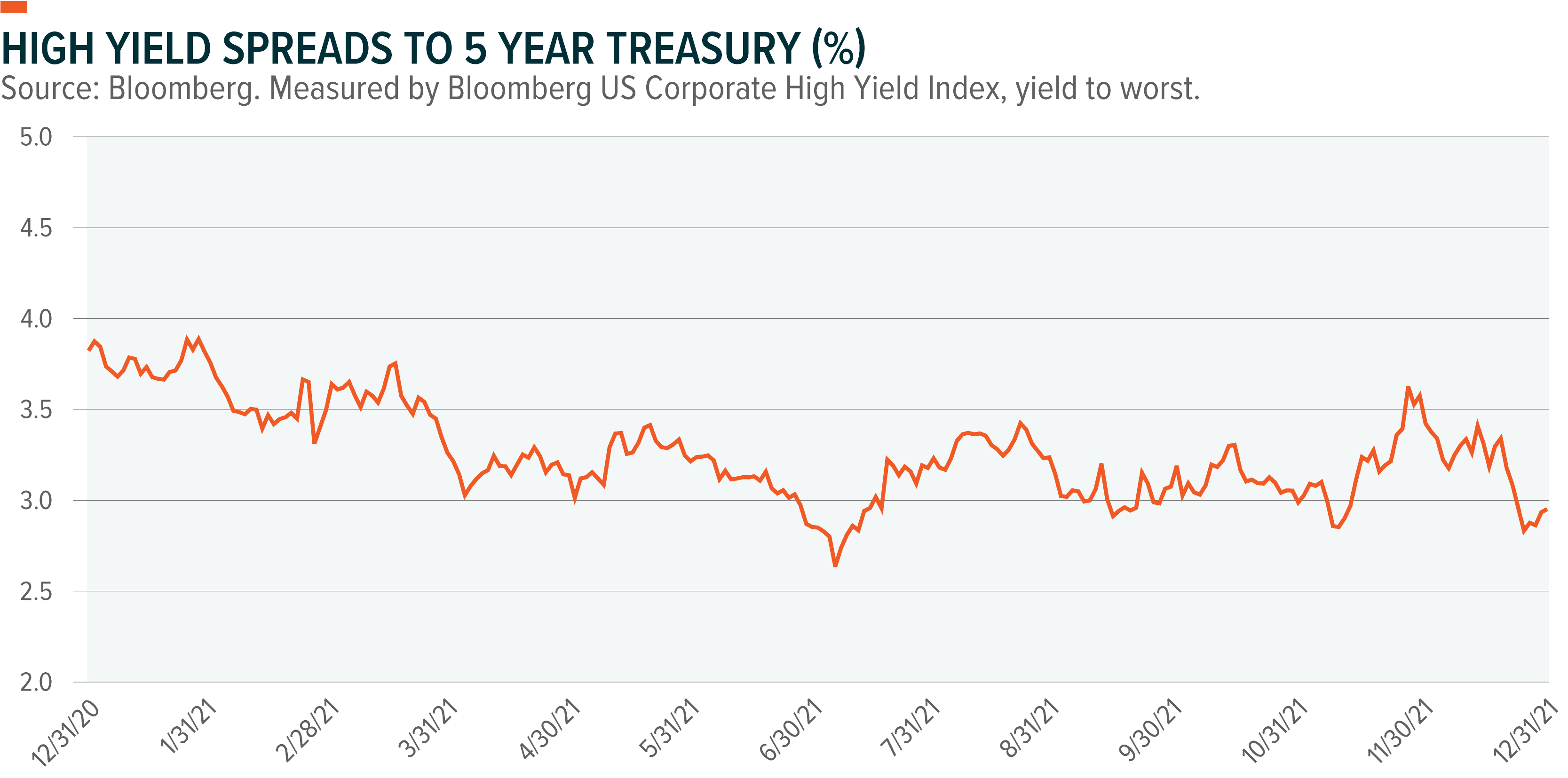

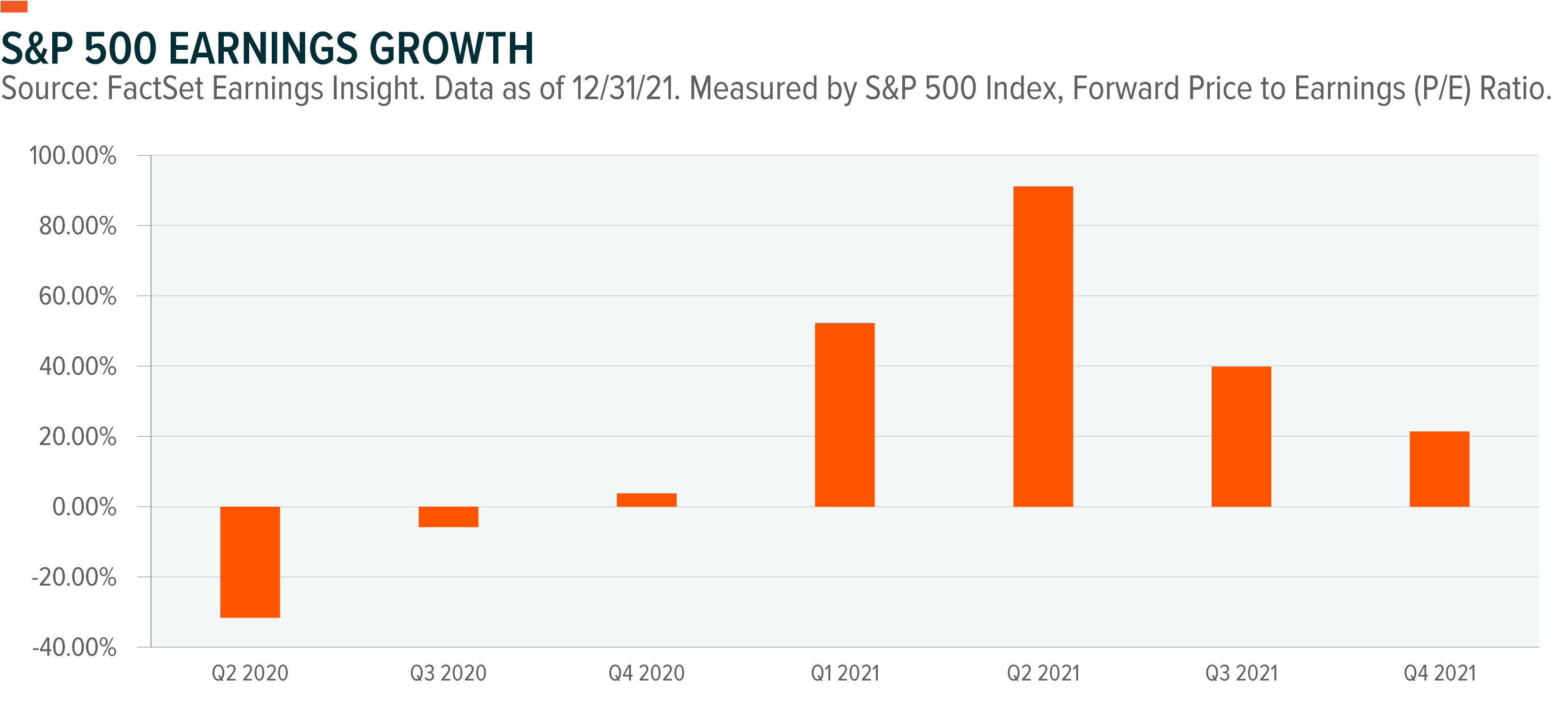

While expectations for a more hawkish Fed are being acutely felt in the early weeks of 2022, their impact on Q4 returns were more of a mixed bag. For example, the Information Technology sector recovered in Q4, returning 16.7% and outpaced all sectors except Real Estate, after the selloff towards the end of Q3.5 But small caps posted just a 2.1% gain for the quarter, as concerns about rising rates negatively affected the segment.6 The appreciation of the dollar helped keep small caps in the green. The Dollar Index started Q4 at 94.2 before finishing at 95.7. The index bottomed for the year at sub-90 in late-May.7 High yield bonds finished Q4 up 0.71%, well outpacing the broader bond market’s return of 0.01%.8 The downward trajectory of credit spreads towards quarter-end boosted high yield bonds. Risk assets across the credit space performed well as a result.

Inflation Leading to Late Cycle Indicators In the Markets

The Fed dropped the word ‘transitory’ from its inflation expectations. Inflation jumped from 1.4% at the end of 2020 to 7.0% at the end of 2021, primarily due to rising energy prices, a tight labor market, and supply chain issues.9 Several auto and tech company executives indicated they still expect supply chain issues to persist for the next year or two, and U-6 unemployment stands at just 7.3% after peaking at 23.0% in April 2020, demonstrating tightness in the labor markets.10 US consumers expect inflation to be in the 6% range in 2022, and 4% over the next three years, according to the New York Fed’s December 2021 Survey of Consumer Expectations report. It is normal that the Fed’s policies will include more aggressive measures like rate hikes and a phase-out of tapering programs to combat elevated inflation. Inflation and rising rates can hurt returns for fixed income investors, making it a key risk.

Options for Income Investors

Energy and Materials could be well-positioned for this inflationary period. Materials companies that mine or process commodities can typically easily pass-through higher costs to their customers. Historically, in higher inflation environments, Materials companies and Commodities futures tend to outperform the broader market because of their greater degree of insulation from inflationary pressures. In the last economic cycle when Consumer Price Index (CPI) growth steadily rose from 1.3% to 5.6% between October 2006 to July 2008, just before the ensuing crash, the returns for each asset class were Commodities: 31%; Materials: 25%; and the S&P 500: -5%; in that time span.11

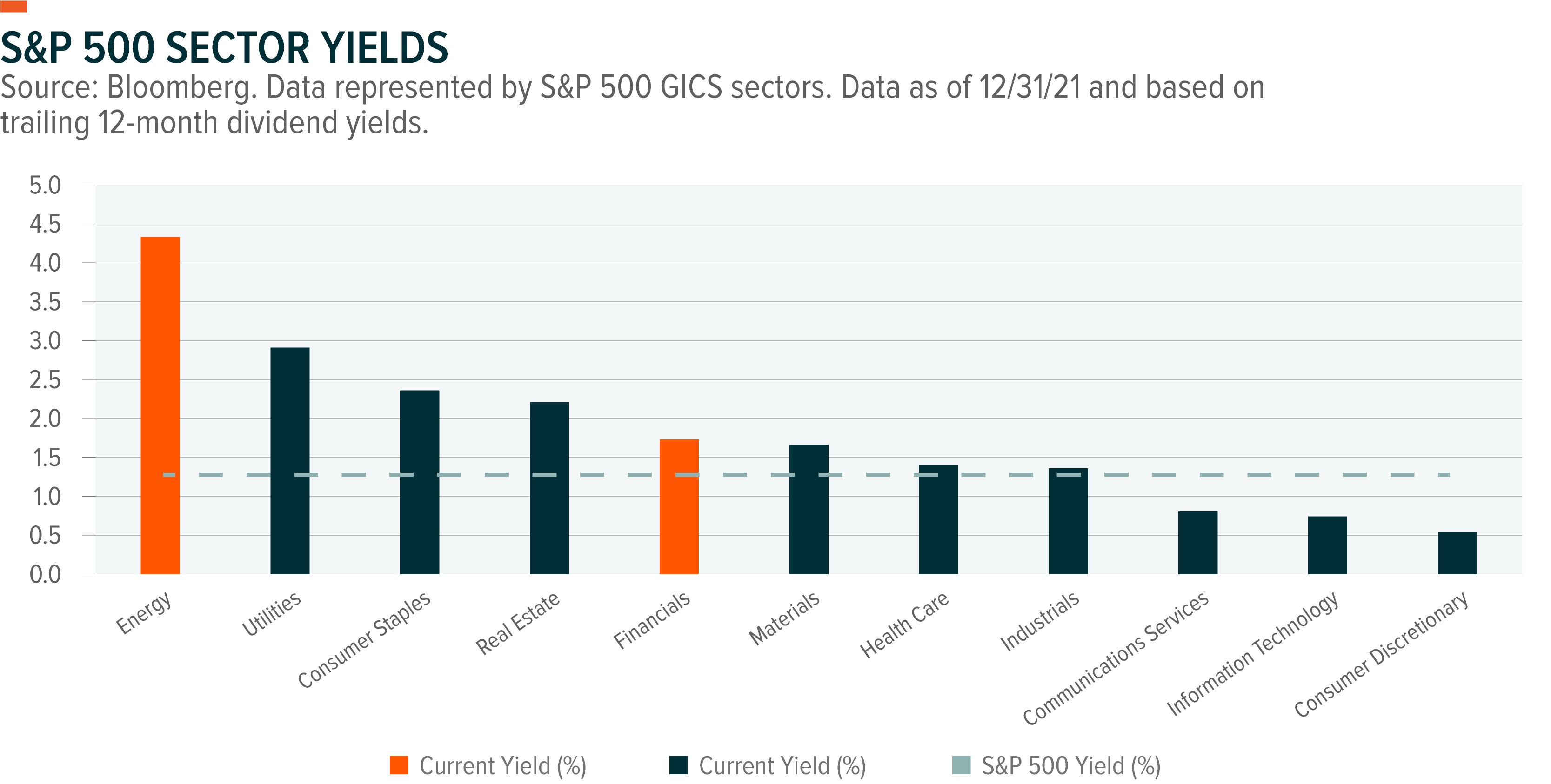

Traditional value sectors like Financials and Energy tend to benefit from rising yields and consumer demand. Banks make loans to consumers and small businesses at longer term rates such as the 30-year mortgage rate, for example. If loan growth picks up and credit quality remains stable, banks may be well positioned to add additional interest income to their books. Duration risk acutely affects other types of fixed income assets investors currently own though, including longer term government bonds and corporate bonds. In a rising rate environment, variable rate preferreds could be a solution for income investors looking to reduce duration risk in fixed income. Variable rate preferreds, for example, offered lower duration of 2.1 years compared to the broader fixed income market of 6.7 at the end of the year.12 Energy companies are generally either directly exposed to oil and gas prices (exploration & production) or indirectly (midstream/pipelines). Oil prices were on an upward trajectory to finish the year, closing at $75 for West Texas Intermediate (WTI) crude oil, after the initial risk-off appetite from the Omicron variant drove prices down the $65 in early December. As inflation remains elevated at 7.0% and oil supply remains curtailed by organizations like OPEC+, there are reasons to believe oil prices could remain elevated throughout 2022. Energy infrastructure equities like master limited partnerships (MLPs) could offer advantages if US energy production continues rising in an elevated oil price environment. Another added potential advantage for income investors is the dividend yields from Energy and Financials companies. As we can see below, these sectors had above-average dividend yields.

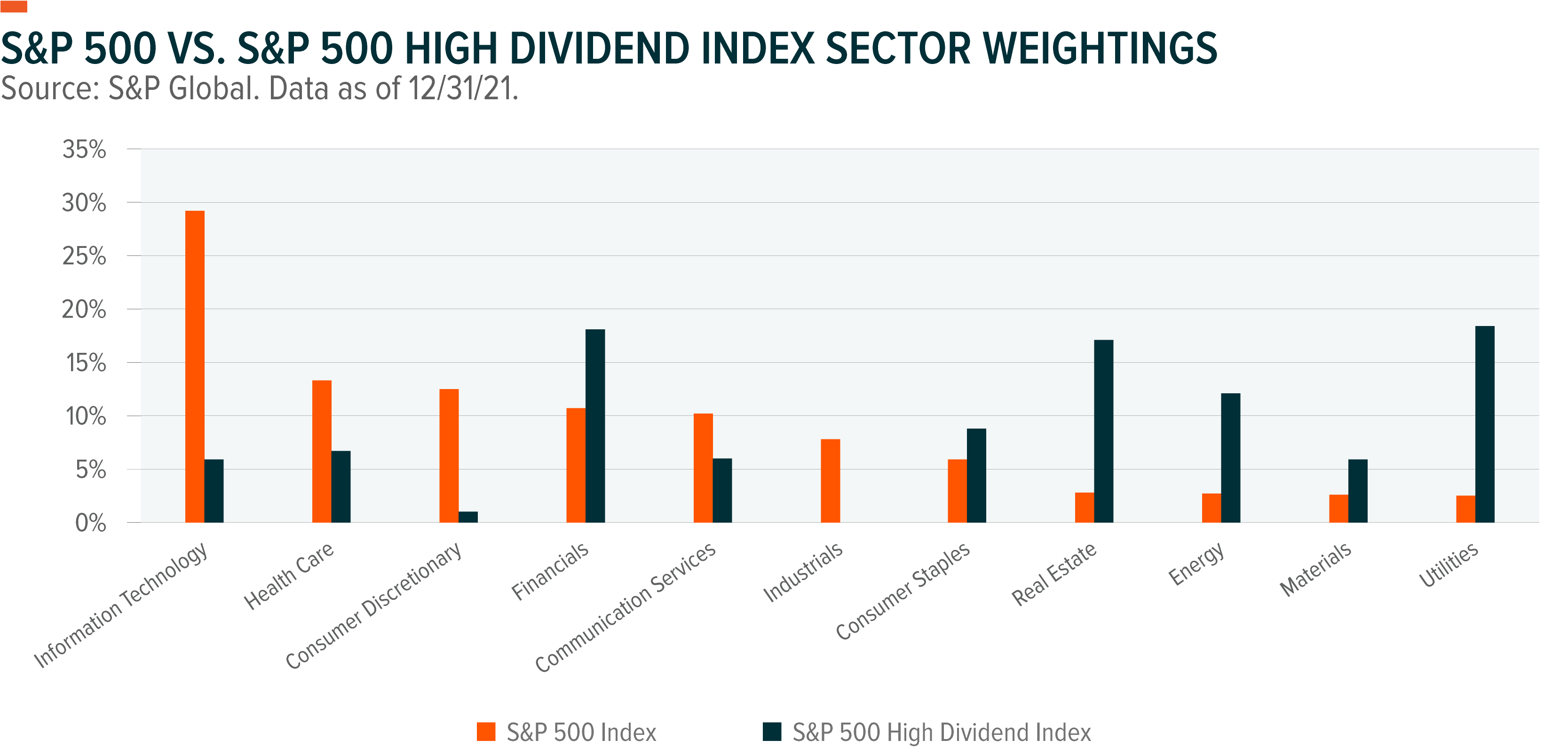

With the shift from growth to value, broader baskets of dividend paying stocks could be an attractive option for investors as well. Dividend paying strategies are often overweight value sectors like Financials, Energy, and Real Estate compared to broad market indices. Just in the past decade, dividends account for 23% of the S&P 500’s total return.13 If earnings growth falls, dividends may begin to account for a larger portion of equity returns.

High yielding international dividend payers are another option with current inflation levels eclipsing US dividend yields. International equities generally struggled in 2021, returning just 8.29% compared to the S&P 500’s return of 28.68%.14 A lack of progress on the vaccination front hampered overseas economies’ economic recoveries. But lower valuations and the potential to catch up in vaccination rates could see international dividend payers thrive in 2022.

Rising inflation makes evaluating dividend strategies particularly important for investors who rely on their dividends for regular cash flow. Companies with strong balance sheets and that can pass through rising costs to customers are likely to see dividend growth keep pace with inflation, whereas others may not. Quality dividend strategies are one way to potentially isolate these types of companies. Quality dividend strategies tend to look for profitable companies with low levels of financial leverage, potentially providing a ballast to uncertain economic factors and avoiding companies with worsening fundamentals.

Defensive Solutions for the Tech sector

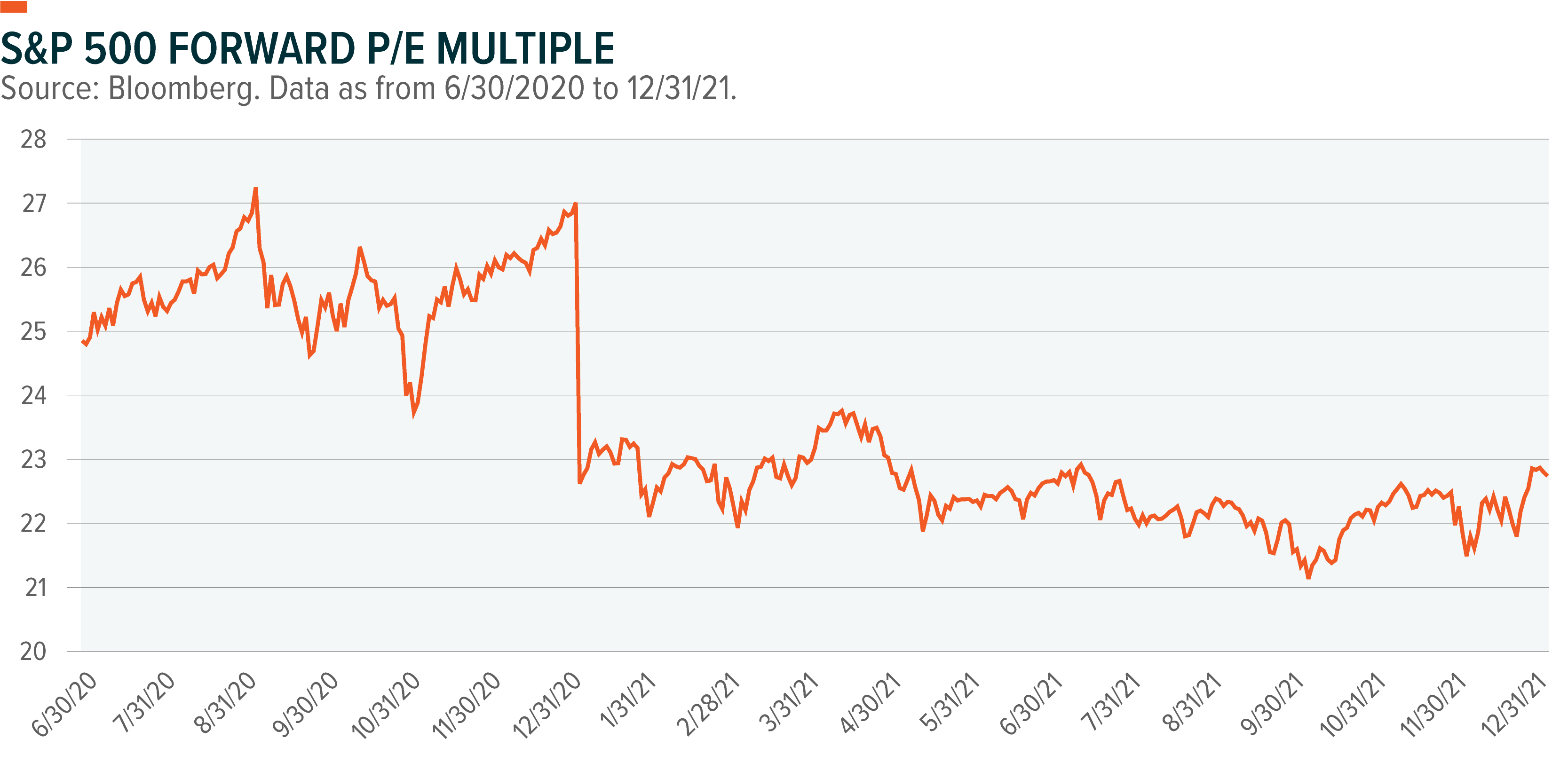

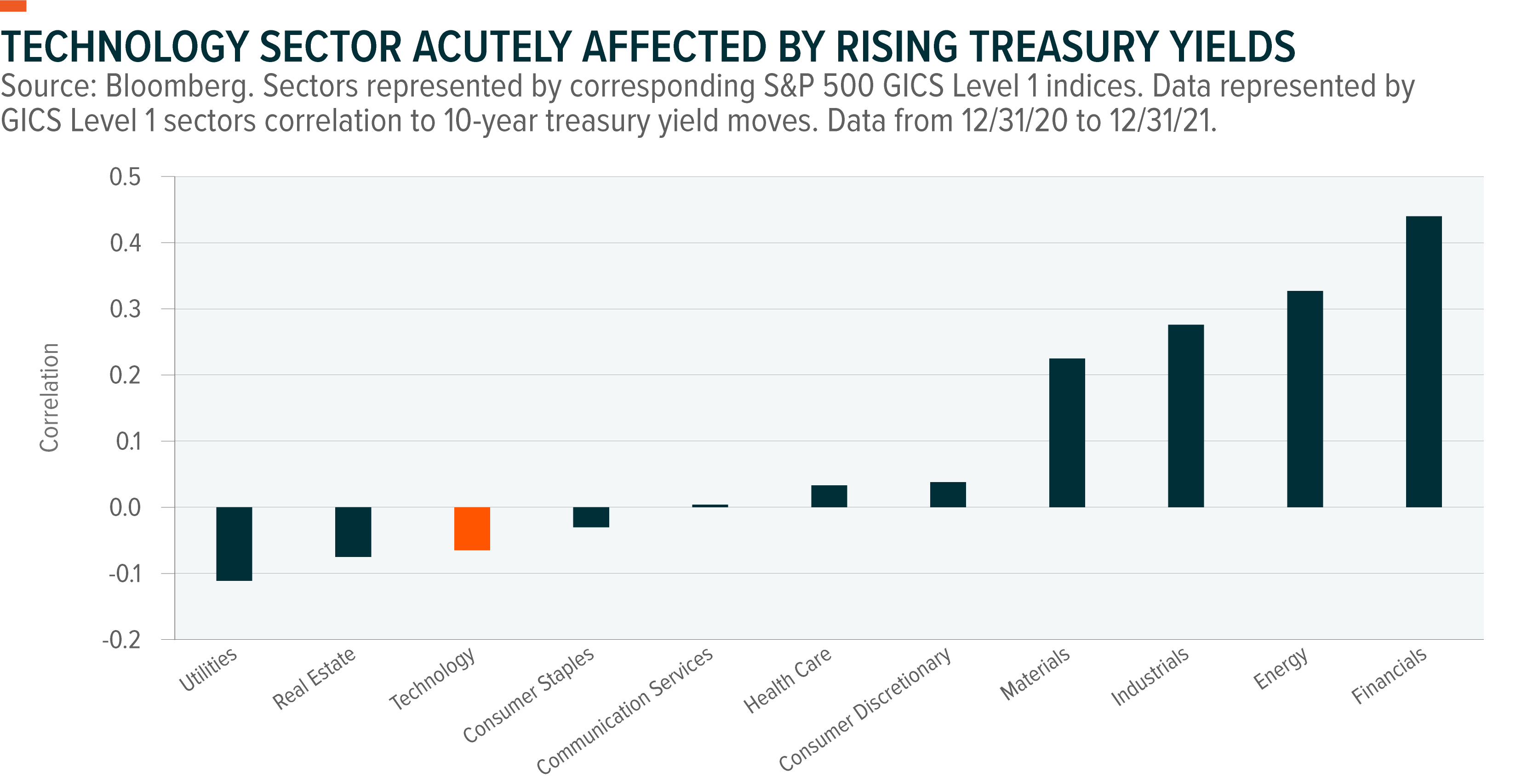

Maintaining long-term tech exposure is still the preferred strategy for many growth-oriented investors. But high valuations, rising rates, and credit spread expansion could provide headwinds for the space. In 2021, the Information Technology sector was among the most sensitive to rising bond yields, only trailing the capital-intensive Utilities and Real Estate sectors.

More profitable tech companies may be able to withstand interest rate increases, particularly if their business models are able to maintain strong earnings growth, but some of the higher growth, unprofitable companies could be at greater risk. This could make risk management strategies for Tech-oriented funds a route for investors in 2022 to play this sector. Examples of this include put option protection that can mitigate downside risks or covered call strategies that seek to monetize volatility.Conclusion

Conclusion

Fed communication makes it clear we should be prepared for rates to rise this year, with potentially four hikes forecasted by the market. Most assets have exhibited positive performance with low rates because credit spreads dropped, and valuation multiples expanded. The good news for investors is there are asset classes and strategies designed for these types of inflationary and late cycle environments. Value sectors like Financials and Energy, as well as commodity assets like oil and copper have responded well late cycle when inflation picks up, based on historical precedent. Growth assets like Technology shouldn’t necessarily be eschewed, but may warrant using risk management techniques for the sector. We may not see the broad risk asset rally like we have for the past decade, but investors can seek to appropriately position their portfolios in a rising rate environment like this.

Related ETFs

MLPA: The Global X MLP ETF invests in some of the largest, most liquid midstream Master Limited Partnerships (MLPs).

MLPX: The Global X MLP & Energy Infrastructure ETF is a tax-efficient vehicle for gaining access to MLPs and similar entities, such as the General Partners of MLPs and energy infrastructure corporations.

PFFD: The Global X U.S. Preferred ETF invests in a broad basket of U.S. preferred securities, providing benchmark-like exposure to the asset class. It seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the ICE BofAML Diversified Core U.S. Preferred Securities Index.

SRET: The Global X SuperDividend REIT ETF (SRET) invests in 30 of the highest yielding REITs around the world.

QRMI: The Global X Nasdaq 100 Risk Managed Income ETF (QRMI) invests in the securities of the Nasdaq 100 with a 1-Month 5% Out-of-the-Money (OTM) Put and 1-Month At-the-Money (ATM) Call net credit collar option overlay in an effort to generate income while providing a floor on potential losses.

Please click the fund names above for current fund holdings and important performance information. Holdings are subject to change.