Health & Wellness 2.0: At-Home Fitness & Preventative Health Take Centerstage

The Health and Wellness theme experienced remarkable disruption in 2020. Pandemic-induced lockdowns and social distancing brought the world to a standstill, giving way to the Stay-at-Home Economy. Gyms shuttered, fitness classes ceased operations, and health-focused stores closed their doors. Forced to look elsewhere for physical activity and wellness goods, consumers embraced at-home fitness and turned to digital mediums for health and wellness-related products and services. Beyond this, infection fears and a growing body of evidence correlating overall health and disease-severity are underscoring what most already knew – that lifestyle choices meaningfully impact one’s long-term health.

In the following, we delve into the new paradigm for health and wellness in the wake of the pandemic, identifying key changes in the industry and exploring why we think the theme is an attractive long-term investment opportunity. Key focus areas include:

- Streaming and on-demand fitness services/applications

- At-home fitness equipment

- Athleisure and e-commerce

- Preventative health approaches and nutrition

At-Home Fitness Reshapes Business Models

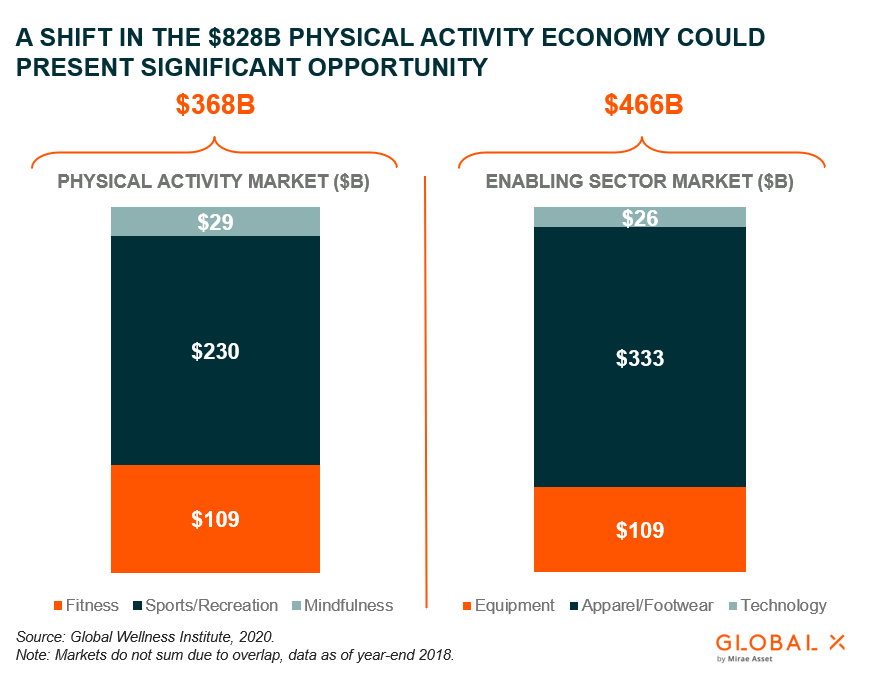

At-home fitness equipment and classes are by no means a novel concept. Despite their long history, the COVID-19 pandemic could represent an inflection point for their place in the $828B physical activity economy.1

In 1958, the hula hoop sold over 100 million units in six months, advertised as at-home exercise equipment, and throughout the 1980s, Jane Fonda and Richard Simmons sold tens of millions of workout VHS tapes.2 As new technologies emerged – first the television, then the VHS player, and finally the internet – at-home fitness segments steadily grew. Despite this success, however, the market for health and fitness clubs reigned supreme. Global health club revenues reached $96.7B in 2019, growing 16.4% (+$13.6B) from 2016 levels, or by a 5.2% compound annual growth rate. Membership increased 14% to 184 million people over the same period.3,4 For comparison, the Global Wellness Institute reports that in 2018, at-home streaming/on-demand fitness spend totaled $5.5B across 28.8 million people.5

But as was the case across most sectors and industries, the events of 2020 inalterably reshaped the ecosystem for fitness services. The gym and health club industry came crashing down with revenues plummeting 58% and 17% of U.S. facilities permanently closing.6 Gold’s Gym, 24 Hour Fitness, and Town Sports International, the owner of New York Sports Clubs, all filed for bankruptcy.7 Yet, brick-and-mortar losses were at-home fitness’ gains. Subscriptions to digital fitness services and at-home fitness equipment soared on the back of unmet health-related consumer demand, heightened digital content delivery, and accelerated e-commerce.

2020 U.S. health and fitness app installs grew 23% year-over-year (YoY) to reach 409 million, exceeding the 3% YoY rate seen in 2019 and grossing $837M.8 Top 10 installed apps included Under Armour’s MyFitnessPal and Map My Run, Weight Watchers International’s WW app, and eponymous apps from Peloton International and Planet Fitness.9 Notably, some gyms like Planet Fitness, which rolled out digital experiences for existing and new non-brick-and-mortar members, endured closures without filing for bankruptcy. In Planet Fitness’ Q4 earnings call CEO Chris Rondeau noted that “more than 20% their [$5.99 digital-only service] PF+ are non-Planet Fitness visit members, and more than 20% of them have since become brick-and-mortar members.”10 For gyms to compete in this new paradigm, it is becoming imperative that they offer digital services to complement to their in-person experiences.

Many consumers sought to continue their pre-pandemic fitness regimens and purchased at-home fitness equipment through e-commerce channels. NPD Group estimates that the global at-home fitness equipment market grew 40% YoY in 2020, reaching $9.5B.11 Different than the bulky home-gym equipment of the 1990s (or the hula hoop for that matter), today’s equipment shares more DNA with our smartphones. It’s smarter, more compact, and suitable for homes or cramped apartments. Embedded IoT sensors and connected chips track users’ workouts and monitor vitals, generating data that artificial intelligence can use to create personalized and dynamic workout experiences. Internet connectivity allows the equipment to stream fitness classes or movies and TV shows.

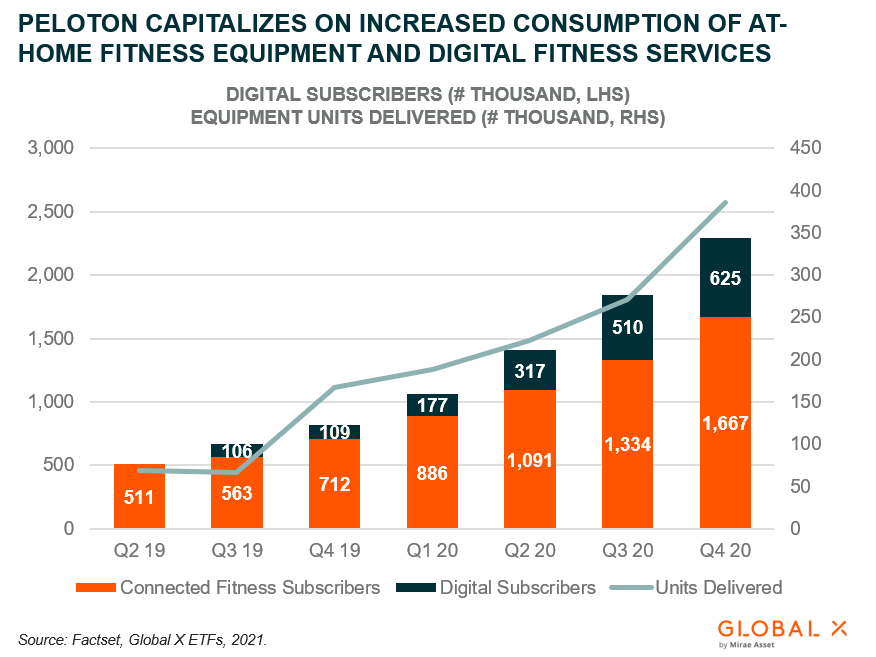

The biggest winners of the fitness paradigm shift are companies that sell digital fitness services and at-home equipment as both complementary and independent offerings. Peloton, the leader in the space since launching its connected stationary bicycle in 2014, saw revenues grow 139% YoY in the 2020 calendar year. Their stock price increased 433% over the same period.12 As of today, Peloton’s product offering includes two price-point variations of their signature connected stationary bike and connected treadmill. Both product-lines feature mounted screens that stream live studio classes and are available to users via a monthly digital subscription (Connected Fitness Subscription). Additionally, they offer live, equipment-free classes via subscription through their mobile app (Digital Subscribers) and allow for integration with health-tracking wearables across all their products.

Within the context of the pandemic, Peloton’s product portfolio optimally positioned them to capitalize on accelerating at-home fitness trends. But more importantly, synergies between their products and services, alignment with disruptive technology trends, and their innovative approach to user engagement establish a long-term growth case for them and peers with similar models.

Digital subscription services establish recurring revenue streams that offer consistent cash flow, even when equipment sales might lag. This is particularly important to fitness companies as product cycles around a stationary bike or a treadmill could be a decade or longer. Additionally, integration with wearables, live and on-demand content, and consistent updates keep the experience fresh and relevant. If done right, this can turn customers into fans rather than just subscribers. And finally, high upfront expenditures on equipment (a new top-line Peloton bike costs $1,895) and consistent customer engagement fortify member retention, making recurring revenues more resilient – this is evident by Peloton’s miniscule monthly 0.8% churn rate. 13

With the post-pandemic ‘New Normal Economy’ in sight, one might fairly ask if the at-home fitness trend will continue or if the fitness industry will revert to its pre-pandemic state. We think the answer is somewhere in between. In our view, the fitness industry will become a hybrid of traditional brick-and-mortar and at-home models. We expect that this will partially be consumer-driven as convenience, reduced health risks, and synergies with disruptive technologies and consumer trends like wearables reinforce the staying power of at-home fitness. According to a recent TD Ameritrade survey, 59% of Americans do not plan on going back to the gym after the pandemic.14 And for those that do return, a separate survey found that 87% plan on continuing to work out at home.15

We also expect businesses to embrace the hybrid model to recognize the benefits of digital content delivery while building resilience to obsolescence and idiosyncratic events. Finally, we believe the total addressable market for fitness is larger than ever, driven by an expanded at-home fitness offering and a shift toward preventative health, which we will discuss later in this piece.

Athleisure: Clothing for Performance & Comfort

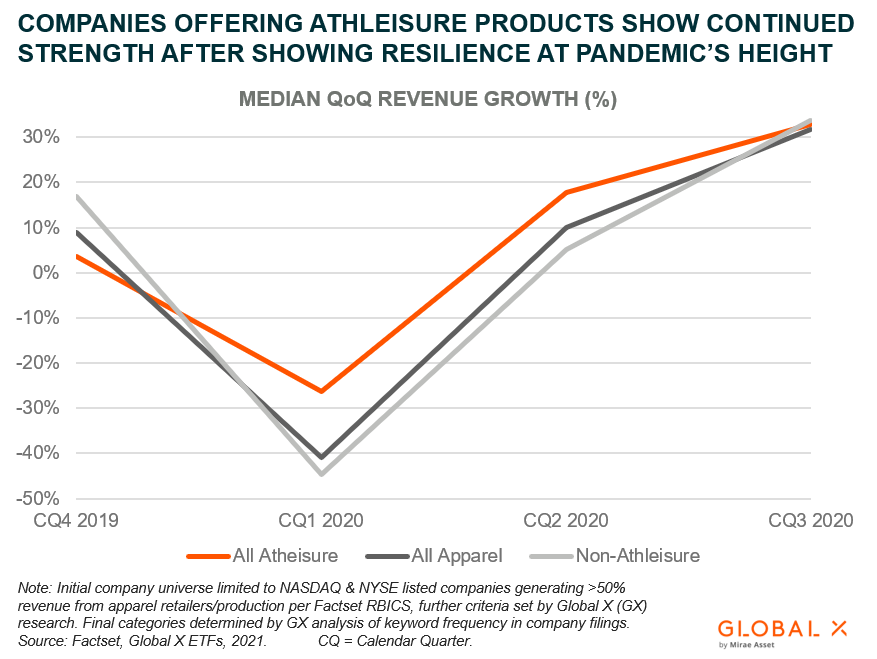

Unique characteristics of the pandemic benefitted athleisure within the apparel segment. It solidified the segment’s position as hybrid athletic-comfort wear and expanded its reach as consumers eschewed traditional work outfits amid work-from-home mandates.

Global apparel revenues were estimated at $1.4T at the end of 2018, with approximately $333B attributed to fitness apparel.16,17 And within fitness apparel, athleisure made up roughly over 40% of sales.18 The apparel industry was growing steadily, albeit fitness apparel and athleisure’s share of the industry’s overall revenue mix increasing.

In 2020, however, apparel sales plunged. Consumers were stuck at home, no longer shopping for the latest fashion trends or work clothing amid social distancing and office closures. According to Boston Consulting Group, industry revenue losses may have totaled $640B, representing a YoY decrease of more than 1/3.19 Longtime retail giants like Neiman Marcus Group, J.C. Penney, J. Crew, and Brooks Brothers filed for Chapter 11 bankruptcy protection.20

Athleisure categories concurrently thrived as consumers purchased clothing suitable for work-from-home and at-home fitness through digital channels. According to NPD Group, sales of sweatpants increased 17% in 2020, and from March to July, active shorts and sports bras were up 3% and 7%, respectively.21,22 Most retailers still struggled due to brick-and-mortar closures, but those with significant omnichannel e-commerce presences and athleisure offerings bounced back quickly.

Nike, for example, set a goal for 30% of sales to come from e-commerce channels by 2023. Their initiative paid off. Though sales were down at the height of the pandemic, Nike reported $11.2B in revenues in the fiscal quarter ending in November 2020, representing 9% YoY growth and a 78% recovery from their quarter ending in May.23 Digital sales were up 80% over the quarter and e-commerce’s share of total revenues exceeded their 30% goal – three years earlier than planned.24 Lululemon rebounded in a similar fashion. After enduring a first quarter when sales fell 53% sequentially, second quarter revenues rebounded 38%, driven by a 157% YoY increase in online sales.25

With the post-pandemic New Normal Economy nearing, we expect retailers to further expand their athleisure offerings and digital sales efforts to adjust for a long-term shift to hybrid remote work-from-home arrangements and continued e-commerce penetration. Already, Gap’s subsidiary Old Navy noted recently that it offered 55% more activewear at the end of last year.26 Retailer L.L. Bean is similarly adjusting their strategy, expanding their athleisure offering and partnering with Zappos.com to sell footwear on their e-commerce footwear platform.27

Preventative Healthcare Entails a Holistic, Consumer-Driven Approach

COVID-19 is accelerating the shift to preventative healthcare and increasing the importance of consumer-driven health and wellness. The pandemic facilitated digitization and virtualized treatment within the healthcare sector – two transformations that are proving essential in the shift to proactive and preventative care.

Consumers have more access to healthcare professionals and health data than ever and can utilize these tools to make more informed and personalized health decisions. We anticipate an increased convergence of preventative medicine and holistic health that should increase the consumption of active and healthy lifestyle products and services. We also expect the palpable nature of the pandemic to drive real progress on public health efforts to improve overall health, particularly given the positive correlation between comorbidity and COVID-severity.28,29

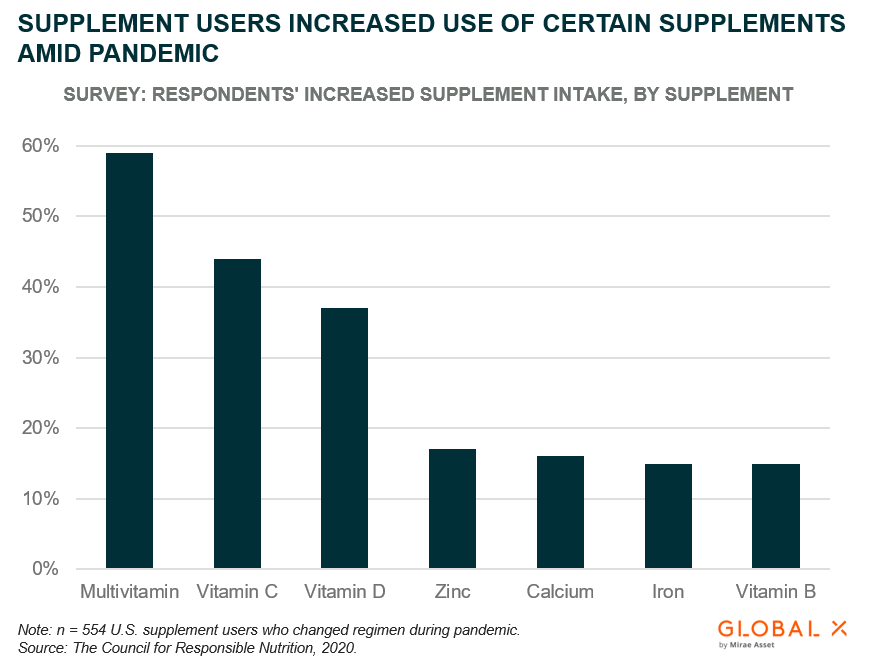

Many consumers are already making changes to their nutritional regimens, or plan to in the future. A recent survey conducted by the Council for Responsible Nutrition reported that 73% of Americans take dietary supplements and 30% of this cohort increased their supplement intake in 2020.30 Primary rationales for increased intake included immune support and general health and wellness benefits.31 Separately, a survey conducted in May 2020 found that 73% of global consumers plan to eat healthier as a result of COVID-19.32

Companies selling nutritional supplements and health foods are already seeing these changes translate to revenues. Supplement retailer Herbalife Nutrition’s most recent earnings release noted that the $5.5B revenues it recognized in 2020 were the most in the company’s 40-year history. Looking at historical annual revenue growth, 2020’s 14% YoY rate was the most since 2013.33 Health food grocer Sprout’s Farmers Market saw similar success. Their 2020 revenues of $6.5B exceeded any prior year, reaccelerating to 15% annual growth after multiple years of declines.34

In our view, these trends will continue as preventative and personalized health approaches become more prevalent and as e-commerce expands the reach of health and wellness products.

Conclusion

The winners and losers of the COVID-19 pandemic within the health and wellness ecosystem will likely define the industry’s next decade. We believe the New Normal Economy represents an inflection point where businesses that furthered disruption, embraced digital transformation, or capitalized on changing consumer habits are primed for success. In our view, investors should take notice of approaches that capture this universe of companies and invest for long-term growth.

Related ETF:

BFIT: The Global X Health & Wellness Thematic ETF (BFIT) seeks to harness the effects of changing consumer lifestyles by investing in companies geared toward promoting physical activity and well-being.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.