Harnessing Implied Volatility as a Leading Market Indicator

Equity market performance is predicated on an array of factors. Among them are things like monetary policy, hard economic data, and geopolitical events. These are the forces that help dictate corporate earnings power and the premiums or discounts that might be necessary to apply to stock valuations and other financial instruments. They are also the indicators that play a pivotal role in the establishment of general investor sentiment, a measure characterized by market volatility. In this piece, we seek to investigate the inputs that are used in the construction of broad index implied volatility measures. In doing so, we endeavor to show how their ability to gauge investor sentiment can make them dependable leading indicators of broad market direction and worthwhile considerations in investment decisions.

Key Takeaways

- There are a wide variety of inputs that factor into characterizing market volatility. Today, the most prominently followed gauges of the measure, including Cboe’s VIX, harness options pricing data to assess investor sentiment about future performance.

- Volatility measures may often be thought of as lagging indicators, in that they respond to disruptive market forces. However, they can also represent meaningful predictors of near-term performance, considerably influencing the investment decision.

- Recognizing volatility’s value as a leading market indicator, investors can gain an effective tool in scenario analysis that might be used to identify hedging and tactical trading opportunities. Historical tendencies associated with the measure might also be considered in anticipating future levels of volatility.

The VIX Put a New Spin on Volatility

The Cboe Volatility Index (VIX), widely considered to represent one of the most trusted gauges of investor sentiment, is defined as a measure of implied volatility of the S&P 500 Index (SPX) over the coming 30 days. It made its debut in 1993 as the first real-time volatility index based on S&P 500 Index options. This feature helped it gain acclaim as a point of reference for volatility. It also inspired the creation of alternative volatility indexes tracking commodities, currencies, fixed income instruments, and equities, among others.

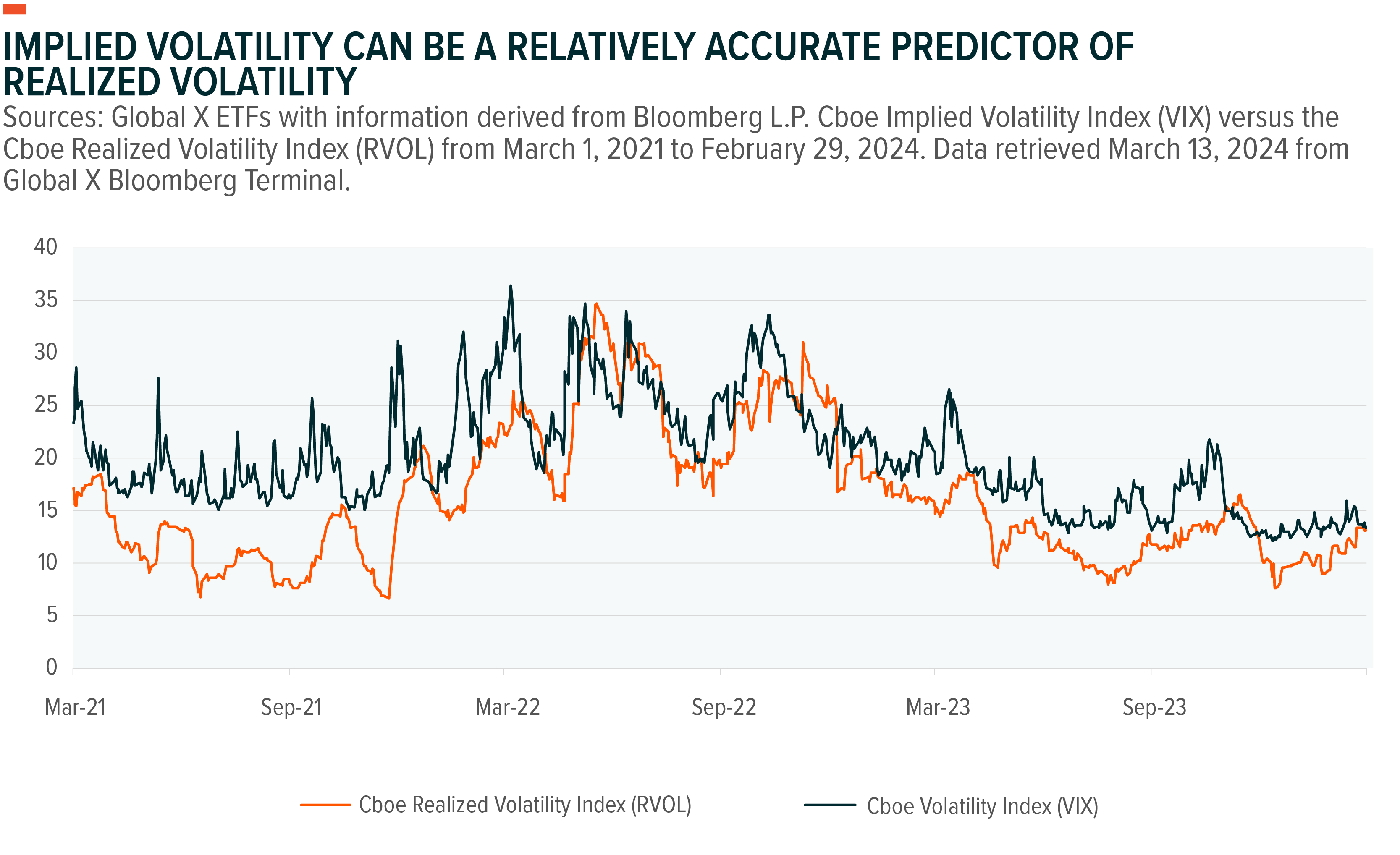

The VIX is determined using SPX options with times to expiration ranging from 23 to 37 days out into the future. It derives its value from the pricing of these options, the variance of their respective strike prices, and the risk-free interest rates presented by the yield curve.1 Historically, this makeup has led the VIX to represent a decent predictor of realized volatility. Notably, however, implied volatility has been known to receive a premium from investors, maintaining a value roughly three points higher, on average, to that of the Cboe Realized Volatility Index over the last ten years.2

Volatility Gauges Are Effective Leading Market Indicators

The makeup of most modern volatility indexes uses an array of option contracts to derive value. With this in mind, investors can take the relationships that generally hold true across the options trade and apply them to these data sets in their various forms of analysis. One of these relationships, which investors often weigh intuitively, is the general inverse relationship that exists between volatility and underlying asset performance. Indeed, that relative uncertainty surrounding future cash flows might lead to greater oscillation in equity price returns, and affect investor sentiment as a result, is a fairly easy concept to grasp.

Correlation metrics between the S&P 500 and the VIX tell the tale of the tape, checking in at -0.667 at the end of 2023, based on data going back to the VIX’s inception in 1993.3 Examining the frequency of volatile trading days versus the relative price performance of the underlying S&P 500 Index in that same year can also help demonstrate this relationship.

Investors should be aware, however, that while a spike on the VIX, or any other measure of volatility operating under a similar methodology, might seem solely incidental, it is in fact designed to tell a story about what degree of price volatility investors can anticipate in the future. This can be put into context by examining the average level of the VIX on a monthly basis versus the frequency of S&P 500 returns without any directional bias across various intervals in the month to follow. What we can see is a pattern illustrating that the higher the average value of the VIX in a given month, the more widely in price we can expect the underlying S&P 500 to trade in the following month.

Investors Have Opportunities Under Falling and Rising Volatility Regimes

Operating amid today’s investment backdrop, there are plenty of levers being pulled that could leave investors feeling bullish or bearish about the future for equities. However, if we continue to look at the VIX as an example, and examine its positioning against recent trends, we can take the temperature of the underlying S&P 500 and potentially draw some conclusions.

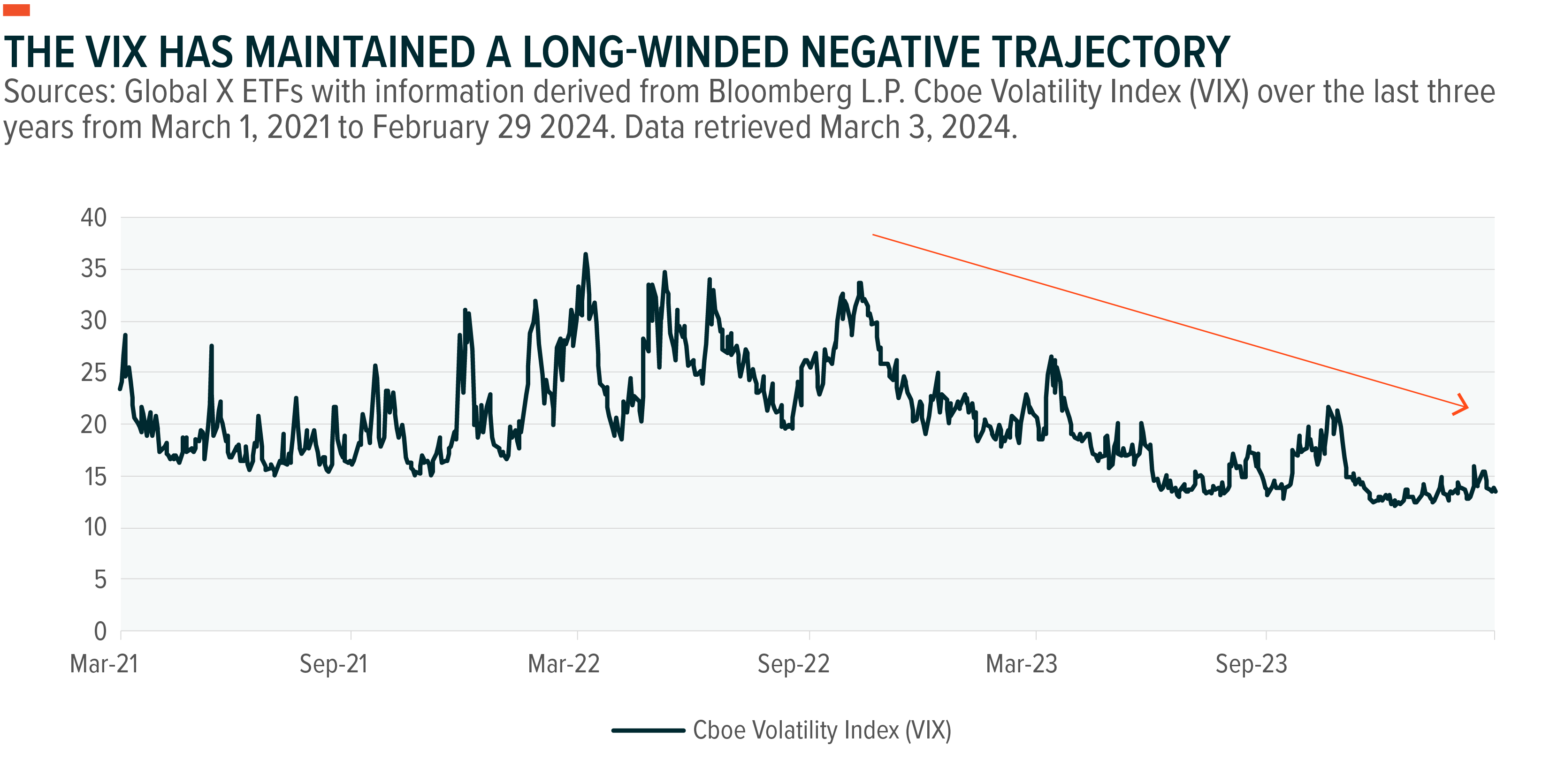

First, looking at the trends that have led us to the present, the negative correlation that exists between the VIX and the S&P 500 has been on prominent display for more than a year, with the market’s rally beginning in October of 2022 and running through the first quarter of 2024 being met by a consistent negative trend for the VIX.

Had investors been tracking the VIX as this chain of events had unfolded, it’s possible that they would have been inclined to maintain their long holdings in the underlying constituents of the S&P 500. In fact, with the VIX now tracking in the 13.40 vicinity, versus its five-year average of about 21.24, investors can probably draw a similar conclusion about the S&P 500 over the coming thirty days.4

Volatility cannot remain depressed in perpetuity, however. At least from a historical perspective, the figures that characterize market volatility have tended to revert to their respective means. And though this implies that the underlying markets may proceed to move negatively, or correct, it does not mean that there is an environment on the horizon where investors have no opportunity to reap value. Indeed, if we key in on one of the other core relationships involved in the options trade, which is the positive correlation that exists between volatility and option premiums, we can see that backdrops featuring rising volatility offer investors the opportunity to sell options at higher premium values to drive returns.

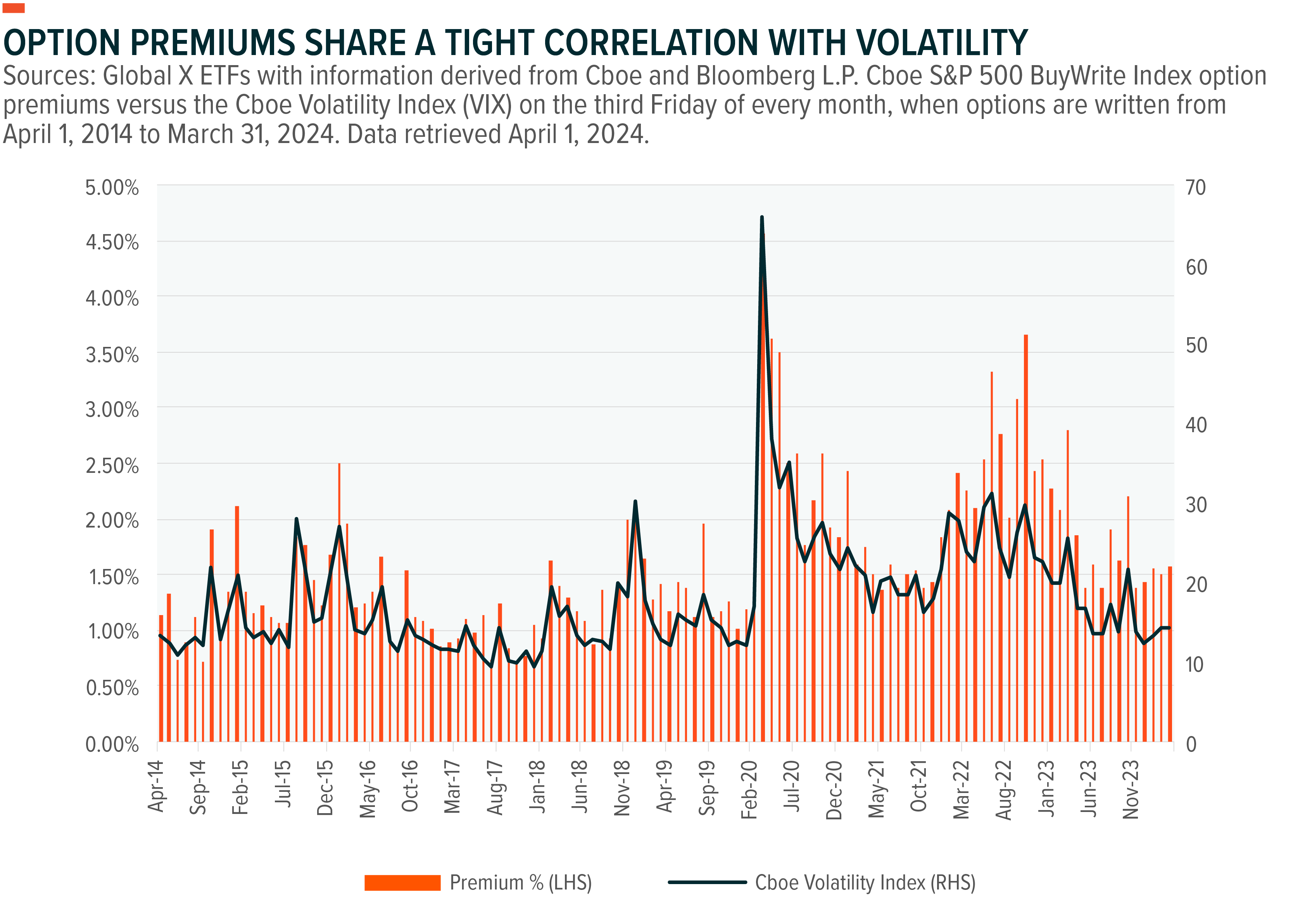

Looking at the chart of option premium values associated with the Cboe S&P 500 BuyWrite Index (BXM) below, which is an index that seeks to write monthly covered calls on the S&P 500, and comparing how they trend relative to the Cboe Volatility Index, a positive correlation might be discerned with the naked eye. Boiling the relationship down to a single figure, however, the positive correlation between these premium values and the VIX dating back over the last ten years is about 90%.5

An important consideration to call back to at this juncture is the tendency for implied volatility indexes to overstate the amount of volatility that is embedded in the markets relative to what volatility might look like when it is realized. This deviation contributes to the effectiveness of the option writing strategy, where the investor is often selling a contract based on a value that, when realized, is smaller than that which was implied.

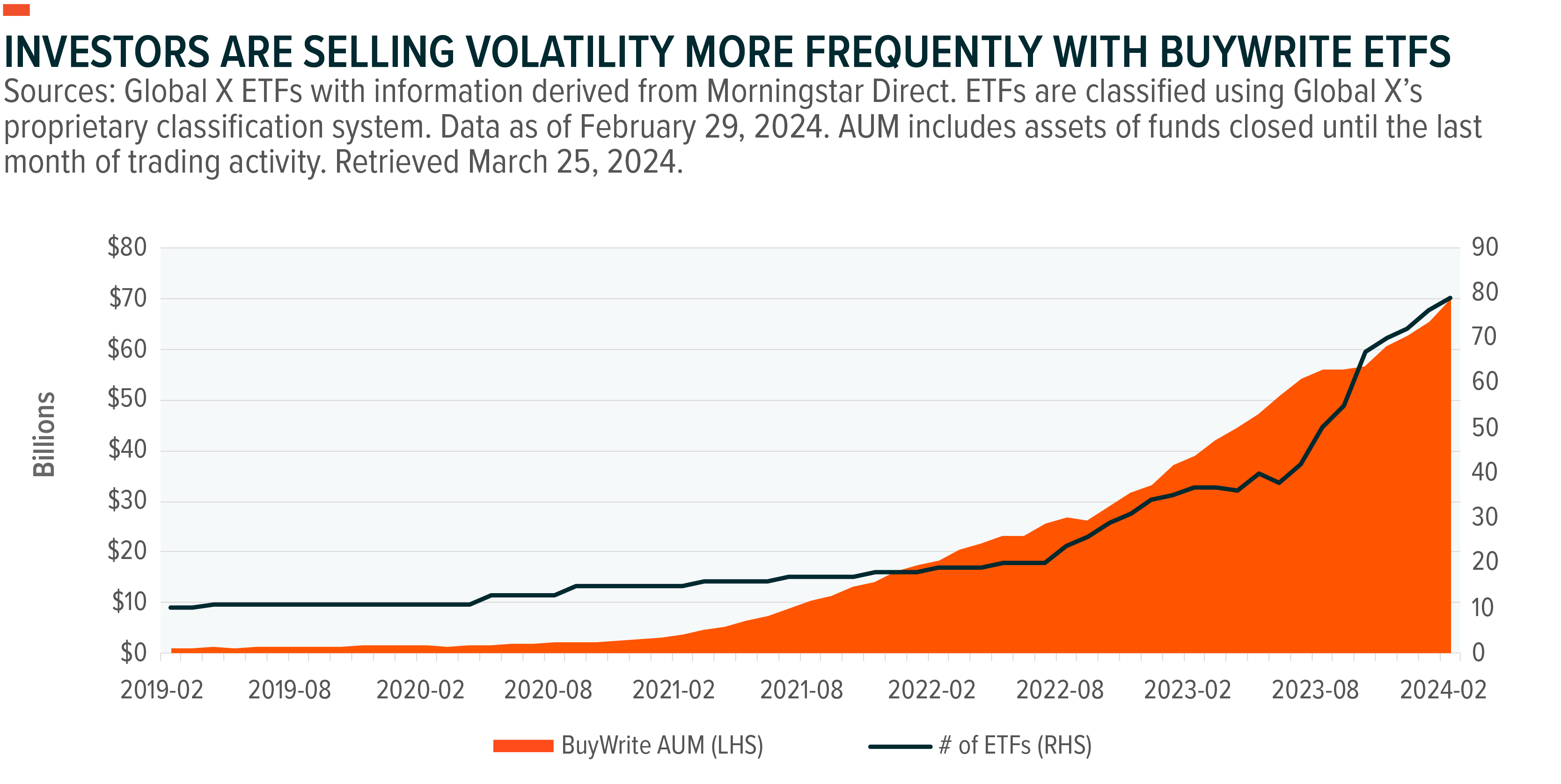

Selling volatility has become so popular, in fact, that it has even led to some extraordinary proliferation across the ETF landscape, particularly as it pertains to funds engaging in derivative income-based strategies like covered call writing and put writing. Indeed, over the last two years, the number of funds launched with an aim at generating income using derivative buywrite strategies has grown more than 4x, to about 80.6 For the whole of 2023, investment flows associated with these fund types exceeded $29 billion, contributing to what has become a total of almost $70 billion in assets under management by the end of February, 2024.7

Historic Volatility Trends May Promote Opportunities on the Horizon

Investors can learn a lot by examining the sequential trends and relative values exhibited by the major market volatility indexes. However, to turn this into actionable information it would be prudent to gain an understanding of how these measures are expected to move in the future, as well. Recognition of the mean-reverting tendencies exhibited by the volatility gauges is a good start, outlining the likelihood that volatility will bounce back from recently depressed levels over the long haul. This information might be combined with some other trends exhibited by volatility gauges like the VIX to add meaningful support to the investment decision.

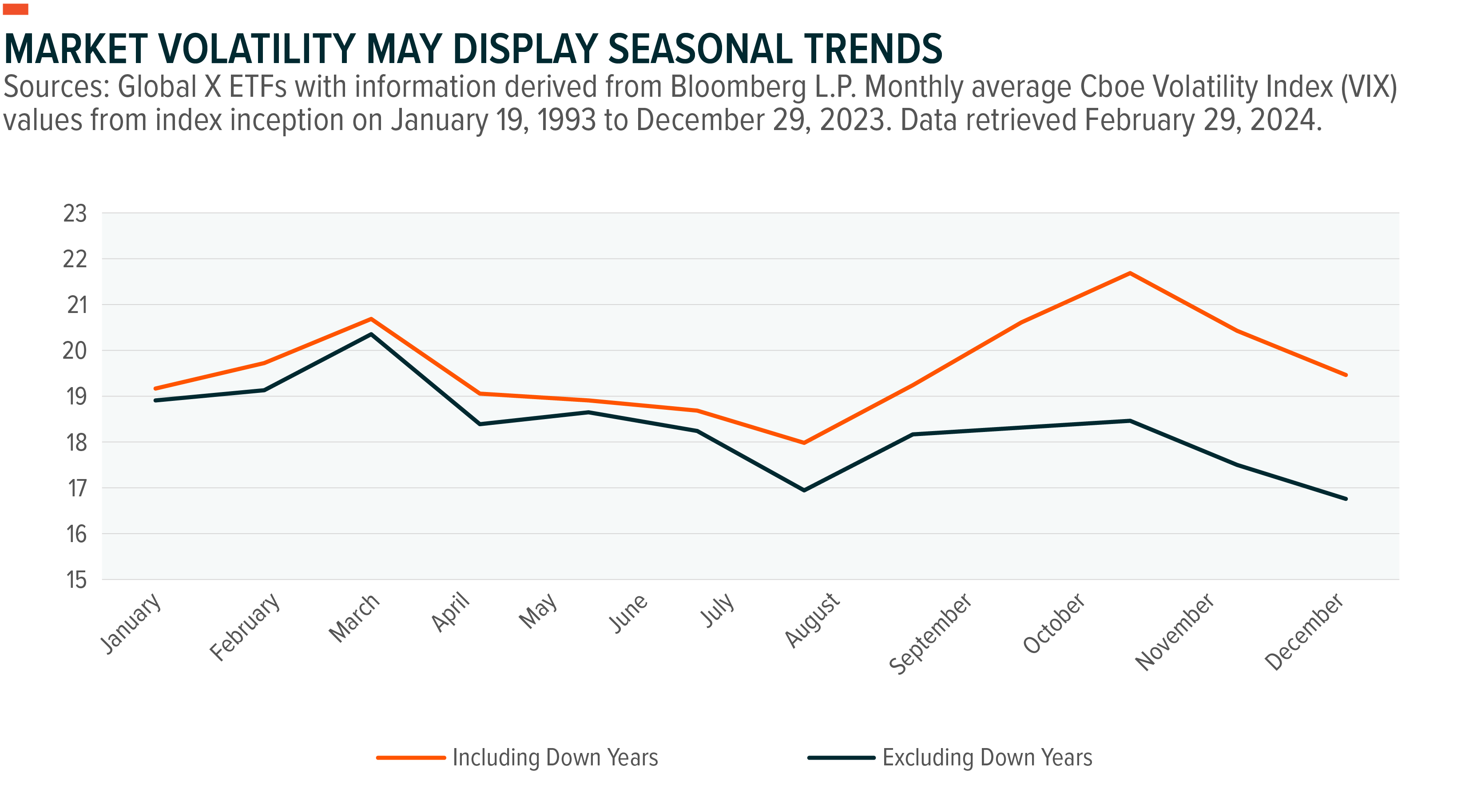

Much as is the case with some core segments of the market like commodities and retail, volatility has shown a propensity to demonstrate some seasonally cyclical behavior. Examining the chart below, we can see that traditionally the VIX tends to rise moving through the first quarter before moderating heading into the summer, and then rising again as the calendar turns to the fall. Since we’ve established that the VIX tends to spike when markets trend down, we’ve included in our presentation both a reflection of all available data, as well as one that removes the impact of down-market years. Even to date, in 2024, when market volatility has proven largely depressed by historical standards, the first quarter has still fit the bill for this pattern.

Gaining an understanding of this cyclical pattern might help an investor recognize when a market rally is nearing an end. It could also help with positioning, imploring investors to take advantage of what might be a soft pricing environment for put options in the spring, when volatility has historically been on the decline, to hedge exposure to more speculative assets before markets potentially trend negatively and volatility appreciates from July through October.

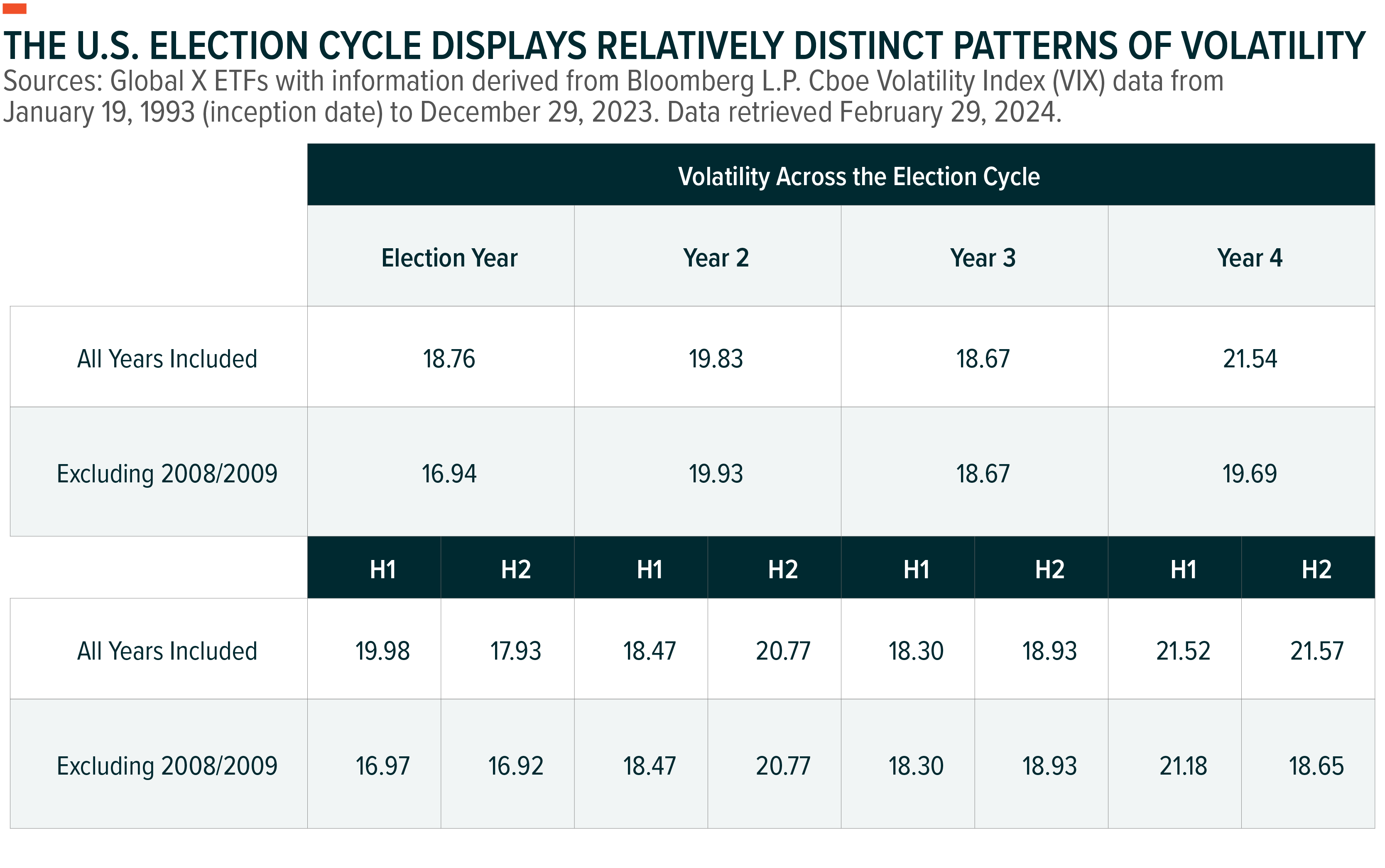

This cycle might help investors manage exposures on an intra-year basis. However, there are broader cycles that can prove telling, as well. It being an election year, it might be appropriate to discuss the relatively distinct patterns of volatility that tend to be experienced over the course of the election cycle. It might help us gain an understanding over what we can expect from the markets over the balance of 2024, as well as what the next Presidential regime might mean for investors and underlying volatility.

Below, we have provided the average levels of volatility experienced by the VIX over election cycles dating back to its inception. We have also provided a breakdown of volatility discounting outlier years like 2008 and 2009, when markets were contending with a widespread financial crisis. What we can gain from this illustration is the understanding that election years indeed tend to be materially less volatile than other years associated with this cycle. It is a factor that might help explain why, through the first quarter of 2024, the VIX failed to close above the 16 level on even a single occasion.8

Moving past the current year in question, however, we can see how, discounting outliers, the first year of a Presidential term tends to be most volatile. This could be attributed to investors expressing uncertainty about the election’s outcome or the potential policies that may be brought about as a result. It may also reflect the mean-reverting tendencies associated with the VIX that we highlighted earlier.

All told, volatility’s tendency to track these patterns through various cycles is not absolute. Simply because markets tend to trade in more of a volatile fashion in the final year of an election cycle relative to the third year does not mean that they must do so on all occasions. That said, having this understanding of the tendencies exhibited by the VIX and, likewise, the underlying markets, can lend support to various investment decisions. As it pertains to options, specifically, these periods of falling volatility might represent an opportunity for an investor to stay long stocks and hedge with lower-cost puts. Alternatively, in environments where volatility is expected to be on the rise, investors could sell calls for potentially increasingly higher premiums, supplementing the returns of a broader investment portfolio.

Conclusion: Volatility Indexes Tell a Broad, Informative Story

Investors have numerous metrics at their disposal that can help inform their investment decisions. Corporate profits, interest rates, inflation, and many others offer meaningful insight into economic and market trends. Similarly, gauges that seek to quantify investor sentiment can be critical components of investment decisions. But they’re not just fear measures, in our view. The VIX is a gauge that reacts incidentally and tells a story about potential price movements in the S&P 500. Combine the story that it tells with other metrics, and it can shed light on potential price and market direction and help investors in their capital allocation.