FinTech Trends Beyond Digital Payments

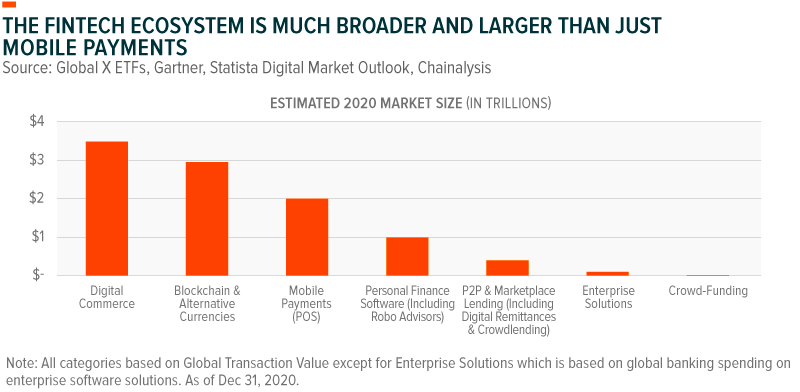

The ability to pay for goods and services by tapping a smartphone on a point-of-sale receiver or tapping a ‘buy now’ button on an e-commerce app makes digital payments FinTech’s most recognizable segment. But digital payments alone don’t capture the full disruption happening at the intersection of technology and financial services. In this piece, we will discuss a few of the trends beyond digital payments that are powering Fintech’s long-term growth trajectory, including:

- Buy Now Pay Later (BNPL) services putting a new spin on the old concept of paying in installments with enhanced benefits for merchants and consumers

- Digital wallets providing access to cryptocurrencies.

- Cloud enterprise solutions for financial firms provide reducing costs through automation, while allowing for effective and convenient client onboarding, and risk mitigation.

Early adoption of new trends like these may create opportunities for higher growth rates than some of the more known verticals in the FinTech ecosystem, like mobile payments.

Buy Now Pay Later: Disrupting Credit Card Debt

Credit cards date back more than 100 years, but it wasn’t until the 1950s when credit card adoption began to rise. Since then, credit card networks have mastered facilitating payments in exchange for transaction fees and interest on credit balances. They give customers a loan to buy something on the promise that the customer pays back the debt over a period of time. The longer it takes the customer to pay, the more fees or interest that accrue.

BNPL services change the consumer credit paradigm by allowing consumers to purchase goods and services in pre-defined installments. For example, instead of paying upfront for a $100 product, consumers can acquire the item for an upfront payment of $25 and pay the remaining balance in installments over several weeks or months. Australian firm Afterpay, for example, let’s online shoppers break down payments in four installments due every two weeks.

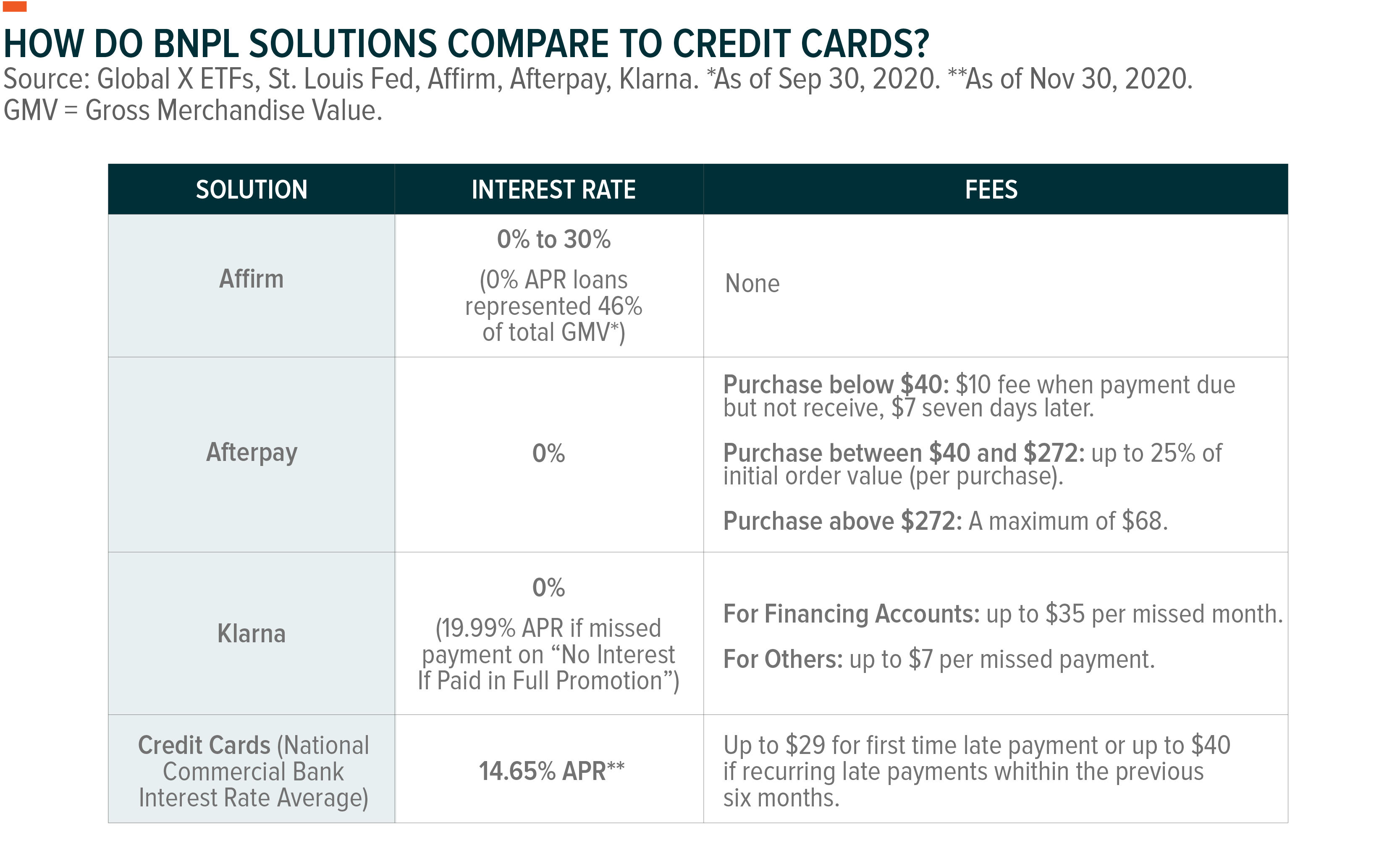

In a dramatic contrast to credit card lending rates, BNPL often features 0% APR for consumers, which can make BNPL a good option for consumers with low or nonexistent credit. Consumers only incur fees if they’re late on their payment schedule. Late payments can hurt a consumer’s credit score or their chances of qualifying for another BNPL loan. For merchants, BNPL may lead to higher sales. Some studies show that half of consumers spend 10–40% more when they use a BNPL service instead of a credit card.1 American BNPL firm, Affirm, estimates that BNPL solutions increase by 20% conversion rates and 87% in average order value for retailers.2

Despite often offering zero-interest loans, BNPL firms have several ways to monetize their services. Some firms charge merchants a flat fee on a portion of the total transaction. They can also collect revenue from late fees. Other firms structure their business models differently, choosing to charge interest to consumers but forgo late fees, service fees, or prepayment fees.

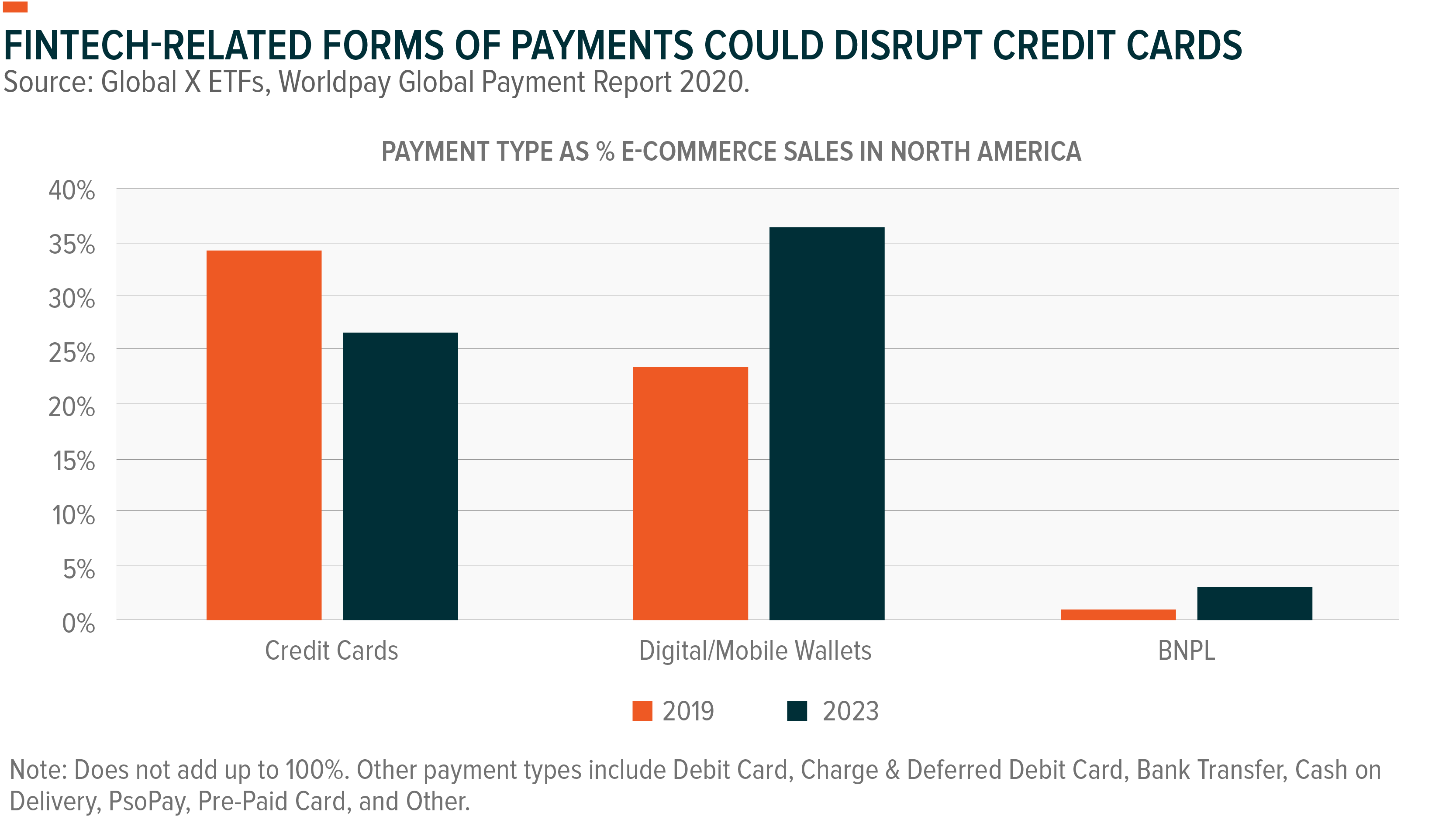

BNPL is expected to take market share from credit cards over time. BNPL accounts for only 1% of online shopping in the U.S., but countries such as Sweden, Germany and Australia have over 10% penetration rates.3 By 2023, BNPL may account for about 3% of total e-commerce sales in North America. The appeal is such that established FinTech and e-commerce companies are looking at the segment. PayPal entered the segment with its “Pay in 4” offering, which allows payment over a six-week period for purchases between $30 and $600.4 And Shopify partnered with Affirm, which recently went public, to let Shopify merchants offer this more transparent, flexible alternative to traditional credit card payments.

Cryptocurrency Integration: New Growth Avenues for Digital Wallets

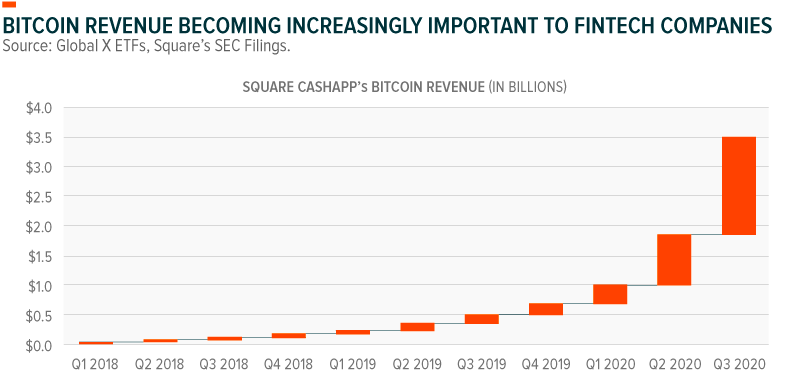

The FinTech firms behind digital wallets continue to add products that can drive higher customer lifetime value. Cryptocurrency is one vertical that is proving adept at accelerating top-line revenue growth for companies. For example, Square launched Bitcoin trading through its CashApp in 2018. Cumulative revenue generated through its Bitcoin offering since then totals $3.5 billion, including $1.6 billion in Q3 2020 alone.

PayPal introduced cryptocurrency trading in 2020, and since then almost 20% of the company’s user base of more than 300 million has transacted in Bitcoin in the app.5 By one estimate, PayPal users are responsible for buying 70% of Bitcoin’s new supply.6 PayPal expects to monetize cryptocurrency transactions on the spread between what it costs the company to acquire the currency and what the consumer purchases from any of the company’s 26 million affiliated merchants. For merchants, the cryptocurrency is immediately converted and settled in fiat currency at no additional cost to the merchant. PayPal has a take rate similar to the one offered for other purchases which, essentially, is a percentage or flat fee of the total payment volume.

The recent rally in prices for certain cryptocurrencies may be due to integration like this, in addition to other factors such as large public companies adding Bitcoin to their balance sheets. Importantly for investors, crypto integration among digital wallet companies may result in a less volatile way to capitalize on the potential growth of cryptocurrencies. Over the last 4.5 years, Bitcoin’s price volatility is twice as much as the Indxx Global FinTech Thematic Index.7

Cloud Banking: Enhancing Traditional Bank Products and Services

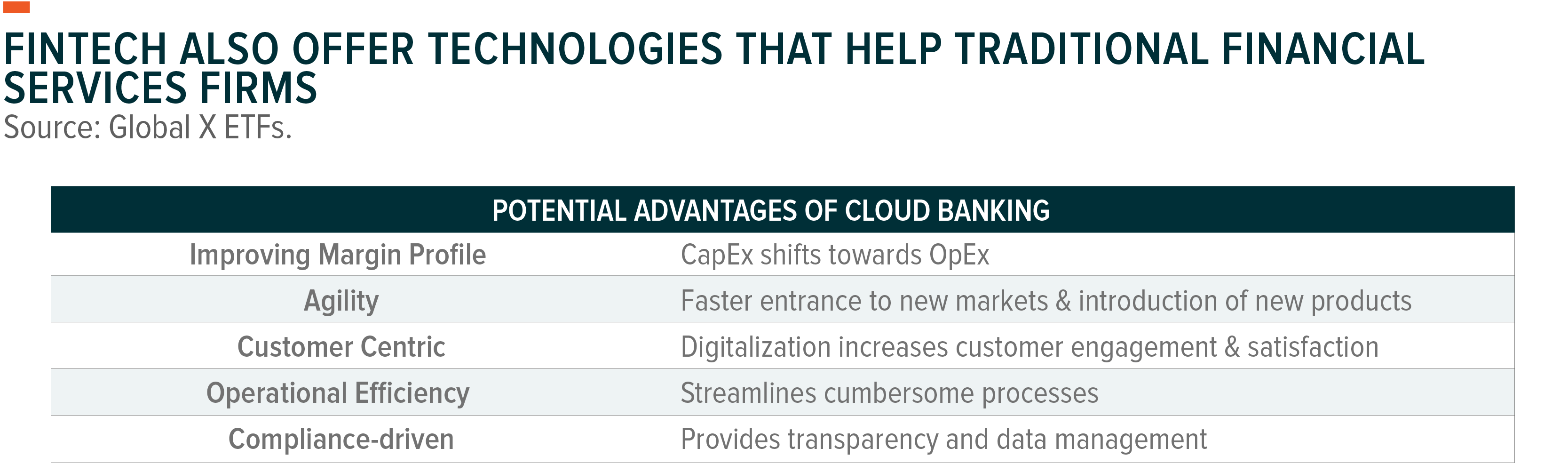

FinTech’s reputation is that of a disruptor of traditional financial services. That reputation is well-earned, but it doesn’t tell the whole story. FinTech firms also offer technologies that help traditional financial services companies enhance their services, rather than disrupting them. Cloud banking is one such growing vertical. Worldwide banking spending on enterprise software solutions is expected to increase 11% year-over-year to $112 billion in 2021.8

Increased investment in these solutions comes in tandem with growing consumer appetite for cloud-driven financial services. According to one report, 80% of Americans believe they can manage their financial services without ever going to a bank branch.9 Digital access to different services like banking, brokerage, lending, and more can be easier and more convenient.

Cloud technology can also streamline previously cumbersome processes for banks, such as onboarding new clients, opening accounts, and managing regulatory compliance. For example, nCino’s cloud solution for commercial lenders can reduce underwriting times by as much as 81%.10 Cloud banking also allows firms to react quickly to market dynamics and enter new markets. With Temenos’ software, U.S. banks can bring new products to market up to 16 times faster than the average.11 Cloud banking provides these solutions while being cost-effective because it shifts bank expenditures from large upfront investments in IT services to lower-cost, subscription-based software-as-a-service (SaaS) models.

Conclusion

FinTech’s scope continues to increase, helping consumers and financial institutions alike. As it grows, we believe investors should broaden their view of FinTech. More than just digital payments, the next generation of disruptive FinTech includes services like BNPL, digital wallets, and powerful cloud solutions that can improve the banking experiences. These are a few of the trends in the FinTech ecosystem that we expect to increasingly test the financial service industry’s traditional norms and create investment new opportunities.

Related ETFs

FINX: The Global X FinTech ETF seeks to invest in companies on the leading edge of the emerging financial technology sector, which encompasses a range of innovations helping to transform established industries like insurance, investing, fundraising, and third-party lending through unique mobile and digital solutions.