Cloud Technology: Business Appears Stronger Than the Market Suggests

Recent earnings from cloud computing leaders indicate that underlying sales growth is robust and exceeding market expectations. Hyperscalers running massive datacenters are aggressively investing in building capacity in anticipation of an imminent boom in demand. Industry analysts like Gartner expect growth in total spending on cloud deployed solutions to top 20% in 20221. Meanwhile, the stocks of market-leading application and infrastructure providers have pulled back considerably, with valuations disregarding all the fundamental business growth over the past two years. We believe this dislocation likely presents an opportunity for investors to capitalize on the sustainable growth of cloud computing, as IT workloads favor operational flexibility, lower cost, security, and permanently shift away from on-premise.

Key Takeaways

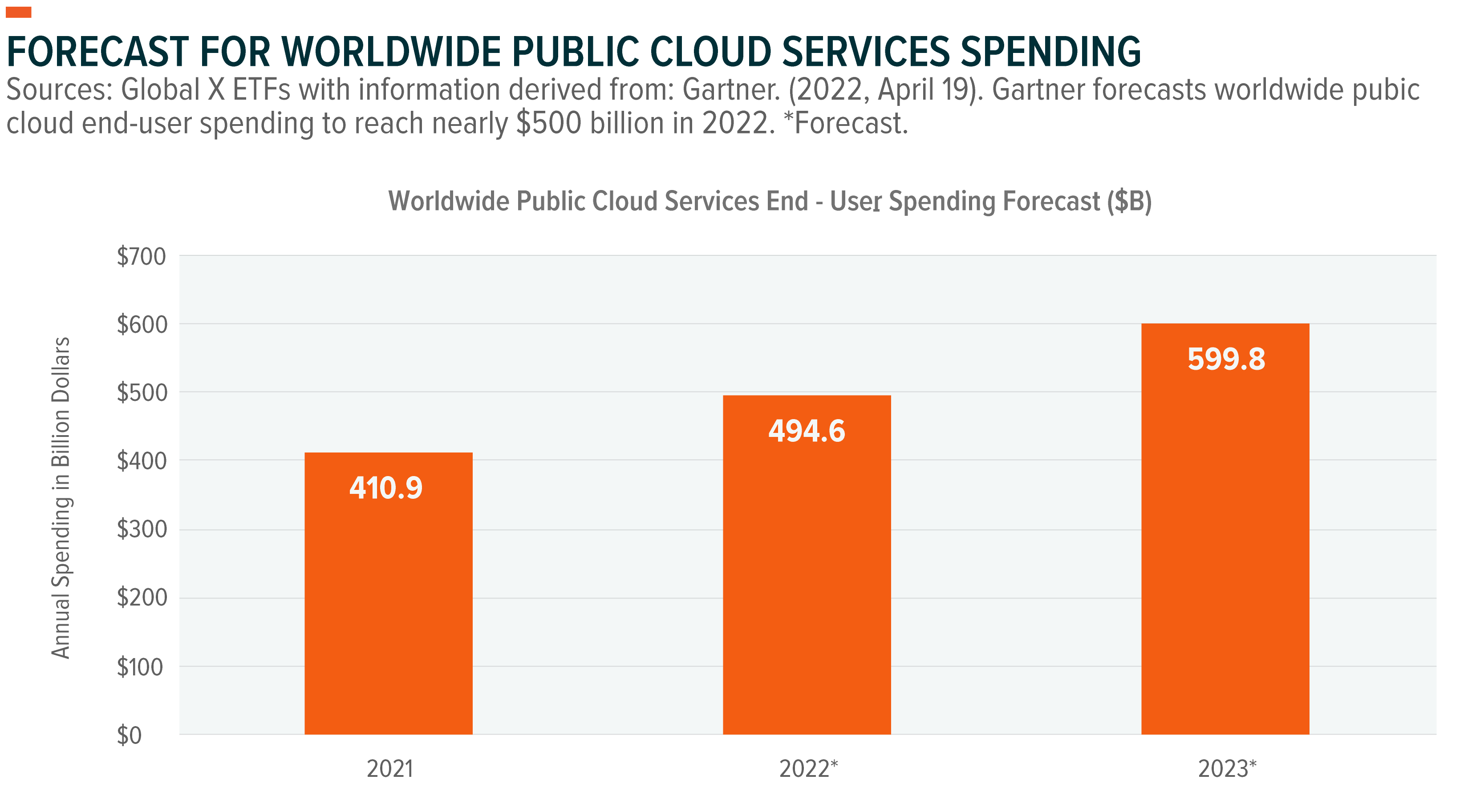

- Enterprise IT’s shift to the cloud marks a multi-decade pursuit of adopting remotely deployed, centrally hosted software solutions, versus buying monolithic self-hosted IT products or building tech internally. With close to $500 billion expected to be spent on cloud software this year, we believe the opportunity is still in its early phases.

- Underlying growth reported by public cloud companies in their most recent reported earnings showed no signs of a slowdown. Hyperscalers continue to invest in buildouts in anticipation of growing consumption. Tailwinds supporting adoption are also strong with multiple potential catalysts on the horizon, such as hybrid work, remote education, appetite for rich media experiences, and global cyber insecurity.

- When the market turmoil subsides, we believe that cloud computing stocks could recover much stronger and swiftly relative to broad market benchmark such as the Nasdaq 100 Index.

The Cloud Continues to Prove Itself

Sixteen years ago, Amazon opened its internally designed modular IT system to literally anyone willing to pay to use it. The innovative model was designed to deal with the complexity that modern consumer technology companies faced with internet scale, as they commonly found themselves struggling to add more servers, disks, and networking gear, to service an explosive growth in users and data.

This seemingly innocuous decision by Amazon catalyzed a new model of IT delivery, commonly referred to today as the public cloud. The system was revolutionary because it didn’t need companies to spend upfront on servers or hardware, and it seamlessly scaled with an enterprise’s traffic and processing needs. In the years that followed, businesses of all shapes and sizes, motivated by the clear cost benefits and operational flexibility, raced to leverage the benefits of the cloud. By 2021, global spending on cloud services totaled close to $411 billion3.

Simultaneously, the cloud delivery model has overcome considerable skepticism about scalability, security, and economic viability, with dedicated progress in processing, security, storage, and networking. The biggest testament of this success is Netflix, one of the largest internet platforms of the modern era. The company offers the most extensive library of on-demand content seamlessly to 220 million+ subscribers, processing 125 million+ hours of viewership daily by running most of its infrastructure on Amazon’s AWS platform4.

Amazon’s discovery and the hefty margins that this business carried attracted other big tech companies to the cloud opportunity. Microsoft, under new leadership, reoriented to become a cloud-first software business. Alphabet, eager to diversify its empire away from digital advertising, leveraged its email and business apps suite to begin selling hosting services. IBM saw the cloud as an opportunity to supplement its decaying mainframes empire. Chinese internet giants took notice too. By the mid-2010s, Tencent, Alibaba, and a host of other enterprise tech staples jumped in, intensifying competition within the space. Hyperscalers responded by spending hundreds of billions to install giga-sized hosting, processing, and networking facilities to enable the influx of traffic from IT buyers.

It wasn’t until COVID came knocking that cloud software really got a chance to display its remarkable scalability and efficiency. It allowed businesses and governments to maintain a semblance of functionality through even the worst phases of lockdowns while enabling users’ greater participation in the virtual world.

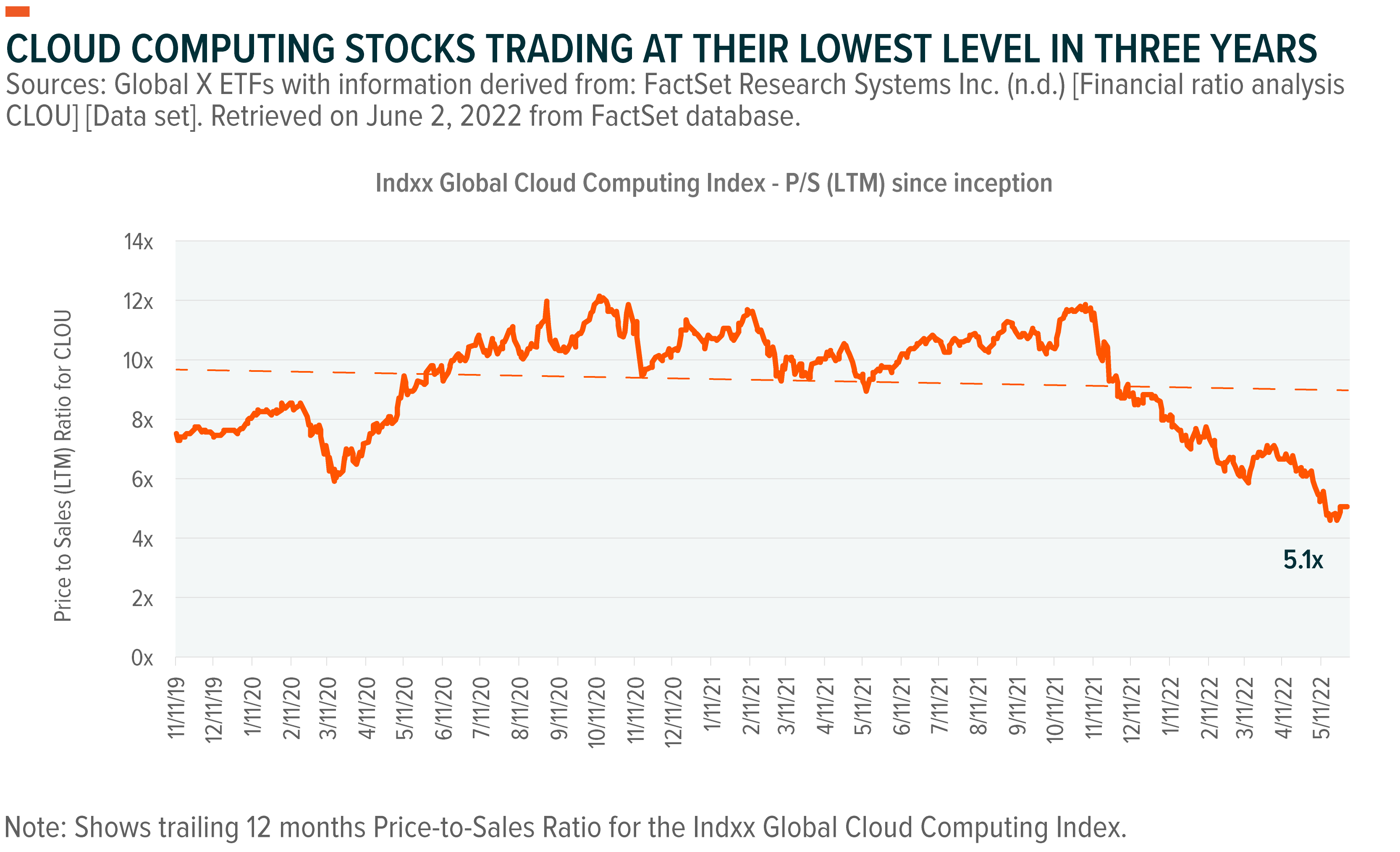

Two years later, cloud computing stocks are trading as though this secular growth phase is over. For example, constituents in the Indxx Global Cloud Computing Index are trading at a 5.1x last 12-month (LTM) sales multiple, down more than 40% from January 2020 levels.

Despite what near-term market price action suggests, we believe the runway for growth for cloud stocks is significantly longer. With rising rates and broad inflationary pressures, we expect the cloud’s efficiency, cost advantages, and lower total cost of ownership to figure prominently in corporate IT budgets. For leading cloud companies, we believe these factors could accelerate growth over the next few years.

1Q22 Earnings: Better Than Anticipated

In 2021, hyperscalers and enterprise software majors took a cautious stance in terms of the industry outlook, respecting uncertain macroeconomic conditions and the lingering risk of COVID-19 and its variants.

Catalysts on the horizon such as distributed working, remote education, increased consumption of digital services, and cybersecurity threats appeared strong. But it was natural for large enterprise IT buyers to take their time to rework new spending agendas suitable for COVID-era needs. A resurgence of the virus could hamper travel plans, hurt sales agendas, and deprioritize software consumption in specific segments. Also, rising corporate bankruptcies and early recession signals could further pressure buyers.

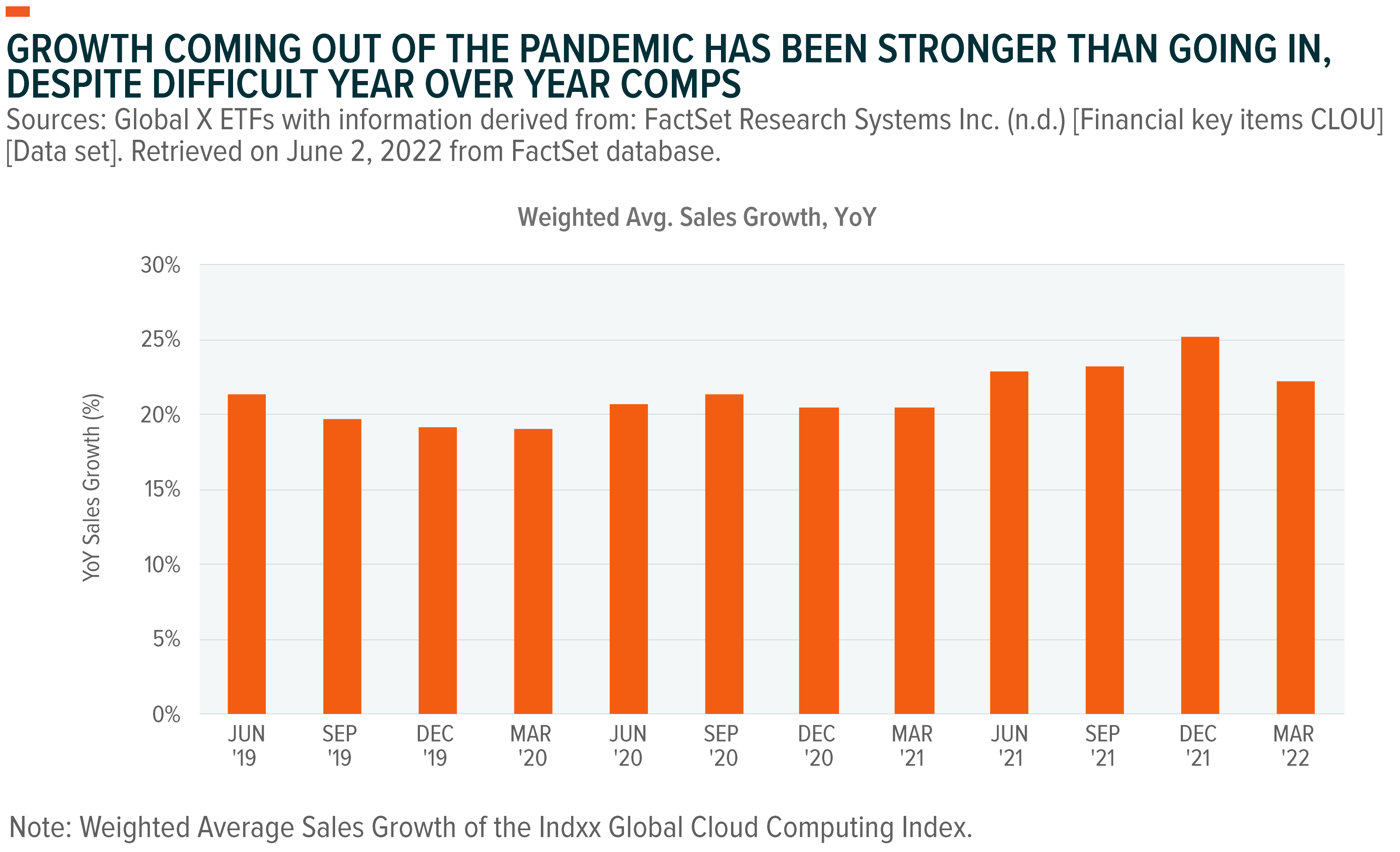

Some of the haziness subsided when 4Q21 and full year 2021 earnings numbers began rolling in at the beginning of 2022. Large enterprise software companies reported significantly better earnings than anticipated, causing them to raise their outlooks for full year 2022. That momentum continued into 1Q22 earnings. In their most recently reported quarter, Indxx Global Cloud Computing Index’s constituents reported 22.3% year-over-year (YoY) average weighted top-line growth, a 180-basis point (bp) increase YoY, as the chart below shows. Sales beat average consensus expectations by 1.5% for the quarter.

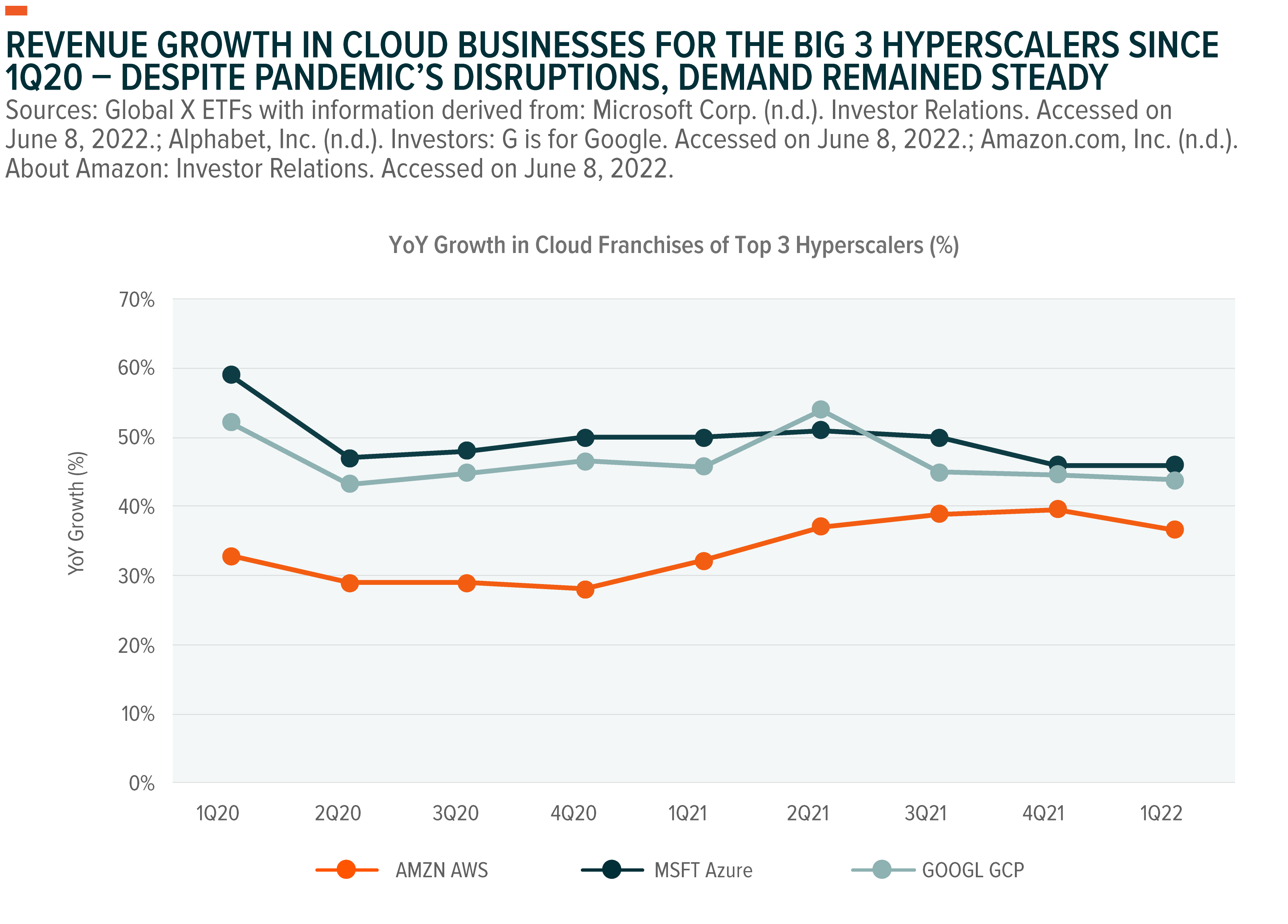

Infrastructure-as-a-Service (IaaS) providers carried the rally. Amazon, Google, Microsoft, the three largest public cloud infrastructure service providers, exceeded lofty expectations. Amazon’s AWS, the flagship cloud empire, grew its top line by 37% YoY in 1Q22, bringing in a total of $18.4 billion in sales5. With that, Amazon made a whopping $67 billion in 12-month recurring sales through the segment. Microsoft Azure grew its top line by 46% YoY, keeping pace with its average growth for the previous four quarters6. Google’s Cloud Platform reported strong numbers with growth topping 44% YoY and sales totaling $5.8 billion for the quarter7.

Management commentary from all three big cloud players was equally bullish. For example, Microsoft Azure said that it nearly doubled new deals signed for over $100 million on a YoY basis, with large spenders like Boeing, Kraft Heinz, US Bank, and Westpac converting in the latest quarter8. The strong outlooks translated into increased investment dollars too. Capital expenditures (capex) from all three players grew for the quarter. Google increased its capex by a record 64.7% YoY9. Amazon’s capex is inflated by the rest of its ecommerce business, but it was up 24% YoY10, a significant portion of which is going to cloud data centers, especially as the company pulls back on investments directed at the ecommerce business11. Microsoft’s capex grew a softer 5% YoY for 1Q22, but that’s on top of a 26.2% YoY growth in 2021 for full year capex, and 38.2% YoY growth in 202012.

Another datapoint for underlying momentum in the cloud space comes from tracking datacenter segment sales for some key suppliers to hyperscale data centers. At Intel, which primarily supplies x86 based processing units and field-programmable gate arrays (FPGAs) for AI training, datacenter segment revenues grew by 22% YoY in 1Q22 and quarterly sales totaled $6 billion13. That growth followed the segment’s 20% YoY growth in 4Q21. At Nvidia, the leading vendor of GPUs to datacenters meant for AI workload acceleration, datacenter segment sales grew 83% YoY, a 15% sequential increase14. Lastly, sales within AMD’s Computing and Graphics business segment increased 31% YoY in 1Q2215. AMD is a major supplier of EPYC processors to AWS and Microsoft’s Azure, with about a quarter of its total revenue coming from datacenter sales.

Application (SaaS) companies within the Indxx Global Cloud Computing Index posted an average top-line surprise of 1.9% for the most recently reported quarter, growing their top lines by 18.3% YoY on average. Also, platform and hybrid cloud product vendors, which sit at the intersection of infrastructure and SaaS, continued to display momentum. For example, IBM reported that hybrid cloud revenue, which includes platform-as-a-service (PaaS) products and software provider Red Hat, increased 14% YoY16.

Runway for Cloud Adoption Is Much Longer

Industry estimates continue to paint a rosy outlook for the broader cloud market. Gartner projects global spending on cloud services to grow nearly 20% in 2022 to $496 billion17. In our view, spending is likely to exceed this projection, as it has consistently done so over the past decade.

In total, global IT spending including communications services, software, security, platforms, and other non-hardware categories has topped nearly $3.6 trillion a year18. We believe the best part about cloud software is that its management can be outsourced. An organization’s focus can remain solely on utilizing the resources, which means no direct spending on rent, facilities, labor, maintenance, insurance, and other expenses that come with running IT with self-managed data centers. Typically, that operational expense could add up to a third of the total IT spend19, and when added to the total IT spend on systems, bring cloud technology’s total addressable market (TAM) to well over $4 trillion. With cloud services spending levels forecasts of nearly $500 billion for 202220, the market will effectively be only under 15% penetrated, leaving ample runway for sustainable growth through this decade.

In this challenging macro environment, corporate fiscal discipline will be key. Automation and low-maintenance software can play a critical role in helping businesses remain resilient. During such times, the potential cost advantages of cloud services will be underlined, as companies can avoid buying servers, racks, and expensive hosting contracts, freeing up valuable cash while still accessing top-notch software.

Decision makers are already beginning to take action. Fifty-seven percent of IT executives21 surveyed for IT advisory and consulting firm Flexera’s Annual State of Cloud Report 2022 said that migrating more workload to the cloud is one of their top strategic initiatives for the year, along with optimizing existing cloud spending. Forty-two percent said that shifting of on-premise software to SaaS was their top priority. Executives also indicated that they plan on increasing spending on cloud resources by nearly 29% over the next 12 months22, well ahead of what industry analysts project.

In addition, enterprises are embracing multiple vendors and diversifying supplier risk. A survey by HCI supplier Nutanix revealed that nearly 64% of surveyed firms23 expect to be operating in a multi-cloud environment within the next 1–3 years, which alleviates market’s concerns over competitive headwinds.

With all this focus on IT, the strategic influence of IT decision makers within organizations is growing too. In a survey conducted by CIO.com as part of its 2022 State of the CIO report, nearly 74% of chief information officers24 believe their role is gaining visibility across their organization simply due to the importance of IT security.

Cybersecurity is another driver of demand. Cybersecurity incidents hit all-time highs during the pandemic with more users online25. Geopolitics will likely remain another major driver of cybersecurity threats. Russia’s invasion of Ukraine and the growing threat of Chinese espionage has the U.S. government and businesses on high alert and likely to ramp up their defenses in the near future26. We expect spending from enterprises to secure vulnerable nodes and monitor traffic will increasingly tilt in favor of cloud deployed, universally accessible solutions.

Also, among corporations that are already heavy consumers of cloud technologies, their focus in the short term could be on optimizing cloud performance and controlling associated costs.

Emerging Trends Favor the Cloud

In addition to purely functional advantages and industrywide momentum driving migration of IT to the cloud, emerging end-use cases can continue to drive demand for cloud services.

- Remote work:Cloud-deployed ubiquitous applications play a fundamental role in enabling remote work for millions of distributed employees worldwide. Even as employees step back into offices, hybrid work will likely continue, and software platforms are positioned to assume a central role to facilitate operations and drive output. Remote work directly supports consumption of communication services, authentication tools, productivity and project management tools, business management software, as well as specific vertical tools in areas like corporate finance, human resources, planning, and business process management.

- Remote education:Hybrid instruction may remain an option for students, as needed. Homeschooling is becoming popular in the U.S., which is expected to drive demand for supplemental online learning services27. Online instruction will likely also continue to make inroads in professional learning, graduate studies, or broad career upskilling, perhaps due in part to the weaker economic conditions. Also, universities with large IT divisions could ramp up their cloud spending to make up for their lack of prior investments.

- New consumer behaviors:COVID forced the adoption of digital services for routine living, such as ecommerce, digital payments, and delivery. For entertainment, consumers embraced streaming, gaming, and social media. While some rotation out of digital is overdue as the economy moves away from the pandemic, we believe consumers will continue to prioritize the convenience of technology-enabled services, further propelling demand for underlying cloud solutions that power top platforms. Consumer habits and expectations can also catalyze downstream second-order innovation, such as delivery drones, autonomous driving, the Internet of Things (IoT), and home technologies, and spur exploratory investments.

- Rich media experiences:Consumer appetite for gaming, streaming, corporate communication, and other avenues will likely remain high. Lags and buffering won’t be acceptable, so much so that we expect that they likely become a competitive risk to platforms and push up demand for cloud delivery networks and edge platforms. Consumption of higher resolution content also implies operating denser data files, increasing the need for storage, data processing tools, analytics services, and other similar technologies.

- Custom and hybrid IT requirements:Enterprises tightly bundling and integrating existing on-premise solutions to the cloud is expected to be common, driving demand for hybrid tooling, integration software, and associated services. This will likely force laggard enterprises to seek help from industry consultants to navigate an architecturally complex landscape. IT consulting was a $57 billion market in 2021, and it’s forecasted to double by 203028.

Conclusion: An Opportunity to Capture a Structural Shift

We believe the public cloud market is poised for accelerated and sustainable growth coming out of the pandemic as enterprises ramp up investments to remain competitive. Growth across the cloud franchises of hyperscalers, enterprise software vendors, application pure-plays, and suppliers of cloud hardware is a testament to buyers’ enthusiasm for the new model of IT delivery.

Consensus estimates continue to embed pessimism, and the market continues to seem to disregard all the growth added over the past two years and the growth that is expected over the next five years. But with multiples trading at three-year lows, we believe this could be an opportunity for long-term investors looking for exposure to a potentially lasting, structural shift.

Related ETFs

CLOU: The Global X Cloud Computing ETF seeks to invest in companies positioned to benefit from the increased adoption of cloud computing technology, including companies whose principal business is in offering computing Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), Infrastructure-as-a-Service (IaaS), managed server storage space and data center real estate investment trusts, and/or cloud and edge computing infrastructure and hardware.

BUG: The Global X Cybersecurity ETF seeks to invest in companies that stand to potentially benefit from the increased adoption of cybersecurity technology, such as those whose principal business is in the development and management of security protocols preventing intrusion and attacks to systems, networks, applications, computers, and mobile devices.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.