Balancing Equity Portfolios With Covered Calls as an Alternative to Fixed Income

Income opportunities are in the limelight with the first half of 2024 bringing about a series of new all-time highs for the major U.S. equity indices. Indeed, tumultuous markets in recent years are one reason for solid flows into bond funds, and market dynamics seemingly position these instruments to gain value over the near term. It’s important, however, to examine this growth narrative. In many cases, writing covered calls can be a suitable alternative to fixed income, as these strategies seek to produce current income while potentially helping to mitigate the impact of downside movements across an equity portfolio.

Key Takeaways

- The long-dormant bond market has seemingly reawakened, but even with the support of elevated interest rates, the yield potential offered by bond strategies may be surpassed by writing covered calls.

- The path to coupon income and bond price appreciation by way of interest rate cuts may not be as clear-cut as some investors anticipate.

- Historically, a loose correlation between bonds and equities has made debt instruments adequate portfolio diversifiers. In the current environment, however, monetizing volatility may be the more effective means by which to pursue diversification.

Bond Yields Are Back, but They May Not Be as Competitive as They Seem

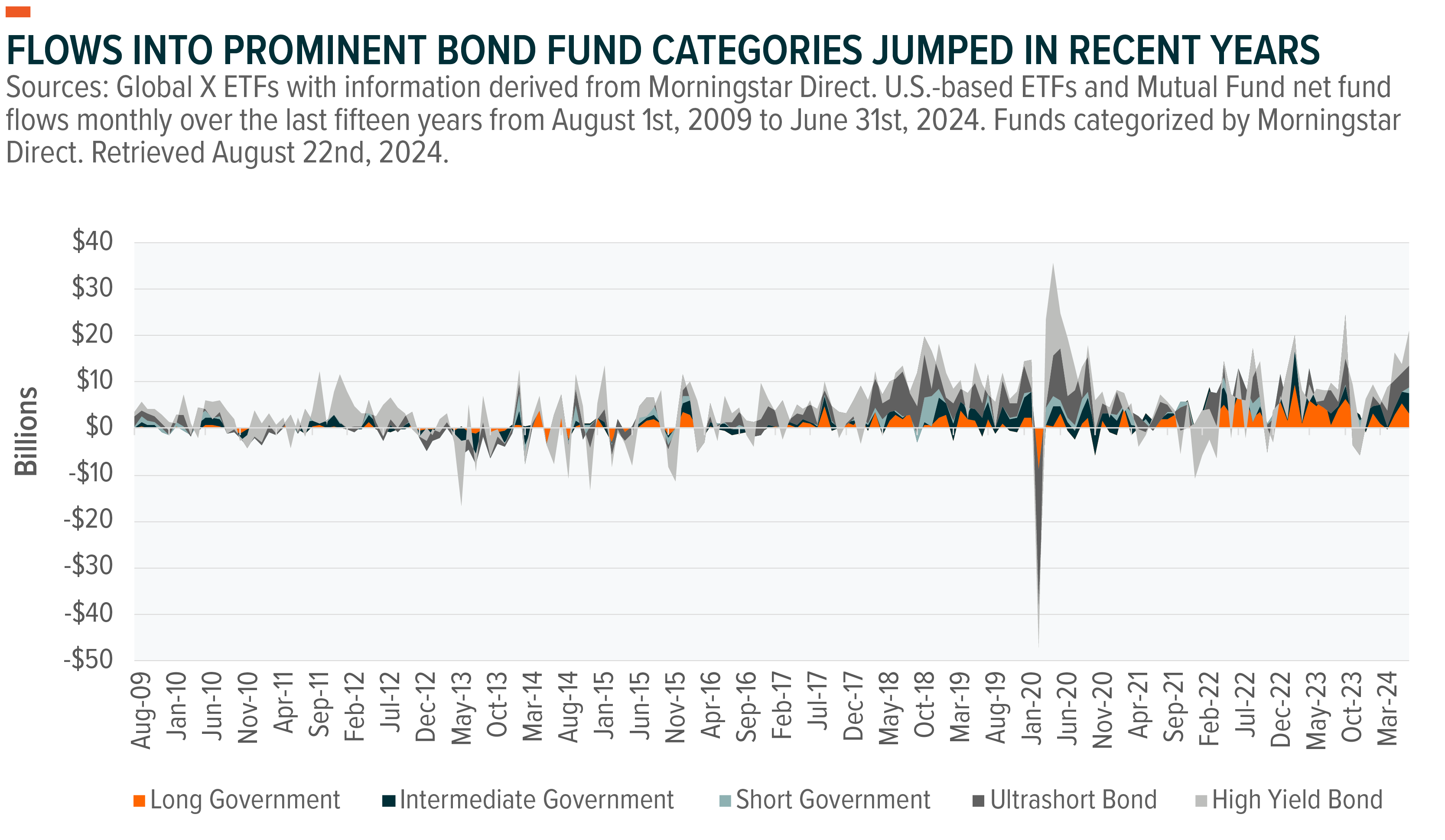

Before the Federal Reserve (Fed) embarked on its year-and-a-half-long rate hiking cycle to combat post-pandemic inflation, 10-year U.S. government bond issues failed to consistently yield beyond 2% dating all the way back to 2009.1 Returns were particularly underwhelming when considering the lack of price appreciation by many of these instruments. The argument for “risk-free” fixed income became much more compelling in recent years, as the federal funds rate was boosted to levels not seen since 2007.2 Factor in markets rising to record highs in 2024 and investors likely reaping significant returns from their equity positions, and bond fund flow catalysts mounted rather quickly. Strong flows are evident across bond categories, and investors experienced improved Investment Grade and junk bond yields.3

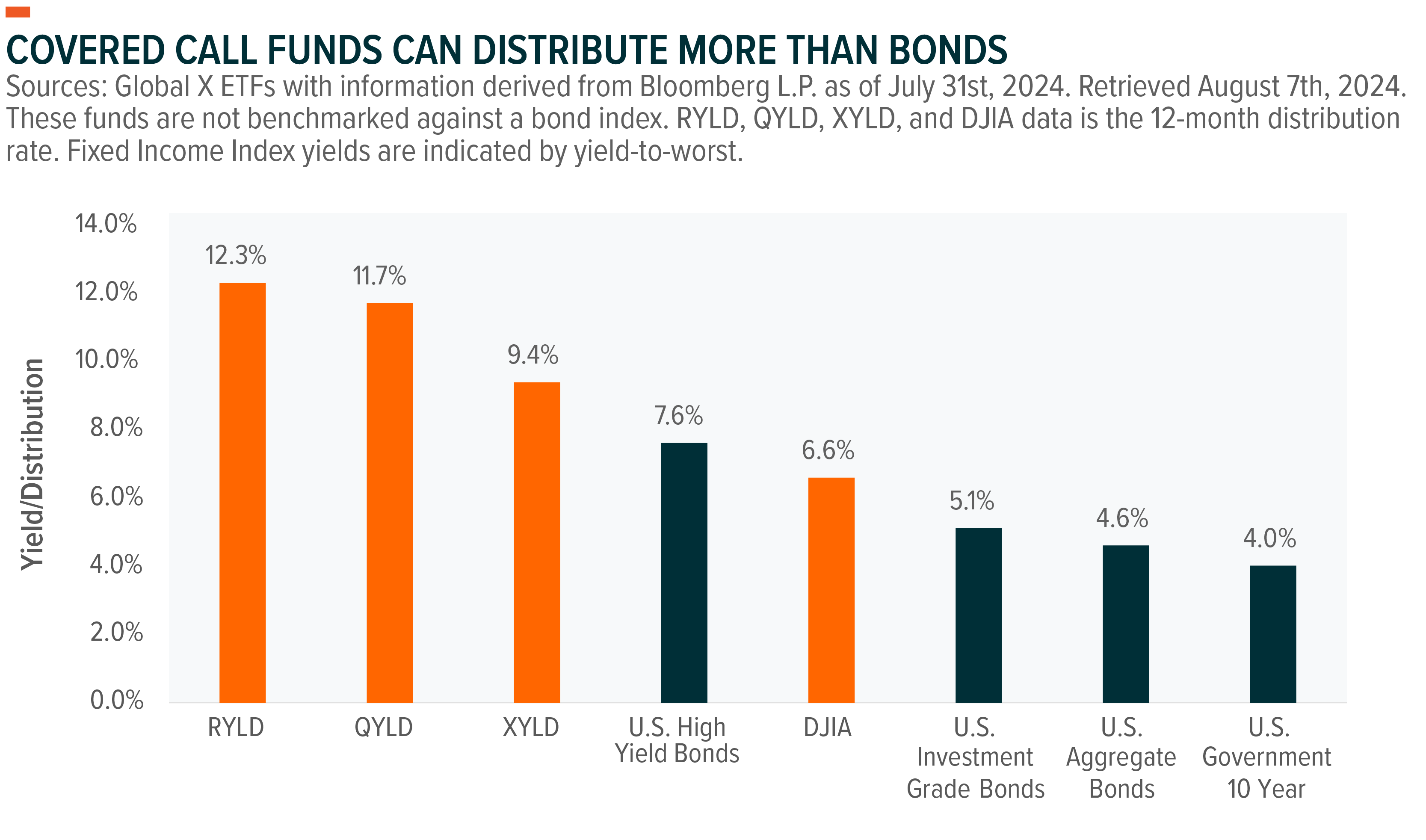

Even with income opportunities from bonds looking more appealing, the distribution rate offered by our 100% covered call strategies can potentially prove more appealing. The table below highlights the most recent yield-to-worst on four prominent bond indexes and compares them to the trailing 12-month distribution rates of our family of Global X ETFs that operate covered call strategies on the Russell 2000, Nasdaq 100, S&P 500, and Dow Jones Industrial Average. Purely from a distribution perspective, a covered call strategy could be a better opportunity, as it can help add balance to the equity sleeve of a portfolio. A covered call strategy can also help alleviate concerns over managing bond duration and the potential for credit defaults.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month- and quarter-end and 30-day SEC yields is available at RYLD, QYLD, XYLD, and DJIA.

A portion of the funds’ distribution rates is estimated to include return of capital. For a breakdown of the distributions, please see the Tax Supplements. These do not imply rates for any future distributions.

Asset class representations are as follows: U.S. High Yield Bonds, Bloomberg U.S. Corporate High Yield Total Return Index; U.S. Investment Grade Bonds, Bloomberg U.S. Corporate Total Return Index; U.S. Aggregate Bonds, Bloomberg U.S. Aggregate Index; U.S. Government 10 Year, US Generic Govt 10 Year.

The Bond Growth Story May Prove to Be More of a Saga

The Fed’s rate hiking cycle appears to be over, with inflation on a downward path. Following the release of a higher-than-expected July unemployment rate, the market is now pricing in a 100% chance of the Fed cutting the federal funds rate at its September 2024 meeting.4 Meanwhile, the investment case for bonds suggests adequate coupon rates and bond value appreciation. Still, investors subscribing to this base case may not want to hold their breath until it comes to fruition.

The path to the Fed’s first rate cut is one that has been playing out for the better part of the last year. When the Federal Open Market Committee (FOMC) last raised the rate in July 2023, markets were expecting the first cut in March 2024.5 At the start of 2024, the market had priced in as many as six additional rate cuts for the year.6 However, inflation proved stubborn, and the market proceeded to gradually take rate cuts off the table.

A healthy U.S. economy supported by increasing corporate investment, earnings, and consumer spending argued against a Fed pivot to lower rates and quantitative easing measures. Many of these underlying factors remain evident, and the concern that the Fed’s initial rate cut reignites inflation remains top of mind. Given that risk, the Fed may be inclined to test the waters by lowering the rate by 25 basis points to 5.00–5.25%, and sporadically thereafter, keeping rates elevated for a prolonged period.

Rate cuts can be a double-edged sword. While bonds values may benefit, yields may become less impactful for income-seeking investors, potentially bringing reinvestment risk into play. The rate cut impact will also vary across the bond investment scape, with longer-duration instruments typically receiving the biggest boost. That said, investors using bonds as a source of income would likely be less exposed to these instruments, as the yields on short-term investments have been more generous of late.7

Covered Call Writing May Be a Better Hedge Than Traditional Bonds in This Environment

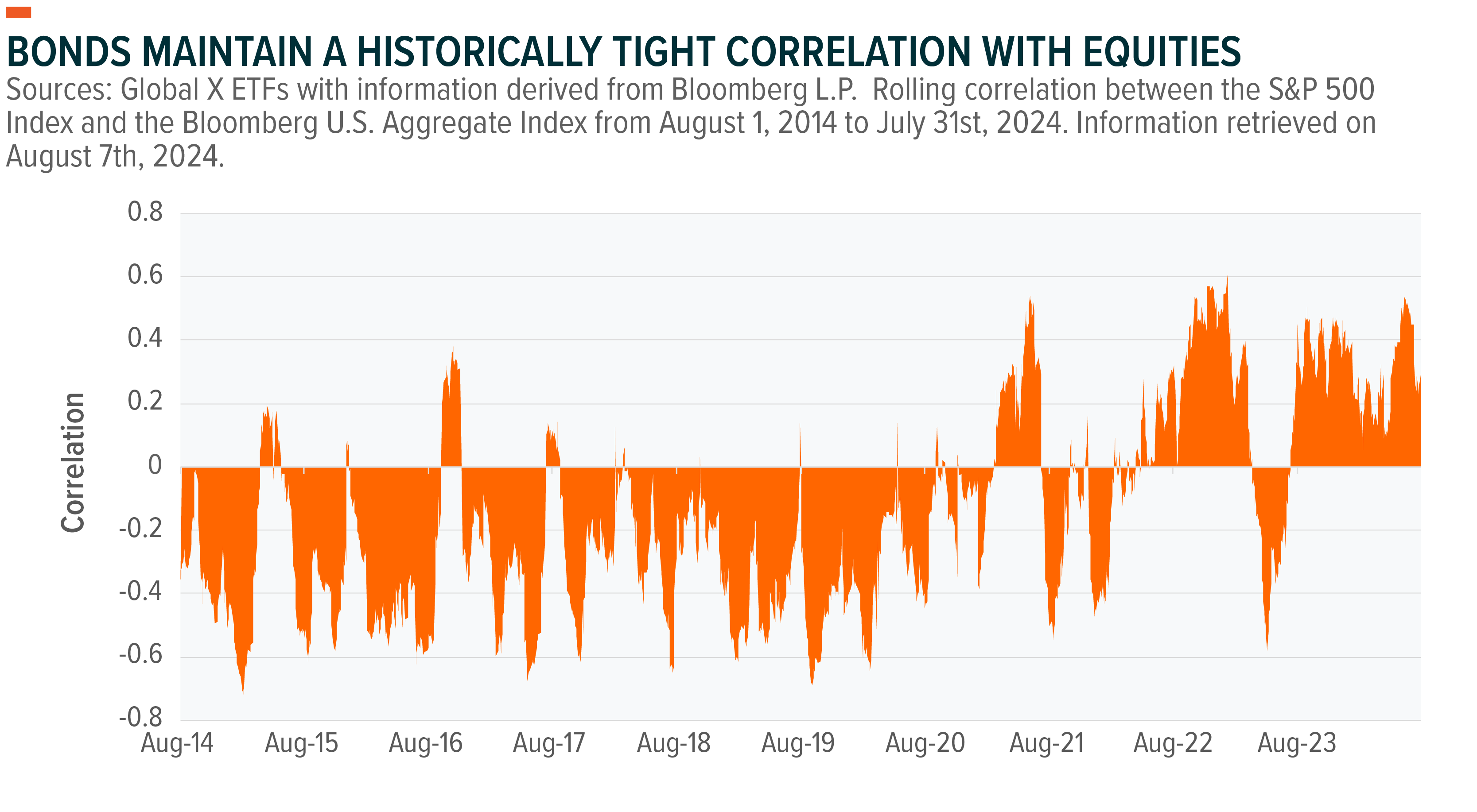

The recent narrative surrounding bond flows stretches beyond the interest rate story and the opportunity for price appreciation. With equity markets continually eclipsing all-time highs in the first half of 2024, bonds’ traditional role as a portfolio diversifier is more than likely playing a part in portfolio hedging, as well. But in a potential equity market contraction, bonds may fail to offer as much risk mitigation as they have in the past. For one, the correlation between bond and equity performance remains relatively high, signaling that any selloff may be somewhat commensurate.

Although past performance is not a guarantee of future results, historical bond performance should also be taken into consideration regardless of the interest rate backdrop. After all, lower borrowing rates can present a more advantageous environment for companies to reinvest in their businesses. If this scenario were to stoke risk-on sentiment, it could cause bond flows to slow should rate cuts boost equities. If the correlation remains intact but secular drivers continue to promote positive market sentiment, other means of portfolio diversification may be more prudent to seek to curtail downside risk. Covered call writing can act as a downside hedge for underlying equity positions by seeking to harvest call option premia.

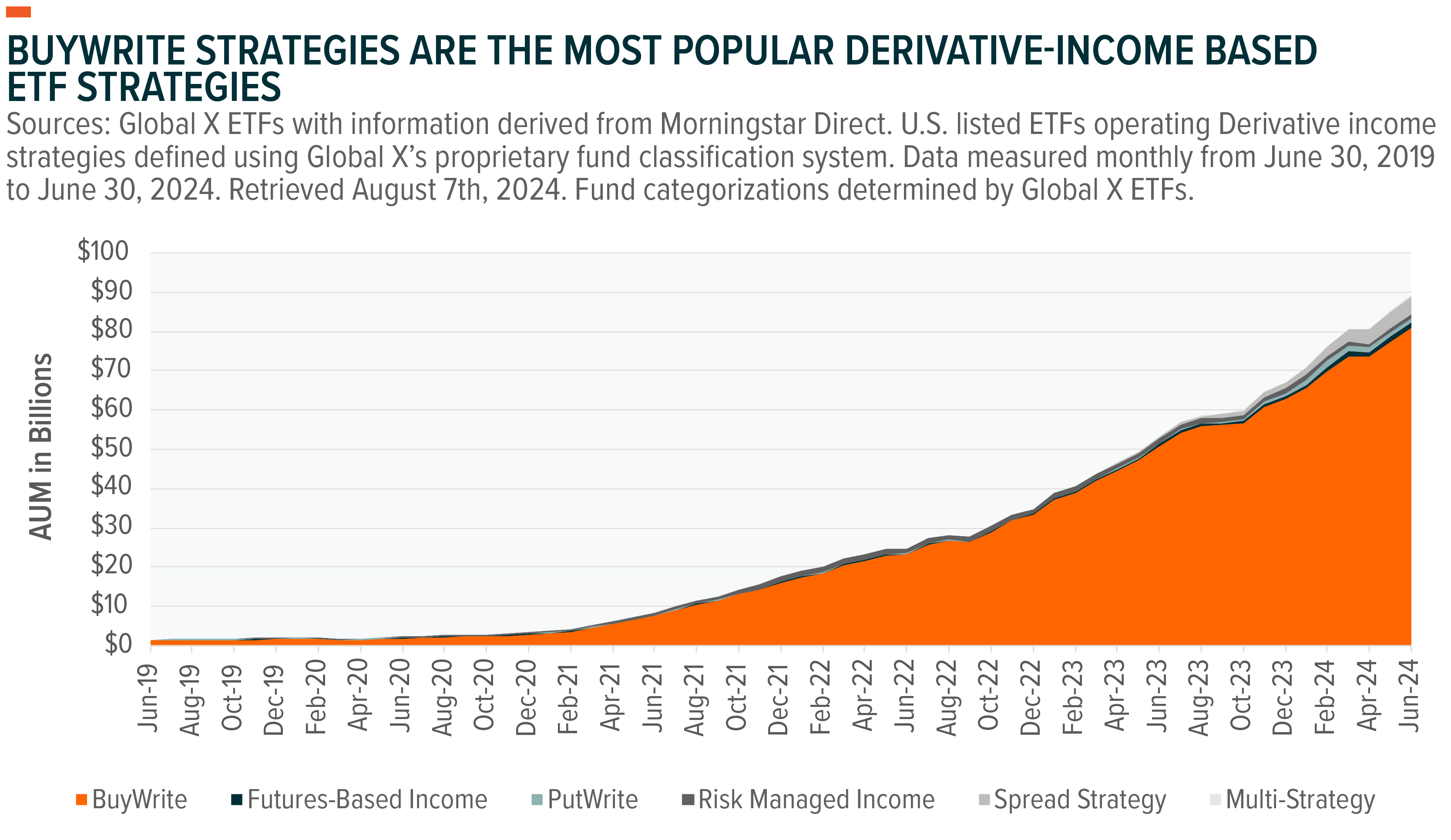

Factoring into covered call writing’s popularity is the potential buffer to the downside, based on the premium value that is collected by selling the call option. The premium receive can offset some of the fall in the underlying asset(s). Fixed income instruments, on the other hand, theoretically can fall to zero value, so the degree to which they can act as a hedge is somewhat unknown.

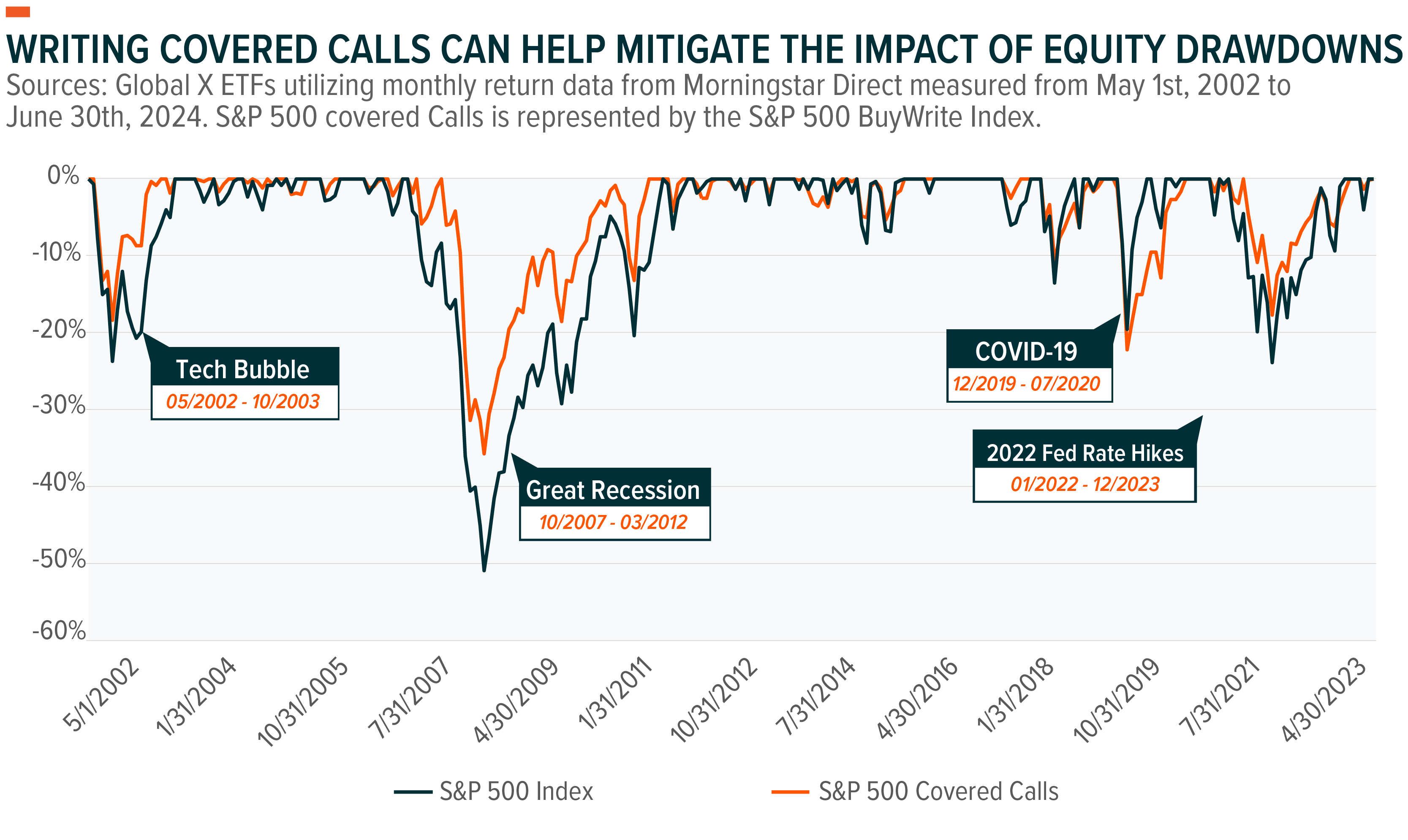

By aiming to monetize volatility and pursue the premiums that are attainable by writing calls, investors may be able to maintain some equity exposure and still outperform major indices during a contraction. This characteristic has been particularly notable when analyzing the performance of a systematic covered call writing strategy like that of the Cboe S&P 500 BuyWrite Index during broader S&P 500 downturns.

Past performance is not a guarantee of future results. Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Conclusion: A Fluid Rate Situation May Make Covered Call Writing an Appealing Bond Alternative

The economic backdrop appears to be shaping up well for bond investments, but it’s early in fixed income’s growth story. As it plays out, the economy can turn down any number of avenues that benefit or hurt fixed income’s potential to act as a hedge. We believe that investors may be better served allocating funds to covered call instruments, which may offer a higher yield and better hedge, should recession, geopolitical, or other risks bring tumult to the markets.

Related ETFs

XYLD – Global X S&P 500 Covered Call ETF

QYLD – Global X Nasdaq 100 Covered Call ETF

RYLD – Global X Russell 2000 Covered Call ETF

DJIA – Global X Dow 30 Covered Call ETF

Click the fund name above to view current performance and holdings. Holdings are subject to change. Current and future holdings are subject to risk.