Investment Strategy Monthly Insights, April 2022

After four decades of low inflation, developed economies are grappling with an inflation spike. The risk of double-digit inflation is real, as soaring commodity and agricultural input prices could have lagging and lasting effects on food prices. In the United States, 2-year breakeven rates retraced from their highs in late March, suggesting the Fed’s hawkish statements are starting to feed lower inflation expectations.1 After the 25-basis point hike in March, markets now anticipate eight more Fed hikes this year, including 50-basis point increases in May and June before returning to quarter-point increases in the second half. In Europe, short-term breakeven rates remain at their highs. Germany’s 2-year breakeven was over 5.5% on 7 April. Markets expect 70bps of key rates increase from the European Central Bank (ECB) this year and 138bps of key rates increase from the Bank of England on 13 April.

While Europe faces a sustained energy crisis and higher risk of stagflation, the U.S. economy should be more resilient to higher energy prices because it is a net energy exporter and benefits from sound economic fundamentals. However, the risk of soaring inflation is tangible in the United States amid strong demand coupled with supply shortages. U.S. wage inflation is increasing, which should offset some of the tempered demand due to higher prices. But as long as higher interest rates do not translate into higher credit risk, we believe that the risk of recession is low.

In this context, we expect equity markets to be supported by continued economic growth and negative real yields as high inflation persists. We prefer U.S. equities over European and emerging market equities.

Investment strategies highlighted this month:

- Recession risk and geopolitical tensions to keep volatility elevated:– In these uncertain markets, we highlight the new equity diversifiers – thematic and cryptocurrencies.

- Supply-led inflation is likely to remain elevated in the near to medium term:– U.S. growth stocks show resiliency amid expectations for higher interest rates.

- Higher food prices for longer are likely as agricultural input prices soar:Higher fertilizer prices offer an example of how the adoption of precision agriculture could maintain food security.

Economic and Geopolitical Risks Likely to Keep Markets Vulnerable to Volatility

The markets’ risk-off sentiment due to the war has dissipated. The VIX, which measures the volatility of the S&P 500, now hovers at roughly 20 points compared to over 36 points at the beginning of March.2 In theory, equities can protect investors against inflation because companies can charge customers more when input costs rise, and in turn, increase cash flows and earnings as prices increase. However, this inflation hedge is imperfect, as equities might not hold when inflation soars and recession risk rises. We do not expect a recession to occur this year.

The risk of further sanctions on Russia, combined with the French elections and soaring energy and food prices, are likely to keep markets vulnerable. Despite the VIX coming down, we expect volatility to remain in the U.S. equity markets as investors nervously eye signs of a slowdown. In this environment, defensive equity strategies, like high dividend stocks, should do relatively well. This environment may also create opportunities for investors to seek exposure to new assets with diversification potential, including thematics and cryptocurrencies.

Thematics: Combining Assets With Low Correlations Can Lower a Portfolio’s Risk Profile

Historically, U.S. Treasuries are the most used diversifier, in addition to being a core holding. But in the current environment, rising interest rates and inflation may dampen their diversification benefits. Performance for most equity investment styles, sectors, and factor indices has been closely aligned with the overall market, limiting their usefulness as diversifiers. Absolute performance between growth and value stocks has diverged significantly.

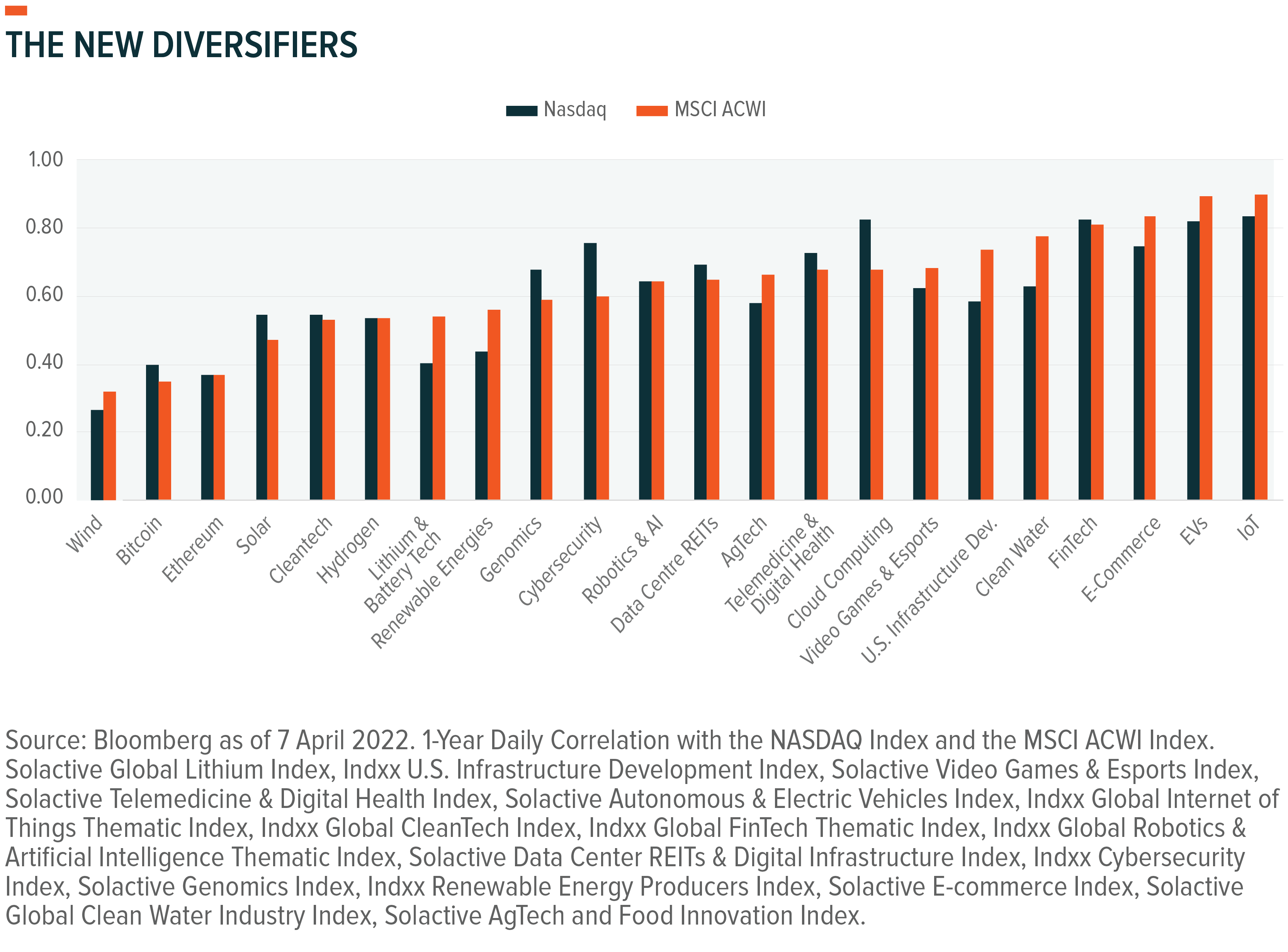

However, diversification strategies that combine assets that exhibit low correlation of returns can reduce a portfolio’s overall risk profile. For example, the chart below shows the 1-year daily correlation of themes with the Nasdaq Index and the MSCI ACWI. The lower the correlation, the greater the reduction in volatility when adding assets to a portfolio. Themes pertaining to the physical environment, such as climate-related themes, provide particularly good diversification benefits, in addition to being supported by short- and long-term tailwinds amid the ongoing energy crisis. Cryptocurrencies can also play a role as equity diversifiers, given their low correlation with the broader equity indices, including technology indices like the Nasdaq 100 Stock Index.

Cryptocurrencies: Seen as a New Store of Value With Long-Term Diversification Potential

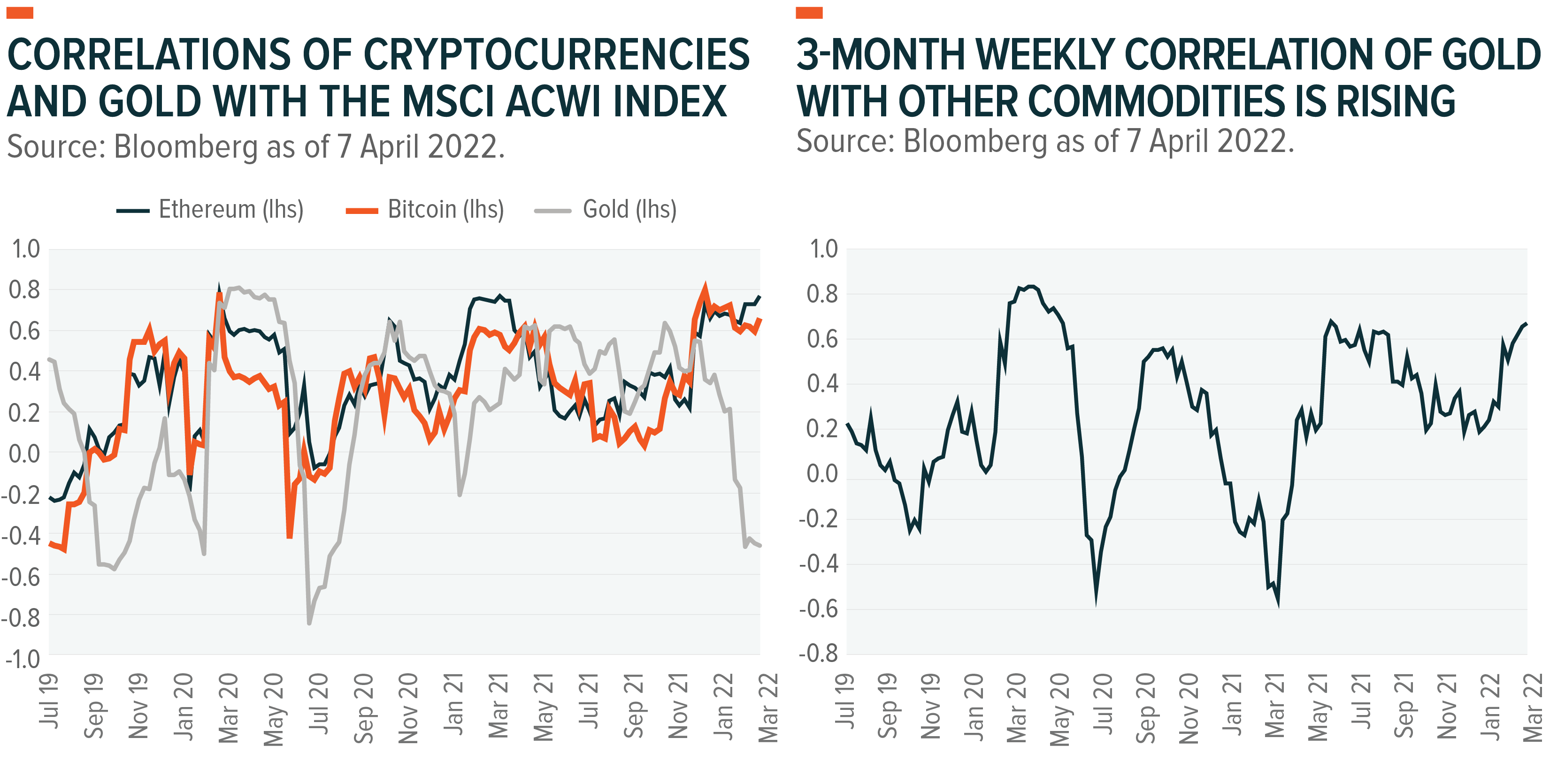

Cash is a traditional alternative to U.S. Treasuries from a diversification standpoint, but soaring inflation limits its typical store of value benefit. Today, another way to add diversification to global portfolios could be cryptocurrencies, such as bitcoin (BTC) or ether (ETH), by far the two largest digital currencies by market size. In developed markets, some cryptocurrencies are increasingly seen as store of value investments with diversification benefits, given that their typical 1-year daily correlation with global equities is about 0.35.3 Interestingly, correlations between most commodities have increased, even for gold, making it a less effective diversifier to the broad commodity market than it once was.

Recently, BTC and ETH have behaved the exact opposite of gold, as the second graph below shows. Over the last three years, BTC and ETH show relatively similar correlations to global equities (MSCI ACWI Index) compared to gold, with long-term weekly correlations of 0.28 for BTC, 0.36 for ETH, and 0.21 for gold. However, in times of extreme volatility, gold remains a safe haven asset, while cryptocurrencies’ correlation with equities tends to rise. The recent decoupling of cryptocurrencies and gold with equities illustrates gold’s defensive characteristics, although a rising positive correlation to the broad commodity market also drives performance for gold.

In our view, the long-term diversification benefits of cryptocurrencies to global equity and commodity exposures make them relevant as part of a strategic asset allocation. In addition, high fluctuations in the correlation between gold and equities and commodity markets could be relevant for short-term adjustments and tactical asset allocation in periods of extreme volatility. But for investors it’s not necessarily an either/or scenario: exposure to gold and cryptocurrencies, such as BTC and ETH, could be complementary.

Why U.S. Growth Stocks Continue to Rise Amid Expectations of Higher Interest Rates

Despite expectations of higher interest rates, U.S. growth stocks continue to rise for three main reasons.

- Even if U.S. interest rates increase, they are starting from a very low base. For rates to impact financing conditions for growth stocks, they must rise meaningfully higher.

- The geopolitical situation in Europe and the regulatory crackdown in China are dampening investor sentiment in these regions. U.S. stocks are likely benefiting, as these risks seem to outweigh the inflationary risks in investors’ regional preferences. Investors perceive U.S. stocks, even growth stocks, as less risky than European and Chinese stocks.

- S. growth stocks comprise a strong structural tailwind, in that they provide a significant share of the technology required for the global economy’s ongoing digitalization and transition to net-zero emissions by 2050.

When assessing the equity markets over the medium term, U.S. inflation has room to accelerate further given the lagging impact of higher commodity prices on consumer goods in the years to come. The market has tested the Fed’s credibility since the beginning of the year, as reflected by stubbornly high breakeven rates. However, the current 2-year U.S. breakeven rate is down from its recent highs despite oil prices rising above the $100/barrel again, which suggests renewed market confidence in the Fed’s willingness to reduce its monetary base.

If the Fed disappoints in the coming months by falling short of market expectations for an aggressive monetary policy tightening, we believe the risk of persistently higher inflation will rise again and U.S. stocks could drop. If growth stocks help drive U.S. innovation and the monetary base is reduced, the stock markets are likely to be protected. But if the U.S. economy does not innovate and simply relies on debt, then hyperinflation is a real possibility.

Heading Toward a Global Food Crisis in 2023, AgTech Offers Solutions

After contending with the energy crisis for nearly a year now, the war in Ukraine is yet another major challenge for European agriculture—and the world. Local supply disruptions in Russia and Ukraine pose a serious threat to global food security, with low- and middle-income countries among the most vulnerable. The world has only partially offset lower grain exports from Ukraine thus far.4 And the situation could grow more severe amid soaring costs of nitrogen fertilizers, which have almost tripled from a year ago, and cereals.5 For example, Brazil imports most of its fertilizer from Russia.6 As one of the top agricultural producers in the world, a fertilizer shortage in Brazil could result in smaller harvests and higher food costs globally.

Higher costs are likely to result in significant shortfalls in food production at least until next year, and possibly beyond. In Europe, governments are trying to find alternatives to fertilizers to reduce dependence on Russia. In the United Kingdom, the agriculture sector is looking at traditional farming practices and organic materials.7 In Germany, Federal Minister of Agriculture Cem Özdemir declared that food security would require “consistent steps towards a sustainable agriculture that is more robust in the face of crises.”8

We believe that the rising cost of fertilizer makes agriculture technology (AgTech), and precision agriculture (PA) technologies in particular, more competitive and likely to accelerate the shift towards sustainable and digital farming. These technologies can increase crop yields efficiently while using fewer traditional inputs, such as land, water, energy, pesticides, and fertiliser.9 For example, rather than applying the same amount of fertilizer over an entire field, PA measures variations in conditions and adapts its fertilizer and harvest strategies accordingly. Likewise, PA assesses the needs of individual animals in larger herds and optimizes feeding on a per-animal basis.

Precision agriculture relies on various digital technologies, including sensor technologies, satellite imaging, and the Internet of Things. For example, chemical company Bayer Crop Science provides innovative digital and sustainable solutions to farmers, such as agricultural biologicals that are largely created from natural living organisms to protect crops. The company’s software tools integrate data from satellites, field sensors, irrigation systems, and drones, giving farmers a complete picture of their operation.10

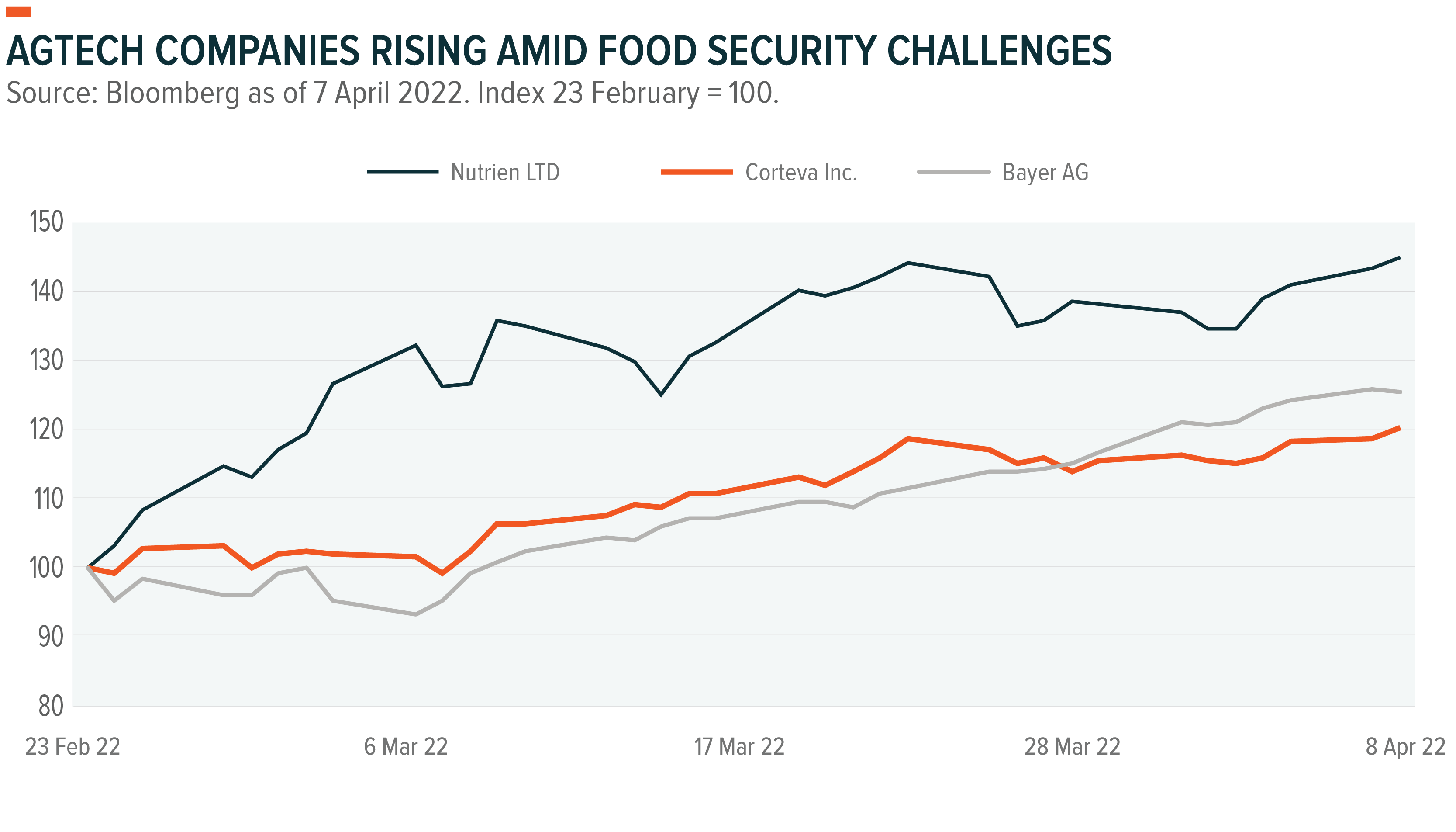

For agricultural product specialist companies, the current macroeconomic and geopolitical backdrop is resulting in strong momentum. Companies providing crop inputs—such as potash, nitrogen, and phosphate products for agricultural, industrial, and feed customers—have performed well since the beginning of the war. Nutrien Ltd’s stock is up 36% and Corteva Inc’s 17% year-to-date, while Bayer AG is up 27%.11 However, for investors, identifying the companies involved in the production of crop products and digital farming solutions can be challenging because it requires an agnostic view of sectors. For example, Bayer AG is typically classified in Healthcare, while Nutrien Ltd and Corteva Inc are classified as Materials companies.

A potential solution for investors is to opt for a basket of holdings identified as pure-plays in AgTech. A basket can provide a targeted forward-looking approach that fully captures the structural shift in global agriculture while maintaining diversification within the theme. The Solactive Agtech and Innovation Index, which holds these three companies, has increased almost 10% since Russia’s invasion of Ukraine to 13 April.12