Introducing the Global X Blockchain ETF (BKCH)

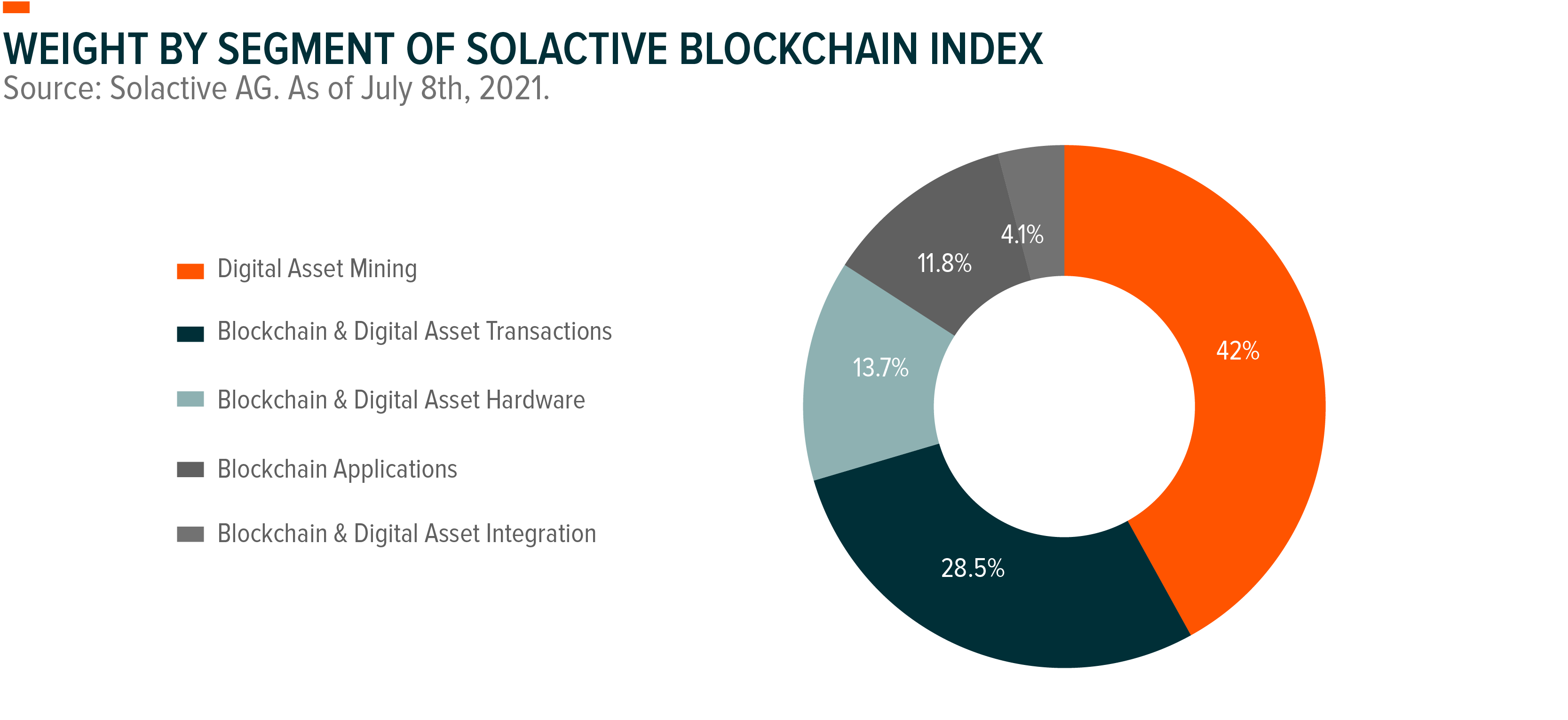

On July 14th, 2021, we listed the Global X Blockchain ETF (BKCH) on Nasdaq. BKCH seeks to invest in companies that are well-positioned to benefit from further advances in the field of blockchain technology. Specifically, the strategy seeks to include companies in Digital Asset Mining, Blockchain & Digital Asset Transactions, Blockchain Applications, Blockchain & Digital Asset Hardware, and Blockchain & Digital Asset Integration.

Key Takeaways:

- Blockchain technology is a distributed approach to collecting and maintain records, allowing for higher degrees of accuracy, transparency, security, and immutability than centralized approaches.

- Blockchain is essential to cryptocurrencies because an immutable distributed ledger brings trust and transparency to digital transactions.

- Beyond cryptocurrencies there are several valuable use cases for blockchain technology including smart legal contracts, tracking and monitoring supply chains, and accessing and sharing health care records.

- The blockchain ecosystem is still in its early stages but consists of several companies involved in a variety of activities including: 1) digital asset mining; 2) blockchain & digital asset transactions; 3) blockchain applications; 4) blockchain & digital asset hardware; and 5) blockchain & digital asset integration.

What is Blockchain Technology?

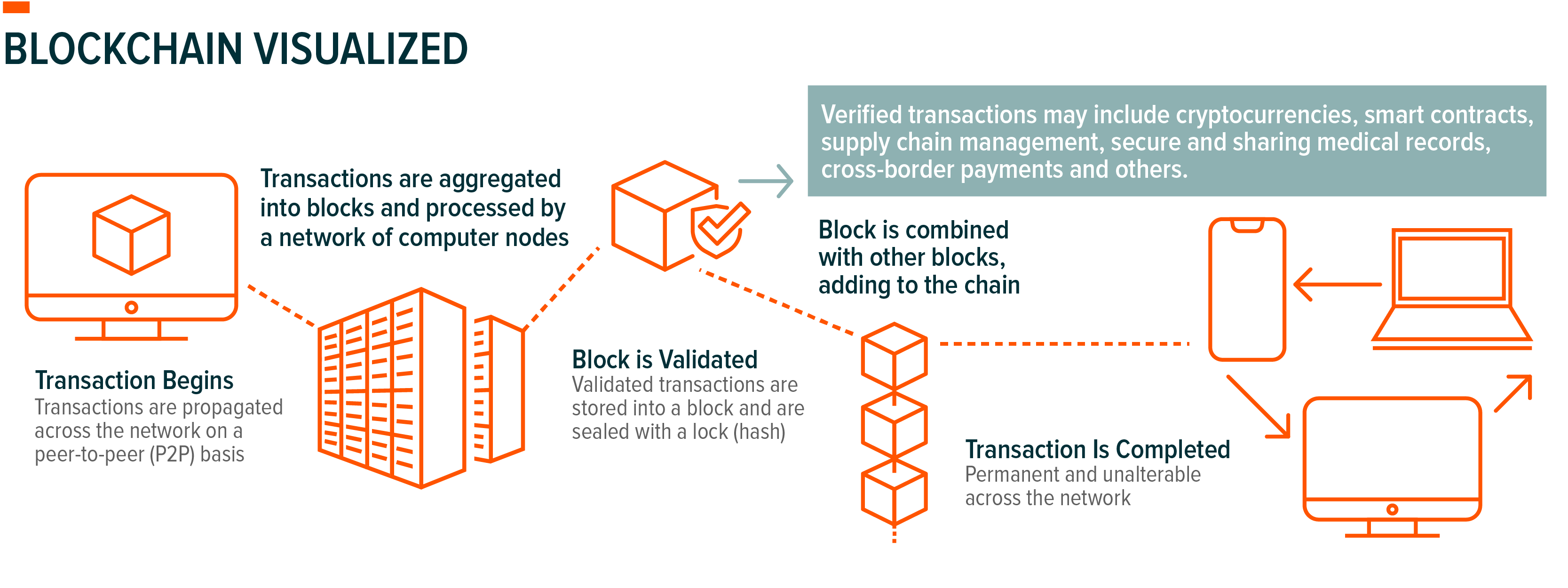

In its most basic sense, a blockchain is a type of database focused on recording and maintaining data. But its unique properties stem from its decentralized – or distributed ledger – approach. In a centralized database, a singular authority retains total control over all aspects, including entering data, ensuring its validity, and maintaining that data. In the blockchain’s decentralized approach, data is recorded in “blocks” that are distributed and validated across several participants, or nodes, on a P2P (peer-to-peer) network. While anyone can create data on public blockchains by creating a new block and chaining it to a previous block, the consensus-based approach to validation means nobody can edit or falsify the data once it’s received a sufficient number of block confirmations.

The advantages of a decentralized ledger are based on the premise of trust. First, all the network participants have access to a copy of the blockchain in real time, including its history. In other words, it is fully transparent. Second, once a block has received sufficient confirmations, the transactions inside it cannot be duplicated, corrupted, modified or eliminated by any one actor or node. Because of this immutable nature, it can provide superior security and traceability. And third, since it removes the figure of a central authority, there is no need for third-party verifications or reconciliations, eliminating middle-men costs.

The Relationship Between Blockchain Technology & Digital Assets

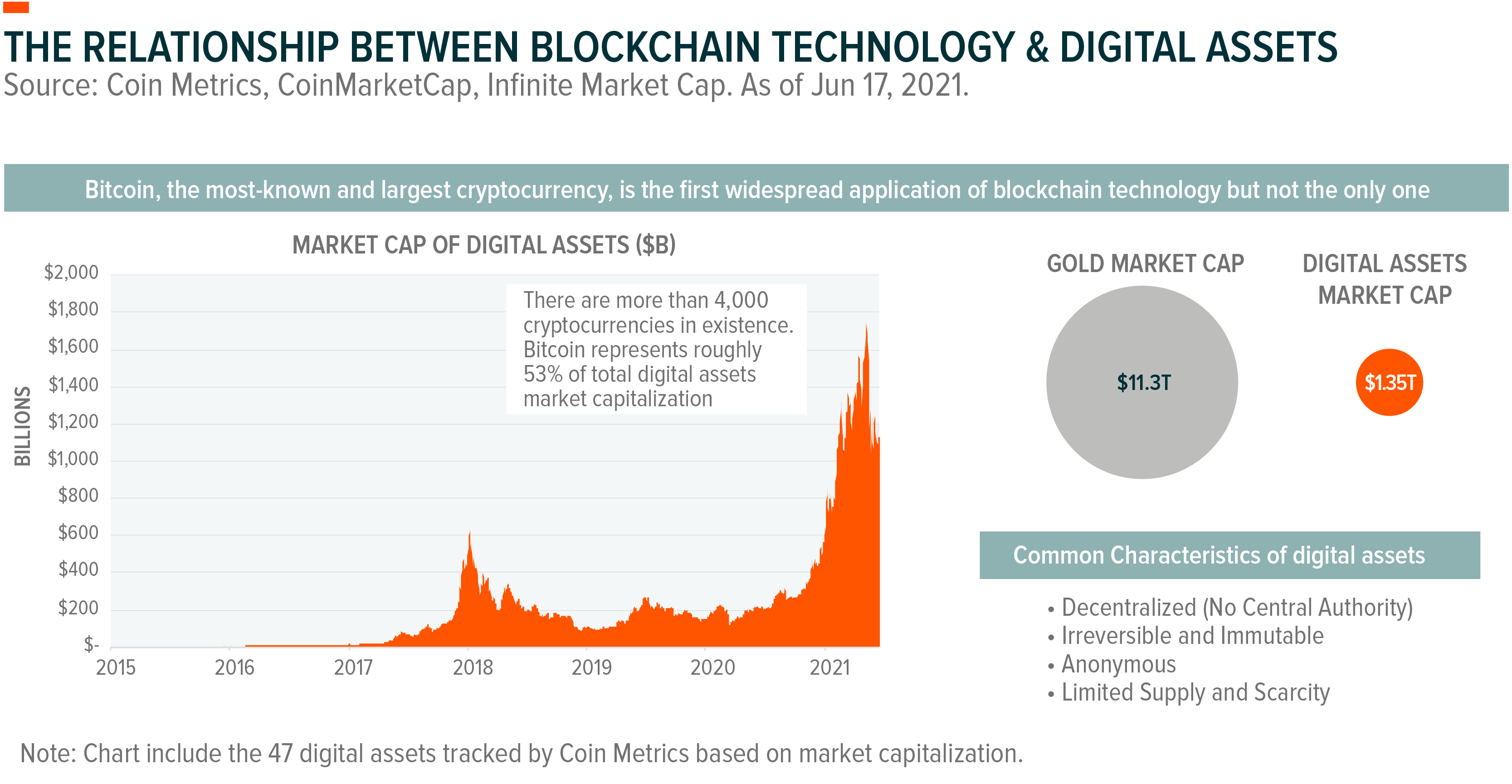

Blockchain technology is closely linked with cryptocurrencies and other digital assets. Cryptocurrencies are designed to serve as a medium of exchange that uses encryption techniques to control the creation of monetary units and to verify transactions. Beyond cryptocurrencies, tokenized securities or crypto-derivatives represent additional types of digital assets with potential value. Digital assets are primarily developed on blockchain networks where transactions are validated by independent nodes and propagated throughout the network on a peer-to-peer basis. Digital assets are typically traded through digital asset exchanges, but they can also be traded on a peer-to-peer basis directly on the blockchain.

Bitcoin, the best-known and largest cryptocurrency by market capitalization, is the first widespread application of blockchain technology. Benefitting from the unique aspects of blockchain technology, bitcoin has never been hacked or compromised, it is not governed by a central authority, and its transactions are made transparent across the network. Bitcoin is often explained as ‘digital gold’ as many see it as a secure store of value that can also be used for transactions. Beyond bitcoin, there are several types of cryptocurrencies that serve alternative purposes, like Ethereum’s ether. The Ethereum blockchain expands on the bitcoin blockchain’s use case by incorporating a virtual machine that’s capable of executing more advanced programs (i.e. smart contracts). Ethereum is a programmable blockchain or, essentially, a decentralized computer that powers censorship resistant applications that can be independently built and used by anyone. Transacting on the Ethereum network requires computational power which users must pay for in the blockchain’s native token ether. Hence, demand for ether is partially tied to the utility provided from the applications built on the Ethereum blockchain.

Let’s explore an example. Non-Fungible Tokens (NFTs) are currently taking the digital art and collectibles world by storm. NFTs are tokens that people can use to represent ownership of unique items.1 They let people tokenize things like art, collectibles, even real estate. They can only have one official owner at a time and they’re secured by the Ethereum blockchain – no one can modify the record of ownership or copy/paste a new NFT into existence.2 In theory, the scope for NFTs is vast and can include anything that is unique and needs provable ownership.

Top Cryptocurrencies by Market Capitalization3 (as of Jun 24th, 2021).

- Bitcoin – $629 billion: Created in 2009, Bitcoin is the first decentralized cryptocurrency that can be used and sent via the internet.

- Ethereum – $227 billion: Proposed in 2013 and launched in 2015, Ethereum is the community-run technology powering the cryptocurrency, ether and thousands of decentralized applications.

- Tether – $63 billion: Launched in 2014, Tether is the world’s first stablecoin that mimics the value of the US Dollar (USD). A stablecoin aims to peg its value to an external reference, often a fiat currency.

- Binance Coin – $47 billion: Launched in 2017, Binance Coin is a cryptocurrency that can be used to trade and pay fees on the Binance cryptocurrency exchange.

- Cardano – $43 billion: Cardano was founded back in 2017, and it’s underlying ADA token is designed to ensure that owners can participate in the operation of the network. Because of this, those who hold the cryptocurrency have the right to vote on any proposed changes to the software.

The aggregate of market capitalization across all digital assets, which is a function of unit price multiplied by its circulating supply, is over approximately $1.35 trillion.4

Blockchain Use Cases Beyond Digital Assets

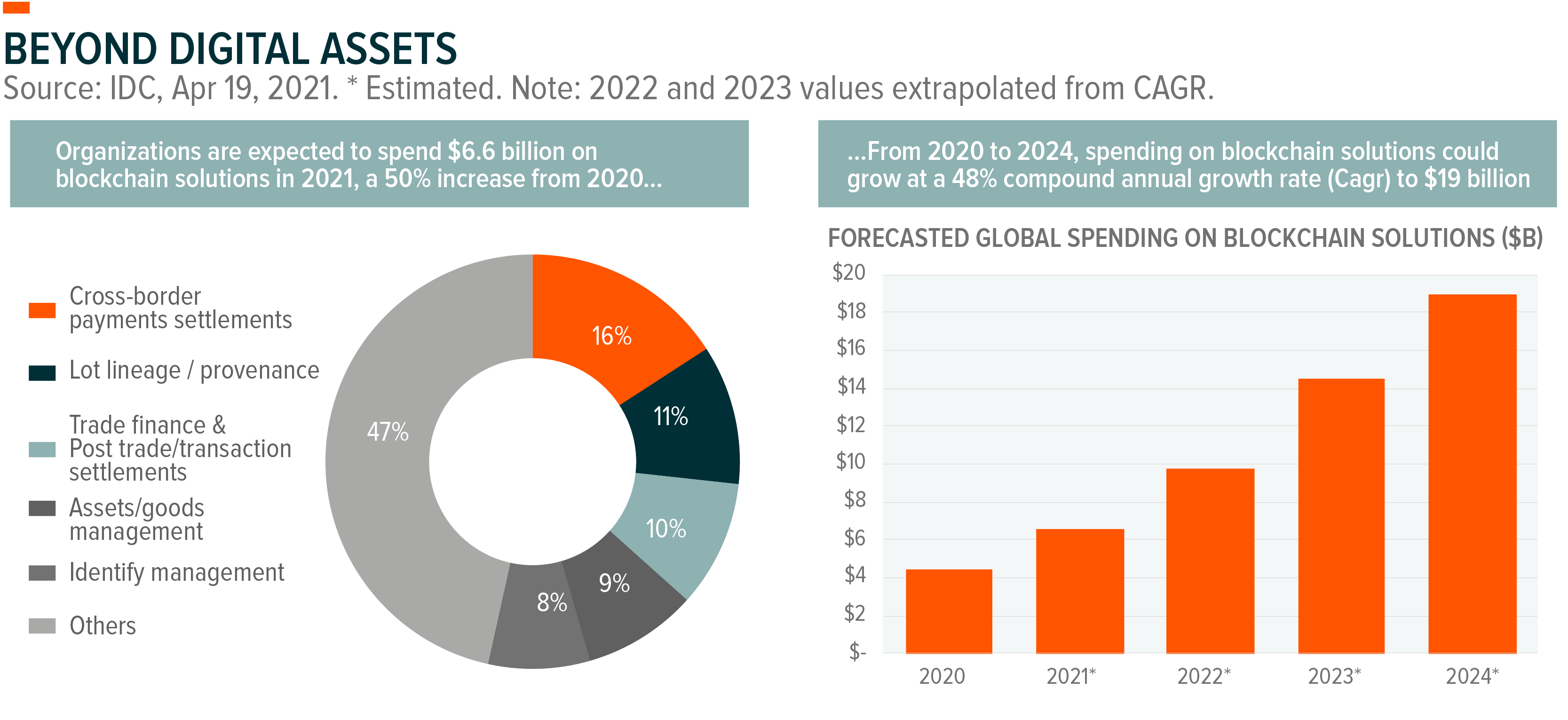

Just as email is one way to leverage the internet, bitcoin and other digital assets are just one use case for blockchain. Virtually any capacity, regardless of industry or segment, that can benefit from the features of transparent, verified transactions and immutable data entry and record keeping could find value in implementing blockchain technology. Given this wide appeal, organizations are expected to spend $6.6 billion on blockchain solutions in 2021, a 50% increase from 2020.5 By 2024, total spending in blockchain solutions is expected to reach $19 billion, a 48% compound annual growth rate (CAGR).6

To understand how the blockchain can provide value, it’s important to contrast it with traditional record-keeping. Historically, each party manages their own centralized ledger and tries to reconcile transactions between them. For example, businesses and their suppliers must relay information to each other on invoices, goods sold, deliveries, inventory, and more. Each group must be satisfied that the other’s data is valid, while discrepancies can create major headaches that need to be resolved. With blockchain, all groups operate with the same datasets, trust that the data and transactions are recorded accurately, and have transparency into historical transactions.

Below are a few examples of how blockchain can be used in supply chains, health care data, and smart contracts.

- Supply Chains: Supply chain transparency is the rule today, not the exception. Consumers want to know the backstories of the products they buy and accountability from the companies who make and distribute them. As a result, supply chain management is critical. But keeping tabs on a product’s journey can be costly, time-consuming, and fraught with risk for companies. An intriguing solution to modern supply chain management is blockchain technology.

Blockchain’s secure, easily trackable ledger creates efficiencies for the entities who work to get products into consumer hands. Blockchain can be particularly useful for when things go wrong. For example, an interesting use case is in the grocery space. Food isn’t just a product, it’s a product that affects public health. So, a contaminated food shipment, like the 2019 romaine lettuce E-coli incident in the US, is a risk with far-reaching implications. For grocers, traditionally, news of such an outbreak could mean pulling the entire inventory off the shelves. But with blockchain, they can quickly track the contaminated inventory back to the source, preserve the uncontaminated inventory, and prevent future outbreaks.

- Healthcare Tracking: Today, patient health records are fragmented and stored as a mix of paper and electronic health records (EHRs) at different service providers’ facilities. This structure makes it very challenging to visualize and share the patient’s historical data in real time. EHRs have improved as different health providers share the data digitally. However, it remains a challenge to effectively combine all records into a single platform and manage the governance and security over the information via a centralized system. Such a centralized architecture has some drawbacks that it may face the risk of single-point-of-failure and bottleneck of data flow when the system becomes larger.7

Health records could be effectively stored in a blockchain by using a unique patient identifier, allowing patients to access their own records and authorize health service providers to access the information in real time.

- Smart Contracts: Smart contracts are a set of predetermined rules by which blockchain transactions can occur. These rules are structured by “if/when” parameters followed by “then.” This automated approach can execute a contract only if all pre-determined conditions are met, allowing all the participants to be certain of the outcome. Examples of these transactions are selling digital art, releasing funds, real estate title transfers, and insurance claims. Once the transaction is finalized, it’s recorded in the blockchain, meaning that it cannot be changed or eliminated, and all the parties involved can have access to it.

Smart contracts can increase the efficiency of transactions since there is no paperwork involved and no time spent reconciling errors, are secured by encryption mechanisms, and can be fully trusted by participants since they’re decentralized and transparent.

What Are the Sub-Themes Involved in The Blockchain Ecosystem?

With the rapid growth of cryptocurrencies and high expectations for blockchain adoption in other capacities, investors are increasingly looking to gain exposure to this theme. One method of course is to invest in cryptocurrencies themselves, but due to an accelerating pace of Initial Public Offerings (IPOs), shifting business models, and rising market capitalizations, there are now a couple dozen public equities that provide targeted exposure to this theme. These companies hail from several sub-themes within the blockchain ecosystem, including digital asset mining, blockchain & digital asset transactions, blockchain & digital asset hardware, and blockchain applications & integration.

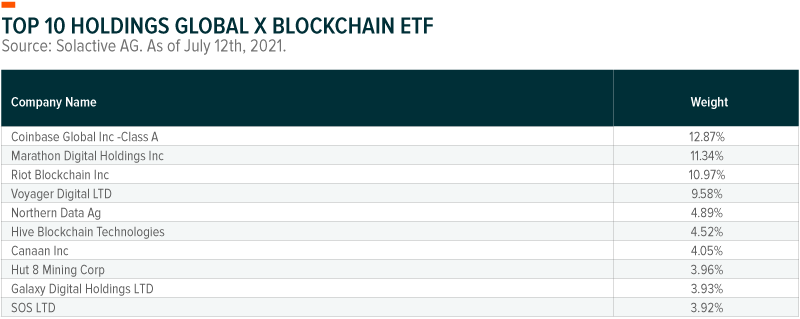

Digital Asset Mining consists of companies involved in verifying and adding digital asset transactions to various blockchain ledgers, or that produce technology that is used in digital asset mining.

- Examples: Marathon Digital Holdings, Riot Blockchain, Hive Blockchain, Argo Blockchain, Bitfarms, Hut 8 Mining, Bit Digital, Bit Mining, CleanSpark

Click here to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.

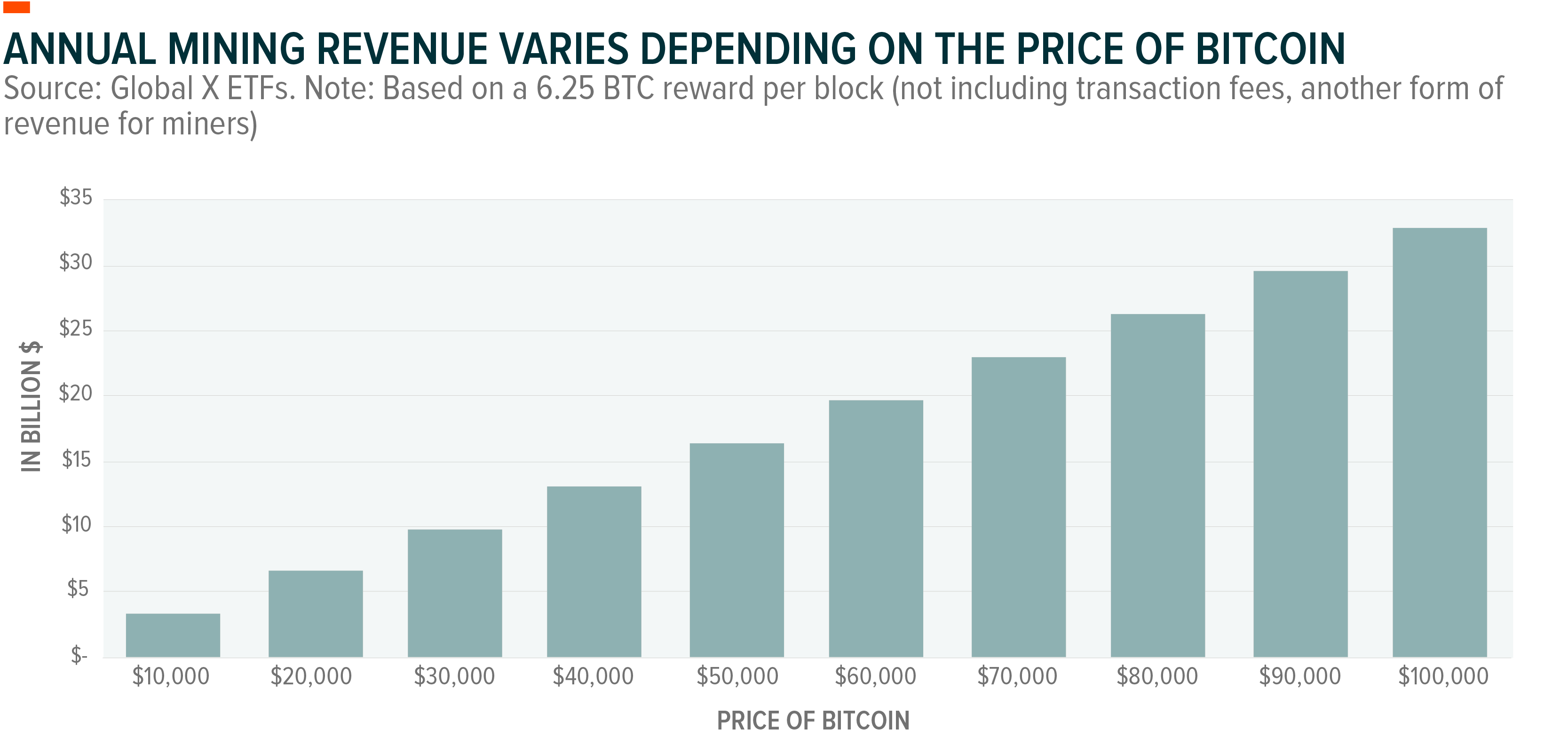

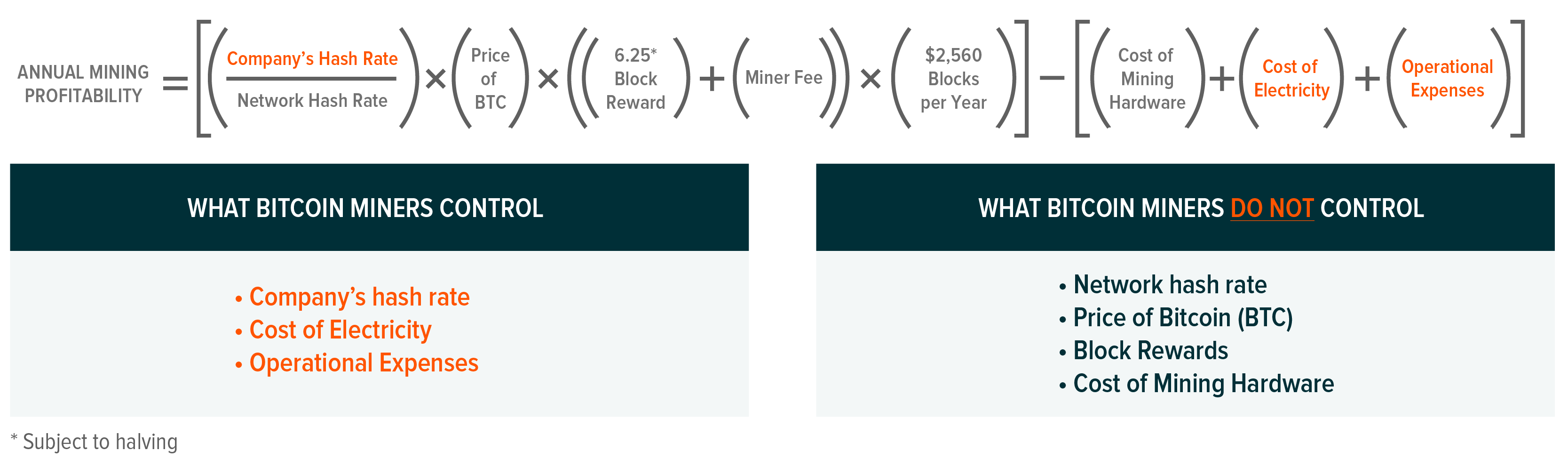

Bitcoin is, by far, the most mined cryptocurrency in the world. Today, this is mostly done using purpose-built bitcoin mining devices that compete with other miners to be the first to solve a specific mathematical problem as fast as possible. Each solution to this mathematical problem generates a 64-digit hexadecimal number, a process known as hashing. The first miner to successfully solve this problem is allowed to create the next block and extend the blockchain, receiving the block rewards and the transaction fees associated with all the transactions inside their block. Blocks are solved every ten minutes on average, and miners are currently awarded 6.25 bitcoins per block. Once a block is added to the chain, miners effectively restart the problem searching for another hash that meets the criteria after incorporating the extra information from the newly added block.8

Since miners are rewarded in bitcoin, their revenue is closely tied to bitcoin’s market price. For example, if one bitcoin is worth $50,000, the annual revenue generated by miners adds to approximately $16.4 billion.

It’s important to note that the block rewards received by miners experience halving events over time. After every 210,000 blocks mined, or roughly every four years, the block rewards awarded to bitcoin miners for processing transactions is cut in half. The next halving event is expected to occur around the Spring of 2024, reducing each block reward to 3.125 bitcoins. Halving is necessary because there are a finite number of bitcoins that can be mined. There are currently ~18.7 million bitcoins in existence and a cap of 21 million; the remaining ~2.3 million bitcoin will likely be completely mined by 2140.9,10

Based on current bitcoin protocols, once all 21 million bitcoins are mined, miners will need to rely solely on transaction fees for revenue. To ensure that transactions are processed on cryptocurrency networks, outgoing transactions to external cryptocurrency addresses typically incur a “mining” or “network” fee.11 These fees represent as little as 6.5% of a miner’s revenue today.12 Bitcoin miner fees are not fixed, but rather subject to demand/supply dynamics. The bitcoin block size is subject to a finite limit, which means that miners can only confirm a finite number of transactions for each block (which again, occurs roughly every 10 minutes). If the number of transactions waiting to confirm exceeds what can fit in one block, bitcoin miners prioritize the transactions offering the highest mining fees.

The major costs for miners are electricity, the price of their computer system, and any other operational expenses to run the business. On the electricity front, since miners are incentivized to minimize their power costs, they tend to be located in places with cheap electricity or operate during off-peak hours. Today, on average, new solar photovoltaic (PV) and onshore wind power cost less than keeping many existing coal plants in operation, making renewable energy consumption increasingly favored by bitcoin miners.13 Approximately, 76% of miners utilize renewable energy as a part of their energy mix, with renewable energy accounting for about 40% of overall energy consumption.14 Moreover, bitcoin’s consumption of electricity (87.7 TWh per year) only accounts for 0.40% of total global electricity consumption.15

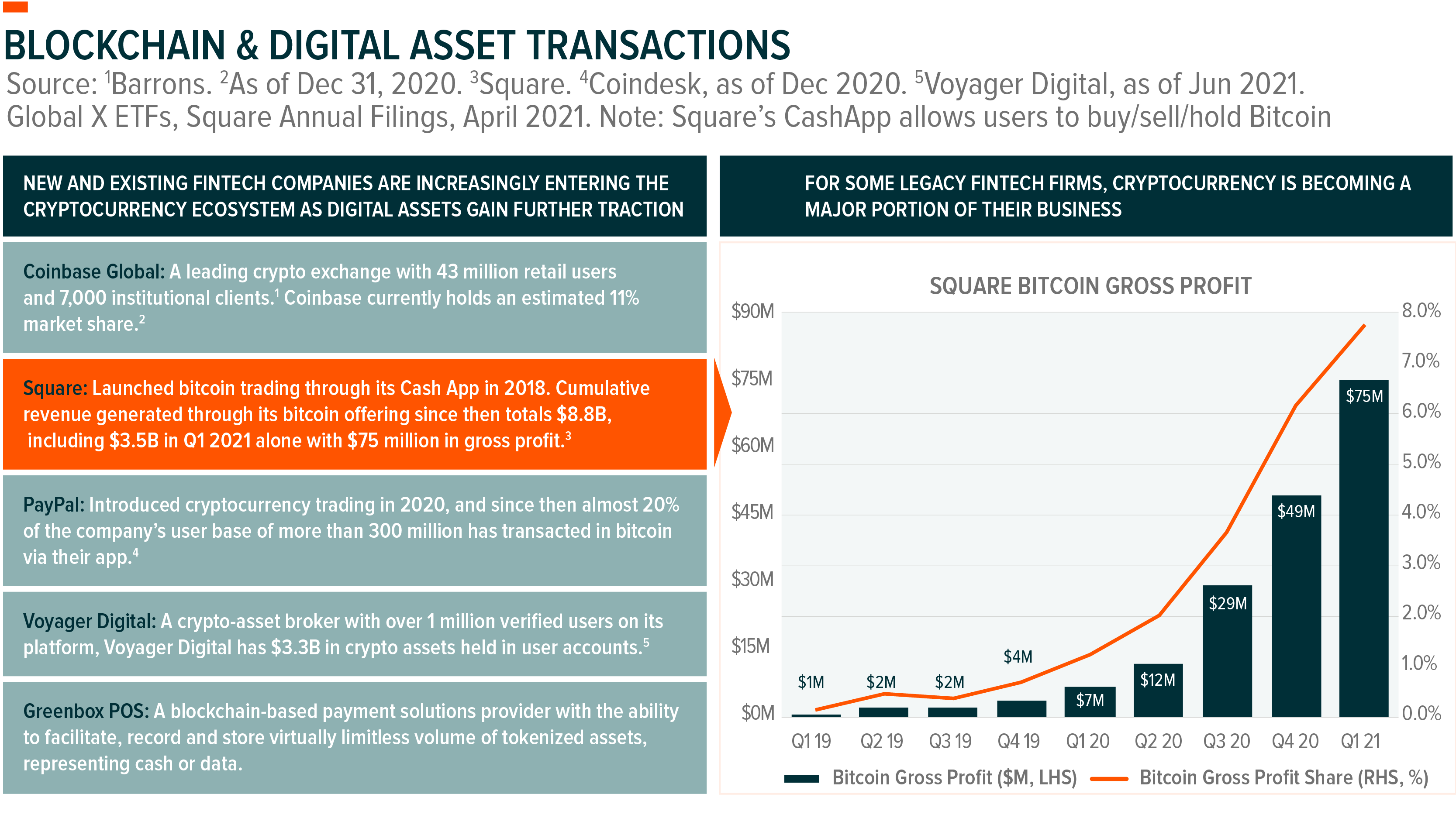

The Blockchain & Digital Asset Transactions segment includes companies that operate digital asset trading platforms/exchanges, custodians, wallets, and/or payment gateways.

- Examples: Coinbase Global, Square, PayPal, Voyager Digital, Greenbox POS

Digital asset wallets or exchanges are platforms that allow customers to trade between various digital assets or to convert between digital assets and fiat currencies. These platforms facilitate buying and selling, as well as often offer custody and other services like collateralized lending. They differentiate among each other by the types of fees charged (e.g. per trade, withdrawals), number and type of digital assets supported, features, maximum trading amounts, client segment focus, and geography.

Within these platforms, bitcoin is today the most traded digital asset as its value accounts for approximately 45% of the total market capitalization of digital assets.16 But bitcoin is just one of the thousands of digital assets in existence.

Beyond digital assets-only platforms, the growing interest in cryptocurrencies has caused many FinTech companies to shift their product offering to accommodate cryptocurrencies. For example, Square launched bitcoin trading through its CashApp in 2018. Cumulative revenue generated through its bitcoin offering since then totals $8.8 billion, including $3.5 billion in Q1 2021 alone with $75 million in gross profit, or approximately 8% of total gross profit.17

PayPal introduced cryptocurrency trading in 2020, and since then almost 20% of the company’s user base of more than 300 million has transacted in bitcoin via their app.18 Other companies such as Voyager and Coinbase differentiate in that they are native wallets and exchanges that focus only on cryptocurrency transactions. At the end of 2020, Coinbase had 43 million retail users and 7,000 institutions on their platform demonstrating the growing acceptance of cryptocurrencies among a range of user types.19 Coinbase monetizes their users based on transaction fees that are either a flat fee or a percentage of the value of each transaction. In 2020, the average fee for Coinbase retail users was 1.4%, and 0.1% for institutional investors.20

Blockchain & Digital Asset Hardware includes companies that manufacture and distribute infrastructure and/or hardware used in blockchain and digital asset activities.

- Examples: Nvidia, Northern Data, Ebang International Holdings, Canaan

Cryptocurrency miners’ capital expenditures (CapEx) are largely directed towards acquiring cutting edge technology hardware. The hardware is essentially specialized computers, with high powered elements such as CPUs (Central Processing Units), motherboards, memory, and storage. Where miners differentiate from each other is in the use of either graphic cards or GPUs (Graphics Processing Units) or ASIC chips (Application-Specific Integrated Circuit). These hardware components provide the processing power necessary to facilitate the complex problem solving involved in cryptocurrency mining.

Miners may decide to house their hardware equipment in third party data centers, which provide power, cooling, security, and other services. Data center operators usually charge a hosting and engineering fee in addition to profit sharing agreements with cryptocurrency miners.

Blockchain Applications includes companies involved in the development and distribution of applications and software services related to blockchain and digital asset technology, including smart contracts. Similarly, Blockchain & Digital Asset Integration includes companies that provide engineering and consulting services for the adoption and utilization of blockchain and digital asset technologies.

- Examples: BC Technology Group, SOS Ltd., Overstock.com, Future FinTech Group, Diginex, Galaxy Digital, BIGG Digital Assets

Blockchain technology can be applied to several other segments, such as e-commerce. Cloud Chain Mall, a business vertical of Future FinTech Group, built its online shopping mall on Ethereum. Overstock.com, another e-commerce operator, partnered with Coinbase to enable Bitcoin as a form of payment on the platform. Among the benefits, users have the ability to send and receive any amount of money instantly, anywhere, and at any time, and always have secured transactions since bitcoins have not ever been compromised.

Overview of the Global X Blockchain ETF (BKCH)

The Global X Blockchain ETF (BKCH) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Blockchain Index. BKCH seeks to invest in companies positioned to benefit from the increased adoption of blockchain technology, including companies in Digital Asset Mining, Blockchain & Digital Asset Transactions, Blockchain Applications, Blockchain & Digital Asset Hardware, and Blockchain & Digital Asset Integration.

Currently, the breakdown of BKCH heavily favors Digital Asset Mining firms (at 38% of the fund’s weight) and Blockchain & Digital Asset Transactions companies (at 30%), as these segments of the public equity markets are more developed and feature among the largest companies in the blockchain ecosystem. Because these firms derive a substantial portion of their revenue based on the price of crypto assets, we expect the fund to exhibit a meaningful correlation to crypto prices, particularly bitcoin. As blockchain technology reaches further adoption beyond cryptocurrencies, we expect to see the Blockchain Applications and Blockchain & Digital Asset Integration companies become a growing segment of the portfolio.

Conclusion

Digitalization is accelerating the transformation of many industries, with the rise of blockchain and digital assets potentially upending traditional finance. With digital assets surpassing $1 trillion in market capitalization, adoption is accelerating, and new cryptocurrency-based economies are forming around the world.21 Yet what began with bitcoin as the first major application of blockchain technology, is now evolving to include potential applications ranging across several segments of the economy.