The Value of Data in a Digital World

Prior to the internet revolution, companies were often valued based on their tangible assets. An energy company could receive a multiple based on their oil and gas reserves, or a manufacturer based on the value of their machinery. That’s because these physical assets were key to value creation: an energy company made its money extracting its oil reserves from the earth and selling it for more than it costs.

With widespread internet connectivity we now live in a digital world where many of the world’s leading companies derive their value from virtual assets, namely data. High tech firms like those in social media, search, e-commerce, artificial intelligence, and cloud computing are in the business of monetizing proprietary data by selling hyper-targeted advertisements, recommending a new hit song or TV show, or anticipating our need to stock up on housewares.

Unlike tangible assets, data is a quasi-infinite, non-linear growing asset. The world produces 2.5 quintillion bytes of data daily, but that figure should grow at an accelerating rate as more people and devices are connected to the internet.1 As data collection continues to surge and new techniques to monetize data arise, we believe it will become an increasingly valuable asset. Therefore, investors should consider analytical frameworks to better evaluate companies’ data in order better understand their intrinsic value and potential for growth.

Why Data Should Be Considered an Asset?

Infonomics or datanomics treat digital information as a legitimate economic asset because an asset is defined as something that has economic value with the potential to provide its owner future benefit. Social media companies, for example, collect user data like age, gender, and location because it allows them to charge a higher price for their advertisements when they can be more specifically targeted to likely consumers. Of course, many tech firms have much more vast and comprehensive data on their users, creating virtually endless possibilities to extract economic value from this information.

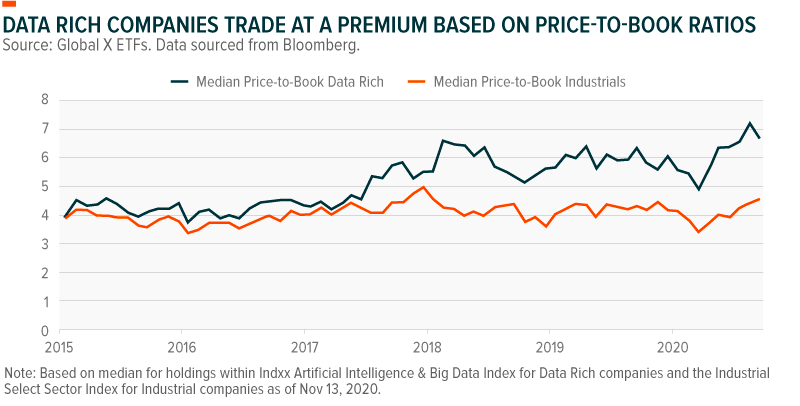

One key argument in favor of treating data as an asset is that companies have made significant investments in collecting, storing, and using their data. It is projected that total spending on big data and analytics could reach $274 billion by 2022.2 Accounting rules, however, do not treat data as an asset. Therefore, costs associated with storing and maintaining data is treated as expenses rather than capital investments, which depresses earnings and impact ratios like price-to-earnings (P/E).

But if data were treated as an asset in accounting rules, certain valuations would likely adjust. For example, high tech companies tend to trade at high multiples based on asset-based metrics like price-to-book (P/B) ratios. However, all things equal, treating data as an asset on a firm’s balance sheet would increase a company’s book value and reduce the P/B multiple for many high-tech organizations. Further, by more accurately accounting for data, investors would have greater transparency into a very key ingredient in a firm’s ability to generate revenue.

What’s Data Worth?

The top five companies in the S&P 500 index – Apple, Alphabet, Microsoft, Amazon, and Facebook – are all data-rich tech firms and together represent approximately 26% of the index, implying that data is indeed very valuable.3 While each firm dominates different aspects of the tech world, they share a commonality in being among the world’s largest collectors and users of data, leveraging this resource in numerous ways to either directly monetize users or to indirectly generate revenue by enhancing their product offerings. Yet specifically valuing their data presents a challenge, not just because it isn’t reported as an asset in financial statements, but because the companies also closely protect what data they have and how they use it. And not all data has the same value. Customer information, product status, company sales, or social media engagements, can range in value, while additional factors can further impact the analysis, like quality, accuracy, timeliness and size.

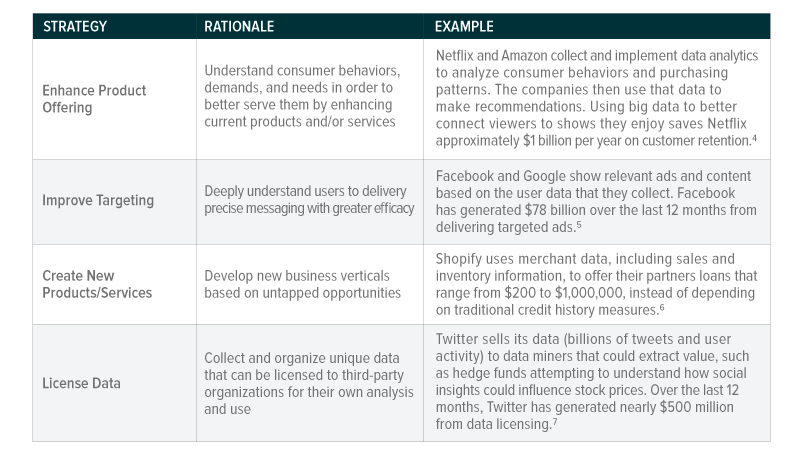

Typical Data Monetization Strategies

The name of the game for data-rich firms is to collect as much data as possible and to monetize it to its fullest potential. Below are a few commonly used strategies for monetizing data as well as examples of companies that are effective in executing each strategy.

Three Approaches to Data Valuation

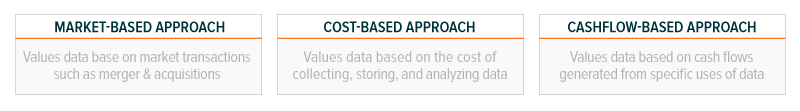

Like valuing any part of a company’s assets, valuing data isn’t an exact science and there isn’t one path to finding its value. However, three common approaches can be applied to data valuation that are used for valuing other types of assets as well: Market-based, Cost-based, and Cash flow-based.

Market-based approach

As mentioned, data doesn’t have a place on a company’s balance sheet. It’s not even recorded as an intangible asset. However, a company’s transaction history, including mergers and acquisitions, bankruptcy filings, and data sales, can provide insight into what a company’s data may be worth. If a company is acquired, for example, then that data will ultimately become part of the acquiring company’s goodwill.

For example, Microsoft bought LinkedIn for $26.2 billion in 2016, the company’s largest acquisition ever. At the time, LinkedIn had 433 million users, 106 million of which were monthly active users (MAUs).8 Some quick math reveals that Microsoft valued each user at $61, or each MAU at $247. Today, LinkedIn’s current user base is much higher at 706 million globally, which would put the company’s value at about $43 billion, holding all else equal.9

Along the same lines of historical social media transactions, Facebook’s acquisition of Instagram in 2012 valued each MAU at $20.10 TikTok’s US operations recent estimated valuation of $60 billion values each of their 100 million MAUs in the US at $600.11

This approach equates active social media users (MAUs) to data. Users provide personal information, create and share digital content, and consume advertisements. For many social media platforms, users are both the product that creates the data and the consumer that allows that data to be valuable (by getting served ads). Therefore, equating users with data can be an appropriate approach for social media platforms.

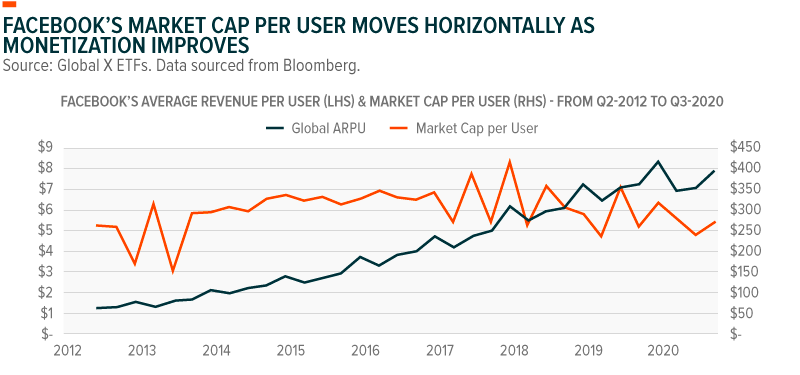

But the value of a social media user can fluctuate over time. Looking at Facebook’s historical value based on market capitalization, the market has priced each user between $150 and $420 since Facebook’s public debut. When Facebook IPO’ed in 2012, its value per MAU was $265, almost the same level as its $272/MAU valuation in Q3 2020. Despite these fluctuations, Facebook has steadily improved its monetization of each user. Average quarterly revenue per user was just $1.30 in Q2 2012. In Q3 2020, it was $7.89. The better a company is at monetizing each user, the more valuable the data on each user becomes. Yet also factoring in to the valuation of a company is expectations for growth. Even though Facebook has better monetized its users over the last eight years, user growth has slowed, resulting in little overall change in value per MAU.

Cost-based approach

Another approach to value data looks to set at least a minimum valuation by considering the cost of data collection, storage, and analysis. In theory, no data would be stored if it’s less valuable than the total cost of ownership. Not accounting for collection costs, data stored in the cloud could cost approximately $0.02/GB, or $1.00/ 50 GB of storage capacity per month.12

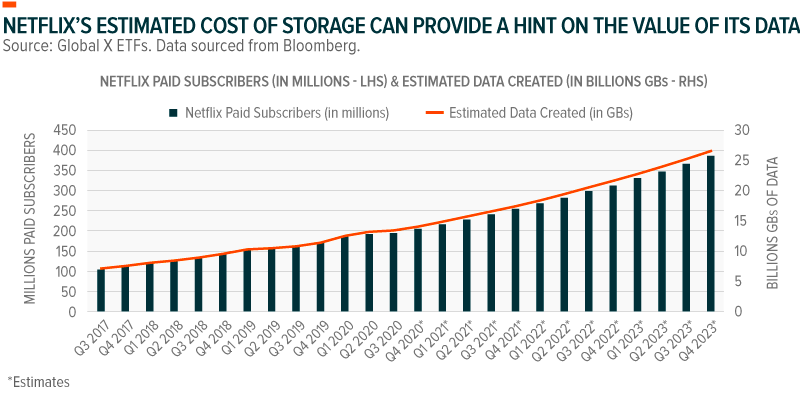

Looking at Netflix, for example, we can attempt to isolate the value of Netflix’s user data. By collecting browsing data from its millions of users, Netflix better understands their customers’ behaviors and preferences, giving it a competitive advantage in determining what types of movies and shows they produce. The cost-based method of valuing Netflix’s user data therefore looks to estimate how much browsing data is collected, the cost of storing and analyzing this data, and calculating its net present value.

Inputs:

- Cost of storing data in the cloud = $0.02/GB per month or $0.24/GB per year13

- Average minutes browsing on Netflix = 7.4 minutes/day14

- Average amount of data created per minute of browsing = 102MB/minute15

Results:

- Data created: 7.4 minutes/day x 102MB/minute x 365 days/year = 275.5GB per person per year

- 275.5GB x $0.24/GB = $66 annual total cost of data storage per user

Based on these results and the estimated number of Netflix’s users over the next three years, we can estimate the net present value of the firm’s user data from this cost-based approach to be $12.4 billion.16 In other words, the cost-based approach implies that Netflix’s user data is worth 6% of Netflix’s market cap.17

The cost-based approach can present several drawbacks. One is that estimating the cost of data storage varies significantly as firms can negotiate pricing with data storage providers or build their own data centers. In addition, it’s difficult to estimate how much data that is created is ultimately stored, and if so, for how long. The cost-based method is also only setting a minimum bar for the value of the data, but does not seek to determine the future benefit of that data. In the case of Netflix, its lengthy history of collecting user data is a clear advantage over newer streaming entrants, and therefore could be worth much more than the cost-based approach implies. Last, the cost of storage is only one variable of the many used to effectively monetize data. Collection and analysis costs, for example, can often be greater than the cost of storage. As such, not accounting for all variables could result in underestimating the intrinsic value of a company’s data.

Cash Flow-based approach

The data a company converts directly to free cash flow can also provide insight into what data is truly worth. For example, consumer credit reporting agency Equifax sells information about individual consumers and businesses, including credit history, current credit status, payment history, and address information. The company has 105 million active records in its database, generating $3.9 billion in annual revenue and $1.3 billion in annual EBITDA.18, 19 Those figures translate to $37 in annual revenue per record.

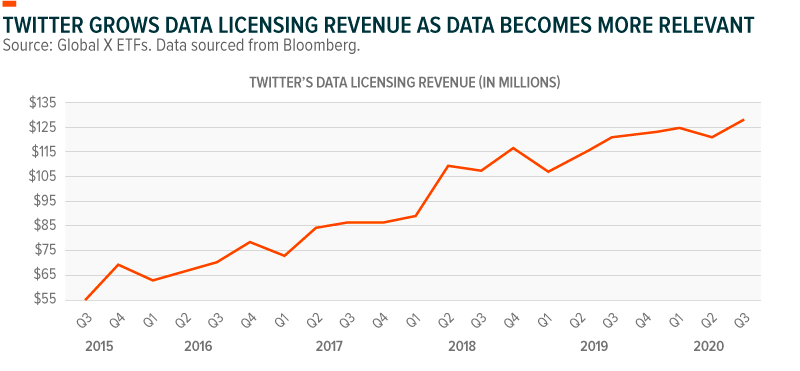

Twitter provides another example for directly licensing data. Companies can pay to access Twitter’s historical and real-time data stemming from over 500 million daily tweets. They license this data to generate insights for product launches, identify consumer trends, or even inform investing activities. Over the last five years, Twitter’s data licensing revenue has grown from $56 million in Q3 2015 to $128 million in Q3 2020.20 Moreover, looking at the present value of future cash flows from that business vertical over the next 5 years, we could estimate the value of that data to be worth $2.8 billion, or approximately 8% of Twitter’s market cap.21

In a cash flow-based analysis, an analyst may look at the cash being derived from existing data, forecast its growth, and discount those values back to present day value. An important factor to consider though is that data has increasing returns to scale. In other words, if a company doubles the amount of data it has, it could triple the value of that data. This is exhibited by Chinese food delivery giant Meituan Dianping, which benefits from strong network effects: the more shoppers that use Meituan Dianping’s platform, the more sellers are drawn to using the app, creating a virtuous cycle of data collection, usage, and value across these two groups. The same principle holds true for many data-rich companies; the more data they collect, the better the product, and the more users they attract, who in turn provide more data to the system. This is a major reason why we see such dominant players and concentrated industries in social media, search, and e-commerce. Therefore, in developing a cash flow-based analysis, one must not just consider the current value of data, but how the value of that data may grow as a platform gathers more and more complementary information.

Data-Rich Enterprises: Seizing the Opportunity

While we present a few methods for valuing data, exactly what data companies have and how they monetize it often remains a well-guarded secret. But what we do know is that the world is producing data on an accelerating growth trajectory and the value of that data is likely quickly growing as well. The companies already adept at collecting and managing data are likely to be among the best positioned to gather additional data in the future and effectively monetize this asset. Data services and hardware companies, including those that turn unstructured data into structured data, like AI development, AI-as-a-Service (AIaaS), AI hardware, and quantum computing companies, are also likely to benefit from a greater emphasis data, as firms look to greatly accelerate their investments in data for rapidly digitalizing world.

Related ETFs

AIQ: The Global X Future Analytics Tech ETF (AIQ) seeks to invest in companies that potentially stand to benefit from the further development and utilization of artificial intelligence (AI) technology in their products and services, as well as in companies that provide hardware facilitating the use of AI for the analysis of big data.

BOTZ: The Global X Robotics & Artificial Intelligence ETF (BOTZ) seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

SOCL: The Global X Social Media ETF (SOCL) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Social Media Total Return Index.

CLOU: The Global X Cloud Computing ETF (CLOU) seeks to invest in companies positioned to benefit from the increased adoption of cloud computing technology, including companies whose principal business is in offering computing Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), Infrastructure-as-a-Service (IaaS), managed server storage space and data center real estate investment trusts, and/or cloud and edge computing infrastructure and hardware.

VPN: The Global X Data Center REITs & Digital Infrastructure ETF (VPN) seeks to invest in companies that operate data center REITs and other digital infrastructure supporting the growth of communication networks.