Global X ETFs: 2020 Second Half Outlook

2020 has been quite the start to a new decade. After the S&P 500 reached all-time highs in February, COVID-19 brought the global economy to an unprecedented standstill and the longest-running bull market in history to an end. In addition to the quickest move to bear territory, the COVID-19 era is also credited with the shortest jump back to bull market territory. Within 12 trading days of its trough, the market came roaring back. Since that trough, the S&P 500 Index increased around 39%, and on June 8th even brought its YTD return into positive territory. The Nasdaq Composite Index set a new all-time high on June 23rd.1

While not yet in positive territory for the year, the S&P 500 Index had its strongest quarter in more than 20 years.2 The S&P 500 Index returned +20.5% in Q2 while only being down -3.1% in the first half. International developed and emerging markets also had a good quarter, returning +15.3% and +18.1%, respectively. With this shift to risk on sentiment, Treasuries took a back seat, dampening the performance of the Bloomberg Barclays Aggregate Bond Index, which returned +2.9% for the quarter.

To some, the recent market optimism has been befuddling. While stock prices are supposed to reflect expected future cash flows, does it currently reflect the wisdom of crowds, or the chaos of mobs? Ample liquidity provided by the Federal Reserve (Fed), along with Main Street programs offered by Congress, have shifted the market’s risk-reward dynamics in favor of higher risk. This helped markets roar back to life and “don’t fight the Fed” remains the winning strategy for this crisis. At least for the moment.

COVID-19, the economic shutdowns and quick actions by the Fed have certainly taken center stage during the first half. Into the second half, the market’s attention is likely to be captivated by: a nation facing (and addressing) racial injustices, the re-opening process and progress, trends in employment, the ability to keep the virus under control, progress on finding a vaccine, and of course, the November election.

Getting the Cogs Turning Again

The re-opening process across the U.S. and the globe has begun, yet the speed and the effectiveness of the opening remain unknown. May’s non-farm payrolls provided a pleasant surprise with 2.5 million jobs added when further losses were expected. June’s private payrolls were also encouraging with 2.4 million jobs added during the month of June, only marginally below the 2.5 million expected. 3 Similarly, U.S. retail sales in May increased 17.7%, more than double the level expected by economists.4 While it is encouraging that consumers are starting to spend, is this an indication of pent up demand, or a more sustainable increase back to prior consumption patterns? We need continued strong sales growth to make up for the sharp decline in the prior two months. If economic data continues in this robust fashion, there remains some potential for a V-shaped recovery.5 However, we have thus far only seen the bounce in economic activity driven by the initial re-openings. This was the easiest time for the numbers to look impressive.

Sustaining and building on the economic improvement will be essential throughout the reopening progress. There were two factors driving improving employment trends in May. First, states starting to reopen boosted employment in industries that were hardest hit by COVID-19 restrictions. This was especially evident within the Hospitality and Leisure segment which rehired 1.2 million of the 8.1 million workers who filed for unemployment since the start of the COVID-19 crisis. Second, the Paycheck Protection Program (PPP) meant that companies needed to rehire employees to ensure that company PPP loans could effectively become grants.

This jump in employment was encouraging, but is it sustainable? On the one hand, as many states continue to relax their restrictions, a continued increase in employment activity is likely. Potentially offsetting this are three risk factors that could hamper sustained employment growth. First, the risk of another wave of infections or increased restrictions could result in businesses choosing not to reopen or failing in their re-opening attempts. Second, a growing number of corporate bankruptcies as well as the potential for corporate cost-cutting and right-sizing to deal with the high debt burden. Third, the structure of the PPP program.

While the rules of the PPP programs have been updated, the majority of companies participating in the program took PPP loans under the old rules in which they needed to spend at least 75% of the money borrowed on worker retention over an eight-week period. This has since been changed to 60% on worker retention over a two-year period. Given the length of the lock-downs, as companies are starting to re-open, they will now need to determine if their businesses are still viable and if they have sufficient liquidity to re-open.6

According to Allianz Chief Economic Advisor, Mohamed El-Erian, restarting an economy is far more challenging than restarting a financial system. While the financial system is based on trust and can be restarted using the Fed’s balance sheet, restarting the economy successfully requires synchronization.7 When a business considers reopening, they need to think about their supply chains, their employees and their customers. Without these factors restarting in a synchronized manner throughout the economy, there is the risk that this restarting process may be a bumpy road.

Under Control or Not at All?

Keeping the virus risk low is key in the success of the economic re-opening. While certain states have been highly successful at reducing their case numbers, this does not yet apply to the country as a whole. Growing case numbers within select states has resulted in concerns about another surge in cases. As summer activity increases, it seems as though the incidence of virus cases has also escalated in the south and western portions of the country. Additionally, country wide protests have the potential to complicate the COVID recovery path. From an economic perspective, the disruption caused by the protests could adversely affect the re-opening of small businesses. While from a virus perspective, large gatherings remain a potential risk for increased spread.

Outside of the U.S. the epicenter of the virus is shifting from the developed world to emerging markets. In terms of the global spread of the virus, it is already in its third phase. The first was China-focused, followed by its spread within Europe, South Korea and the U.S. Global daily case numbers plateaued between mid-April and mid-May as most of these regions gained control over the virus. However, since mid-May there has been a concerning upward trend in daily global case numbers predominantly driven by poorer nations that are least able or willing to deal with the virus. Additionally concerning, within these regions, lockdown measures were less effective at flattening the virus curve. In certain countries, lockdown restrictions started to be removed while cases numbers were still increasing at a rising rate.

With global cases on the rise, finding a successful vaccine is becoming increasingly important. Despite the global investment in finding a vaccine, this is not an overnight project. Currently there are more than 130 vaccines being developed. Vaccine development typically takes years. A 2013 study found that the average development time for a vaccine is close to 11 years.8 As such, with some COVID vaccines scheduled to enter phase three trials in July, the industry is certainly moving faster than normal. However, these initial vaccines are focused on preventing symptoms rather than preventing infection. As such, the initial vaccines may help reduce the worst-case impacts of the virus while not necessarily stopping its spread.9

It is encouraging the speed at which vaccine development has reached phase 3 trials. But this is not the end of the road. Once a vaccine is developed, it would still need to be manufactured in scale and distributed, not a simple task.

Strangest Election Year

In case you’ve forgotten, the U.S. Presidential election is four months away. COVID-19 and the resulting economic hardships has dampened Trump’s probabilities of being reelected.10 This doesn’t yet seem to be reflected in the market. As discussed in our recent piece on Wall Street being open while Main Street is broken, monetary and fiscal policy has provided a boost to the market. As such, the market does not yet seem to be paying much attention to the election –despite the betting markets currently predicting a Democratic sweep.11 The focus instead is on the Fed as the backstop to risk assets. With the Fed willing to do whatever it takes to support the economy, the risk-reward dynamics have become skewed towards increasing risk.

Interest Rates & Income – Central Bank Stimulus Means Looking Elsewhere for Yield

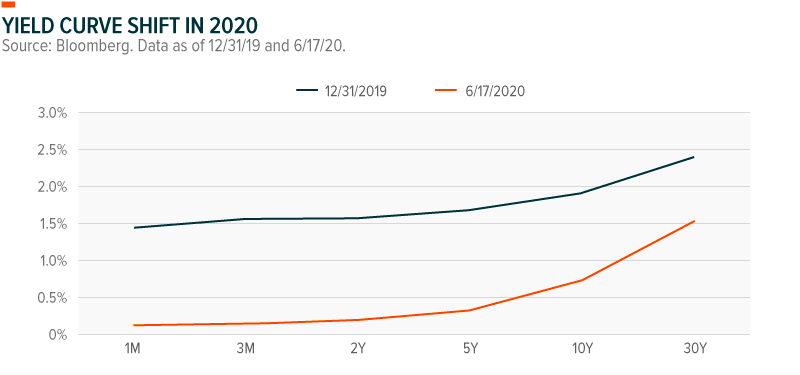

The Fed and central banks around the world are implementing drastic measures to stabilize the global economy, including dropping official rates to historic lows and injecting trillions of dollars of liquidity to support asset prices. At their June 2020 meeting, the Fed stated interest rates are unlikely to be raised through 2022. The front end of the treasury curve is trading at close to zero yield, and the futures curve is pricing in a greater chance of a rate decrease into negative territory as opposed to an increase for the rest of 2020.

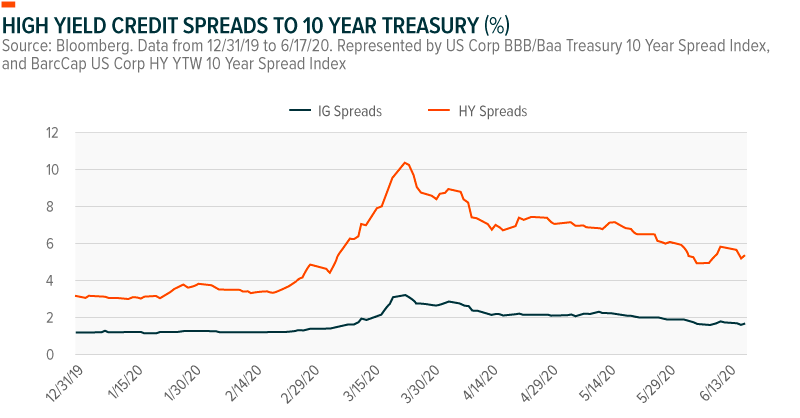

Beyond a low federal funds rate, the Fed has taken aggressive measures to reign in the yields on treasuries and credit spreads across mortgage backed securities (MBS), investment grade bonds, and high yield bonds. The Fed owns north of $4.1 trillion in treasuries compared to about $2.2 trillion at the end of last year. It’s a similar story within Agency & MBS securities, as they now own over $1.9 trillion of these securities compared to under $1.4 trillion in mid-March. The Fed has also purchased over $1 billion in fixed income ETFs and individual bonds to further tighten credit spreads.

Outside of the U.S., interest rates remain at ultra-low rates too:

ECB: The European Central Bank (ECB) deposit rate currently stands at -0.5%. This has not changed since last September. What has changed is their borrowing program and asset purchase programs. Banks are looking to borrow €1.3 trillion from the ECB’s primary refinancing program. The program effectively acts as a subsidy for negative rates. This will bring the ECB’s balance sheet to €6 trillion. The ECB also raised its pandemic bond buying program from €750 billion to €1.35 trillion in June that will likely last until the end of the year or June 2021.

BOJ: The Bank of Japan (BOJ)’s policy rate stands at -0.10%. The BOJ’s monetary policy stance hasn’t changed, but they did expand their COVID-19 loan program to over $1 trillion. The BOJ does not believe interest rates will rise for the foreseeable future. In a continuation of their historic yield curve control policy, the BOJ will cap 10-year bond yields around 0%.

PBOC: The People’s Bank of China (PBOC)’s benchmark interest rate has been steadily falling over the past year. The one-year prime rate stood at 4.25% in August last year before dropping to 3.85% in April. The PBOC has not cut rates in their last two meetings. Rates fell in the wake of slowing economic growth and the COVID-19 pandemic, but China’s recent re-openings may temporarily spur growth. The PBOC is actively looking to stimulate the economy through measures other than rate reductions. In March, the PBOC reduced reserve ratios by 0.5%-1% depending on the size of the bank in order to inject $79 billion into the economy. China indicated they may reduce this ratio further. Growth in credit being extended, particularly to households, is expected to rise further. Accommodative monetary policy, including central bank purchases of loans made to small business, as well as China’s focus on extending bank credit may spur additional growth in the second half of the year.

BOE: The Bank of England (BOE) aggressively cut interest rates earlier in the year to stem the fallout from the COVID-19 spread. The official bank rate stands at 0.10% compared to 0.75% in early-March. At their latest June meeting, the BOE also raised their asset purchases by £100 billion. The BOE is one of the few key central banks to impart a mixed view on whether it was dovish or not. Some of this is can be attributed to Brexit.

For borrowers, such powerful actions from the Fed and central banks around the world are welcome, as they reduce the cost of debt at a time when many companies need loans. But for income-oriented investors, these actions present a challenge, as traditional sources of income like government and investment grade bonds are unlikely to deliver the yield demanded from investors’ retirement savings.

Complicating this issue is that lack of certainty around a key asset class for income investors: dividend stocks. The PPP program announced by Congress in late-March was a $500 billion stimulus effort designed to support businesses during this challenging economic period. Yet a unique feature of PPP stipulates that companies, for the term of the loan and for 12 months after, cannot pay dividends or distributions to common stockholders. In addition, stock buybacks are not allowed. Some of the companies heavily affected and eligible for these loans are in traditional dividend paying sectors. Most notably, airlines, consumer discretionary, and upstream energy companies that pay dividends could see those dividends put at risk if they pursue PPP loans. Discontinuations of some dividends by companies in these sectors are already occurring, making income less certain except from companies with the highest quality balance sheets.

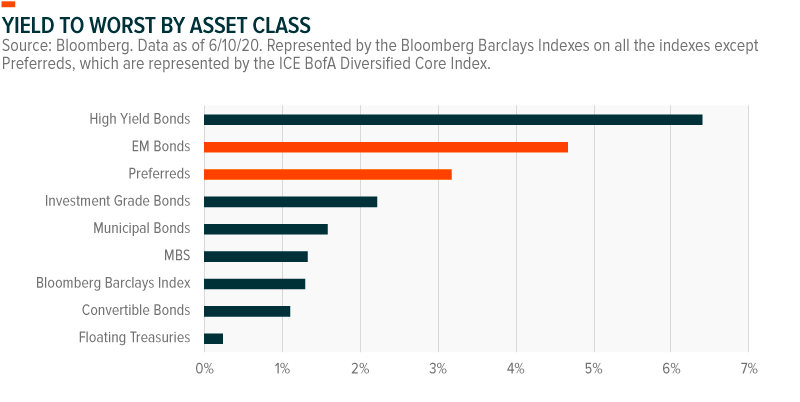

Given the challenges facing income investors in fixed income and equity dividends, we believe there are three areas that may be of increased importance to income investors in the coming months: Covered Calls, Preferreds, and Emerging Market Bonds.

Covered Calls:

Despite extreme volatility in March, markets recovered, and recent performance has been quite resilient. Fragile economic data is not weighing much on the financial markets, at least not yet. Tech-heavy indexes like the Nasdaq 100 have reached new all-time highs this year and broad market indexes like the S&P 500 are close to where they started the year. An unprecedented pandemic weighing on GDP and employment data is creating a dichotomy between the real economy versus the financial economy.

Timing the markets is always a near-impossible task, but we believe mitigating the risk that the markets run out of steam is prudent. A covered call strategy allows an investor to both stay in the markets and monetize volatility. If markets become choppy again or take a temporary turn for the worse, using covered calls allows one to mitigate some of your downside equity risk. Options premiums typically enjoy a positive correlation to volatility. When market volatility increases, investors are often willing to pay more for an options contract. Higher options premiums can then help buffer downside long equity risk. Investors are able to stay invested in the market and still mitigate some of their downside risk. In environments like today, covered calls can be a very useful strategy.

Preferreds:

As discussed earlier, the Fed’s asset purchasing program has tightened credit spreads in the near term. But the precarious state of the economy, already tight spreads, and potential ratings downgrades make junk bond susceptible to a potential downturn. Preferreds on the other hand typically offer better credit quality and comparable yields at this stage. They’re sensitive to interest rates and credit spreads but barring any major pivot in Fed policy or the economy, these factors are expected to remain stable.

EM Bonds:

Many sovereign dollar denominated Emerging Market bonds are currently trading at attractive valuations too. The strengthening dollar caused by a flight to safety drove hard currency EM bonds down. We see more downside for the dollar in the second half of the year than upside. Extremely dovish monetary policy, re-opening of economies globally, and an improving commodity price outlook may lead to a confluence of events leading to dollar weakening. EM Bonds are another place aside from Preferreds where High Yield money can be reallocated to.

International: Foreign Economies Reopen Despite a Lingering Pandemic

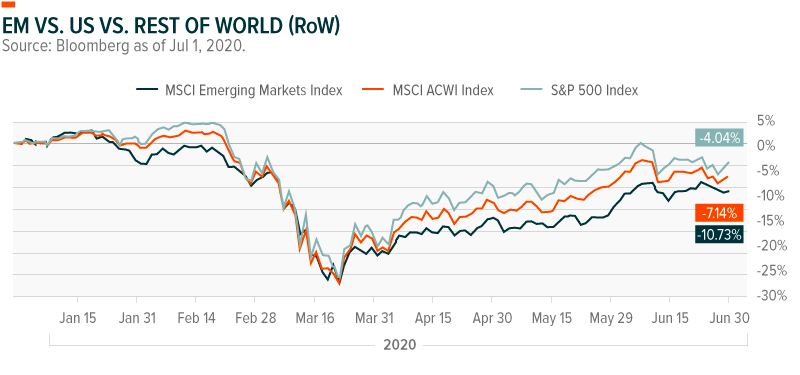

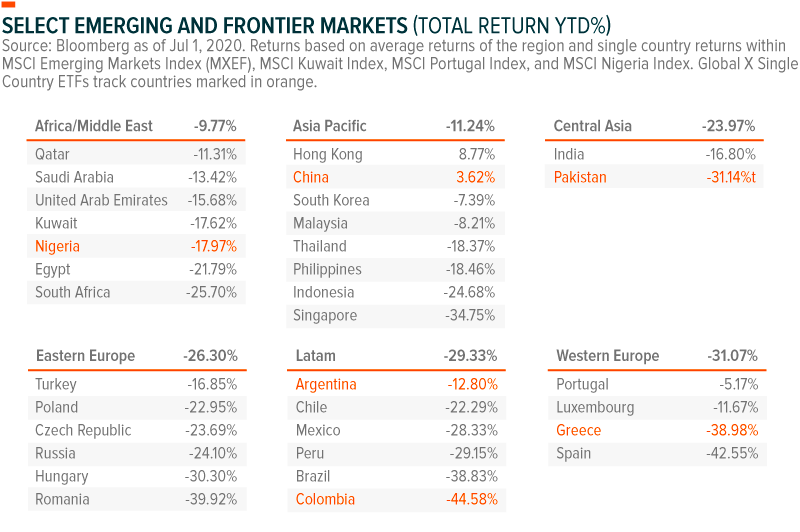

In the first half of 2020, global markets roiled with the spread of COVID-19. Because of their higher dependence on commodities and exports, and their sensitivity to market instability, Emerging Markets (EM) fared worse than U.S. and global equity markets, as tracked by MSCI All Country World Index (ACWI). EMs were hit particularly hard in March when oil prices collapsed because of a drop in demand related to COVID-19 and the snowball effect of the hardline stance Russia took in supply cut negotiations with OPEC. U.S. markets also suffered from COVID-19 and the collapse in oil prices, but the S&P 500 still outperformed relative to EM and ACWI, in part because of a stronger dollar as well as the “flight to safety” by many investors reallocating their equity exposure to the U.S.

Performance data represents past performance. Past performance is not indicative of future results. Indices are unmanaged and do not include the effect of fees. One cannot invest directly in an index.

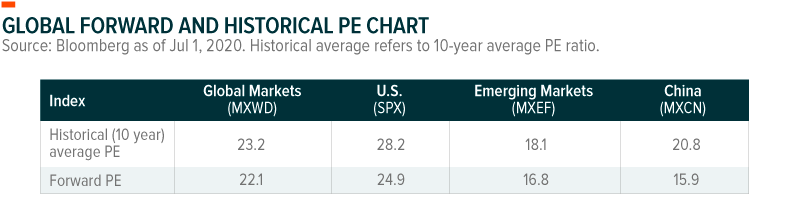

Because of their relative performance this year, EMs are trading at a discount to U.S. and equity markets globally at the same time as they each trade at a significant discount to their historical averages. While U.S. markets are trading at a high forward price-to-earnings (PE) ratio of 24.9, global markets overall are still less expensive with a forward PE ratio of 22.1.12 And despite outperformance relative to global and U.S. markets this year, broad China equities are trading even lower at a steep discount to U.S. markets, with a forward PE of 16.8. Such wide gaps within and between EMs and DMs reflected in their relative levels of volatility suggests that a recovery will be uneven.

Historical average refers to 10-year average PE ratio. To benchmark performance, we used the following indexes as proxies in our analysis: Global markets refers to MSCI All Country World Index (MXWD); Broad U.S. refers to S&P 500 (SPX); Broad Emerging Markets refers to MSCI Emerging Markets (MXEF) Broad China refers to MSCI China (MXCN). Source: Bloomberg of Jul 6, 2020.

Developed and emerging markets are contending with unprecedented health, societal, and economic challenges as a result of the COVID-19 outbreak. But as we noted earlier this year, because of their demographics, institutions, and economic strength, EMs face unique external and internal challenges. Critical factors continue to shape the outlook for EMs as COVID-19 and its impact lingers, including prior experience with viral outbreaks, the state of public health systems, leadership and policy measures to prevent the virus’s spread, and fiscal and monetary options to stimulate economic growth.

Monitoring the Uneven Impact and Global Recovery

While a full recovery for the global economy may be dependent on a slow recovery in demand, recent flows indicate that the recovery will likely be uneven. Countries experiencing the strongest inflows over the last several weeks include some of the largest EMs including China, which saw $4.8 billion of inflows into their equity markets.13 As one of the first countries to experience COVID-19 and implement aggressive containment measures, China’s initial easing of lockdown measures and uptick in economic activity seem to have helped it attract stronger flows. Meanwhile, countries including Brazil and Turkey, failed to prevent widespread infections which was reflected in their large outflows and more negative returns compared to other EMs in May.

Opportunities for Global Investors

EMs best equipped for crisis are those with experience or a responsive approach to virus control, strong public health infrastructure, proactive leadership on policy and public health measures, less exposure to low oil prices, as well as long-term focused economic stimulus measures. Countries that are likely to suffer most from the impact of COVID-19 are those that took the longest to respond to the outbreak, are adversely impacted by low commodity prices, have weaker health care systems compared to other EMs, have little room for fiscal or monetary stimulus, and have little experience dealing with prior viral outbreaks.

While some investors may increase their equity exposure to countries like China or Taiwan, others may be attracted to sovereign bond yields in countries like Morocco, or by corporate issuances in countries like Brazil, which were harder hit by COVID-19, and may be trading at a discount. By toggling exposures to EM equity markets or utilizing discretionary approaches to investing in EM bond markets, investors may be better-protected or benefit more from an uneven recovery between countries and regions.

Market performance divergence is not unique to developed and emerging markets broadly. The impact COVID-19 has on regions and single countries depends on their containment policies, fiscal and monetary responses, and the health of their financial and public health systems. Certain regions, such as the Asia Pacific region (APAC), for example, seem better prepared for the ongoing crisis than others such as Latin America. On a more granular level, countries like Vietnam and South Korea had strong economic fundamentals and relatively more robust public health systems prior to the crisis, implemented aggressive containment policies early on, and began to resume economic activity sooner than countries like Brazil, which was facing significant economic headwinds and confronting significant fiscal challenges prior to the crisis and was slower in responding to the crisis.

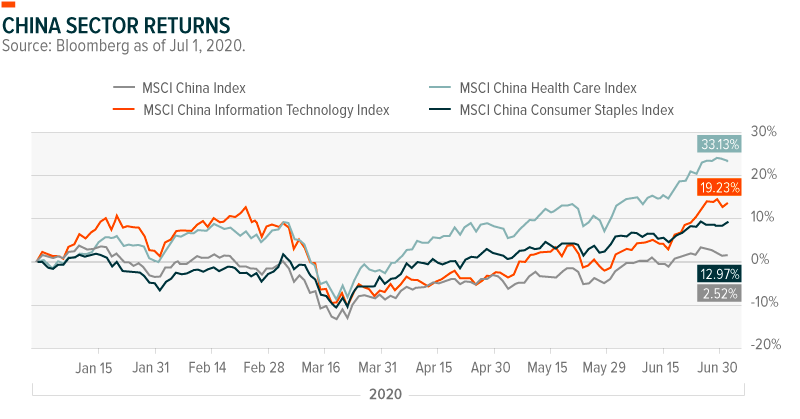

At an even more granular level, certain sectors within EM economies have demonstrated a strong divergence in performance. In China, for example, where sector divergence tends to be wider, sectors like Health Care, Information Technology, and Consumer Staples outperformed their benchmark (MSCI China) starting in December at the earliest reported case of COVID-19 in China.

A global economic recovery will not be symmetric and although Emerging Markets may be disproportionately hurt from COVID-19, some countries may be more resilient than their developed market peers. Many EMs are familiar with crises, especially within Emerging Asia, which suffered through back to back crises, including the Global Financial Crisis, the Russian Banking Crisis, and the 1997 Asian Financial Crisis. While COVID-19 is a unique crisis, it began in Asia which gives the region a natural head-start in terms of timeline. The recent uptick in economic activity across the region suggests that certain EMs could reopen sooner than the developed West, which is reflected in their economic growth relative to the rest of the world in 2020.

Thematic Disruption: Necessity is the Mother of Adoption, Too

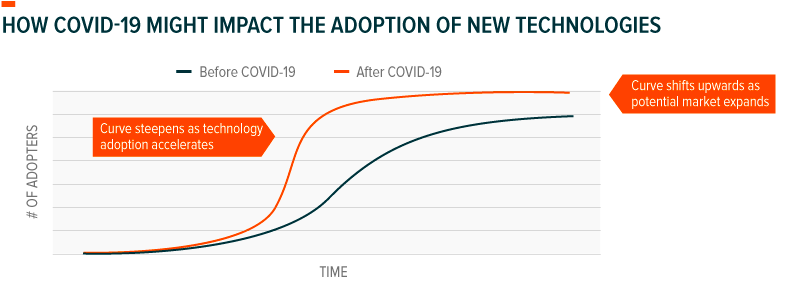

Structural trends and paradigm-shifts typically manifest over extended periods of time. The adoption of new technology, changes in the ways consumers spend their money and time, and the redrawing of demographics aren’t usually overnight phenomena. But there are exceptions.

Many of history’s most transformative eras emerged sharply, materializing as necessity stoked innovation and forced adoption. We can look to antiquity, at Archimedes’ invention of the eponymously named water-screw which is still used in agriculture today; or at Edward Jenner’s invention of modern vaccination during 1796’s smallpox outbreak; and to the 20th century, at the industrial revolution fueled by World War II. We believe the COVID-19 pandemic at-hand presents similar necessity, driving the adoption of numerous disruptive technologies.

In thematic investing, we often assess themes by modeling their growth on an adoption curve. Typically following an S-shaped pattern, an adoption curve offers a look at both a theme’s expected growth trajectory and its market potential. In the below, we discuss how COVID-19 has both accelerated the adoption of key technologies and themes, as well as increased the potential market size.

Genomics: In early January, researchers identified an irregular, lethal pneumonia spreading through China as the disease we now know as COVID-19. Global efforts to identify, treat, and limit the spread of the disease mobilized unprecedented resources toward Genomics, a cutting-edge field of biology with especially valuable medical applications. Genomic subsciences like genomic sequencing and computational genomics give us insight into the virus’ functionality and spread, while genetically-derived or -based therapies seek to use that information to treat symptoms, limit fatalities, and hopefully find a cure. From the virus’ first known days to now, we can observe impactful applications of each and glimpse what this might mean for genomics moving forward. For more, please see Genomics: How a Cutting-Edge Field is Fighting COVID-19.

E-commerce: Though e-commerce is nearly two decades old, just 12% of total retail sales in the U.S. come from the internet.14 Why so little? While online retail penetration is strong many areas, others, like health, auto, and food/beverage, have had trouble gaining e-commerce traction. Online grocery sales, for example, represented just 3% of total grocery purchases before COVID-19 hit the U.S. But over the past few months, the pandemic accelerated adoption in these areas. Online grocery sales surged 200%, as consumers quickly formed new shopping habits to stay within their homes.15 And during their Q1 earnings call, Tesla attributed online car purchases to some of their sales numbers. As first-time users like the Silent Generation experience the benefits of e-commerce, we expect the category to remain a major contributor of e-commerce’s growth moving forward, even after the COVID-19 pandemic.

Cloud Computing: The COVID-19 pandemic and its disruptive impact on economies, societies, and industries around the world is placing a new emphasis on cloud-based solutions. Many governments shuttered non-essential businesses and encouraged workers to work from home as much as possible. For many, cloud infrastructure (IaaS) and software as a service (SaaS) make it possible for critical business functions to operate as usual. Requiring only a computer and an internet connection, employees can use the same applications they would in the office, access files stored on their companies’ servers and collaborate with their colleagues through virtual work environments, videoconferencing, and messaging services. As the world recovers, learns, and adapts from this crisis, we expect companies and their employees to place an even greater emphasis on migrating to cloud-based solutions. The flexibility to work from the office, at home, or on the road, is now a key piece of business operations and continuity planning. For more, please see Mapping the Cloud: A Look at the Segments Driving Growth.

Video Games & Esports: Video game and esports-related spending and attention surged during COVID-19 stay-at-home orders as consumers looked for immersive social experiences they could enjoy while distancing. We can look to esports’ emergence as an example of this. Forced to suspend in-person sporting contests, many leagues turned to the virtual realm. For example, the Formula 1 Virtual Grand Prix Series, which featured current F1 drivers and myriad celebrities, reached 85 million views around the world.16 Other sports, too, like basketball, football, soccer, and baseball, found esports audiences during the pandemic, reaching millions of individuals of all ages and backgrounds. In-person sporting events may not be in the cards for a while and, in our view, this should continue to serve as a tailwind for streaming and esports’ continued march into the mainstream. However, we see more than just COVID-induced momentum. As the audience for gaming expands and additional products and services like next-gen consoles and cloud gaming platforms roll out, we expect adoption to accelerate and addressable markets to widen.

The Internet of Things (IoT): At the onset of the pandemic, the IoT’s growth stalled as international commerce slowed, stressing supply chains, and causing weakness in components like semiconductors and sensors. More recently, however, the IoT has rebounded as many realize the technology’s transformative potential in a post-COVID-19 world. Connected occupancy and proximity sensors can relay information around social distancing in closed spaces. Contactless payments and touch-free device controls mean fewer human touchpoints, possibly limiting infection. The most compelling use cases, however, are in the medical field. In China, IoT drones enable the swift transportation of patient samples for testing and tracking. Connected robots are sanitizing hospitals with greater frequency and safety than was previously possible. And finally, countries rely on IoT for contact tracing, using connected chips to notify people if they’ve been in proximity with infected individuals.

U.S. Infrastructure: While U.S. infrastructure development wasn’t initially bolstered by the stay-at-home nature of the pandemic, it is now emerging as a likely beneficiary as federal, state, and local governments look for potential ways to stimulate growth. COVID-19 resulted in tens of millions lost jobs, decreased consumption, and increased general economic uncertainty. Upgrading existing assets and building new infrastructure could be a remedy. Building infrastructure means investing in the country to support future growth, injecting capital into the private and public sectors to get it built, and hiring people to do the construction itself. This kind of talk should bring back memories of the American Recovery and Reinvestment Act of 2009, where the government allocated $105B to infrastructure investment following the Great Recession. Many are looking to do the same thing now, perhaps on an even larger scale, to create jobs and support a more competitive economy for the coming decades.

Conclusion

It’s been said that there are years where nothing happens, and there are weeks or months where years happen. We believe that COVID-19 and the resulting environment accelerated numerous themes’ adoption by demonstrating proof of concept, changing consumer habits, and highlighting the need for new areas of investment.

Increased adoption of thematic equity combined with improving economic data is encouraging. However, we have only seen the initial re-opening data – where we were most likely to experience a large improvement from a low base. Restarting an economy in a synchronized fashion is easier said than done. As such, there remains the risk of a bumpy re-opening that could be marred by several risk factors including the employment consumption feedback loop, increased virus risk and bankruptcy risk.

While macroeconomic data is improving, progress is still needed. Driven by continued uncertainty, market volatility is expected to remain above its long-term average until there is a viable solution to the pandemic. With the U.S. Presidential election in November, this is another factor that may drive market volatility. Amidst this uncertainty, remaining ahead of the thematic trends shaping the economy is essential, which makes thematic investing seem to be a bright spot within the current market conditions.